Dear New World Investor:

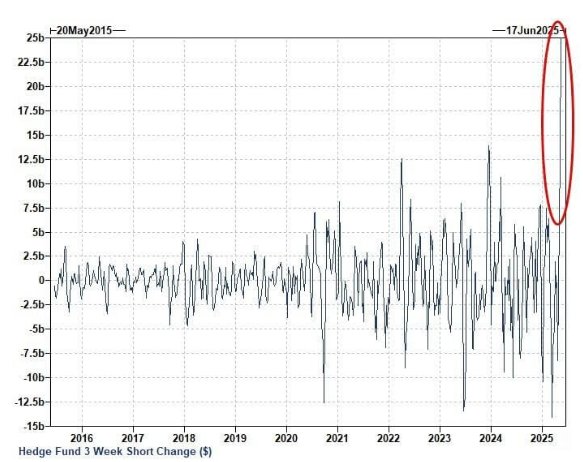

Who are the bears with sideline cash to take the stock market to all-time highs? Well, hedge funds have added $25 Billion of short equity futures exposure over the last three Commitment Of Traders reports, the largest increase in the last ten years.

Market Outlook

The S&P 500 lost 1.3% since last Thursday as worries about the bond market overcame easing geopolitical factors. The Index is down 0.7% year-to-date. The Nasdaq Composite lost 1.0% and is down 2.0% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 2.2% as we enter the medical and brokerage firms conference season. It is still deep in the hole year-to-date, down 12.0%. The small-cap Russell 2000 dropped 2.3% and is down 9.2% in 2025.

The fractal dimension hit the fully consolidated level, so the energy is there to start the next trend. It should be up, but we know from experience that the Index could consolidate further before a trend starts.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX – ScyNexis – Announce resolution of the manufacturing problem, lifting of clinical hold, restart of MARIO trial, maybe GSK files for hospital use approval

EQT EQT –natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model June quarter real GDP forecast ticked down a tenth to +2.4% after the weak housing starts report.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Monday, May 26

Markets Closed – Memorial Day

Tuesday, May 27

Short Interest – After the close

Wednesday, May 28

PYPL – PayPal – 9:00am – Bernstein Strategic Decisions Conference

META – Meta Platforms – 1:00pm – Annual Meeting

NVDA – Nvidia – 5:00pm – Earnings conference call

Thursday, May 29

March quarter GDP – 8:30am – Second estimate

GILD – Gilead Sciences – 2:30pm – Bernstein Strategic Decisions Conference

PD – PagerDuty – 5:00pm – Earnings conference call

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Gilead Sciences (GILD – $106.74) EVP of the Kite subsidiary Cindy Perettie presented at the RBC Capital Markets Global Healthcare Conference (AUDIO HERE and TRANSCRIPT HERE). She gave a wide-ranging review of their various programs and probable coming programs, including solid tumors. They have a lot of oncology data presentations coming up with longer follow-up data.

Gilead and Kite will present more than 20 abstracts at the big American Society of Clinical Oncology (ASCO) annual meeting from May 30 to June 3 and the European Hematology Association (EHA) Annual Congress June 12 through 15. The trials include breast cancer and other solid tumors – glioblastoma, endometrial cancer, lung cancer, and gastric cancer. Other trials include multiple blood cancers, multiple myeloma, large B-cell lymphoma, indolent non-Hodgkin lymphoma, and acute lymphoblastic leukemia.

At ASCO, Gilead will present detailed late-breaking results from the Phase 3 ASCENT-04 trial showing a statistically significant and clinically meaningful benefit in progression-free survival for Trodelvy plus Keytruda versus standard of care chemotherapy plus Keytruda in patients with inoperable locally advanced or metastatic triple-negative breast cancer whose tumors express PD-L1. Additionally, Kite research collaborators at the University of Pennsylvania Perelman School of Medicine will present Phase 1 results evaluating a novel investigational CAR T-cell therapy using a dual-target approach in patients with recurrent glioblastoma during an oral session at ASCO.

