Dear New World Investor:

This is our year-end performance review. Overall, we had a great year, up 52.9%, thanks primarily to three factors:

** Our precious metals holdings were up 160.6%

** The Dominators were up 45.8%, including 135.0% on Palantir (PLTR), and 125.3% on Micron (MU) in less than 10 months. Only two of the Magnificent 7, Google and Nvidia, beat the S&P 500 last year.

** The biotechs didn’t go down

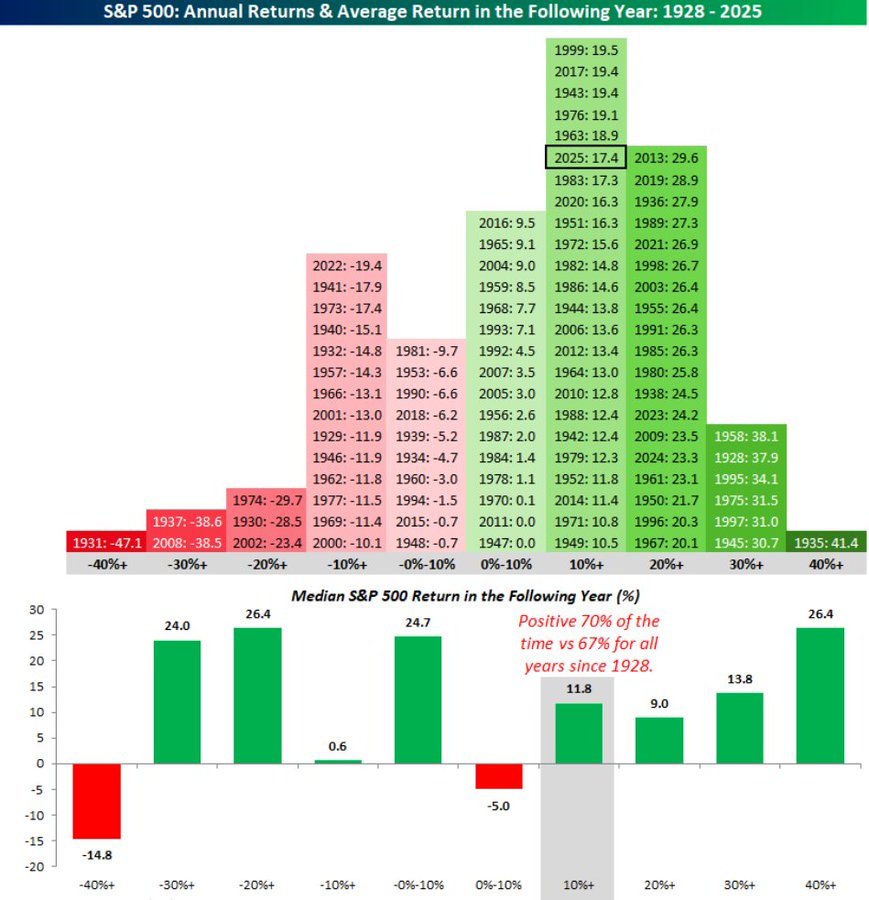

Obviously, in spite of tariff turmoil, the Fed, a government shutdown, increasing unemployment, and consumer confidence in the toilet, it was a bull market. The S&P posted a respectable +16.4% capital gain (I’ve not included dividends). It’s interesting that in the 23 prior years when the S&P 500 was up between 10% and 20%, the median gain the following year was 11.8%, with positive returns 70% of the time. It’s also interesting to note that it has been more common for the S&P 500 to be up 20% to 30% than it has been for it to be up between 0% and 10%.

Click for larger graphic h/t @bespokeinvest

Dominators – We owned enough of the AI stocks, from the obvious like Nvidia to the recently-discovered like Corning, to push the Dominators to a +45.8% gain.

Although we got more than a double from Micron (MU) in less than 10 months, it’s gone on up to close at $327.02 today. Investors are forgetting that memory semiconductors are a thin-margin, cyclical business…but they’ll soon be reminded of that.

In 2026, I think the 2025 under-performers – ON, PYPL, and SNAP – will outperform the AI stocks. The probably wrong rumor is that OpenAI will buy SNAP.

