Dear New World Investor:

According to Bloomberg, the Fed is stopping their Quantitative Tightening in December and beginning Quantitative Easing, apparently because they are worried about the labor market. They described it as a technical maneuver and Chairman Powell cautioned that “…at a certain point, you’ll want reserves to start gradually growing to keep up with the size of the banking system and the size of the economy. So we’ll be adding reserves at a certain point…”

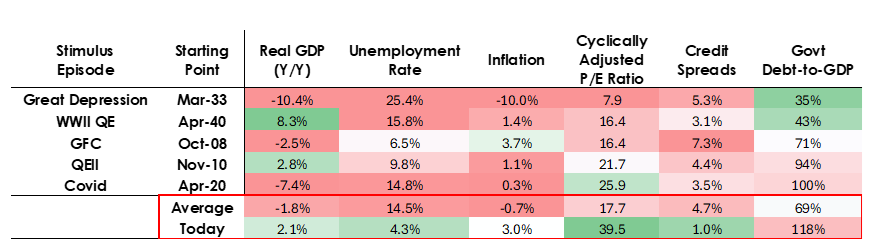

“At a certain point” means sometime in the future. (Bloomberg thinks that could be as early as next summer – or later.) In the past, the Fed starts Quantitative Easing when asset valuations were falling and inexpensive or not overvalued, the economy was contracting or very weak, inflation was low or falling, and debt and liquidity problems were large and credit spreads were wide.

What is happening right now is they are stimulating when the national debt just hit $38 trillion, two months after it crossed $37 trillion. Asset valuations are at highs and rising, the economy is relatively strong, inflation is above target, and credit and liquidity are abundant, and credit spreads are near record lows. Ray Dalio called this “stimulating into a bubble.”

We can expect P/E multiples to go even higher in 2026. The Fed is supposed to take away the punch bowl when the party gets overheated. Not to mix metaphors, but this looks more like throwing gasoline on the fire. Dalio said: “That’s what makes what is happening different in ways that seem to make it more dangerous and more inflationary. This looks like a bold and dangerous big bet on growth, especially AI growth, financed through very liberal looseness in fiscal policies, monetary policies, and regulatory policies that we will have to monitor closely to navigate well.”

But here’s what these folks are missing. As JC Parets said, most people are suffering from Tech Leadership Denial Syndrome. This bull market is NOT being driven by the Mag 7. Like every bull market for the last century, it’s being driven by all technology. There is no weak market breadth. There never was.

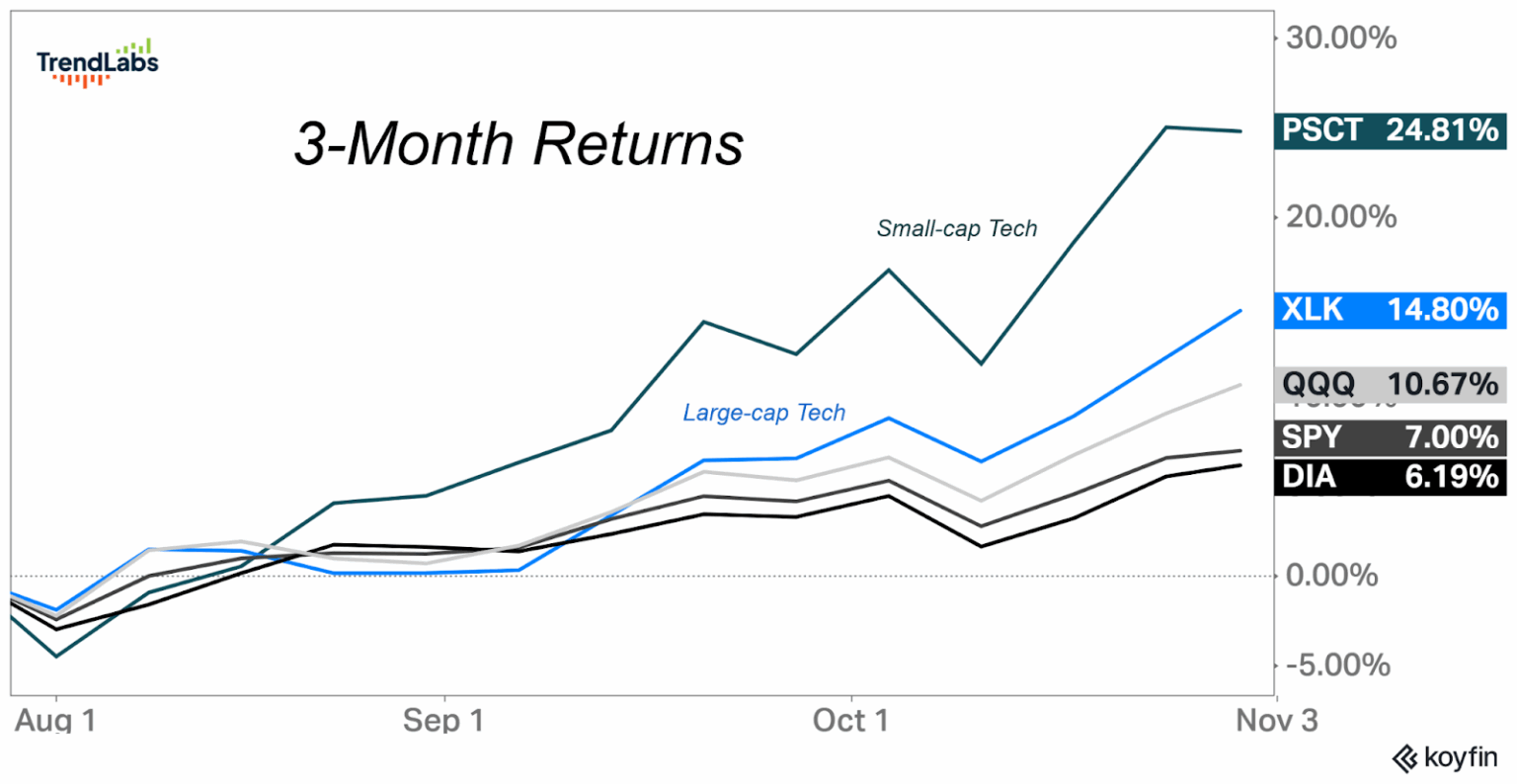

Over the past three months, small-cap tech has massively outperformed its large-cap counterparts. Both the Small-Cap Tech Index (PSCT) and the Large-Cap Tech Index (XLK) are crushing the S&P 500, but the real leader is the little guys (+24.8%) massively outperforming the bigger tech stocks (+14.8%):