At EHA, Kite and its partner Arcellix will present updated findings from the Phase 2 registrational trial of anito-cel in relapsed/refractory multiple myeloma during an oral presentation. Additional abstracts supporting pipeline therapies like KITE-363, a C19/20 dual-target CAR T and results from collaborative studies will also be presented as orals across ASCO and EHA. GILD is a Long-Term Buy under $90 for a first target of $120.

Nvidia (NVDA – $132.83) reports earnings next Wednesday after the close. Analysts are expecting revenues to be up 65.86% from last year to $43.2 billion with 73¢ earnings per share. Guidance should be for $45.81 billion and $1.00.

CEO Jensen Huang made an important argument in this week’s COMPUTEX 2025 keynote, for why humanoid robots are the only universal type of robot that will work. He said: “The reason for that is because technology needs scale. Most of the robotic systems we’ve had so far are too low volume and those low volume systems will never achieve the technology scale to get the flywheel going far enough, fast enough so that we are willing to dedicate enough technology into it to make it better.”

Robots were just trained for the first time to perform a new task by watching a video. Nvidia Research will show other breakthroughs at the big International Conference on Robotics and Automation (ICRA) starting tomorrow.

NVDA is a Buy under $125 for a $180 first target.

Palantir (PLTR – $122.29) and Divergent Technologies announced a strategic partnership to provide access to Divergent’s 3D printing platform s via Palantir’s software platforms, bringing digitally manufactured parts to Warp Speed and Foundry customers on-demand. Divergent’s Adaptive Production System combines AI-driven design, industrial-level 3D printing, and universal robotic assembly to make aerospace-grade parts on demand. Palantir’s customers will be able to rapidly identify emerging supply chain vulnerabilities and then directly address them through on-demand manufacturing of critical parts by Divergent.

Palantir CTO Shyam Sankar said: “Divergent is a trailblazer in the new industrial revolution that is sweeping the US. The Divergent Adaptive Production System is a mind-bending example of what’s possible when the world’s most advanced software fuses with the world’s most advanced manufacturing. We are proud to support Divergent’s innovative operations with Warp Speed as it scales in ambition and impact.”

Palantir is going to become the operating system for modern manufacturing. These are the highlights from the most recent AIPCon:

BofA raised their target price from $125 to $150. PLTR is a Buy under $100 for a $150 target.

Small Tech

PagerDuty (PD – $16.04) reports April first quarter earnings next Thursday after the close. The consensus forecast is for revenues to be up 7.0% from last year to $118.98 million with 19¢ earnings per share. Guidance should be for $123.81 million and 23¢.PD is a Buy up to $30 for a 2- to 5-year hold as their digital operations management Software-As-A-Service gains market share.

Primary Risk: Digital operations management is a competitive area.

QuickLogic (QUIK – $5.15) presented at the Ladenburg Thalmann Innovation EXPO25 (AUDIO SHOULD BE HERE but I’m still blocked. SLIDES ARE HERE). Judging by the slides, CEO Brian Faith gave the standard presentation. QuickLogic has a $1+ billion available market in aerospace & defense, industrial IoT, AI, and security. They go to market via several channels:

QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

Redwire (RDW – $12.71) won a contract of unrevealed size from SpaceTech GmbH to provide critical avionics technology for the European Space Agency’s (ESA) Next Generation Gravity Mission (NGGM) satellites. The NGGM satellites are ESA’s contribution to a planned NASA and ESA Earth observation satellite constellation known as Mass Change and Geophysics International Constellation (MAGIC). MAGIC will combine four satellites, two NGGM satellites developed through ESA and two GRACE satellites developed through NASA and the German Aerospace Center, to measure fluctuations in Earth’s gravitational field. The planned constellation will provide unprecedented data for water management applications, including monitoring droughts, floods, ice melts, and sea level rise.