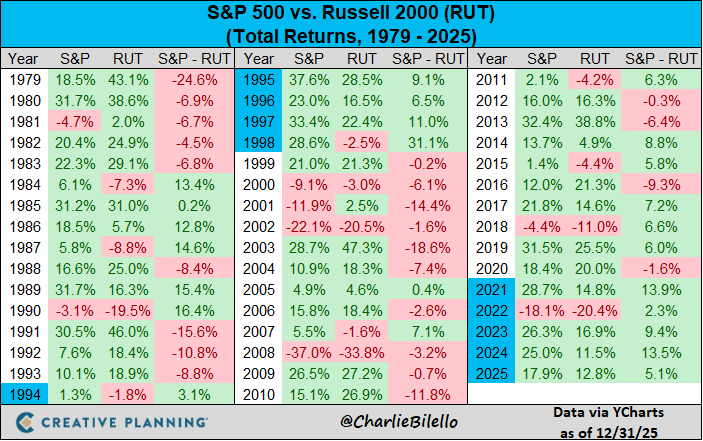

US Large Cap stocks outperformed US Small Cap stocks by 5% in 2025, their fifth straight year of outperformance. That ties 1994-1998 for the longest streak of Large Cap outperformance ever. That prior streak was followed by six straight years of Small Cap outperformance (1999-2004).

Click for larger graphic h/t @charliebilello

Small Tech – So I guess it’s not surprising that the small tech stocks under-preformed the large ones. Enovix (ENVX) suffered from the risk-off environment because it wasn’t in commercial production in 2025, although it will be in 2026. Both PagerDuty (PD) and QuickLogic (QUIK) fell due to disappointing results. QUIK will be OK in 2026, but we’ll have to see about PD.

If Rocket Lab has any delay in their Neutron program, the stock will get killed and we’ll reenter. If not, we’ll reenter anyway but at a higher price.

Biotech – Although the biotech stock average was up, five of the eight recommendations were down. The big biotech stocks ended their bear market in 2025, and I expect the small ones to follow in 2026.

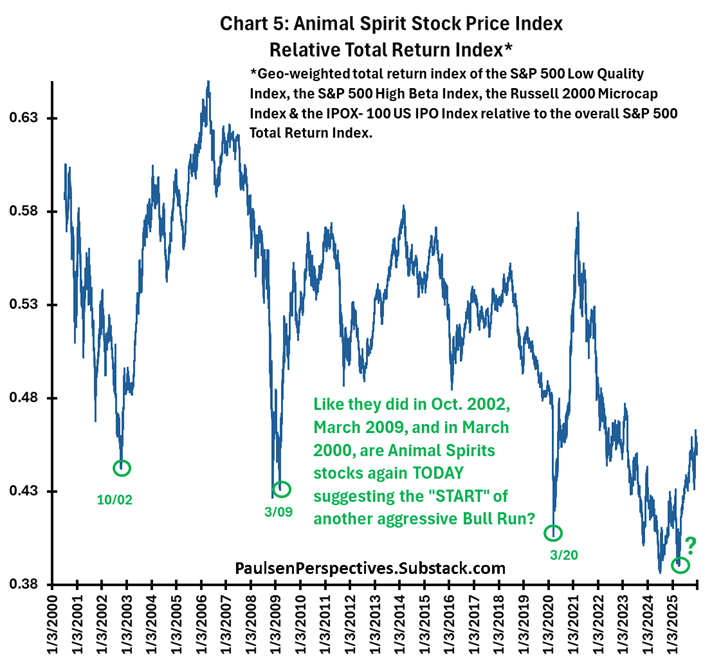

In fact, the “Animal Spirits” stocks in the S&P 500 Low Quality Index, the S&P 500 High Beta Index, the Russell 2000 Microcap Index, and the IPOX-100 US IPO Index are already leading the stock market. That’s the signal of a new risk-on bull market.

Click for larger graphic h/t @jimwpaulsen

Hyperinflation – 2025 was the year our precious metals stocks paid off…well, began to pay off. The “debasement trade” should continue to pay off until the Administration stops running huge deficits and the Fed stops funding them.