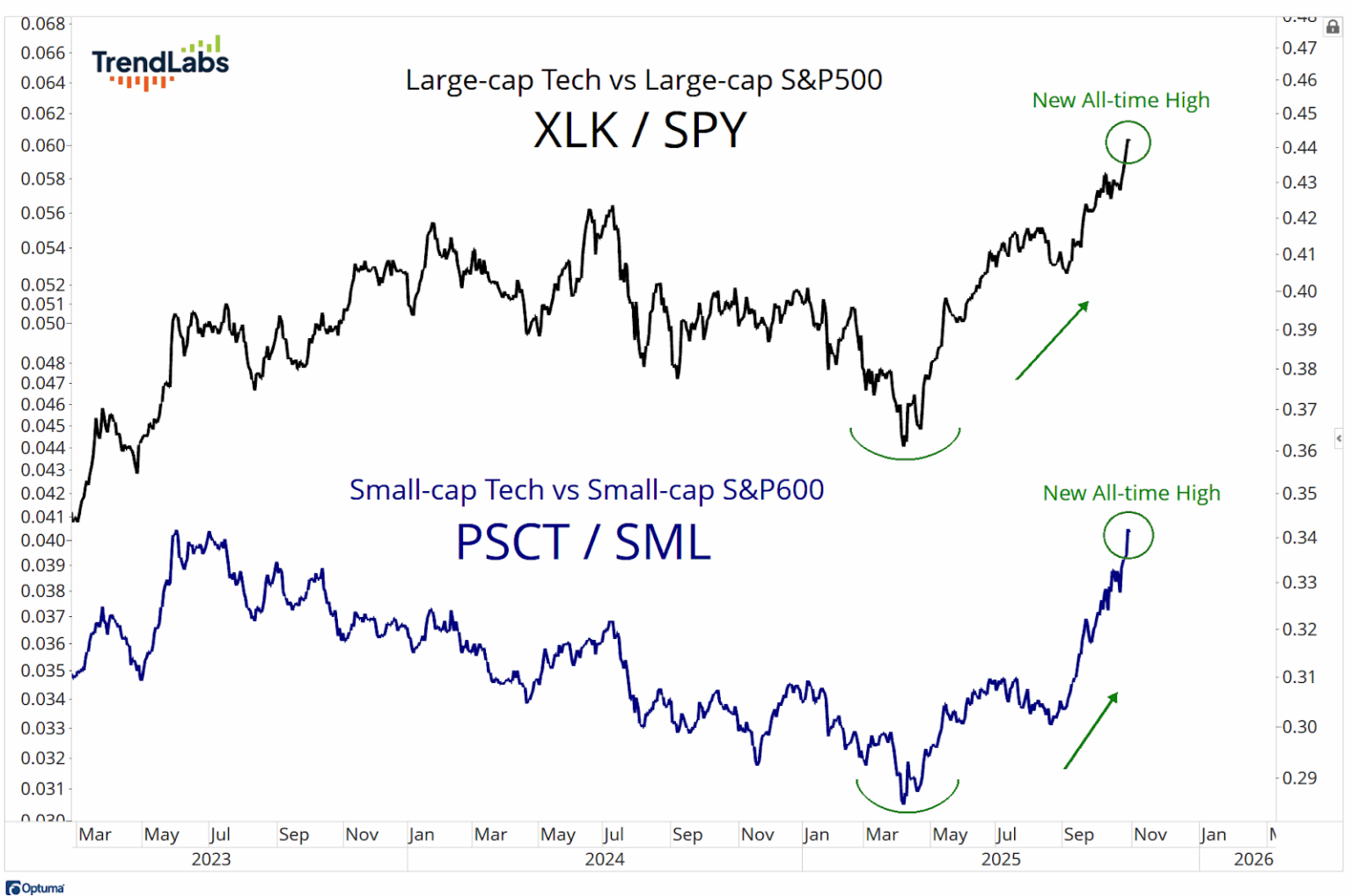

The turn happened last April, when both the Large-Cap Tech Index compared to the S&P 500 Large-caps and the Small-Cap Tech Index compared to the S&P 600 Small-caps marched up to new all-time highs:

We’re only about six months into this sector rotation — the lifeblood of a healthy bull market. September and October, which are typically bearish seasonally, were actually bullish months this year. And now the seasonals have turned bullish, which will provide a tailwind into year-end.

Market Outlook

The S&P 500 lost 1.2% over the last two weeks due to today’s drop. The Index is up 14.6% year-to-date. The Nasdaq Composite was hit a bit harder, losing 3.0%, but still is up 18.4% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) was exactly flat for the two weeks. It is winning the performance derby, up 24.3% year-to-date. The small-cap Russell 2000 dropped 3.4% in the risk-off environment and is up just 6.9% in 2025.

The fractal dimension flipped into consolidation before it hit the 30 level that shows trend exhaustion. Although that sometimes is a real change, it’s often a head fake and the previous trend reasserts itself. We got pretty close to 30, so this may be one of those times it’s a real change. The next couple of weeks will tell the tale.

Top 5

Changes this week: I was dead wrong about AKBA’s November 10 conference call being very positive, but we should get a steady drumbeat of good news over the next eight weeks, so I left it in near-term. I added META to near-term for a rebound from its recent weakness.

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

META Meta – rebound from its recent weakness

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model is anticipating 4.0% real GDP growth in the September quarter, much stronger than the Blue Chip economists’ +2.5%. It would be a shockingly high number that President Trump would use to say his tariffs are working and the Fed has to cut.

The problem, of course, is that the Federal government shutdown has delayed most of the inputs to the model. I am sure the Atlanta Fed has been scrambling to find alternative measures of things, and I’m equally sure that the error range around that 4% estimate is wider than usual. Still, we should get the first estimate soon (it was due October 30) and it will be good enough to push the market higher.

Dollar Death Watch

I hate to say it, but that is a good-looking chart. I hate to say it because a weak dollar supports stock prices and really drives precious metals prices. As Jared Dillian said, what I see is a big base in the dollar that is now starting to break out. Sentiment, as you know, has been very bearish. This may have caught everyone offsides.

If the strong September quarter GDP report causes the Fed to not cut a quarter-point on December 10, the dollar will strengthen, stocks will be nicked, and precious metals will tank.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Friday, November 14

AG – First Majestic – Through 11/15 – Deutsche Goldmesse Fall Conference

INO – Inovio – 1:45pm – World Federation of Hemophilia Global Forum

Monday, November 17

AG – First Majestic – Through 11/18 – 121 Mining Investment

AKBA – Akebia – 7:00am – Jefferies Global Healthcare Conference

Tuesday, November 18

QUIK – QuickLogic – Unspec. – Craig-Hallum Alpha Select Conference

ABCL – AbCellera – Unspec. – Jefferies Global Healthcare Conference

QUIK – QuickLogic – Through 11/20 – Space Tech Expo Europe 2025

FCX – Freeport McMoRan – 10:00am – Update conference call

Wednesday, November 19

GILD – Gilead Sciences – 9:00am – Jefferies Global Healthcare Conference

PYPL – PayPal – 9:00am – Citi FinTech Conference

FSLY – Fastly – 10:40am – RBC Capital Markets Global Technology, Internet, Media and Telecommunications Conference

NVDA – Nvidia – 5:00pm – Earnings conference call

Thursday, November 20

No New World Investor today

AG – First Majestic – Through 11/21 – Swiss Mining Institutent

Monday, November 24

AG – First Majestic – Through 11/25 – National Bank CEO Mining Conference

Tuesday, November 25

Short Interest – After the close

PD – PagerDuty – 5:00pm – Earnings conference call

Wednesday, November 26

Next New World Investor – one day early

September quarter GDP – 8:30pm – Second estimate scheduled, but they haven’t released the first one yet

Thursday, November 27

Markets Closed – Thanksgiving

Friday, November 28

Markets Close Early – 1:00pm

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $272.95) was upgraded from Hold to Buy at DZ Bank with a $300 target price. AAPL is a Buy under $205.

