Dear New World Investor:

The headline September payrolls report claimed the US added 119,000 jobs in September. That’s (A) more than double the consensus estimate for +50,000; (B) more than 5x August’s originally reported +22,000; (C) a positive number following August’s -26,000 revision to minus 4,000; and (D) probably wrong.

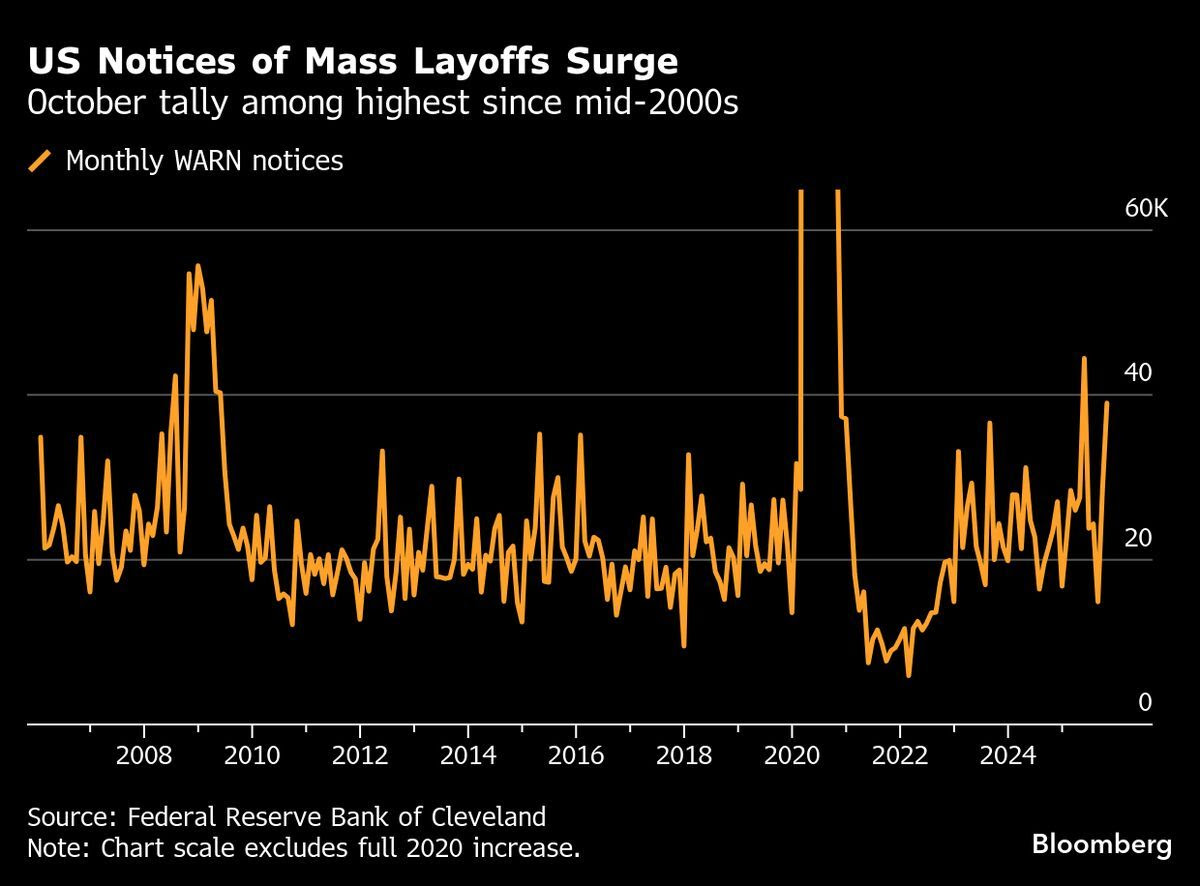

WARN-act notices of impending layoffs across the 21 states tracked by the Federal Reserve Bank of Cleveland spiked to 39,000 in October. We have only seen a greater number of warnings in 2008, 2009, 2020 – all years marked by severe economic downturns – and May 2025.

As of today, the CME FedWatch tool has an 84.7% chance of a 25 basis point (¼ of 1%) cut in the Fed funds rate at the FOMC meeting on December 10. I still think they will cut and that it would be the wrong thing to do because, in spite of current interest rates, the economy is pretty strong.

But it’s true, as Jim Paulsen pointed out, that a dominant feature of the current bull market has been restrictive economic policies. Since the bull began in October 2022, the US dollar has hovered near its highest, most restrictive levels since it was first floated in the early 1970s. After never being below zero in its history, the annual growth of the real M2 money supply was negative for 16 consecutive months between November 2022 and March 2024. The Federal Reserve has been contracting its balance sheet through the entire bull market. Finally, during this bull market, the 10-year treasury yield to Fed Funds rate yield curve has been “inverted” an unprecedented almost 80% of the time.

Yet the economy’s cyclical prospects remain pretty clear, in sharp contrast to Fed Chairman Powell’s recent remark that policymakers are “driving in a fog” because so much government data is missing.

The ECRI US Long Leading Index (USLLI) and Weekly Leading Index (WLI) showed growth firming as early as last summer.

Click for larger graphic h/t ECRI

After turning down late last year, USLLI growth reversed course after Liberation Day, as trade distortions eased and supply-chains began to stabilize – and it remains in an upswing. Following suit, WLI growth turned down early this year, rebounded after Liberation Day, and has since mostly trended higher despite brief dips. With both indexes holding near their recent highs, the message is clear: US growth is poised to firm, not falter.

I am not surprised. The arguments for a rebound in the economy over the coming quarters are that (1) Liberation Day was almost eight months ago, (2) fiscal policy is easy – high deficits, (3) monetary policy is getting easier as the Fed cuts, and (4) easing financial conditions lead to a reacceleration in the economy.

Earnings season is in the bag and the results were spectacular. The September quarter growth rate settled in at 15% after starting the season at 7%. That’s an outsized bounce. The Mag 7 stole the show of course, with estimates propelling ever higher. But estimates for the other 493 stocks also are rising. Strong upward revisions outside the Mag 7 show the foundation of the market is healthier than the clickbait headlines suggest. Broad-based earnings strength is exactly what long-term investors want to see.