If I had to own only one Hyperinflation stock it would be Royal Gold (RGLD) because royalty companies are safer than individual miners with much of the same leverage to precious metals prices. But I don’t have to own only one, so I am happy with the mix of exchange-traded funds and individual miners.

Crypto – The cryptocurrency recommendations were down for the year. Despite reaching a fresh record high at $126,000 in early October, bitcoin had its first annual loss since 2022.

But bitcoin’s longer term trend looks to be holding.

Energy – I’ve been really wrong on the price of oil. I still don’t see a lot of new supply with US shale production falling. The idea that Venezuela’s very sour crude oil will make any difference to world supply is nuts. And they don’t have 300 billion barrels of reserves – that’s their guess. It’s probably more like 30 billion barrels, and it will be three to five years before production increases. But I’m either going to have to roll the July 2026 futures recommendation forward or just give up on the energy recommendations entirely. Vermilion (VET) is a European natural gas play in disguise and EQT (EQT) will be a big beneficiary of AI data center energy demand, so I’d hate to cut them loose.

On To 2026 – Today’s Job Openings and Labor Turnover Survey (JOLTS) reported a larger-than-expected 303,000 decline in US job openings to a 14-month low of 7.146 million in November. October’s openings were revised down to 7.449 million. There were 0.91 job openings for every unemployed person in November, the lowest level seen since March 2021. Employers remained hesitant to carry out mass layoffs, keeping the labor market in a “no hire, no fire” state. Tomorrow’s December payrolls report is expected to show only 60,000 new jobs, less than the 64,000 reported for November (which probably will be revised down).

Market Outlook

The S&P 500 lost 0.2% over the last two weeks as Santa forgot his year-end rally. The Nasdaq Composite lost 0.6%. The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 2.1%. The small-cap Russell 2000 gained 2.2% – see above.

The fractal dimension is giving the first signs of an impending consolidation, right on schedule.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model forecast for December quarter real GDP doubled to +5.4% on holiday strength in personal consumption expenditures growth and a sharp drop in imports.

FWIW, I think that’s way too high while, at the same time, the Blue Chip consensus of +0.9% is way too low. I’m expecting a “surprisingly strong” +3.0% to be announced on February 20.

In contrast, the St. Louis Fed Economic News Index is projecting December quarter real GDP growth of 1.1% at an annual rate. Also way too low.

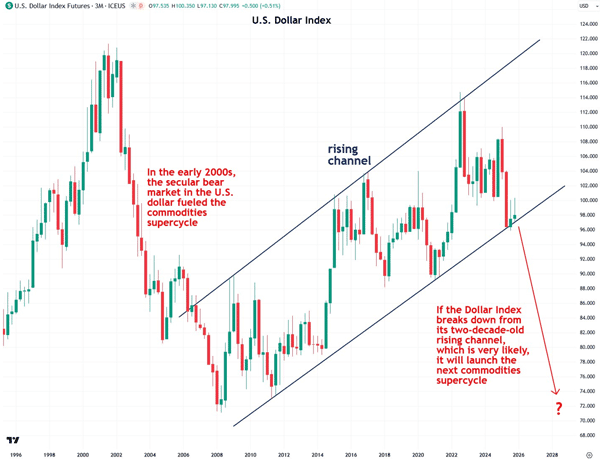

Dollar Death Watch

If US interest rates are going down and rates are going up in the rest of the world (which they are), then the dollar will be worth less.

Click for larger graphic h/t @dailydirtnap

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Friday, January 9

December payrolls – 8:30am – +60,000 expected; November was +64,000

Monday, January 12

GILD – Gilead – 2:15pm – JPMorgan Healthcare Conference

Short Interest – After the close

NVDA – Nvidia – 8:15pm – JPMorgan Healthcare Conference

Tuesday, January 13

QUIK – QuickLogic – Through 1/13 – Needham Growth Conference

TGTX – TG Therapeutics – 4:30pm – JPMorgan Healthcare Conference

Wednesday, January 14

ABCL – AbCellera – 6:45pm – JPMorgan Healthcare Conference

Thursday, January 22

Next New World Investor

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $259.04) is adding Los Angeles Lakers games to the Vision Pro starting tomorrow night against the Milwaukee Bucks. But according to International Data Corporation, Apple’s Chinese manufacturing partner, Luxshare, halted Vision Pro production at the start of last year. It shipped only 390,000 units in 2024, and IDC expects Apple to sell just 45,000 units in the last quarter of 2025, which includes the busy holiday shopping season. According to Sensor Tower, Apple also slashed digital advertising spending for Vision Pro in markets including the US and UK.