Gilead Sciences (GILD – $125.20) CFO Andy Dickinson presented at the UBS Global Healthcare Conference (AUDIO HERE and TRANSCRIPT HERE). It was just a review of their overall position and the recent third quarter results.

This morning, they announced that the 48-week Phase 3 ARTISTRY-1 trial, which tested a new single-tablet regimen of the antiviral bictegravir and the HIV PrEP therapy lenacapavir in adults with HIV, reached its primary endpoint and was statistically as effective as (non-inferior to) multi-tablet regimens. Their Phase 3 ARTISTRY-2 trial, designed to evaluate bictegravir and lenacapavir in patients switching from Gilead’s once-daily HIV pill Biktarvy, is currently underway, with topline data expected later this year. GILD is a Long-Term Buy under $115 for a first target of $150.

Meta Platforms (META – $609.99) broke ground on their 30th data center in Beaver Dam, Wisconsin.

The stock has fallen due to their $600 billion AI capital spending spree. The story going around was best explained by Kuppy as the potential revenue from AI will never justify the capital spending. As proof, he cites the rapidly growing use of AI but the much slower growth of revenues, because so much of it is free.

I realized what is wrong with that argument. This is the cocaine strategy. Why not try a little bump? After all, it’s f-r-e-e. Oh, you want more? You want to completely integrate it into your work flow? Sure, go ahead, it’s cheap. Oh, now you’re completely dependent on it to do your job? No problem – except we’re going to 10x the price. You don’t want to pay that, so you’re going to switch to Google? Perhaps you didn’t hear that they 10x’d their price, too.

The idea that all the hyperscalers are run by stupid people who can’t see what is obvious to us, is 2D chess. I suspect they are playing 3D chess. META is a Strong Buy while it is under $705 for a long-term hold.

Nvidia (NVDA – $186.86) will benefit as the AI buildout continues. Amazon announced a $38 million deal to provide OpenAI access to hundreds of thousands of Nvidia GPUs to be deployed by Amazon Web Services. Note that the much-vaunted Amazon custom processor is not part of this deal.

Incidentally, Amazon stock rose sharply when they reported a great September quarter with $1.95 earnings per share. They have an investment in Anthropic, the private AI company that was valued at $121.5 billion last spring. Anthropic just did another financing round at a $183.0 billion valuation – not bad for six months’ work – so Amazon wrote up the value of their investment. That accounted for 66¢ of the $1.95.

Microsoft got US approval to ship 66,000 Nvidia GB300 Grace Blackwell GPUs to the United Arab Emirates to build data centers. Samsung just announced it’s buying 50,000 Nvidia GPUs to build an AI Megafactory that will automate chip production for smartphones and robots.

SoftBank sold its entire $5.83 billion stake in Nvidia in October — along with part of its T-Mobile holdings — as it raises capital for what CFO Yoshimitsu Goto called “safe funding” and “asset monetization.” But SoftBank is making a $22.5 billion investment in OpenAI, and both OpenAI and SoftBank list Nvidia as a partner. I don’t think their stock sale means anything. After all, no less than the Financial Times says Nvidia CEO Jensen Huang is one of the six minds behind modern AI:

NVDA is a Hold for a $180 first target.

Onsemi (ON – $48.13) reported a good quarter even though revenues were down 11.9% from last year to $1.55 billion, a skotch above the $1.52 billion estimate. Pro forma earnings of 63¢ a share beat the 59¢ estimate. On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Hassane El-Khoury guided the December quarter to revenues of $1.48-$1.58 billion, right on the $1.53 billion consensus estimate. He expects pro forma earnings of 57¢-67¢, also right on the 62¢ estimate.

What was good about the quarter was that Hassane said they’re seeing continued sign of stabilization across their core markets, primarily automotive and industrial, with positive growth in AI. So is ON suddenly an AI play, like Corning? Not really, but that market can carry them until the recovery in their core market hits. They continue to introduce the newest and best power semiconductors in the world, which also provide new revenue opportunities even while their end markets are down. Hassane said: “As energy efficiency becomes a defining requirement for next-generation automotive, industrial, and AI platforms, we are expanding our offering to deliver system-level value that enables our customers to achieve more with less power.”

They had $418.7 million in cash from operations in the quarter and $372.4 million in free cash flow. As their end markets recover, they have a lot of operational leverage to hit their 2027 target financial model.

ON is a Buy under $60 for a $100 first target.

Palantir (PLTR – $172.14) did it again. September quarter revenues rose 62.6% from last year to $1.18 billion, above what Wall Street thought was an aggressive estimate of $1.09 billion. Pro forma earnings of 21¢ a share easily beat the 17¢ estimate. Their customer count grew 45% year-over-year.

The company closed 204 deals of at least $1 million, including 91 deals of at least $5 million, which included 53 deals of at least $10 million. The deals added up to a record $2.76 billion of total contract value, up 151% year-over-year, including a record $1.31 billion of U.S. commercial total contract value, up 342% year-over-year. When we bought PLTR, the skeptics were saying: “Yeah, they’ve got government business, but they’ll never get commercial business.” At this point, the U.S. commercial remaining deal value (future revenues) is $3.63 billion, up 199% year-over-year and 30% from the June quarter.

On the conference call (YOUTUBE HERE and SLIDES HERE and PRESIDENT’S LETTER HERE and TRANSCRIPT HERE), CEO Alex Karp guided December quarter revenues to grow 61% from last year to $1.327-$1.331 billion, substantially above the $1.18 billion estimate and the highest quarter-over-quarter guidance they’ve ever given. He raised their full-year guidance from $4.16 billion to $4.296-$4.400 billion. The Street was at $4.16 billion.

In spite of the double beats on results and guidance, the stock fell $16.44 or 7.94% the day after the conference call as multiple Wall Street analysts voiced concerns that Palantir’s performance and guidance fail to justify its valuation. For example, Jefferies wrote: “We believe the risk/reward is unfavorable as the current valuation is susceptible to any downtick in the AI hype cycle” and maintained their Underperform rating on the stock with a $70 target price.

Did you spot the most important word in that? “Maintained.” They’ve missed the stock the whole way up, so they are going for the “stopped clock” strategy to talk to customers in the future. RBC is in the same boat. Target prices: BofA $255; UBS $205; Mizuho $205; Goldman Sachs $188; Baird $200; Jefferies $70; RBC: $50.

The current highest estimates for 2026 are revenues of $7.39 billion and earnings of $1.36, so at today’s close the stock is selling for 55x those 2026 revenues and 126x 2026 earnings. Palantir is a great company and the best-positioned software company to benefit as businesses apply AI. But there is no doubt these are nosebleed valuations, and we will have to sell the stock before the inevitable quarterly disappointment. PLTR is a Buy under $160 for a $200 first target.