Market Outlook

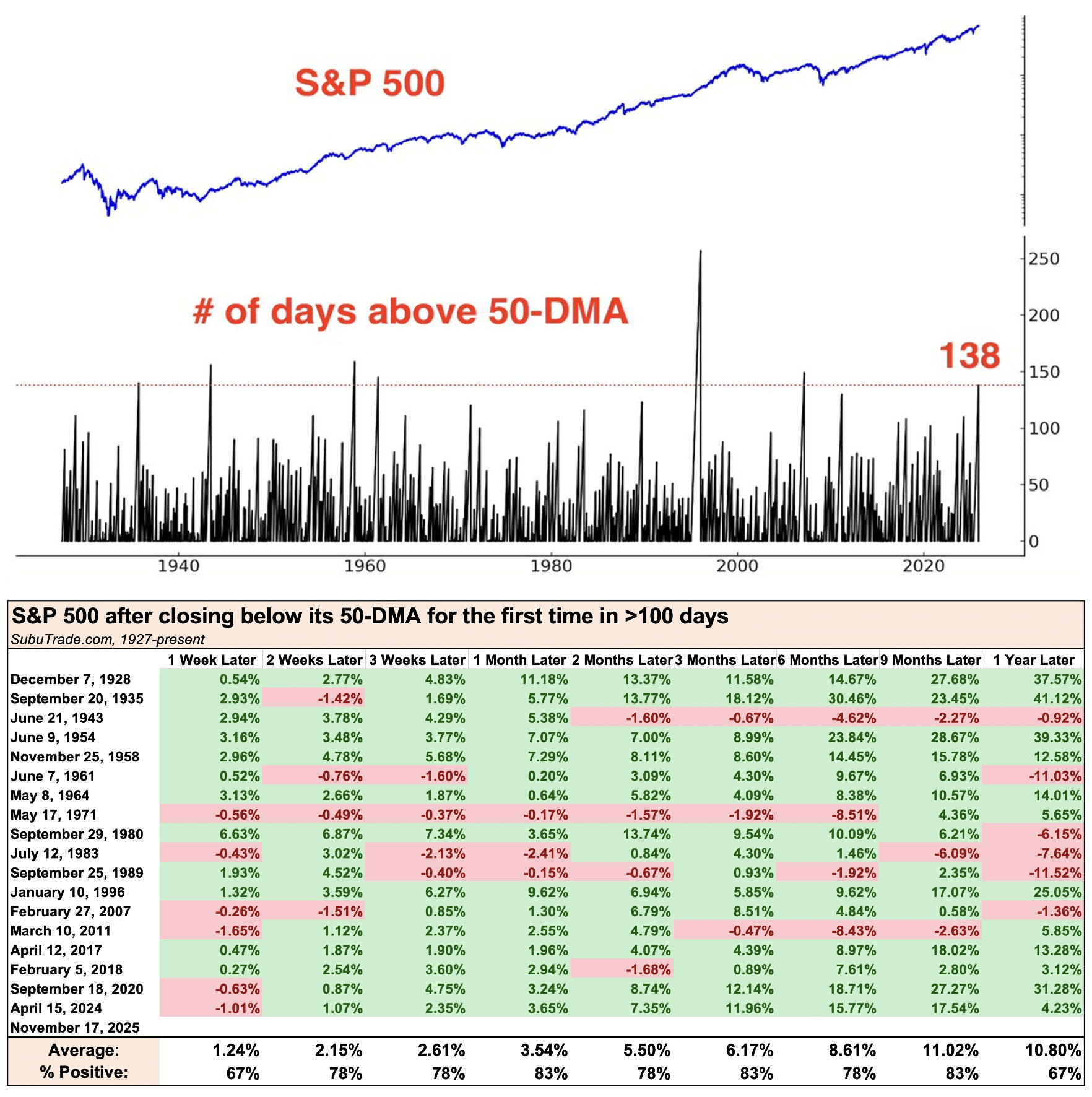

The S&P 500 added 1.1% over the last two weeks, including its best four-day stretch since May after last Thursday’s rout. After 138 days, the Index finally closed below its 50-day moving average. Here’s what it did next after such long rallies ended.

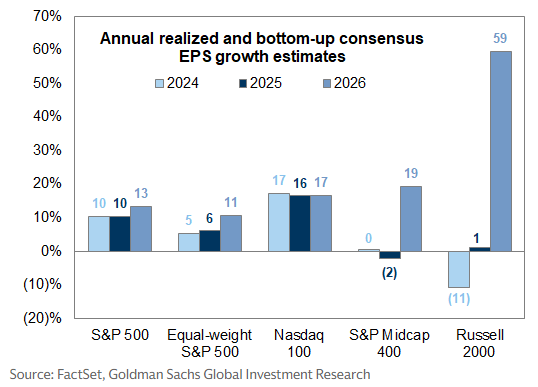

The Index is up 15.8% year-to-date. The Nasdaq Composite gained 1.5% as the MAG 7 recovered. It is up 20.2% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) won the two weeks, climbing 9.8%. It is up a whopping 36.4% year-to-date. The small-cap Russell 2000 soared 4.3% and is up 10.0% in 2025. Russell 2000 earnings per share growth is now expected to be 59% in 2026, revised up from 42% in recent weeks.

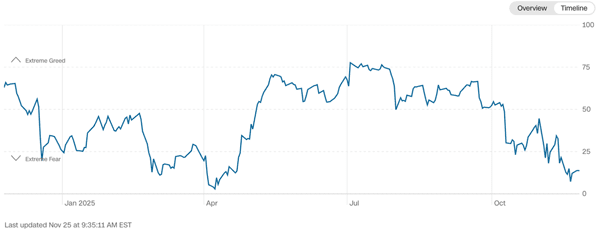

Retail investors are, of course, scared. On November 20, the CNN Fear & Greed Index dropped to 6. That’s the third lowest level since the pandemic. The other two times it got that low were the end of the 2022 bear market and the April 2025 bottom after President Trump’s tariff announcement. After each of those two the market was SUBSTANTIALLY higher several months later

That’s almost as negative as when the Trump tariffs were announced:

Click for larger graphic h/t CNN

The fractal dimension is consolidating at a high level. Another strong week or two would flip it back into the uptrend. But we’re very close to the 30 level that usually marks the end of a trend, so I don’t think the uptrend could get very far. There certainly is room for a Santa Claus rally to turn retail sentiment positive and suck in their money, but some market weakness early next year would probably follow. It might be better to see alternating up and down weeks to consolidate more before 2026 gets underway.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX ScyNexis – Resolution of GSK situation

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model estimate for September quarter real GDP growth is +3.9%.

Dollar Death Watch

The dollar broke out above its 200-day moving average, potentially trapping all the bears.

This is not good for stocks and precious metals, as it creates a headwind for further advances. Strong seasonals probably will still move stocks higher through the end of the year, but not as much as they would have in the weak dollar environment.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Thursday, November 27

Markets Closed – Happy Thanksgiving!

Friday, November 28

Markets Close Early at 1:00pm

Tuesday, December 2

CDE – Coeur Mining – Unspec – BofA Leveraged Finance Conference

AG – First Majestic – Through 12/3 – Scotiabank Mining Conference

DC – Dakota Gold – Through 12/3 – Scotiabank Mining Conference

INO – Inovio – 8:30am – Piper Sandler Healthcare Conference

EDIT – Editas – 9:10am – Evercore Healthcare Conference

NVDA – Nvidia – 9:35am – UBS Global Technology and AI Conference

DC – Dakota Gold – 9:50am – Mines and Money Resourcing Tomorrow

CMPS – Compass Pathways – 10:00am – Evercore Healthcare Conference

GILD – Gilead Sciences – 11:15am – Citi Global Healthcare Conference

ON – Onsemi – 11:35am – UBS Global Technology and AI Conference

AKBA – Akebia Therapeutics – 4:30pm – Piper Sandler Healthcare Conference

Wednesday, December 3

CDE – Coeur Mining – Unspec – Scotiabank Mining Conference

ABCL – AbCellera – 8:00am – Piper Sandler Healthcare Conference

PYPL – PayPal – 10:15am – UBS Global Technology and AI Conference

GILD – Gilead Sciences – 10:50am – Evercore Healthcare Conference

FSLY – Fastly – 12:55pm – UBS Global Technology and AI Conference

RGLD – Royal Gold – 1:15pm – Scotiabank Mining Conference

Thursday, December 4

No New World Investor this week

CMPS – Compass Pathways – 10:30am – Piper Sandler Healthcare Conference

RGLD – Royal Gold – 12:00pm – Renmark Financial Communications Virtual Non-Deal Roadshow Series

Sunday, December 7

Pearl Harbor Day

Monday, December 8

FSLY – Fastly – 8:40am – Raymond James TMT & Consumer Conference

Tuesday, December 9

ON – Onsemi – 9:00am – Nasdaq Investor Conference

Short Interest – After the close

Wednesday, December 10

Consumer Price Index – 8:30am – Maybe

Fed Meeting – 2:00pm press release; 2:30pm press conference

Thursday, December 11

Next New World Investor

PZG – Paramount Gold – 11:00am – Annual meeting

INO – Inovio – 12:05pm – Oppenheimer Movers in Rare Disease Summit panel. Topic: Elevator Pitches from Rare Disease Companies with Key Near-Term, Potentially Stock-Moving Catalysts

Well, that’s pretty blunt!