Evercore ISI reiterated it as the firm’s top pick in technology hardware, citing strength in the iPhone. They wrote: “AAPL remains our top pick across our hardware coverage, as we believe it’s poised to outperform [near-term] expectations on a strong iPhone cycle and the potential around an AI Siri upgrade.”

AAPL is a Buy under $205.

Gilead Sciences (GILD – $120.67) got a Buy recommendation at UBS, with a $145 target price. GILD is a Long-Term Buy under $115 for a first target of $150.

Nvidia (NVDA – $185.04) announced the launch of its next-generation Vera Rubin superchip at CES 2026 on Monday in Las Vegas. One of six chips that make up what Nvidia is now calling its Rubin platform, Vera Rubin combines one Vera CPU and two Rubin GPUs in a single processor. Nvidia is framing the Rubin platform as ideal for agentic AI, advanced reasoning models, and mixture-of-experts (MoE) models, which combine a series of “expert” AIs and route queries to the appropriate one depending on the question a user asks.

(TRANSCRIPT HERE)

Jensen also announced an expansion into the autonomous driving sector with its open-source Alpamayo platform to accelerate safe, reasoning-based autonomous vehicle development. They partnered with Visteon (VC) and Hesai Group (HSAI) to integrate high-performance lidar and cockpit systems into a unified “Rubin” AI platform that rivals Tesla’s (TSLA) Full Self-Driving (FSD) stack. Nvidia is delivering major gains in performance, efficiency, and scale across inference, robotics, autonomous systems, and data center workloads. AI compute demand is surging far beyond current supply, and every chip and system these companies can produce is being snapped up by hyperscalers and enterprises racing to scale.

According to Bloomberg, Chinese demand for Nvidia’s H200 chips is strong, but Beijing asked some Chinese tech companies to halt orders for those chips this week. The government is expected to mandate domestic AI chip purchases.

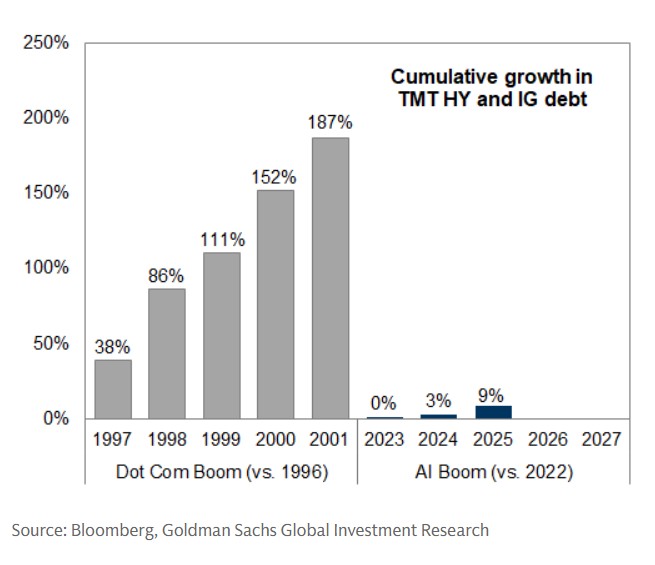

The key difference between the late 1990’s Dot Com and the current AI capex booms is that the dot coms were funded by high yield debt and a hot IPO market, while the AI boom is funded by cash flow from big, very profitable companies.

Click for larger graphic h/t Goldman Sachs via @DannyDayan5

NVDA is a Hold for a $180 first target.

Onsemi (ON – $60.89) is #11 on BofA’s “Stocks The Hedge Funds Love To Short” list with 9.9% of its float sold short. Or, as I call them, “Future Buyers At Higher Prices.” ON is a Buy under $60 for a $130 first target.