Redwire Space NV will design and build the engineering qualification model of the spacecraft’s Instrument Control Unit (ICU). The ICU will serve as the central system for managing and controlling NGGM’s primary scientific instrument, handling data collection and processing and communication between the instrument and the satellite’s other onboard systems. The ICU will play a pivotal role in the mission’s ability to observe small variations in Earth’s gravitational field. RDW is a Buy under $18 for a $36 first target as space exploration grows.

Primary Risk: A new competitor emerges.

Rocket Lab USA (RKLB – $25.82) successfully launched its third mission for its Japanese customer, Institute for Q-shu Pioneers of Space (iQPS). This was the third overall launch for iQPS and the second in a multi-launch contract to launch eight missions for the company in 2025 and 2026. Four more launches are scheduled for launch this year, with the remaining two scheduled for 2026. Rocket Lab’s next mission for iQPS is scheduled to launch in less than a month.

The company also scheduled its second launch in a series of four for BlackSky in a launch window opening May 28. This will be the seventh Electron mission of 2025 and its 65th launch overall, bringing the total number of satellites delivered to space by Rocket Lab to 226. RKLB is a Buy up to $13 for my $30+ target as low earth orbit satellites and space exploration grow.

Primary Risk: A new competitor emerges.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

We hasn’t seen this much short interest in biotech stocks in decades.

AbCellera Biologics (ABCL- $2.00) got authorization from Health Canada to start the Phase 1 clinical trial of ABCL635 for moderate-to-severe vasomotor symptoms (hot flashes) due to menopause. ABCL635 is an antibody antagonist targeting the neurokinin 3 receptor (NK3R). The trial will start in the September quarter. Buy ABCL up to $6 for a long-term hold to $30 or more.

Primary Risk: Partnered and owned drugs fail in the clinic.

Clinical stage of lead product: Partnered: Various Owned: Preclinical

Probable time of next FDA approval: 2027-2028

Probable time of next financing: 2026-2027 or never

Akebia Therapeutics (AKBA- $2.83) presented at the H.C. Wainwright BioConnect Investor Conference (FIRESIDE CHAT HERE). CEO John Butler said they are very happy about the way the launch is going, but gave no specifics on June quarter revenues. In the first quarter, most of their prescriptions were written for patients managed by U.S. Renal Care. There are 150,000 patients at the small and medium providers who are adopting Vafseo first.

But all five of the top dialysis providers who manage 85% of all diabetes patients have ordered Vafseo, including Fresenius and DaVita. Those two have it on an exception basis for patients who need it instead of Amgen’s Procrit. DaVita will be running a 50- to 200-center pilot program to train doctors in the September quarter and then opening usage broadly in the December quarter. 50% of the doctors at U.S. Renal Care have patients who are treated at DaVita as well, and they want to use Vafseo at both clinics. Fresenius is designing a similar program.

90% of all dialysis patients need to be treated for anemia. Dialysis providers only get a $274 payment for the bundle of drugs and services required to treat a patient with four hours of pretty intense medical care, so they are on very thin margins. There are 156 dialysis sessions a year – three a week. TDAPA gives the provider an immediate cost reduction in the Procrit they don’t have to use and covers the cost of the Vafseo that replaces it. By making the price of Vafseo volume-sensitive, Akebia plans to get it down to the cost of Procrit by January 1, 2027, when TDAPA expires.

Akebia already is seeing 20% of prescriptions outside of Medicare – fee for service covered by insurance, which they did not expect this early. Their goal is to make Vafseo the standard of care for everyone with chronic kidney disease, whether they are on dialysis or not. This year, they will get a path forward with the FDA for non-dialysis patients and plan to start that Phase 3 trial before the end of the year.