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $277.55) CEO Tim Cook may step down as early as next year, according to a rumor reported by the Financial Times. I like him, but the truth is it wouldn’t matter much. Apple is a juggernaut that mostly just needs to increase its revenue from current customers. According to Bloomberg, Apple is undertaking its most sweeping iPhone revamp to date, with three completely new models set to arrive over three consecutive years, starting with this year’s introduction of the iPhone Air and redesigned iPhone 17 Pro models. A foldable iPhone is expected next fall, followed in 2027 by a premium device featuring curved glass and an under-display camera.

Supposedly, the company is also making a fundamental change to its product-launch rhythm. After more than 10 years of unveiling its main models each fall, Apple plans to split its annual releases across two periods. Beginning in 2026, they will introduce their highest-end phones (the iPhone 18 Pro lineup and the first foldable) in the fall, with the standard iPhone 18, an “e” version, and possibly an updated iPhone Air arriving roughly six months later. The company is expected to release five to six iPhone models a year under this system, which is designed to smooth out the revenue flow and reduce pressure on the supply chain.

They just announced Digital ID for the iPhone and Apple Watch, which uses information from your passport and can be used to fly domestically without a Real ID drivers license.

Major League Soccer (MLS) and Apple said that beginning in 2026, all MLS matches will be available to stream for Apple TV subscribers at no additional cost. Fans can watch every regular-season match, the annual Leagues Cup tournament, the MLS All-Star Game, the Campeones Cup, and the Audi MLS Cup Playoffs. Soccer is popular enough to drive some iPhone sales. AAPL is a Buy under $205.

Gilead Sciences (GILD – $127.51) CFO Andy Dickinson presented at the Jefferies Global Healthcare Conference in London (AUDIO HERE and TRANSCRIPT HERE). He said they’ve got the company set in terms of areas of interest, and new partnerships and acquisitions will be in those areas. Interestingly, he said about half of those might be with Chinese companies, whereas five years ago it would have been more like 5%.

They announced one clinical trial failure and one success. The Phase 3 ASCENT-07 trial investigating Trodelvy versus chemotherapy as a first-line treatment post-endocrine therapy in HR+/HER2-negative metastatic breast cancer patients did not meet the primary endpoint of progression-free survival. Overall survival, a key secondary endpoint, was not mature at the time of the primary analysis but an early trend favored patients treated with Trodelvy compared to chemotherapy. So the trial will continue to further assess overall survival.

In better news, the Phase 2/3 ARTISTRY-1 open-label trial evaluated the treatment responses of adults with HIV who are virologically suppressed switching from a multi-tablet regimen to an investigational single-tablet regimen of bictegravir and lenacapavir (BIC/LEN). BIC/LEN efficacy was found to be statistically non-inferior to multi-tablet antiretroviral therapy regimens. Gilead plans to file the Phase 3 data from the ARTISTRY trials with regulatory authorities. GILD is a Long-Term Buy under $115 for a first target of $150.

Meta Platforms (META – $633.61) did something that caused Yahoo Finance to answer the challenge: “Tell me you don’t understand AI semiconductors without telling me you don’t understand AI semiconductors”:

Aside from the ludicrous idea that Google’s TPU AI chip is somehow better than Nvidia’s, I guess Yahoo didn’t notice that Nvida is sold out, in part because Meta is buying more than $100 billion of Nvidia GPUs, so the only way Meta can build data centers as fast as they want to is to buy additional semiconductors from other – even inferior – vendors.

(The TPU is a good chip for inference, but not for training AI models. For a deep dive, read The chip made for the AI inference era – the Google TPU.)

Seven months ago, the Federal Trade Commission sued Meta, claiming they shouldn’t have been allowed to buy Instagram in 2012 and WhatsApp in 2014. The judge just ruled that Meta does not have a monopoly in the social networking market. Meta won.

Coverage on the stock was initiated at BNP Paribas Exane with an Outperform rating and an $800 target price. META is a Buy under $705 for a long-term hold.

Nvidia (NVDA – $180.26) reported an interesting October third quarter. Analysts expected revenues up 57.1% from last year to $55.1 billion. 57% growth when you are doing over $200 billion a year in revenues is pretty good. Analysts expected pro forma earnings per share to keep pace, up 55.6% from last year to $1.26 a share.

Nvidia beat on the top and bottom lines, with $57.0 billion in revenues and $1.30 a share. Then they guided January fourth quarter revenue to $65.0 billion ±2%, well above the $61.834 billion estimate. And that’s without China.

They’ll probably earn about $1.55 a share in the January quarter, again well above the $1.43 estimate. That sets them up for fiscal year January 2027 pro forma earnings of $7+ a share. That puts the forward valuation at a reasonable 26x earnings.

On the conference call, CEO Jensen Huang said: “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different. As a reminder, Nvidia is unlike any other accelerator. We excel at every phase of AI. Blackwell sales are off the charts, and cloud GPUs are sold out. Compute demand keeps accelerating and compounding across training and inference – each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

CFO Colette Kress said the company has visibility toward $500 billion – half a trillion dollars – in Blackwell and Rubin AI chip revenue through calendar 2026. NVDA is a Hold for a $180 first target.

Jensen on AI & the Next Frontier of Growth

Onsemi (ON – $49.64) rose after they announced a $6 billion stock buyback authorization over the next three years. That’s double the current $3 billion program that expires at the end of the year.

The company got approval from the European Commission to receive a $518 million grant from the Czech Republic to build an integrated chip manufacturing plant for silicon carbide power devices. ON will use the grant to partly fund the $1.89 billion facility. Onsemi said the plant, which will be a first-of-its-kind facility in the EU, will use 200mm SiC technology and come online in 2027. ON is a Buy under $60 for a $100 first target.

Palantir (PLTR – $165.77) achieved the PROTECTED level under the Australian Information Security Registered Assessors Program (IRAP), a key requirement for organizations working with Australian government agencies.

They also signed a multiyear, multimillion dollar expansion of their strategic alliance with PwC UK to deliver advanced AI and data solutions to UK organizations.

Finally, they signed a multiyear deal with FTAI Aviation Ltd. (FTAI), a global leader in aircraft engine maintenance. Palantir’s AIP is helping FTAI transform productivity and reduce manufacturing costs by improving maintenance scheduling and inventory optimization across FTAI’s operations worldwide. This includes transforming its internal supply chain and driving further efficiencies through automated workflows, rapid asset allocation, and dynamic procurement strategies for component parts. PLTR is a Buy under $160 for a $200 first target.

PayPal Holdings (PYPL – $61.83) presented at both the KBW Fintech Payments Conference (AUDIO HERE and TRANSCRIPT HERE) and Citi’s FinTech Conference (AUDIO HERE and TRANSCRIPT HERE).