Palantir (PLTR – $176.86) famously dropped 5.6% on January 2, 2026’s first trading day. Truist Securities immediately initiated coverage with a Buy and a $223 target price. They wrote: “We acknowledge the significant valuation premium PLTR commands, but continue to view it as a Buy given its significant opportunity to drive GenAI adoption for governments & enterprises. PLTR has seen material improvement in its momentum driven by the release of AIP, with top-line growth accelerating to 63% y/y from 13% y/y as of 2Q23 – with a larger portion of this growth flowing down to op. margins, reaching 50%+ margins. The company has provided a leading software platform that integrates large organizations’ proprietary data with their operations and security to improve decision-making, which now positions Palantir to capture GenAI implementation with its AIP as organizations race to generate insights and efficiencies with the technology.”

PLTR is a Buy under $160 for a $200 first target.

PayPal Holdings (PYPL – $58.27) is pivoting towards crypto and agentic AI payments to drive business expansion over the long term amid legacy branded checkout headwinds. The stock is incredibly cheap at only 10x 2026 earnings estimates despite growing EPS at a 15% clip in 2025. PYPL is a Buy under $75 for a double in three years.

SoftBank (SFTBY – $13.87) did a 4-for-1 stock split today. They completed their $40 billion investment in OpenAI by yearend, as Masa had promised. I’m not so sure that was a good idea, but Masa is smarter than I am. SFTBY is a Hold as the discount to hard book value disappears.

Small Tech

Enovix (ENVX – $7.91) is covered by nine Wall Street analysts. Seven have a Buy rating, and two have a Hold. The median one-year target price is $19. ENVX is a Buy up to $20 for a 4-year hold to $100+ as their BrakeFlow lithium-ion battery takes market share.

Primary Risk: A new competitor invents a better battery.

ARK Venture Fund (ARKVX – $46.25) must have participated in the latest SpaceX financing raising $20 billion at a $230 billion valuation, because SpaceX jumped from around 9% of the ARK Venture Fund portfolio to 12.26%. ARKVX is a Buy for the SpaceX IPO.

Primary Risk: Cathie sells the stock before the IPO.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

Click for larger graphic h/t @GooseData

AbCellera Biologics (ABCL- $4.11) will present at the big JPMorgan Healthcare Conference next Wednesday. It’s a compelling story. Buy ABCL up to $6 for a long-term hold to $30 or more.

Primary Risk: Partnered and owned drugs fail in the clinic.

Clinical stage of lead product: Partnered: Various Owned: Preclinical

Probable time of next FDA approval: 2027-2028

Probable time of next financing: 2026-2027 or never

Akebia Therapeutics (AKBA- $1.49) dosed the first patient in their Phase 2 clinical trial of praliciguat, an oral, once-daily, soluble guanylate cyclase (sGC) stimulator being evaluated for the treatment of biopsy-confirmed Focal Segmental Glomerulosclerosis (FSGS), a rare, serious kidney disease causing scarring in the glomeruli (kidney filters), leading to protein leakage (proteinuria), swelling, and potentially kidney failure. FSGS affects approximately 40,000 patients in the US, and there are no approved treatments.

Praliciguat is a key component of Akebia’s recently announced mid-stage rare kidney disease pipeline, and they plans to assess it for other rare podocytopathies in the future. They licensed it from Cyclerion Therapeutics. No significant safety issues were observed with praliciguat in Phase 1 studies in healthy volunteers and Phase 2 studies in heart failure and diabetic kidney disease. Adverse events were infrequent and consistent with its known blood pressure lowering effect. Buy AKBA up to $4 for the Vafseo launches in the EU, UK, and US. I think GSK and/or Amgen will make a bid for the company.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Compass Pathways (CMPS – $7.62) said the FDA cleared them for a Phase 2b/3 trial of COMP360 for post-traumatic stress disorder (PTSD). The trial has two parts:

* Part A (blinded) is a 12-week fixed repeat-dose, double-blinded, controlled part to confirm the efficacy of two administrations of COMP360 25 mg versus two administrations of COMP360 1 mg. The second COMP360 administration session will occur approximately four weeks later. The primary efficacy endpoint is the change from baseline in CAPS-5 total severity score at Week 8.