About 550,000 non-dialysis chronic kidney disease patients are Stages 4 and 5, where anemia shows up. That’s about the same patient size as the dialysis market, but the drug will be priced 4x to 5x higher because they don’t have to bring the price down after TDAPA ends, so it is a much larger market. Dialysis is a $1 billion market; non-dialysis is a $4-$5 billion market. Buy AKBA up to $2 for the Vafseo launches in the EU, UK, and US.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Compass Pathways (CMPS – $4.18) presented at the RBC Capital Markets Global Healthcare Conference (AUDIO HERE). Management said the Phase 3 trial requires bulletproof documentation that patients have treatment-resistant depression as shown by two to four failures of a specific medicine. That requires prescription and dispensing records, which are hard to get in the US. That’s what slowed enrollment in the US Phase 3.Once COMP-360 is approved, doctors will not have to collect past prescription data to prescribe the drug – that will be a clinical decision.

On safety, there has been nothing new from the Data Safety & Monitoring Board. In the Phase 2 trial, they only saw suicidal ideation in three non-responders. They don’t expect it to be a problem in the Phase 3 trials.

They are working on a late-stage Phase 2 trial in PTSD they will announce later this year.

FDA Commissioner Marty Makary said evaluating the potential of psilocybin, MDMA, and other psychedelics will be a “top priority” under the Trump Administration. CMPS is a Buy under $20 for a very long-term hold to a 10x.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2028

Probable time of next financing: Late 2025

Editas Medicine (EDIT – $1.62) said that new data from a study in non-human primates has been accepted for a poster presentation at the European Hematology Association (EHA) 2025 Congress being held June 12-15. They will present key delivery, editing, and biodistribution data, including:

* * High efficiency hematopoietic stem cell delivery of editing cargo.

* * Therapeutically relevant editing levels in the HBG1/2 promoter region exceeding the predicted editing threshold of ≥25% required for therapeutic benefit with a single dose.

* * Favorable biodistribution with Editas’ targeted lipid nanoparticle (tLNP) technology, demonstrating significant de-targeting of the liver in contrast to standard LNPs.

EDIT is a Buy under $6 for a double in 12 months and a long-term hold to much higher prices.

Primary Risk: Other companies’ gene-sequencing drugs fail in the clinic.

Clinical stage of lead product: Partnered: Approved. Owned: Going into the clinic mid-2025.

Probable time of next FDA approval: 2028

Probable time of next financing: Late 2026 or never

Inflation MegaShift

Gold ($3,2295.10) is going higher if Goldman Sachs is right, They just reiterated their “long gold” recommendation with a $4,000 target by mid-2026. The fractal dimension continues its healthy consolidation.

Miners & Related

Coeur Mining (CDE – $7.72) presented at the Canaccord Global Metals & Mining Conference. As usual with Coeur, they illegally block us from haring the audio so there is no transcript, but the SLIDES ARE HERE. Also as usual with Coeur, it was the standard corporate presentation. They added a new slide on the recently-acquired Las Chispas Mine:

and one on the exploration potential at Rochester:

Management is expecting about $350 million in free cash flow in 2025. CDE is a Buy under $5 for a $20 target as gold goes higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Dakota Gold (DC – $2.92) said they have two drills at Richmond Hill. In 2025, they expect to drill ~80,000 feet using a combination of Reverse Circulation and Core drilling. Their primary focus is to collect metallurgical samples for the Feasibility Study, infill, and expansion resource drilling in the northeast corner of the project area. This area is expected to be mined at the beginning of the mine plan and is higher grade than the overall deposit. Drilling started on April 1 and 38 holes have since been completed. Dakota expects to start reporting drill results and will continue through the fall as they are received. DC is a Buy under $2.50 for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $111,174.17) hit a new all-time record after a key procedural victory in the Senate on Monday night for a bill to regulate stablecoins. The measure could face a final vote as early as this week. Its passage could increase the odds of additional legislation covering altcoins and even the formation of a strategic bitcoin reserve.

Now that cryptocurrency advocate Paul Atkins is SEC Chair following Gary Gensler’s welcome departure in January, an industry that was hated for four years has an SEC Chair who is pro-crypto. In addition, on Monday Coinbase (COIN) became the first and only cryptocurrency exchange to join the S&P 500 index.