At Citi, CEO Alex Chriss, who Seeking Alpha is convinced is named “James” Chriss, said: “We called out sort of mid-Q3 that we started to see a slowdown on consumers, particularly around discretionary spending, retail and really in middle to low income brackets, which we are — play a significant role in PayPal. What we’ve seen so far is that there’s a lot of pressure on consumer right now. This is across U.S. and Europe, and it has persisted into Q4. And we expect that to have an impact on branded checkout. I still expect branded checkout in Q4 to grow but grow slower than Q3 if this persists.”

On the September quarter conference call, PayPal guided light for the current quarter, so I don’t think this should have caused a second drop in the stock – but it did.

High Growth Investing wrote a good article on PayPal: PayPal Stock after Q3 2025 – the Company Delivers, the Stock Market Hesitates . I think the turnaround is on track and PYPL is a Buy under $75 for a double in three years.

Snap (SNAP – $7.61) offered Australia an age verification tool ahead of the teen social media ban. SNAP is a Buy under $11 for a $17+ target.

SoftBank (SFTBY – $52.80) completed the acquisition of Ampere Computing Holdings. SFTBY is a Buy under $35 for a first target of $50 and then higher as the discount to hard book value disappears.

Small Tech

Fastly (FSLY – $11.88) presented at the RBC Capital Markets Global Technology, Internet, Media and Telecommunications Conference (AUDIO HERE and TRANSCRIPT HERE). CEO Kip Compton gave the usual corporate story, updated through the September quarter earnings report I covered in the last issue. Fastly has transitioned to a platform software company, which is (A) what customers want, (B) has lower selling expenses, and (C) is more highly valued by Wall Street – when they realize it has happened. Which they will.

They will transfer from the New York Stock Exchange to the Nasdaq Global Select Market on December 9 and retain the same ticker symbol. FSLY is a Buy under $10 for a 3- to 5-year hold to $50+.

Primary Risk:Content and applications delivery networks are a competitive area.

PagerDuty (PD – $11.64) reported October third quarter revenues up 4.7% from last year to $124.55 million, just under the $124.86 million consensus estimate. But pro forma earnings of 33¢ a share solidly beat the 24¢ estimate. On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Jennifer Tejada guided the January fourth quarter to revenue of $122 million to $124 million – growth of only 0% to 2% a year – with pro forma earnings of 24¢-25¢. The Street was at $126.86 million and 24¢.

For the full year, they reduced guidance from $493-$497 million in revenues to $490-$492 million, but raised earnings guidance from $1.00-$1.04 a share to $1.11-$1.12 a share. The Street was at $498.26 million and $1.02. In spite of the rosier earning outlook, the stock dropped 23.3% or $3.54 today because Jen said: “New and expansion bookings were consistent with the first half, offset primarily by customers rightsizing seat licenses amidst budget caution…”

She added: “This will be our sixth consecutive year of expanding operating margins as part of our commitment to profitable growth. Structural efficiency initiatives are accelerating product and business execution while lowering our cost base. With the added benefit of modern software and AI, we expect to continue expanding operating margin towards our long-term target of 30%. Demand for our platform remains strong, with double-digit year-over-year growth in new customer acquisition and in total paid and free customers. Customer retention and growth remain our top priority.”

BTFD! PD is a Buy up to $30 for a 2- to 5-year hold as their digital operations management Software-As-A-Service gains market share.

Primary Risk: Digital operations management is a competitive area.

QuickLogic (QUIK – $6.10) did the standard corporate presentation at the Craig-Hallum Alpha Select Conference (SLIDES HERE).

Their eFPGA Hard IP was selected by Chipus for a high performance data center production ASIC. QuickLogic can deliver eFPGA Hard IP on any new process node within four to six months, supporting applications from high-performance data processing to low-power, battery-operated devices. Once a fab-specific Hard IP is established, customer-specific variants can be delivered in just weeks. QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

Rocket Lab USA (RKLB – $41.93) slid the Neutron launch from late 2025 to some time in 2026, as I expected they would when we sold the stock. CEO Peter Beck said the decision to delay Neutron was based on setting priorities toward ensuring quality and reliability in the rocket’s development and testing phase rather than adhering to the previously set launch timeline. He said that the necessary hardware for Neutron has already been built and is undergoing final testing, but additional time is required to reduce program risks and complete qualification work. Although the stock dropped, I am expecting at least one further delay before we re-enter this position.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

AbCellera Biologics (ABCL- $3.64) presented at the Jefferies Global Healthcare Conference (AUDIO HERE and TRANSCRIPT HERE). CEO Carl Hansen gave the standard presentation with no new information.

Buy ABCL up to $6 for a long-term hold to $30 or more.

Primary Risk: Partnered and owned drugs fail in the clinic.

Clinical stage of lead product: Partnered: Various Owned: Preclinical

Probable time of next FDA approval: 2027-2028

Probable time of next financing: 2026-2027 or never

Akebia Therapeutics (AKBA- $1.59) also presented at the Jefferies Global Healthcare Conference (VIDEO HERE). CEO John Butler said DaVita opened the whole system to Vafseo on November 10, going from the 100 trial centers to all 4,000+ clinics.

The negative I heard is US Renal is switching from sending patients home with daily 150 milligram Vafseo to dosing them three times a week in the center with 300 milligrams of Vafseo. They are making this change because when a patient is switched from an ESA to Vafseo, their hemoglobin often falls for a bit. The anemia managers at US Renal were freaking out and switching patients back to the ESA. John is worried that a doctor who was about to prescribe daily Vafseo will wait until January 1, when all US Renal Clinics will be switched to the three times a week regimen. Also, US Renal is bringing down their inventory of 150 milligram tablets, which will reduce Akebia’s revenues in the December quarter.

Obviously, these are transient problems that might be unnoticeable if DaVita usage takes off in the quarter. But I think Akebia should have anticipated them because they clearly knew about the hemoglobin problem. Buy AKBA up to $4 for the Vafseo launches in the EU, UK, and US. I think GSK and/or Amgen will make a bid for the company.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Inovio (INO – $1.96) Chief Scientific Officer Laurent Humeau presented at the World Federation of Hemophilia Global Forum (SLIDES HERE). The company has a hemophilia A program teed up to start after INO-3107 is approved next summer.

INO is a Buy under $5 for a very long-term hold.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: Mid-2026

Probable time of next financing:After FDA approval in 2026

Medicenna (MDNAF – $1.08) did what appears to be a paid investor webinar on upcoming data release catalysts for the stock.

Buy MDNAF under $3 for a first target of $20.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Entering Phase 3

Probable time of first FDA approval: 2026

Probable time of next financing: 2025

ScyNexis (SCYX – $0.68) completed the transfer of the Brexafemme (ibrexafungerp) New Drug Application (NDA) to GSK. GSK will meet with the FDA to discuss the relaunch of Brexafemme. ScyNexis will get up to $145.5 million in annual net sales milestones as well as royalties following the relaunch.

The company also announced a five-year grant of $7 million annually to the collaboration between Hackensack Meridian CDI and Johns Hopkins researchers aimed at accelerating the development of new therapeutics to combat resistant fungal infections, including ScyNexis’ next generation of triterpenoid antifungals (fungerps). Buy SCYX under $2.50 for a target price of $20.

Primary Risk: Ibrexafungerp fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: 2026

Probable time of next financing: Never

TG Therapeutics (TGTX – $33.41) ranked #27 on the 2025 Deloitte Technology Fast 500, a ranking of the 500 fastest-growing technology, media, telecommunications, life sciences, fintech, and energy tech companies in North America. Buy TGTX under $30 for a target price in a buyout of $40 or more.