* Part B (open-label) is a 40-week open-label follow-up to evaluate the long-term safety and efficacy of treatment in Part A. Eligible participants will receive a single open label retreatment with COMP360 25 mg.

The company held an interesting webinar to discuss both this PTSD trial and their commercialization plans for treatment-resistant depression (TRD) (WEBINAR HERE and SLIDES HERE and TRANSCRIPT HERE). Apparently, the FDA has indicated Compass will get a rolling submission, so they have accelerated the release of the second Phase 3 trial 9-week data to the second half of the March quarter. We’ll also get the first Phase 3 trial 6-week and 26-week data then. The 26-week data release from the second Phase 3 trial has been accelerated to the September 2026 quarter.

They dramatically improved their liquidity position by amending their term loan facility with Hercules Capital. They increased the overall size to up to $150 million, of which $50 million has been drawn down. They extended the interest-only period from January 2026 until at least January 2029, with further extensions subject to the achievement of specified milestones. They also extended the maturity date from July 2027 to January 2031. This should be enough to get them through FDA approval. CMPS is a Buy under $10 for a very long-term hold to $200.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2028

Probable time of next financing: Late 2025

Inovio (INO – $1.61), as predicted, said the FDA has accepted their Biologics License Application for INO-3107. They did not get accelerated review, so the PDUFA date is October 30. Inovio will try to get that changed. The FDA said they are not currently planning to hold an advisory committee meeting – that was unexpected good news. INO is a Buy under $5 for a very long-term hold.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: Mid-2026

Probable time of next financing:After FDA approval in 2026

Inflation MegaShift

Gold ($4,486.90) and silver plunged after the CME Group raised its margin requirements for precious metals contracts on Monday, December 29. After peaking at $4,565 per troy ounce the previous Friday, spot gold was down more than 4% to $4,352. Spot silver hit a high above $84 on Sunday, then fell nearly 9% Monday to just above $73 an ounce.

Even after the drop, gold and silver booked their highest annual returns since 1979, up over 64% in 2025. Probably, some investors who were planning to cash in profits after the first of the year to postpone 2025 tax liabilities decided to get out now. I understand the desire, but the combination of falling interest rates and a weaker dollar, against a background of rising global debt and inflation worries, should continue to push prices higher in the March quarter. The silver supply squeeze and strengthening industrial demand have not gone away.

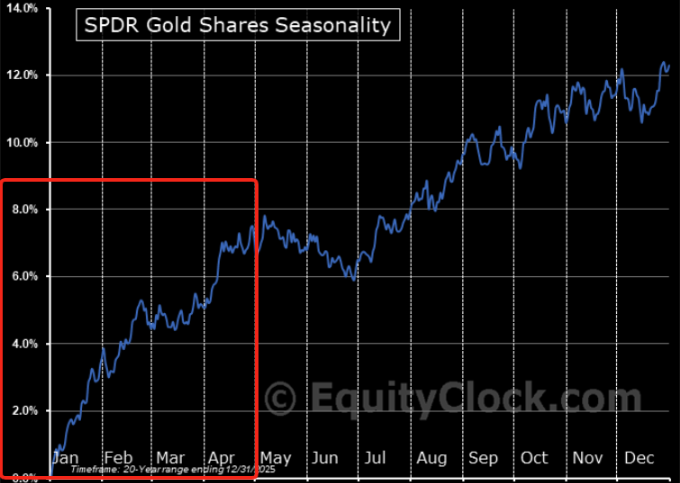

Gold thrives in an environment of uncertainty, and we have plenty of it in 2026. I’m looking for $5,000 gold this quarter and $6,000 in the June quarter. I don’t think this story is anywhere near over yet. Gold seasonality is set to improve from here.

Click for larger graphic h/t @Mayhem4Markets

The Goldman Sachs trading desk pointed out that speculators still haven’t come back; China is positioned at March 2025 levels, about 30% off their peak; commodity trading advisers (CTA) are about 35% lighter; and CFTC speculator data is back to May 2025. Exchange-traded funds’ holdings remain high and sticky, with no real capitulation during October’s sell-off. Their bottom line: We stay constructive.