According to Bernstein, in another sign of crypto’s growing institutional foothold, corporations are increasingly adding bitcoin to their balance sheets. Globally, about 80 companies now hold approximately 3.4% of total supply. That’s roughly 720,000 tokens, up 160% from the 270,000 held at the end of 2023. Bernstein forecasts bitcoin will reach $200,000 by year-end.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $63.23) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

Ethereum (ETH-USD on Yahoo – $2,642.63) has surged nearly 100% since the crypto market’s April lows, including gaining 65% in the last 30 days alone to back above pre-election levels. In addition to etherum shorts covering, crypto interest is expanding beyond store-of-value use cases, with stablecoin payments and tokenized securities gaining real traction. Stripe’s $1.1 billion acquisition of stablecoin platform Bridge and Meta’s recent comment about reigniting its stablecoin venture are helping to bring back a focus on the underlying blockchains. Ethereum, which holds 51% of the total stablecoin supply, is emerging as the key platform proxy for this growth trend. ETH-USD is a Buy.

Primary Risk: Bitcoin extensions outperform Ethereum.

iShares Ethereum Trust (ETHA- $19.99) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $60.78

Oil slipped even though CNN reported that Israel is preparing to potentially strike Iranian nuclear facilities. I don’t pay much attention to these clickbait headlines. Of course Israel has detailed “what if” plans to bomb Iranian nuclear plants if necessary. We probably do, too.

I’m more interested in this. China can now refine more oil than the US. That is no accident.

The July 2026 Crude Oil Futures (CLN26.NYM – $59.69) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.53) is a Buy under $40 for a $100+ target.

Energy Fuels (UUUU – $4.50) benefits from higher uranium prices, and uranium prices go up as more countries turn favorable on nuclear power plants. The latest one is a surprise: Germany. Three weeks after widespread power grid failures across Portugal and Spain, the new conservative government under Chancellor Friedrich Merz has reversed its longstanding opposition to nuclear power. The Financial Times reported that German officials informed Paris they will no longer oppose French efforts to have nuclear energy recognized as equivalent to renewables in EU legislation. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

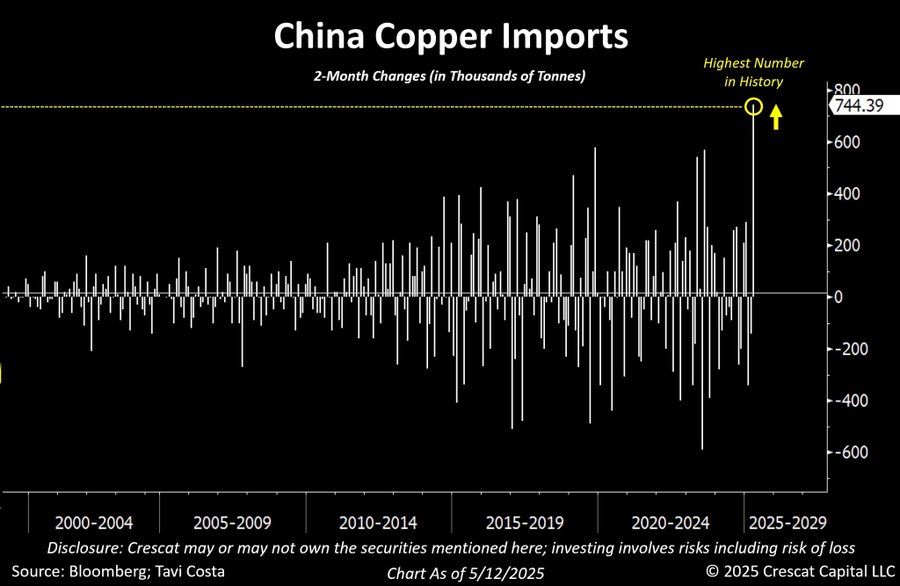

Freeport McMoRan (FCX – $37.70) won’t do well if the markets are right that demand for copper in China is falling…oh, wait. China just reported its largest two-month copper imports in history.