Primary Risk: Briumvi, the MS drug, fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: NM

Probable time of next financing: Never

Inflation MegaShift

Gold ($4,198.10) is solidly bid over $4,000 an ounce, which probably means central banks have good-till-canceled orders to hoover up ounces at that price. The fractal dimension completed this uptrend today. Although we certainly could see a few more up weeks drive the fractals under 30, as we have in the past, the precious metals rally is running on fumes and needs a consolidation through time – several meh weeks – or a scary drop in price.

Miners & Related

Coeur Mining (CDE – $16.19) presented at the RBC London Precious Metals Conference. As usual, the posted the (SLIDES HERE) but violated SEC Rule FD by blocking us from the actual presentation.

And this was a big one, as they clearly are excited about the New Gold acquisition.

How did the audience react to this? Were there any questions? We’ll never know, just like the old pre-FD days. CDE is a Buy under $10 for a $20 target as gold goes higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Dakota Gold (DC – $4.49) intersected high-grade gold mineralization in expansion drilling at Richmond Hill. Expansion and infill drill holes in the northeastern corner of the Project area are intersecting significantly higher-grade gold than the average resource grade including one hole intersecting 1.75 grams per tonne gold (g/t Au) over 19.9 meters (35 gram meters) and another intersecting 2.15 g/t Au over 30.0 meters (65 gram meters). The company said the expansion drilling surrounding the area has the potential to add to the resource based on prior drilling and current resources in the area. The mineralization in the northeast is only limited by drilling and remains open.

CEO Robert Quartermain presented at the New Orleans Investment Conference (WEBINER HERE). DC is a Hold for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

Royal Gold (RGLD – $201.05) sold the Versamet Royalties stock they acquires in the Sandstorm acquisition for C$206.977 million, which they used to pay down debt.

They also announced the 25th consecutive annual increase in the common stock dividend to $1.90 per share for 2026, a 6% increase over the 2025 dividend. RGLD is a Buy under $180.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

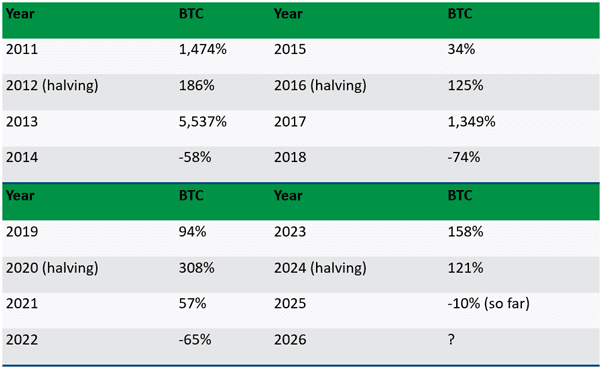

Bitcoin (BTC-USD on Yahoo – $89,774.54) fell about 36% from its October high at $126,251 to a $80,659 low five days ago. One reason for the drop was bitcoin “whales” trying to front-run the four-year cycle that has seen the cryptocurrency drop sharply in the second year after a halving. 2026 will be the second year after the 2024 halving.

Click for larger graphic h/t RiskHedge

Are we going to see another big selloff in 2026? I doubt it. Bitcoin exchange-traded funds were approved on January 11, 2024, and made it as easy to buy as any stock. As wealth managers steadily buy bitcoin for clients, I suspect the four-year cycle is, like the dodo bird, extinct. According to Bernstein, institutional ownership of exchange-traded funds has steadily climbed from 20% to 28%.

There’s a long way to go to get to the normal institutional level of 70%+. Having said that, this is bitcoin’s worst monthly performance since June 2022, when a string of corporate collapses culminated in the downfall of Sam Bankman-Fried’s FTX exchange. I get it if you are worried, but I urge you to start or add to your bitcoin holdings right now. It’s up 10% from its low, a classic sign of a trend reversal.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $51.03) had $2.2 billion in net outflows so far in November, including $523 million in one day on November 17. When they zig, we should zag. It remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $22.90) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $58.60

Oil fell after reports that Kyiv has agreed to the terms of a revised peace deal with Russia. Because the war has not affected Russian production much, I’m not sure what the connection is. Russian oil has been available to India and China at a substantial discount, so somehow the removal of cheap oil means prices go down?

The July 2026 Crude Oil Futures (CLN26.NYM – $58.32) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.86) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $8.66) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Freeport McMoRan (FCX – $42.15) held a conference call about their plans to restart their Grasberg mining operations in Central Papua, Indonesia (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE). They’ve already started production from the unaffected Deep Mill Level Zone and Big Gossan underground mines. They are planning a phased restart and ramp-up of the Grasberg Block Cave underground mine beginning in the March quarter.

Even though they won’t be back to full production until the end of 2027, higher prices for copper will reduce the revenue impact. Not only is their production curtailed, but Panama’s Supreme Court closed down a major copper producer, impacting more than 300,000 tons of annual supply, and the world’s biggest copper producer – Chile’s state-owned (uh-oh) Codelco – just hit a 25-year production low.

Freeport Indonesia had guided for production of about 700,000 metric tons of copper and 45 tons of gold in 2026. They’ve reduced that to 478,000 tons of copper and 26 tons of gold, BUT – get this – they are only cutting their revenue forecast from $8.5 billion to $8.3 billion thanks to higher prices.

Freeport forecast 2025 copper sales 30% lower than previous guidance to 537,000 tons and gold sales 50% lower to 33 tons, although revenues should drop by just 18% due to higher copper prices. The stock was upgraded to Outperform from Sector Perform at Scotiabank with a $47 target price, because “the Grasberg reset improves clarity on the outlook.”

We did the right thing by not panic selling when the mudslide hit. FCX remains a Hold for the mid- to high-$40s.

Primary Risk: Copper prices fall.

* * * * *

The World’s $111 Trillion in Government Debt, in One Giant Chart

* * * * *

RIP Jimmy Cliff

* * * * *

Your looking at 16 charts that explain the AI boom Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 11/26/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $277.55) – Buy under $205

Gilead Sciences (GILD – $127.51) – Buy under $115, first target price $150

Meta (META – $633.61) – Buy under $705 for a long-term hold

Onsemi (ON – $49.64) – Buy under $60, first target price $100

Palantir (PLTR – $165.77) – Buy under $160 for $200 first target price

PayPal (PYPL – $61.83) – Buy under $75, target price $150

Snap (SNAP – $7.61) – Buy under $11, target price $17+

Small Tech

Enovix (ENVX – $7.53) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $72.96) – Buy under $75; 3- to 5-year hold

Fastly (FSLY – $11.88) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $11.64) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $6.10) – Buy under $10, target price $40

ARK Venture Fund (ARKVX – $40.59) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $3.64) – Buy under $6, target $30+

Akebia Therapeutics (AKBA – $1.59) – Buy under $4, target $20

Compass Pathways (CMPS – $5.23) – Buy under $10, hold a long time for a 20x return

Editas Medicines (EDIT – $2.40) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.96) – Buy under $5, hold a long time

Medicenna (MDNAF – $1.08) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.68) – Buy under $2.50, target price $20, then $50

TG Therapeutics (TGTX – $33.41) – Buy under $30 for buyout at $40+

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($53.64) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $66.85) – Buy under $50, target price $75

Sprott Junior Gold Miners ETF (SGDJ – $81.54) – Buy under $60, target price $100

Sprott Physical Gold and Silver Trust (CEF – $40.11) – Buy under $35, target price $60