PayPal Holdings (PYPL – $65.33) launched Pay in 4!, their interest-free, no-fee, buy now, pay later (BNPL) solution in Canada, just in time for Black Friday, Cyber Monday, and the all-important Boxing Day. PYPL is a Buy under $75 for a double in three years.

Snap (SNAP – $8.58) reported some good news and a double beat for the September quarter. Revenues grew 10.2% from last year to $1.51 billion, a skotch above the $1.49 billion estimate. The GAAP loss of 6¢ a share was better than the 12¢ loss expected. Monthly active users grew 7% or 60 million to 943 million users, while daily active users grew 8% or 34 million to 477 million.

Bears tried to focus on the 2.0% year-over-year decline in North American daily active users to divert attention from Snap’s strong results in the rest of the world:

But their message was overwhelmed by Snap’s announcement that they have partnered with Perplexity to integrate Perplexity’s AI-powered answer engine directly into Snapchat. Starting in early 2026, Perplexity will appear in the chat interface for Snapchat users around the world. Perplexity will pay Snap $400 million over one year, through a combination of cash and equity, as Snap rolls the service out globally.

Revenue growth accelerated from 9% in the June quarter to 10% in the September quarter, while adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization) exploded from $41 million to $182 million. On the conference call (AUDIO HERE and SLIDES HERE and INVESTOR LETTER HERE [well worth reading whether you own the stock or not] and TRANSCRIPT HERE), they guided for another big jump in EDITDA in the December quarter to $280-$310 million. The stock gained 71¢ or 9.73% after the call. SNAP remains a Buy under $11 for a $17+ target.

SoftBank (SFTBY – $63.73) announced their first half of the March 2026 fiscal year results. I’ve subtracted the first quarter results from the first half results to get the September quarter numbers. The fact that I have to do this and also translate yen results to dollar results tells you a major reason SFTBY has been undervalued for so long.

First half revenues were up 7.7% from last year to ¥3736.84 billion with GAAP earnings per share of ¥2039.55. June quarter revenues were ¥1820.00 billion with EPS of ¥291.71. Therefore, September quarter revenues were ¥1916.84 billion ($12.44 billion) – a 5.3% sequential gain – with earnings of ¥1747.84 ($11.34) – an explosive 500% sequential gain as, taking a page from Amazon’s playbook, they wrote up the value of their OpenAI investment by $14.6 billion. Masa’s AI investments in the Vision Funds are paying off, and PayPay will go public soon.

On the conference call (FULL LENGTH AND SHORT VERSIONS HERE and SHORT VERSION TRANSCRIPT HERE and 85 SLIDES HERE and TRANSCRIPT HERE), CFO Yoshimitsu Goto said: “Last quarter, I said fiscal 2025 would be a year of acceleration — and that’s exactly what we are seeing. Building on the strong momentum from Arm and OpenAI in Q1, our financial performance and market value have continued to improve. This progress is clearly reflected in our share price, which has risen along with growing excitement about AI. Since the start of the fiscal year, our market cap has increased by about three times, reaching a record high in October.”

Well, that’s true. As a result, SFTBY no longer sells at a 50% discount to its net asset value. Even with the write-up of OpenAI, their net asset value only increased by 3% in the quarter, admittedly to the second-highest level ever. But more important to me is that the discount to net asset value has fallen to 20%, so much of the margin of safety we had when I recommended the stock at $22.35 in 2018 is gone. Also, CEO Masayoshi Son is making a huge bet on Artificial General Intelligence – software that is as intelligent as humans – that I think he’s going to lose.

But that loss, if it comes (Masa is smarter than me), is sometime in the future. Immediately ahead are some Initial Public Offerings to drive their net asset value up and a 4-for-1 stock split on December 31. I’m not ready to get off this bull yet, but I am moving SFTBY to a Hold.

Small Tech

Enovix (ENVX – $8.08) reported a good quarter and the stock fell $2.29 or 20.23% as Wall Street focused their full attention on the wrong thing. Revenues rose 85.0% from last year to $7.99 million, smack in the middle of their $7.5-$8.5 million guidance and just above the $7.93 million estimate. They’ve beaten the revenue estimate in each of the last four quarters. The pro forma loss of 14¢ a share was at the low end of their 14¢-18¢ guidance and better than both the 16¢ loss estimate and last year’s 16¢ loss.

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Raj Talluri guided the December quarter to $9.5-$10.5 million in revenues, up 25% sequentially at the midpoint, with a pro forma loss of 16¢-20¢. That was below the consensus for $12.25 million with a 14¢ loss, which is what caused the stock to drop.

The company revealed that their lead smartphone OEM is Honor, not Samsung.

Honor spun out of Huawei to compete globally in the mid-range smartphone market with foldable phones. They are in over 75 markets and sell close to 100 million phones each year. Enovix said: “Lead customer to perform additional lifecycle testing following our design revision; reflects collaborative, multi-year partnership typical of first-of-its-kind architecture. Second smartphone program accelerating with another mobile customer.” [I expect the second customer also to launch in 2026.]

Enovix also delivered over 1,000 battery packs to their lead smart eyewear customer and delivered samples to nine other smart eyewear companies, several of which are expected to have products launched in 2026.

On the call, Raj said: “Enovix is expanding the limits of battery capabilities and transforming how the battery industry will evolve over the coming years with a silicon battery.”

With the Honor program entering final validation for a first-half-of-2026 launch, the light December quarter guidance is just a sideshow. I still believe Enovix batteries will wind up in most smartphones over the next few years, causing very rapid revenue and earnings growth. Take advantage of this short-sighted dip in the stock’s price.

They finished the quarter with $648 million in cash. ENVX is a Buy up to $20 for a 4-year hold to $100+ as their BrakeFlow lithium-ion battery takes market share.

Primary Risk: A new competitor invents a better battery.

Fastly (FSLY – $11.44) reported September quarter revenues up 15.3% from last year to $158.2 million, easily beating the $151.04 million estimate. They earned 7¢ a share pro forma; the Street expected only breakeven.

On the conference call (AUDIO HERE and INVESTOR SUPPLEMENT HERE and TRANSCRIPT HERE), CEO Kip Compton guided the December quarter to revenues of $159-$163 million with pro forma earnings of 4¢-8¢ per share. Both were above the consensus estimate for $153.93 million and 1¢ per share.

He raised full year guidance to $610-$614 million in revenues with positive pro forma earnings of 3¢-7¢. Again, both were above the consensus estimate for $598.12 million in revenues and a loss of 7¢ a share. Kip highlighted a significant multi-product win with a top 10 strategic account and the launch of new security and AI enhancements for the Fastly platform. He said: “Our platform expansion and cross-sell strategies were major contributors driving our security revenue growth to 30% year-over-year.”

Fastly ended the quarter with $343 million in cash and a new CFO who said: “Since coming on board, I have seen many opportunities in finance where we can influence better outcomes with our customers as well as our financial performance with our investors.” FSLY is a Buy under $10 for a 3- to 5-year hold to $50+.

Primary Risk:Content and applications delivery networks are a competitive area.