FCX is a buy under $44 for a $65 target within two years.

Primary Risk: Copper prices fall.

* * * * *

How to recreate ~70% of the functionality of a Bloomberg terminal for dirt cheap:

1. @getBamSEC for quick document search, conference call transcripts, and keyword alerts

2. @theflynews for real-time stock news

3. @theTIKR for financial analysis, earnings calls, and a screener

4. @wisesheets to pull data and stock prices into Excel

* * * * *

RIP R&B/soul singer John Edwards

* * * * *

Your monitoring the new media Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 5/22/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $201.36) – Buy under $205

Corning (GLW – $48.55) – Buy under $33, target price $60

Gilead Sciences (GILD – $106.74) – Buy under $90, first target price $120

Meta (META – $636.57) – Buy under $655 for a long-term hold

Micron Technology (MU – $94.83) – Buy under $102, first target price $140

Nvidia (NVDA – $132.83) – Buy under $125, first target price $180

Onsemi (ON – $42.29) – Buy under $60, first target price $100

Palantir (PLTR – $122.29) – Buy under $100, target price $150

PayPal (PYPL – $71.45) – Buy under $68, target price $136

Snap (SNAP – $8.43) – Buy under $11, target price $17+

SoftBank (SFTBY – $25.95) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $7.74) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $71.52) – Buy under $70; 3- to 5-year hold

Fastly (FSLY – $7.44) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $16.04) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $5.15) – Buy under $10, target price $40

Redwire (RDW – $12.71) – Buy under $18, first target price $36

Rocket Lab (RKLB – $25.82) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $30.30) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $2.00) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $2.83) – Buy under $2, target $20

Compass Pathways (CMPS – $4.18) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $1.62) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $2.02) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.75) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.77) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($33.16) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $41.84) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $46.95) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $29.07) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $41.92) – Buy under $30, target price $50

Coeur Mining (CDE – $7.72) – Buy under $5, target price $20

Dakota Gold (DC – $2.92) – Buy under $2.50, target price $6

First Majestic Mining (AG – $5.87) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.48) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $8.52) – Buy under $10, target price $25

Sprott Inc. (SII – $56.01) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $111,174.17) – Buy

iShares Bitcoin Trust (IBIT – $63.23) – Buy

Ethereum (ETH-USD – $2,642.63)– Buy

iShares Ethereum Trust (ETHA- $19.99) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $59.69) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $33.53) – Buy under $40; $100+ target

Vermilion Energy (VET – $6.39) – Buy under $11; $24 target

Energy Fuels (UUUU – $4.50) – Buy under $8; $30 target

EQT (EQT – $55.69) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $37.70) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

TG Therapeutics (TGTX – $34.24) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

First

MM–on AKBA, factual corrections to your last paragraph. Dialysis is stage 5 CKD, non dialysis is stage 4. I read the transcript of the fireside chat. At 20 min, Butler is vague and confusing. Fact–there will be no TDAPA for V after 2026. Nondialysis stage 4 patients number 550K, same as stage 5 dialysis. After 2026, the price will be $2500 annually for both DD and NDD. TDAPA pays the dialysis center the exorbitant rate of $15.5K for 300mg dose, $20K for the 400-450mg dose. The dialysis center doesn’t care what the TDAPA rate is, as long as they save the cost and trouble of ESA infusions, and they get reimbursed for the exorbitant charge from AKBA. Under TDAPA, the center is incentivized to get patients on V, but after 2026 without TDAPA, there is no way AKBA is going to get away with ripping off the centers and the govt CMS program and insurance companies for the exorbitant $15.5-20K rate. V will cost $2500, in line with the same for ESA. Therefore, NDD stage 4 is the same $1 billion market as DD stage 5, not 4-5X times as much. Butler is dishonest and vague about that. He also makes the error of saying stage 4/5, initiating the confusion earlier in the chat. Listen at the 20 min mark and read the transcript to see what I mean. If NDD is approved, then the total potential annual V revenue is $2 billion, not $5-6 billion. The “esteemed” ultra bull Hsainu on Stocktwits gets steamed with vulgar language when I point all this out. He’s got a 2025 stock price target of $30 and if NDD is approved, $100 later. I am bullish, but my targets aren’t that high.