Global X Silver Miners ETF (SIL – $73.40) – Buy under $60, target price $100

Coeur Mining (CDE – $16.19) – Buy under $10, target price $20

First Majestic Mining (AG – $13.51) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $1.19) – Buy under $1, first target price $10

Royal Gold (RGLD – $201.05) – Buy under $180

Cryptocurrencies

Bitcoin (BTC-USD – $89,774.54) – Buy

iShares Bitcoin Trust (IBIT – $51.03) – Buy

Ethereum (ETH-USD – $3,027.91)– Buy

iShares Ethereum Trust (ETHA- $22.90) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $58.32) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $33.86) – Buy under $40; $100+ target

Vermilion Energy (VET – $8.66) – Buy under $11; $24+ target

Energy Fuels (UUUU – $14.36) – Buy under $18; $30 target

EQT (EQT – $59.00) – Buy under $70; hold for much higher prices ($100+)

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Nvidia (NVDA – $180.26) – Hold

SoftBank (SFTBY – $52.80) – Hold

Dakota Gold (DC – $4.49) – Hold for $6 target price

Freeport McMoRan (FCX – $42.15) – Hold for an exit in the mid- to high-$40s

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

What? Nobody beat me to the punch? Well, Happy Thanksgiving to all (and may it be a fine wine rather than a rowdy punch).

A director at ABCL bought 50,000 shares at $3.56, apparently on the open market. Is this as much of an endorsement as it appears?

What? 2 liked it but no comment? I took it to heart, added half to my not very large position at 3.46, closing today at 3.65 — so at least it’s headed in the right direction. Small potatoes: while CAPR is giving back 15% of yesterday’s enormous gain, the 3 quantum stocks I follow (IONQ, QBTS, RGTI) are up 13.5%, 14.5% and 15.4%, and their 2x ETFs (IONX, QBTX, RGTU) are indeed up 24.9%, 28.9% and 30.5%. I only have small bits of each, but they are recovering quickly from their recent route.

CAPR–The exosome PR is not a diversion from the PR we want about H3 results. Rather, it is an affirmation that exosome manufacturing can be scaled up. Applications are wide-ranging from better delivery of vaccine and other therapeutic agents. Deramiocel is the 1st application. For the rare DMD it will put money in the company, with much more to come from other applications, but this is long term. Tomorrow is possible H3 news release. If it takes until Jan to get H3 news, incredible bargains will appear.

META $633.00 a social media company. NVDA $180.00 a chip company actually making something to sell! What is up with that? Tell me how that is possible because I don’t get it! I hope everyone had a great turkey day celebration! Thanks MM, for all you do. Great read. Is all that money leaving bitcoin going into gold? Or just profit taking?

Bitcoin is a mathematical abstraction only. It is today’s tulip mania. Gold is real money. So is silver and commodities that are actually needed and useful. Real estate is REAL. It may be slightly overvalued at present due to artificially low IR from money printing. Most of NVDA is AI crap. We have discussed how risky AI companies are, led by the impeccable scholarship of Harris Kuppersmith, “Kuppy.”

You can buy things and pay for things with Bitcoin, its not just an abstraction. Its digital money. It has been adopted as official country currency by El Salvador.

Would you consider US government paper dollar bills to not be real money? Its just paper, not much intrinsic value in the material, only in the social acceptance of it as currency. Probably people were reluctant in the past to accept paper bills instead of actual silver and gold coins. But you can buy things and pay for things with paper money, in locations where it is accepted (many but not all places around the world).

Kuppy invested in Bitcoin during its run-up. Maybe he bought tulips too! 😉

I purchased a little more Bitcoin on the dip.

Why should digital money be an investible asset? Even a manipulated fiat currency from a semi-stable govt is relatively stable. But BTC as a digital proxy for gold or other precious metals has skyrocketed orders of magnitude more than precious metals. So BTC resembles tulips more than gold. This is the elusive abstraction aspect of BTC. Paper gold is NOT real physical gold, but at least it is more in tune with true tangible value measured by gold. Crypto is NOT a store of value the way physical gold, paper gold, real estate are, in descending order.

My second objection to BTC is security of digital wallets. I want paper statements of my brokerage accounts. I don’t trust anything digital, which can be hacked and wiped out.

As an aside, EKG’s come with programmed interpretations. This has been going on for 20 years or more. Now with AI, it is worse. My friend just had hernia surgery. His pre-op EKG had subtle abnormalities but was read as normal by the DAMN AI. I let it pass, because he is strong as an ox and has absolutely no cardiac symptoms. But this kind of EKG calls for a full cardiac evaluation. I got away with it, because 1 year ago his EKG had the exact same abnormalities. He needed the surgery ASAP, and I confided in him that I was only 98% confident and that he should speak with the anesthesiologist about whether to take beta blockers before the surgery. Just an hour ago, I spoke to him and he made it through the surgery with no problems. But my point is that too many idiot doctors are relying on AI and are making mistakes that can lead to death or malpractice/negligence. Don’t be an idiot consumer and trust digital.

I may have just had the best one day for a stock yesterday because of your CAPR call, so I do take your thoughts seriously and, btw, thank you!

I was late to Bitcoin and Ethereum, but I have still done very well with them. I did even better with Grayscale when MM recommended their trusts. Thank you, MM! I have dedicated a small portion of my portfolio to crypto and will keep it. I just see Bitcoin as a maturing asset (store of wealth) in a world that has a lot of currencies with real problems.

The great thing about investing is that we can all view the world from different angles and still do very well.

The FED has to cut interest rates because the real estate market is dying and the real estate market is a BIG part of the economy. Young people CAN’T buy a home. The average age of a first time buyer is now 40 years old. They are even floating the idea of a 50 year mortgage to get monthly payments down to an affordable place. The average annual income is $70-$80 thousand dollars. The median price of a home is $400,000 to $600,000 dollars. Banks can’t make it happen. Just IMO

Many thanks to JGMD for his guidance on CAPR. Up 250%+!!

Capricor Therapeutics Duchenne Treatment Shows Strong Heart And Muscle Results In Trial

BENZINGA

Dec-03-2025 9:23 a.m. ET

Capricor Therapeutics Inc. (CAPR) stock is rallying on Wednesday.

The company shared much-awaited topline results from its pivotal Phase 3 HOPE-3 trial evaluating Deramiocel, the company’s investigational cell therapy for Duchenne muscular dystrophy (DMD).

CAPR shares are climbing with conviction. Get the latest updates here.

Duchenne muscular dystrophy (DMD) is a severe, inherited genetic disorder that causes progressive muscle weakness and degeneration, primarily affecting boys.

The study randomized 106 participants. Participants received intravenous Deramiocel at 150 million cells per infusion or placebo every three months for 12 months.

Read Next: Biohaven Advances Toward Potential First FDA-Approved Therapy For Spinocerebellar Ataxia, FDA Drops Advisory Meeting

Data

The average age of participants was approximately 15 years.

Nearly 54% of patients showed slowing of skeletal muscle disease progression, and around 91% patients showed treatment effect on cardiomyopathy (heart function).

“The HOPE-3 study is the first-ever Phase 3 trial in a largely non-ambulatory population with DMD to successfully meet its primary endpoint and to support the development of an innovative therapy over many years, with this level of impact has been a profound privilege,” said Craig McDonald, an investigator of the HOPE-3 trial.