PagerDuty (PD – $15.59) will report October third quarter earnings two days before Thanksgiving. The consensus expects revenues to be up 5.02% to $124.92 million with 25¢ earnings per share. They expect January fourth quarter guidance for revenues up 4.56% to $126.98 million with 24¢ EPS. Both seem too low. PD is a Buy up to $30 for a 2- to 5-year hold as their digital operations management Software-As-A-Service gains market share.

Primary Risk: Digital operations management is a competitive area.

QuickLogic (QUIK – $5.91) reported the poor September quarter that everyone expected. Revenues fell 52.7% from last year to $2.02 million as Samsung delayed the introduction of their new phone. That was a skotch under the $2.05 million estimate. The pro forma loss of 19¢ a share was 1¢ better than the 20¢ loss expected.

While the poor quarter was expected, I was surprised by the wide guidance for the December quarter. CEO Brian Faith is only projecting revenues of $3.5 million plus maybe another $2.5 million if one big contract comes early enough in December, although it may slip into the March quarter. The pro forma gross margin for the fourth quarter is expected to be approximately 45% at $3.5 million of revenue and 68% at $6.0 million of revenue. If they have $3.5 million in revenues, they expect to lose 11¢ a share, but if they get to the $6 million level, they will make 4¢.

On the conference call (AUDIO HERE and PREPARED REMARKS HERE and TRANSCRIPT HERE), Brian pointed to a change in the scope of the Samsung contract that has caused a delay in closing it. But I noticed that their forward two-year sales pipeline has been cut sharply, gross profit margin guidance is being reduced, and they now have a net debt position.

During the quarter, they did win a $1 million eFPGA Hard IP contract for a high-performance data-center ASIC. And Brian said: “Our investment to accelerate the fabrication of our Strategic Rad Hard FPGA Test Chip is being very well received by potential customers. As a matter of fact, we anticipate receiving orders for our upcoming SRH FPGA Dev Kit, as well as several new eFPGA Hard IP contracts, during the coming weeks. I see this as our first tangible step towards the hundreds of millions of dollars in potential storefront business we could win in the coming years.”

The #1 spending category for semiconductors by the Defense Industrial Base is field-programmable gate arrays (FPGAs), with custom application-specific integrated circuits (ASICs) a close second. Together, these two account for about half of the defense semiconductor market. Brian said that many of the new strategic designs that require various levels of radiation hardness will use either discrete FPGA devices that QuickLogic can sell through their Storefront or eFPGA Hard IP that they can license for new ASIC designs.

These customers are already using GlobalFoundries’ 12LP fabrication process for radiation-tolerant and Strategic Radiation-Hardened ASICs. Government contracts require the use of onshore fabrication for strategic programs when devices are available. QuickLogic is the only source for Strategic Rad Hard FPGAs and SRH eFPGA Hard IP that is fabricated in the US by a US company.

QuickLogic is a beneficiary of the trend to Smart Systems designs. Smart Systems rely on algorithms for their intelligence because algorithms can be processed much faster and with much lower power consumption in hardware than software. Hardware processing is also inherently more secure against cyber threats than software.

But algorithms must be updated over the lifecycle of the product, so the hardware must be programmable so it can adapt to changing algorithms. This has led to the need for larger blocks of eFPGA at the heart of ASIC designs. Many programs must be compliant with requirements ranging from Radiation Tolerant to Strategic Rad Hard – exactly where QuickLogic leads.

I am as tired of these quarterly revenue disappointments as you are, but I think the company is on the edge of a very powerful five to ten-year positive cycle delivered in large part by defense and space applications. They’ll be at Space Tech Expo Europe 2025 in Germany, November 18-20. Brian has done a remarkable job so far, and this is not the time to give up on him. QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

ARK Venture Fund (ARKVX – $41.09) rose a bit after Elon Musk’s xAI reportedly raised $15 billion in a series E funding round that valued it at $200 billion. ARKVX has a 3.97% position in xAI. ARKVX is a Buy for the SpaceX IPO.

Primary Risk: Cathie sells the stock before the IPO.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

AbCellera Biologics (ABCL- $3.62) reported September quarter revenues up 37.8% from last year to $8.96 million, well ahead of the $6.33 million estimate. The GAAP loss per share of 19¢ was 2¢ worse than the 17¢ loss estimate. And none of that matters.

What matters is on the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Carl Hansen said they successfully delivered on two corporate priorities this quarter by starting activities at their new GMP clinical manufacturing facility and substantially completing their platform investments. They started discovery on an additional partner-initiated program with downstreams to reach a cumulative total of 103 partner-initiated program starts with downstreams at the end of September, up from 95 last year. AbCellera and its partners have advanced a cumulative total of 18 molecules into the clinic, up from 14 last year.

The Phase 1 trials of ABCL575 and ABCL635 are on track, and they have nominated another development candidate, ABCL688, for clinical trial-enabling studies.

They finished the quarter with $523 million in cash and $159 million in available non-dilutive government funding, bringing total available liquidity to approximately $680 million. Buy ABCL up to $6 for a long-term hold to $30 or more.

Primary Risk: Partnered and owned drugs fail in the clinic.

Clinical stage of lead product: Partnered: Various Owned: Preclinical

Probable time of next FDA approval: 2027-2028

Probable time of next financing: 2026-2027 or never

Akebia Therapeutics (AKBA- $1.76) reported disappointing Vafseo sales Monday morning. September quarter total revenues rose 57.0% from last year to $58.78 million, above the $56.42 million consensus estimate. But Vafseo revenues only rose $1 million from the June quarter, from $13.3 million to $14.3 million. They broke even on the bottom line, which was better than the 1¢ loss the Street expected.

On the conference call (AUDIO HERE and TRANSCRIPT HERE), CEO John Butler said that through 41 weeks of launch, Vafseo has generated more total prescriptions than any recent launch in dialysis. But he added: “From a business perspective, I’m not satisfied with generating $14.3 million in revenue this quarter. No one on the Akebia team is.”

Butler noted that accessible patients expanded from 40,000 in the first half of the year to almost 70,000 by the end of Q3, citing the initiation of the DaVita pilot and the addition of IRC and other providers.

They are seeing an increase in patients getting a first refill – an important indicator that doctors are staying with Vafseo. Importantly, DaVita has already decided to roll Vafseo out to all its clinics, bringing access to over 200,000 DaVita patients. Vafseo is available broadly as of today. They’ve gone from 100 centers at US Renal to 2,000 including DaVita, and from 60,000 potential patients at the end of September to 275,000 by the end of the year.

The company presented at the Guggenheim Healthcare Innovation Conference later on Monday (AUDIO HERE). John said that when someone on high ESAs is switched to Vafseo, their hemoglobin levels often fall for a bit. Patients should be titrated up, but instead the nurses often freak out and the patient is switched back to an ESA.

At last week’s American Society of Nephrology (ASN) Kidney Week 2025, they presented a post-hoc analysis of data from the INNO2VATE trials comparing dialysis patients taking vadadustat to darbepoetin alfa for CKD-related anemia. The data demonstrated statistically significant more favorable outcomes in the composite of all-cause mortality and hospitalization in patients treated with vadadustat compared to patients in the ESA control group. For about 1/3 of their patients, dialysis centers are on the hook for hospitalization costs.