(I will say that stages 1-3 of CKD are much larger than 4 and 5, but there is little incidence of anemia in the milder stages 1-3.)

JGMD – whats your 2025 target on AKBA?

Let’s figure this out. Peak DD V gross revenue is $2500 X available 550K market for DD = $1.375 billion. Allowing for V side effects and V is made standard of care, assume optimistically that V gets 70+ % of that = $1 billion. Use price/sales of 5 for peak sales (not 10 which would apply for a mature company with still growing earnings) = $5 billion market cap. Divide by 262 million shares = $19/share. One, I don’t know what net revenue will be. Two, I don’t know when AKBA will get $1 billion in sales. With TDAPA, we only need about 25% of the 550K patients because of the exorbitant TDAPA rate of $15.5-20K rate vs post-TDAPA rate of only $2500. The TDAPA rate will average $10K due to large volume order discounts. We might get $1 billion in early 2026 as small/medium centers and big Davita crank up. But in 2027 TDAPA is gone, and we need 70+ % to maintain $1 billion peak sales. So my best case target for end 2025 is a little less than $19. Even $10 is optimistic but doable. If NDD V gets approved in 2027, double these targets (but not 5X) for 2028. If NDD gets approved, sell the stock in 2028-30. If rejected, sell at $10-20 in 2027. I should reduce all these targets by 40-50% because only 40% of patients have Medicare fee for service with TDAPA, and Med Advantage will bring another 10-20% only. There is hope that the large Davita and Fresenius can negotiate higher Med Advantage rates. So my realistic base case target for 2025 is only $5. Everyone vote NO NO NO by June 9 against salary increases and another 18.9 million share dilution. Butler’s big mistake was allowing big Davita and Fresenius to delay launch for nearly 1 year. Protocols and logistics should have been done after approval of V in March 2024 so that every dialysis center would be ready to go in Jan 2025. All these idiots–Butler and these big DO’s– will cause AKBA to only obtain about 1 instead of 2 years of TDAPA benefits for the entire dialysis market.

Brent, what do you think?

I ignored Auryxia. Ultra bulls are assuming Auryxia maintains $40 million in quarterly revenue under TDAPA despite the loss of its patent 3/31/25. If there is no generic phosphate binder competition, yes, add $160 million in Auryxia revenue for 2025. If there is generic competition, 40 + 20 + 20 +20 = $100 million A revenue in 2025. Nothing to sneeze at.

Wow, now thats impressive analytics and analysis! So I should hokd for at least $10?

Another method of valuation. What’s the discount on big orders? TDAPA gross undiscounted is $15.5 to 20K, depending on V dose. Say high volume price is $12K. 40% of Medicare has TDAPA. That’s $4.8K for the Med TDAPA group. Med Advantage base case is $2.5K. 60% of Med pop is Med Advantage, so that’s another $1.5K. Total of $6.3K for the entire Medicare pop on average. Most of dialysis pop is elderly Medicare. I am ignoring younger patients, and the $100-160 million from Auryxia in 2025. Assume 30% of V uptake by end of 2026, 165K patients, which is 30% of 550K dialysis pop. 165K X $6.3K is $1 billion. After TDAPA, V price is $2500 for everyone. (I am skeptical of the 5X rate hinted by Butler for NDD V.) To maintain $1 billion in annual V revenue, we need 400K patients at $2.5K. 400K is just over 70% of 550K. Use price/sales of 5 for peak revenue to get market cap of $5 billion. As above post, this is $19/share just for dialysis. Are my estimates of 30% V uptake by 2026 and 70% uptake for 2027 reasonable? If not, divide $19 by 2 if you think 15% and 35% are reasonable. That’s $9.50/sh. The market will be looking forward to NDD approval, so these targets will be exceeded if the market is looking to the future.