“The statistically and clinically significant preservation of left ventricular ejection fraction in patients treated with Deramiocel observed in HOPE-3 underscores the potential of Deramiocel to address one of the most critical aspects of the disease,” said Jonathan Soslow, Professor of Pediatrics (Cardiology) at Vanderbilt University Medical Center.

Capricor Therapeutics Exec Believes It Is “Prepared To Launch” Deramiocel; Says Co Passed Pre Licensing Inspection For San Diego Manufacturing Facility; Says Deramiocel Can Be Used With Any Therapeutics Currently Approved, Available Or Under Clinical Development

Thanks to Chris as well! I believe Chris was the one that brought CAPR to the attention of this board & provided periodic updates.

i also appreciate all of the research, analysis & insight that JGMD provided on this one.

Thankfully, today with CAPR I have made back all of the money I lost on MM’s disastrous bio picks like APTO, GRPH, SCYX… just to name a few.

I didn’t realize Chris suggested CAPR earlier! Not to mention NGENF!! THX Chris! Great contributions!

Thank you Chris, JGMD and anyone else who recommended CAPR. I was shocked to see it up so much today. I thought there had been a mistake. HA! Merry Christmas!

I agree and am indeed appreciative of Chris and JGMD for sharing their research and wisdom. I’m also appreciative of MM for allowing discussions of non-NWI recommendations to be discussed.

yes indeed, thanks Chris!

Yall’re welcome. Haven’t sold a share yet, but I have sold some Jan $30 calls for $4.50 as I think 34.50 is a fair price now. Although CAPR should eventually double again, I have sold some Jan ’27 $10 calls (that I bought at $2.45) for a bit over $21. Hate to miss out on a 10-bagger, but the beast must be fed.

NGENF has more than doubled since I went on a buying binge as Trump started talking about tariffs a couple months after his inauguration. If it uplists to NASDAQ soon, I think it will double again.

Consider subscribing to biopub.co which is where I learned all about NervGen, Capricorn and many others

Bio Pub is a good source of information. CAPR is going over 100.

You subscribe? It is still difficult to ferret out the few great ones from the usual risky stuff. Have you been able to do that? When Chris first mentioned CAPR, it was 15-20, near a peak at the time. I got in at 7 after the plunge after fear about an Adcom. I got more on misplaced optimism at 11. I bought more at better times, for overall average of 8.5. Several days ago, I put in a GTC order at 4.50. I thought I might get it since the data might have been delayed until next week. Oh well, I can’t complain now. I agree about 100 fairly soon. Exosome R&D is a wild card for 1000 in 5-10 years maybe. Stay healthy. Which is more likely, we reach 100 years of age, or CAPR goes to 1000? I know a gynecologist who charges $3000 for generic exosome injections for anti-aging purposes. She’s not making that much money because the lab bills are high.

I recently purchased a 3 month subscription, for their opinion on CAPR.

I have been a Biopub.co subscriber for many years. Its greater value is separating the wheat from the chaff. At least 80% of biotech offerings are unworthy of investment, even if they offer some gains for a short while. Aptose is a great example of a company that Biopup got behind, but soon realized was to be shunned. Even when a company makes the grade to get a Biopub endorsement, it is constantly scrutinized to make sure it is still on track to reward investors. The few companies that make the grade for coverage do so only after submitting to questioning by the MD PhD founder of Biopup (usually including a site visit) and in-depth Zoom presentation and questioning by discerning questioners with backgrounds in medicine, finance and other areas of expertise.

There are about 400,000 species of plants in the world, but only 30,000 or so are edible. Getting beyond the 3 most ubiquitous (rice, wheat and corn) fewer than 200 are worth growing for food. Biopub seeks to cultivate in its garden the best biotechs with the best prospects of reward for shareholders.

Great food analogy, thanks.

Chris, I also thank you for CAPR, which alone should give me another nice nest egg. I was busy all day following the huge number of posts on ST. Even Yahoo F had lots of posts, when it is normally quiet because everyone there hates the censorship and most people have moved to ST.

Remarkable was the LONG hour and 23 min presentation, probably the longest in history. Read my ST posts as viber7. My best liked post was where I projected 10 years out that with certain assumptions, Deramiocel patients would preserve decent cardiac function whereas placebos would have bad LVEF of 25% which is near death. I predict life expectancy for treated patients to be over 60, a 30-40 year improvement over untreated patients. I go further than the MD experts in DMD, McDonald and Soslow in my enthusiasm for Dera. Near the end, they were somewhat reserved in selecting which patients would qualify for Dera. I say EVERYONE who has had genetic testing with confirmed DMD should be treated. The earlier treatment is begun, the better. This is like how early vs later investing yields much greater returns 50 years later. The reality is that even 3-4 year olds have disability and are recognized when they can’t keep up with other kids in the playground. They already have diminished arm and leg strength. They should all be treated IMO.

Aside–even my parents didn’t recognize that I needed glasses until I was 9. I always sat in the front row since I didn’t see details on the blackboard from further away. I had 20/60 vision without glasses. All my eye doctors said that I cannot be corrected better than 20/25 or 20/30. Not a severe handicap, but I envy those with 20/10 or even 20/20 vision. I can read most nutrition bottles with fine print, but there are a few with extremely fine print, so 20/20 is required without a magnifier which is often unavailable. The world is more beautiful with better vision. The theory is that early correction would have stimulated my retina better. If you don’t use it, you lose it.

CAPR has so much potential with Dera and other exosome applications. MM is wise to recommend holding quality companies for a long time. CAPR is one of those few with enormous potential. I don’t dare trade in and out or use options. Selling calls is a great way to get more income, but there is the risk of losing your shares and not getting back in. I am also uncomfortable trading large sums of money, which is like jumping the roofs of train cars without stumbling. Selling puts can get cheaper buy prices for stocks you want to own. There must be a downside to selling puts which I haven’t figured out yet. Maybe one is that stocks are more liquid if you buy outright. Fast moving stocks have more liquidity than options. Also, bid/ask spreads on options are ridiculously high. Still, selling puts is probably the most productive way to use options. I have owned CAPR for only 6 months. If I consider selling any shares, I want to wait another 6 months to get lower long term capital gains taxes. With most options, you pay higher capital gains taxes, except for LEAP’s. But even LEAP’s have timing problems. Case in point, AKBA. I believe AKBA will bottom in the spring 2026, so you can accumulate shares at cheap prices.

Linda hinted at the end that this overwhelming data plus pressure from the DMD community may get this approved much sooner than the customary 6 months for a resubmitted BLA. This is a chance for FDA staff to do the right thing and grant near immediate approval rather than follow their usual regimented bureaucratic shit. Linda and Drs. McDonald and Soslow said the data is impeccable in response to good analyst questions. They gave the FDA what they wanted. Now is a great opportunity for the hated VP to be a hero and proclaim victory that CAPR followed his commands and everyone will be better for it.

Thumbs up.

There’s a near zero chance the bureaucracy will correct themselves, and do the right thing! 😉

Unless there’s money involved!! 😉

Just kidding…

JGMD,

My two brothers have perfect eyesight. I’m cross-eyed, far-sighted, astigmatic, and have color vision problems. But I got the brains! So did you. Good choice! 😉

I have astigmatism also. The shape of my eyeball is a complex overlay of different radii of curvature. That’s why all scripts are oversimplified. My axis is about 5-10 degrees off, which can be corrected, but even that is oversimplified. What is your best corrected vision?