They finished the quarter with $166.4 million in cash, enough to get them to profitability. Buy AKBA up to $4 for the Vafseo launches in the EU, UK, and US. I think GSK and/or Amgen will make a bid for the company.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Compass Pathways (CMPS – $5.29) reported confusing financial results for the September quarter, accompanied by great news: They are accelerating the COMP360 launch by 9 to 12 months. They’ve completed enrollment of the 585 patients in their second Phase 3 trial early, so they now plan to give us the 9-week data from the second trial together with 26-week data from the first trial in the March quarter. That will be followed by the 26-week data from the second trial early in the September quarter.

Even better, they had a positive meeting with the FDA, and a rolling Biologics Licensing Application (BLA) looks possible to accelerate approval. They have applied for priority review. They’ll file in the September 2026 quarter, after they release the 26-week data.

The confusing finances part is that their GAAP earnings per share loss of $1.55 was way worse than the 39¢ loss estimate – on the surface. But $1.06 of that was a non-cash charge loss from the fair value adjustment of their warrants, which is meaningless and fluctuates wildly.

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Kabir Nath said he is confident that they will be ready to launch on an accelerated time frame.

Steve Levine, Chief Patient Officer, said: “We would expect that any site that is delivering Spravato today would be capable of delivering COMP360.” That’s a lot of sites!

Their presentation this week at the Stifel Healthcare Conference (AUDIO HERE) was more of the same. Compass had $185.9 million in cash at the end of September, enough to carry them through all the data releases into 2027. CMPS is a Buy under $10 for a very long-term hold to $200.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2028

Probable time of next financing: Late 2025

Editas Medicine (EDIT – $2.54) reported a September quarter GAAP loss of 28¢, a bit less than the 31¢ loss Wall Street expected. There was no conference call, but in the 10-Q filing, management said they plan to submit an investigational new drug application (IND) or clinical trial application (CTA) for EDIT-401 to reduce LDL cholesterol by mid-2026, with the goal of achieving initial in vivo human proof-of-concept data by the end of 2026.

CEO Gilmore O’Neill wrote: “We recently presented data at AHA and ESGCT demonstrating the ability of EDIT-401 to reduce mean LDL cholesterol levels by over 90 percent in non-human primates.”

They finished the quarter with $165.6 million in cash, enough to carry them well past the human proof-of-concept data into the September 2027 quarter. EDIT is a Buy under $6 for a double in 12 months and a long-term hold to much higher prices.

Primary Risk: Other companies’ gene-sequencing drugs fail in the clinic.

Clinical stage of lead product: Partnered: Approved. Owned: Going into the clinic mid-2025.

Probable time of next FDA approval: 2028

Probable time of next financing: Late 2026 or never

Inovio (INO – $1.95) reported a September quarter GAAP loss of 87¢ a share, way bigger than the 48¢ loss expected due to a 43¢ non-cash loss on the fair value adjustment related to their warrant liabilities. I ignore that because it fluctuates wildly both up and down. Their real loss was 44¢ a share, 4¢ better than the estimate.

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Jacqueline Shea had two pieces of great news. First, they completed the rolling submission of the BLA for INO-3107 under the FDA’s accelerated approval program and requested a six-month priority review. They should announce file acceptance before the end of the year.

Second, they will begin enrolling patients in the confirmatory trial during the BLA review period. The trial will be conducted at approximately 20 sites across the US. They only have to enroll one patient and show a timely plan for completion before getting approval.

Jackie has done a great job of focusing the company on getting INO-3107 over the finish line and launched, while controlling costs. Operating expenses fell from $27.3 million in last year’s September quarter to $21.2 million this year. There are only 300 to 400 laryngologists that treat the majority of recurrent respiratory papilloma (RRP) patients that they can easily reach with a relatively small sales force.

INO-3107 will be the second approved therapy for RRP, after the August 15 approval of Precigen’s Papzimeos. But the trial design for INO-3107 was much tougher than the one for Papzimeos, where surgeries conducted between Day 0 and Week 12 were not counted against the efficacy endpoint.

INO-3107 should become the preferred product for RRP:

Inovio is not a one-trick pony. They have a very deep pipeline for their size that they can advance with INO-3107 profits:

They finished the quarter with $50.8 million in cash, which would have only carried them into the June 2026 quarter. So they did a $25 million stock offering at $1.90 a share and now have enough money to launch INO-3107 after approval in mid-2026. INO is a Buy under $5 for a very long-term hold.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: Mid-2026

Probable time of next financing:After FDA approval in 2026

ScyNexis (SCYX – $0.59) reported a GAAP loss of 17¢ in the September quarter, smaller than the 20¢ loss expected. There was no conference call, but they did post a new Investor Presentation HERE.

CEO David Angulo said they expect to start a Phase 1 study with the IV formulation of SCY-247 in the March quarter and a Phase 2 study of the oral formulation for the treatment of invasive candidiasis. They will release clinical proof of concept data in invasive candidiasis in 2026. This is the hospital indication that GSK stupidly walked away from.

Management said they are “exploring non-dilutive funding opportunities to support the development of SCY-247,” which probably means another Big Pharma partnership deal.

Meanwhile, GSK will relaunch Brexafemme in 2026. ScyNexis stands to receive up to approximately $146 million in annual net sales milestones as well as royalties, net of payments to Merck, in the low- to mid-single digit range.

They received the GSK payment of $24.8 million for terminating the MARIO study and finished the quarter with $37.9 million, enough to carry them for more than two years. Buy SCYX under $2.50 for a target price of $20.

Primary Risk: Ibrexafungerp fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: 2026

Probable time of next financing: Never

TG Therapeutics (TGTX – $30.96) reported another strong quarter for September and raised Briumvi sales guidance again. Revenues were up 92.8% from last year to $161.71 million, well above the $152.17 million estimate. Earnings of $390.9 million or $2.42 a share included a $365 million one-time tax asset valuation allowance, so they actually earned 16¢ a share, below the 21¢ estimate.

On the conference call (AUDIO HERE and TRANSCRIPT HERE), CEO Michael Weiss raised their 2025 guidance for Briumvi sales from $570-$575 million to $585 million. He guided for total 2025 revenue of $600 million, nicely above the $587.51 million consensus.

Mike said the Phase 3 trial of subcutaneous Briumvi enrollment is progressing well, with data expected by late 2026 or early 2027. He added that these could lead to “meaningful new launches in ’27, ’28 and ’29, each with the potential to drive continued growth into the next decade.” About 35% to 40% of all multiple sclerosis patients and half of the new MS starts opt for self-administered subcutaneous injections.

During the quarter, they completed their first $100 million stock buyback program, buying back 3.5 million shares at an average price of about $28.50. Their Board authorized another $100 million program to, as Mike said: “Give us flexibility to keep doing what makes sense.”

Mike also presented at the TD Cowen Immunology & Inflammation Summit (AUDIO HERE). Buy TGTX under $30 for a target price in a buyout of $40 or more.