Brent, your comments?

$15.5K is the Wholesale Acquisition list price. Nobody is paying that much. Butler has set the volume discounts to get Vafseo down to the price of Procrit by the end of TDAPA.

For non-dialysis, the price will be 4x to 5x the Vafseo price at the end of TDAPA.

Two questions. First, I believe the wholesale acquisition list price (WAC) is set at $15.5K for the 300 mg dose of V, $20K for 450 mg. With small sales so far, that’s the revenue now. When higher volumes of sales develop, there is a discount from the average $18K WAC. My guess is a 1/3 discount to $12K. What do you figure? Whatever the number is, it will be constant for the TDAPA period through 2026. On Jan 1, 2027, it falls off the cliff to be competitive with ESA, or $2.5K. The 5X bonanza TDAPA price through 2026 and dialysis center financial incentives is what will greatly boost V uptake from the mediocre levels outside the US for the past several years.

Second, TDAPA at 5X the ESA price is GONE GONE GONE on Jan 1, 2027. Butler is weaving a deceptive narrative that he will get away with charging 5X the ESA price for nondialysis use of V when it gets approved and launched around 2028. Will V for dialysis at that time be priced at $2.5K like a chocolate candy, but V for non dialysis be $12K like a gold wrapped chocolate? NO NO, RIDICULOUS. If standard of care happens for V, insurance companies will be forced to cover NDD V at that exorbitant rate. Or, they will cover it with an exorbitant copay and deductible, so in effect there will almost no demand for NDD V. Pharmacy benefit managers will plot to cut off the heads of AKBA management. If CMS goes along with AKBA, this will make an excellent target for Trump or his successor to cut waste/abuse.

What is fair is a competitive price for V for DD, NDD, and ESA at $2500 post-TDAPA. The TDAPA incentives will have increased the usage of V for DD and NDD to almost 100%, less the 10% of patients with nausea from V. AKBA doesn’t need to pull a fast one of getting 5X a fair price. They will lose business, and maybe their lives. There is excellent $1 billion blockbuster money to be made if they are not greedy, but twisting arms to get $5 billion from greed will literally kill them.

REALITY–V is merely as good as ESA for efficacy, maybe safer, definitely more convenient. It is NOT 5X better than ESA. But it is an ANCILLARY supportive therapy for anemia of CKD. It is by no means a cure for CKD. It is theoretically possible that V slows the progression of CKD from stage 4 to stage 5, but that is speculative.

Question for the crypto enthusiasts: what coin or coins will be the best performers rest of 2025? BTC, ETH, XRP, others?

ETH of the big coins.

With Trumps nuclear energy exec order today, who has a good nuclear stock?

UUUU? Cameco is a blue chip, but high priced.

* SCYNEXIS RESUMES PATIENT DOSING IN PHASE 3 MARIO STUDY

* SCYNEXIS INC (SCYX.NaE) – RESUMPTION OF DOSING TRIGGERS $10M MILESTONE PAYMENT FROM GSK

Chris / JGMD – NGENF price is down from high of recent weeks, how confident should I be to buy now before the data readout next week? In your opinions is this derisked?

A good poster on YMB said that the latest boom in the stock indicates there was a leak of good news. How good? Go back to Chris’ post with the lit candles on top. If I were Jerry Silver, the scientist behind this innovation, I would be ecstatic even if there were only modest results. Every mother thinks her ugly child is beautiful. With modest results, the stock may fizzle out to $2, considering the dilution it will take to fund future trials. If great results, it may spike to $10-20 but will still fizzle from those levels as the euphoria wears off.

Stock safely advance only when few expect good outcomes. When most people are excited, the stock has been bid up already. It is NOT derisked now. Don’t be late to the party on any stock.

New World Investor for 5.29.25 is posted