I don’t really know but guess about 20-30. Mostly I use computer glasses, which work for both close-up and distance. (Like most people, I hate bifocals.) Plus I spend a significant portion of my time on the computer, or doing renovation projects or building furniture, so they work fine, and perfect eyesight isn’t required. Pretty rare I read much that isn’t online.

Being cross-eyed was a problem when meeting women, most of whom are choosing someone to be a father to their future children, and didn’t want cross-eyed kids (although its recessive genetically).

I graduated from single lens to bifocal to trifocal to finally progressive for the last 30 years. Progressives have thicker lens on the bottom which adds positive diopters giving optimum close acuity. Normal 20/20 people see small print 12″ away. With my 20/25-30, I had progressives made with high diopter readings so I could focus at 8-9″. That way, I see the small print that 20/20 people see at 12″. To see people at 3 feet away, I look through the middle of the lens which focuses on that distance. For 7 feet or greater distance, I look through the top of the lens. It is automatic for me and takes only 1-2 seconds. The only problem is looking on the floor where I would have to hyperextend my neck backward. What I do in this case is lift and tilt the object to see it clearly with my neck in the neutral position. Progressives don’t have the horizontal lines of bifocals or trifocals. That’s the way to go, like having 5+ glasses at various focal lengths.

Right now, my main visual problem is mild-moderate cataracts. Damn computer visual fatigue. Important books I buy paper versions. Bathroom reading and general enjoyment.

Stephkam–the violin pedagogue, Otakar Sevcik went blind after the E string popped in his eyes. I wear glasses when playing the violin even when not reading music.

Money and especially politics are the reasons bureaucracy won’t be corrected. That is the biggest argument for smaller govt, which decreases the influence of the juggernaut bureaucracy. This AM, my latest post on ST as viber7 addresses why rich people may want to pay $5 million for a 5 year trial on themselves to see if Dera will help common congestive heart failure in old people. There are probably at least a handful of NWI subscribers who are worth $10 million, so they can afford 5 million for the most important investment of all–health.

Chris: I subscribed to Biopub before they raised the price beyond my range. I thank you (and JGMD) for the recommendations and info on CAPR and NGENF. I don’t have life-changing amounts but enough to raise my portfolio 14.44% yesterday (and I took profit in 30%, the shares I’d added 11/25 at 4.36, but continue to hold the rest, now my third largest position behind NVDA and PLTR). Is Dr. Helen Ong still active there? She’s the one who turned me on to NVDA, now at 4900% profit for the shares I still hold. Do they still follow DMAC and ONCY?

Dr. Ong has gone underground. DMAC is mentioned from time to time but not endorsed. ONCY? Haven’t heard that name in ages.

Too bad great people have to go underground due to this evil world political situation. The censor persecutors with political power are parasites off the producers. I am also disgusted at most YMB posters who are shorts and don’t give a damn about what CAPR has accomplished. In the last minute of the cc yesterday, Linda said that today is the culmination of 20 years of hard work and dedication to the lives of unfortunate DMD young males. Orson Welles couldn’t have matched Linda’s cool drama of that moment. I cried. These liar shorts are pure evil. I don’t mind reasonable investors who sell calls for prudent financial management.

Those shorts have kept me out of a few really great stocks. The most painful one was TSLA. They convinced me that the company would go bankrupt. I don’t listen to them anymore and I did buy a bit of TSLA a few years ago.

My eyes were so bad when I was a kid that my parents thought I had cognitive issues. I fell all of the time. They finally took me to an eye doctor. I was given some great black horn rimmed glasses and went from clutz to nerd! It was a big step up for me. Ha!

Not under ground, as in deceased, I hope. Withdrawn after an episode, such as we’ve had here over the years? She used to fwd science oriented videos in her other-than-financial persona and I always liked that she had smarts and good taste and incredible empathy. So I wondered what became of her after her main science guy and her own twitter account were suddenly closed without explanation. Do you know?

Dr. Ong, as we all will, ended up like the people in the song by the author of “The Basketball Diaries”, Jim Carroll (1949-2009).

But she had a long and wonderful life and is still missed by those who knew her.

https://youtu.be/9bOjc70f4p8?list=RD9bOjc70f4p8&t=9

I remember ONTX also.

Joining the chorus in thanking you for the recs of CAPR and NGENF, they have been amazing and I look forward to hearing about any others that you feel are worthwhile! Hanging tough!

Thanks again Chris, JGMD, et al,

Q: thoughts on ACXP?

ACXP: Badly run company with some good assets that will never get any money for shareholders.

Asked and answered, thank you

I will add to the people thanking Chris for CAPR. That was the biggest gain I’ve ever had on any stock. Thanks!!

I wanted to share a stock that I have bought and have been following that I think has huge potential.(no pun intended) Please see the Seeking Alpha article below. I’m curious what others think. Thanks!!

Fractyl Health says procedure can maintain weight loss after stopping GLP-1

Dec. 02, 2025 12:21 PM ET Fractyl Health, Inc. (GUTS) StockNVO, LLYBy: Jonathan Block, SA News Editor

Fractyl Health (GUTS) said that data from an open-label study of its Revita outpatient endoscopic procedure helped patients who had stopped taking a GLP-1 medication maintain the weight they had lost.

The REVEAL-1 Cohort enrolled patients who had lost at least 15% of their body weight while on a GLP-1. Patients had been on a drug from five months to five years.

Six-month results found that participants saw a a mean total body weight change of 1.5% ± 1.3%. Also, there was a minimal change in HbA1c levels after the Revita procedure of 0.04% ± 0.08% compared to ~0.4% increase seen after GLP-1 discontinuation.

No serious adverse events were reported and 8 of 22 participants experienced mild treatment-emergent adverse events.

Though GLP-1 drugs for weight loss, such as Novo Nordisk’s (NVO) Wegovy (semaglutide) and Eli Lilly’s (LLY) Zepbound (tirzepatide) are immensely popular, many users discontinue use due to side effects.

Biopub has many questions regarding Fractal

Fractyl

I don’t have a subscription to that. Can you tell me what they are?

NervGen is presenting today, free to register. Not sure if any new information will be presented:

$NGENF NervGen Pharma Corp. will present at The American Spinal Injury Association (“ASIA”) ECRC 2025 Webinar Series on Industry Collaborations Dec 5, 2025 12:00 PM EST

Part 5: Pharma | December 5th, 2025

In the final session, NervGen Pharma Corp. will present its work on nervous system repair, focusing on the collaboration between clinicians, scientists, and industry leaders in the development of therapies for SCI. Presenters will share their experiences in navigating the clinical translation process, including insights from ongoing trials.

2025 Early Career Researcher and/or Clinician (ECRC) Webinars – American Spinal Injury Association

Vermilion Energy announced a virtual Investor Day on Wednesday, December 10 at 11:00 AM ET. The live webcast can be accessed at https://app.webinar.net/O9BjeG7e3bG. The webcast link and conference call slides will be available on Vermilion’s website at https://www.vermilionenergy.com/invest-with-us/events-presentations/ under Upcoming Events prior to the conference call.

Vermilion is the best way to invest in European natural gas.

Paramount Gold Nevada Receives Draft Consolidated Permit Package From The State Of Oregon.

MM – can you give an update on PZG in this week’s newsletter. My recollection is that they only had 10 or so employees, so it would seem now is the time to be sold or perhaps merge with an actual mining company. The Portfolio section says “The most recent PEA shows a value of $160 a share at $1,600 gold” It seems like 2026 should finally be their year.

New World Investor for 12.11.25 is posted.