Primary Risk: Briumvi, the MS drug, fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: NM

Probable time of next financing: Never

Inflation MegaShift

Gold ($4,175.30) can’t seem to decide if ending the government shutdown is good or bad for precious metals prices. Spoiler alert: It’s good, because out-of-control spending will resume. Although Wall Street thinks it’s a 50/50 bet on another Fed rate cut on December 10, I’m pretty sure they’ll respond to reports of labor market weakness and do it. US companies announced the most job cuts for any October in more than 20 years, according to outplacement firm Challenger, Gray & Christmas.

Central banks’ reported net purchases of gold totaled 39 tonnes in September. That was up 79% from August and is the highest month of reported net buying in 2025 so far.

The fractal dimension exhausted the uptrend, turned into consolidation right at the 30 level – and then flipped back again. My best guess is that this is a false signal, but today’s intraday high at $4,250 certainly got my attention. Like the S&P, it’s going to take a couple of weeks to be sure what happened, but for now, I’m going with this move up in gold has peaked.

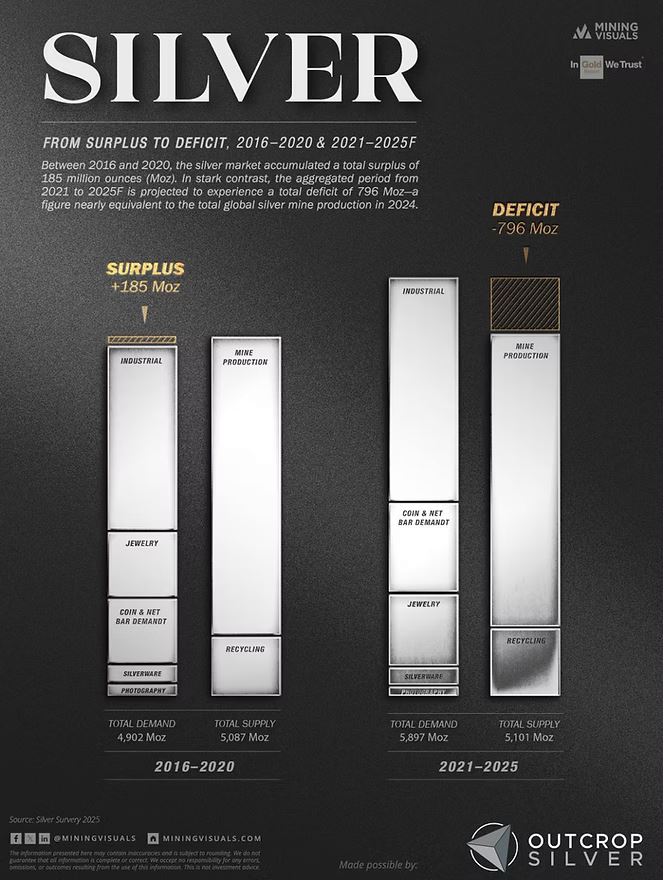

Silver has gone from a surplus of production to a deficit:

Miners & Related

Coeur Mining (CDE – $15.11) is doing a highly accretive acquisition of New Gold (NGD) for $7 billion. The addition of New Gold’s two Canadian mines results in a combined company with seven North American operations generating $3 billion of expected earnubgs before interest, taxes, depreciation & amortization (EBITDA) and $2 billion of expected free cash flow in 2026 from production of approximately 20 million ounces of silver, 900,000 ounces of gold and 100 million pounds of copper.

That will be up from Coeur’s expected 2025 full-year EBITDA of $1 billion and free cash flow of $550 million. The combined company will be among the top 10 largest precious metals companies and top 5 largest silver producers globally, with silver representing 30% of total metals reserves.

The company presented at the RBC London Precious Metals Conference, again blocking us from hearing the presentation or reading a transcript. As is their custom, they did post the presentation HERE. One of the side benefits of the New Gold acquisition may be that this crap will end, and they will come into compliance with SEC Rule FD. CDE is a Buy under $10 for a $20 target as gold goes higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

First Majestic Silver (AG – $12.22) reported September quarter revenues up 95.1% from last year to a record $285.1 million, their third record quarter in a row, but 95.1% wasn’t enough – they were $21.34 million below the consensus estimate for $306.44 million. (Yahoo Finance shows the one publishing analyst was expecting $429.78 million!) They also whiffed on the bottom line, reporting pro forma earnings per share of 7¢, below the 9¢ expected.

Although they had a 45% increase in silver equivalent (AgEq) ounces sold and a 31% increase in the average realized silver price to $39.03 per AgEq ounce during the quarter, they gambled on holding back 758,333 ounces of silver and 3,994 ounces of gold in inventory, with a fair value at quarter end of $50.3 million (and less now). Silver production was up 96% from last year’s 2.0 million ounce to a record 3.9 million ounces.

On the conference call (AUDIO HERE and SLIDES HERE), CEO Keith Neumeyer said the company is on track to hit its updated 2025 guidance:

First Mint, LLC, their 100%-owned minting facility, generated record quarterly sales of $11.1 million compared to $2.7 million last year, including record monthly sales in September.

First Majestic finished the quarter with $435.4 million in cash and $133.4 million in restricted cash, a total of $568.8 million.AG is a Buy under $11 for a $23 next target price as production increases and the price of silver rises.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Royal Gold (RGLD – $189.47) reported slight misses on the top and bottom lines for their September quarter. This is their first quarterly report after we became shareholders through their acquisition of Sandstorm Gold, and it’s going to take a while to get the price/earnings multiple upgrade I’m expecting as Wall Street recognizes their more balanced portfolio of current and future streams.

Revenues rose 30.1% from last year to a record $252.07 million, below the $260.03 consensus estimate. Record pro forma earnings of $2.06 a share also missed the $2.16 estimate. On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Bill Heissenbuttel said 78% of revenues came from gold, 12% from silver, and 7% from copper. He said: “In addition to the strong financial performance, over the last few months we have significantly enhanced the scale, duration, and diversification of our portfolio. Our underlying business continues to produce excellent results, we have seen meaningful value additions from the Mount Milligan mine life extension and Fourmile exploration success, we have acquired the large and long-life Kansanshi stream, and have added further scale, diversification, and growth with the Sandstorm and Horizon portfolios. We will work hard over the coming months to ensure that the market understands and appreciates the cash flow, growth potential, and gold leverage of our expanded business.”

Emphasis added, because that is actually the second-most important driver of RGLD’s price in 2026. (First, of course, is the price of precious metals.) RGLD is a Buy under $180.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $97,958.98) has corrected by close to 20% from its recent highs, with the sharpest decline occurring on October 10 amid record liquidations in perpetual futures — the largest in crypto history. Traders are still rattled after a $340 billion wipeout.

JPMorgan said bitcoin could rise to around $170,000 within the next six to 12 months as leverage resets and its relative volatility versus gold improves. Job #1 is to clear the 200-day moving average around $110,000.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $55.59) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $23.94) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $58.62

Oil briefly recaptured $60 as strong demand for gasoline and diesel made the “crude oversupply” thesis look silly. At the same time, Indian refiners reduced purchases from Russia as analysts increased estimates of the potential impact on Russian supply of the US crackdown on Moscow’s top two producers. OPEC+ decided to halt production hikes next quarter, which Wall Street said was due to an expectation for a seasonal slowdown. Apparently, traders believe OPEC+ was surprised to learn that oil consumption is weakest in the March quarter.