The fractal dimension is so extended I’ve run out of chart room. Precious metals really need to consolidate, at least by the passage of time (many weeks), and possibly by a scary drop in price (~$1,000?).

Miners & Related

First Majestic (AG – $17.90) sent out a year-end update. Touting:

Production That Sparkles

Los Gatos joined the First Majestic family seamlessly, boosting year-to-date production by ~50%

Q3 delivered a record 3.9 million ounces of silver – nearly double last year

We even raised our full-year production guidance (because why stop at expectations?)

Financial Cheer, No Grinches

Revenue more than doubled year-over-year to $793 million Q3-YTD

Free cash flow jumped 470% – proof that discipline really does pay

With $569 million in the treasury as at Q3-2025 and ultra-low-cost financing secured, our balance sheet is feeling very festive

Discoveries Worth Celebrating

Two high-grade discoveries at Santa Elena (Navidad and Santo Niño) added meaningful upside – and there’s more drilling underway across the portfolio

San Dimas and Los Gatos continue to deliver strong exploration results, setting the stage for future growth

AG is a Buy under $11 for a $23 next target price as production increases and the price of silver rises.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $91.008.57) just celebrated its 17th anniversary. The first bitcoin block was mined on January 3, 2009, around 6:15pm server time. It would take another six days for the second block to be mined. Bitcoin founder Satoshi Nakamoto left a message in the code for the block, commonly referred to as Block #0 or the Genesis Block. The message read: The Times 03/Jan/2009 Chancellor on brink of second bailout for banks. That line comes from a London Times article from the same day that detailed a bailout of banks from the British government. While Nakamoto never stated the meaning of the message many believe it is a reference to why bitcoin was started in the first place: To cut banks out of the financial process.

Bitcoin is steadily recovering from its latest dump. I think this continues.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $51.52) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $23.45) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $58.56

Oil closed out 2025 with its steepest annual loss since 2020 as the market confronts wide-ranging geopolitical risks and steadily rising supplies across the globe. West Texas Intermediate fell 20% for the year. Traders still believe a punishing surplus is expected to weigh on prices in 2026 – I don’t believe it.

OPEC+ has decided to hold off on further output hikes. US crude oil stocks decline week after week, including another 3.8 billion barrels announced this week. In 2025, the tank farms at Cushing, Oklahoma, the pricing point for West Texas Intermediate futures, had its lowest annual average storage level since 2008. China, which had been buying 800,000 barrels a day of sanctioned Venezuelan oil, now has to turn to the world market. Managed money short positioning is now at a multi-decade high and the negative sentiment surrounding the Venezuela developments is overblown. Oil is at 20-year lows in real terms, yet people are calling for $30–$50 glut bear scenarios.

I think the real downside risk is maybe 5%–10%, with a potential upside of 100%-200%. That’s the very definition of an asymmetric risk/reward, and I like that trade. But, fair warning, I’ve been wrong so far.

Venezuela’s oil: API Gravity: 8° (“Extra Heavy”); Sulfur: High (“Sour”), Metals: Yes, lots of vanadium (poison to refinery catalysts). This is not Light Sweet Crude, it’s road pavement that hasn’t dried yet. Chemistry is a wonderful thing, and the refining industry can turn this sludge into jet fuel, but it costs a fortune. In reality, Venezuela’s economically recoverable reserves are 25 billion barrels of heavy, sour, metallic oil.

And check out this post on X from @RazorOil:

“As a heavy oil expert, with 18 patents in heavy oil production technology development and optimizations, and prior experience as a senior technical SME at a supermajor U.S. oil company that Venezuela still owes money to….I wanted to correct some of the misguided takes circulating on X.

“While Venezuela has the world’s largest oil reserves, those figures do not translate directly into immediate production flow rates or rapid incremental increases, which demand substantial time and investment. With the next budget season not arriving until Q3, U.S. producers are currently committed to ongoing projects and contractual obligations. Venezuela’s oil faces uniquely difficult geology, low ultimate recovery rates, and severe infrastructure deficits.