The July 2026 Crude Oil Futures (CLN26.NYM – $58.67) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.97) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $8.71) reported September quarter revenues up 15.8% from 2024 to $449.5 million with GAAP earnings of 2¢ a share. On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Anthony Hatcher said they generated $254 million or $1.65 a share of fund flows from operations in the quarter. They have reduced their net debt by over $650 million since the end of March, bringing it down to $1.38 billion at the end of September.

They elected to shut in a portion of their gas production and deferred the start-up of several wells, which resulted in approximately 3,000 barrels of oil equivalent per day (boe/d) of production impact in the September quarter, with production expected to resume this quarter amid stronger pricing. Production averaged 119,062 boe/d (67% natural gas and 33% crude oil and liquids), comprising 88,763 boe/d from the North American assets and 30,299 boe/d from the International assets.

And here I owe you an apology. I have not emphasized enough how rapidly they are transitioning to a European natural gas company. During the quarter, they executed a successful two-well drilling program in the Netherlands, discovering commercial gas in both the Rotliegend and Zechstein formations. Both wells will be completed, tied in, and brought on production in the current quarter. Vermilion has a 20-year track record of exploration success in the Netherlands that, combined with their recent discoveries in Germany, underscores their broader European gas exploration expertise. Natty sells for 3x-4x the US price in Europe.

The company paid $20 million in dividends and bought back 600,000 shares for $6 million in the quarter, for a total of 2.5 million shares repurchased year-to-date. VET is a buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $15.48) reported September quarter revenues up 337.3% – not a misprint – to $17.71 million, far above the $9.79 estimate. But they had a GAAP loss of 7¢ a share, 2¢ worse than the 5¢ loss estimate.

During the quarter, they sold a total of 240,000 pounds of U3O8 at a weighted average realized price of $72.38 per pound, yielding total gross proceeds of $17.4 million at a gross profit margin of 26%. They mined ore containing approximately 465,000 pounds of uranium. On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Mark Chalmers said they expect to process up to approximately 670,000 pounds of U3O8 in the December quarter. That will bring them in at their 2025 production guidance of 700,000 to 1 million pounds of finished U3O8.

They expect to produce between 430,000 and 730,000 pounds of U3O8 during the March quarter. For the full year 2026, they will sell between 620,000 and 880,000 pounds of U3O8 under their current portfolio of long-term uranium sales contracts. In addition, they may sell additional uranium on the spot market or under new long-term contracts.

UUUU hit a high of $27.33 in mid-October as excitement and momentum around rare earth and uranium-focused companies intensified, but Roth Capital just downgraded the stock from Neutral (not Buy – they missed the upswing) to Sell with an $11.50 target price. They said the company’s fundamental assets have not materially changed, the company has not reported any direct government investments, and losses have continued.

I think it’s very early days for both the rare earths story and the new nuclear/uranium story. I am raising the UUUU buy limit to $15, still for a $30 target.

Primary Risk: Uranium prices fall.

Freeport McMoRan (FCX – $40.54) scheduled their update conference call for Tuesday, November 18, at 10:00am EST. They will detail the plan to bring the Indonesian mine back into production and probably guide for quarter-by-quarter ore production. On the theory that Wall Street hates uncertainty more than anything, the stock should get a bump up. FCX is a Hold for the mid- to high-$40s.

Primary Risk: Copper prices fall.

* * * * *

* * * * *

Same Piece, Two Worlds – Segovia vs. Vidović

* * * * *

Your thinking quantum computing is a decade away Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 11/13/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $272.95) – Buy under $205

Gilead Sciences (GILD – $125.20) – Buy under $115, first target price $150

Meta (META – $609.89) – Buy under $705 for a long-term hold

Onsemi (ON – $48.13) – Buy under $60, first target price $100

Palantir (PLTR – $172.14) – Buy under $160 for $200 first target price

PayPal (PYPL – $65.33) – Buy under $75, target price $150

Snap (SNAP – $8.58) – Buy under $11, target price $17+

Small Tech

Enovix (ENVX – $8.08) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $74.76) – Buy under $75; 3- to 5-year hold

Fastly (FSLY – $11.44) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $15.59) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $5.91) – Buy under $10, target price $40

ARK Venture Fund (ARKVX – $41.09) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $3.62) – Buy under $6, target $30+

Akebia Therapeutics (AKBA – $1.76) – Buy under $4, target $20

Compass Pathways (CMPS – $5.29) – Buy under $10, hold a long time for a 20x return

Editas Medicines (EDIT – $2.54) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.95) – Buy under $5, hold a long time

Medicenna (MDNAF – $0.97) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.59) – Buy under $2.50, target price $20, then $50

TG Therapeutics (TGTX – $30.96) – Buy under $30 for buyout at $40+

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($52.27) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $63.20) – Buy under $50, target price $75

Sprott Junior Gold Miners ETF (SGDJ – $74.89) – Buy under $60, target price $100

Sprott Physical Gold and Silver Trust (CEF – $39.99) – Buy under $35, target price $60

Global X Silver Miners ETF (SIL – $69.28) – Buy under $60, target price $100

Coeur Mining (CDE – $15.11) – Buy under $10, target price $20

First Majestic Mining (AG – $12.22) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $1.08) – Buy under $1, first target price $10

Royal Gold (RGLD – $189.47) – Buy under $180

Cryptocurrencies

Bitcoin (BTC-USD – $97,958.98) – Buy

iShares Bitcoin Trust (IBIT – $55.59) – Buy

Ethereum (ETH-USD – $3,206.54)– Buy

iShares Ethereum Trust (ETHA- $23.94) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $58.67) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $33.97) – Buy under $40; $100+ target

Vermilion Energy (VET – $8.71) – Buy under $11; $24+ target

Energy Fuels (UUUU – $15.48) – Buy under $18; $30 target

EQT (EQT – $60.25) – Buy under $70; hold for much higher prices ($100+)

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Nvidia (NVDA – $186.86) – Hold

SoftBank (SFTBY – $63.73) – Hold

Dakota Gold (DC – $4.21) – Hold for $6 target price

Freeport McMoRan (FCX – $40.54) – Hold for an exit in the mid- to high-$40s

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

Any luck including Silver Fractals in your reports going forward?

The idea that quantum is a decade away is very mistaken. I read the article. Very narrow point of view and apparently unaware of the variety of approaches currently in progress in the industry.

Totally agree. I think it’s much closer than people think.

Supply and demand. Silver is in a deficit! I love it when that happens. It’s showing up in Rio Tinto’s bottom line as well. AG closed at $12.21 yesterday. A buying opportunity in my opinion. You miss 100 percent of the shots you don’t take!

MM: Friday, November 28

Markets Close Early – 10:00am

Isn’t that PST? I have market close at 1:00pm EST.

Right-O! I always look to pick up some Back Friday bargains.

You are correct, thanks.

I’ll see your 2 and raise you

https://www.youtube.com/watch?v=e8W2KoooUzg