“From my work alongside Venezuelans who actually operated projects there, many cited rampant corruption and logistical nightmares as reasons they left the country. At current oil prices, the massive capital required for meaningful production growth simply isn’t justified—one leading expert and good friend, estimates it would take at least 3 years to double output, adding about 1 million bbl/d… so not by next week….

“Unlike Canada, Venezuela has zero SAGD [steam-assisted gravity drainage] projects ZERO !!; any greenfield heavy oil development there would require at least $30,000 per flowing barrel, meaning roughly $1 billion!! for every 30,000 bbl/d increment achievable in perhaps three years. They mainly produce cold production, which is cheaper I’ll admit!! But with slower flow rates and rely on diluents and polymers which are enhanced recoveries (EOR) that require capital and supply of these chemicals and infrastructure… more money.

“Finally, people seem to overlook the U.S. Midwest (PADD 2), which already processes around 4 million bbl/d of crude, predominantly from Canada. Venezuela lacks the logistical or practical means to displace that supply. Hope this clarifies things for everyone and helps the understanding of this volatile situation.”

The July 2026 Crude Oil Futures (CLN26.NYM – $57.96) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.90) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $8.13) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil and natural gas prices fall.

Energy Fuels (UUUU – $18.59) said they beat their 2025 guidance for mined uranium ore production, finished uranium production, and uranium concentrate sales. The Pinyon Plain Mine in Arizona and La Sal Complex in Utah mined over 1.6 million pounds of uranium in 2025, exceeding the top end of previously reported guidance by about 11%.

The White Mesa Mill in Utah s produced more than one million pounds of finished U3O8 during 2025, with over 350,000 pounds of U3O8 produced in the month of December alone. This exceeds the top end of previously reported guidance. The company expects to continue milling at current milling rates, averaging approximately 250,000 pounds of U3O8 per month, through the first half of 2026 and then shift to the commercial-scale production of the heavy rare earths dysprosium (Dy) and terbium (Tb) for the rest of the year. That will be the first US commercial production of highly sought heavy rare earths in many years.

Revenues require sales, and there also was good news here. They sold about 360,000 pounds of U3O8 in the December quarter, up 50% from the 240,000 pounds of U3O8 sold in the September quarter. Total gross uranium sales revenue for the December quarter was about $27.0 million with a weighted average sales price of $74.93 per pound.

They also announced two new long-term uranium sales contracts with US nuclear power generating companies, adding to their U3O8 deliveries for the years 2027 to 2032. Both contracts retain exposure to uranium market upside by utilizing hybrid pricing, whereby a portion of the final sales price is calculated on a base escalated price with the other portion based on the spot price at the time of delivery, subject to floors and ceilings.

With the addition of these contracts, Energy Fuels expects to complete sales totaling about 780,000 to 880,000 pounds of U3O8 into its portfolio of long-term contracts in 2026, along with the potential for additional sales on the spot and term markets, subject to continued strong uranium markets and production.

For 2027 to 2032, Energy Fuels’ current portfolio of six long-term contracts has delivery quantities that total 2.41 million to 4.41 million pounds of U3O8, which is expected to leave significant additional uncommitted low-cost uranium for sale above those quantities. They expects their cost of goods sold to begin dropping in the current quarter, as low-cost Pinyon Plain uranium is added into their inventory and sold.

This morning, the company said the updated feasibility study for its Vara Mada project in Madagascar, formerly known as the Toliara project, confirmed the project’s exceptional economics and world-class quantities of high-quality rare earth, titanium, and zircon mineral reserves and resources. They expect annual production of 24,000 tons of monazite with the potential to supply up to 30% of US demand for light REE oxides and 85% of U.S. demand for heavy REE oxides such as dysprosium and terbium. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

Freeport McMoRan (FCX – $54.22) recovered as copper had its best year since 2009, fueled by near-term supply tightness and bets that demand for the metal, key in electrification, will outpace production. Robust momentum in global copper demand is expected over the long term. BloombergNEF estimates consumption could increase by more than a third by 2035 in its baseline scenario. The drivers of this trend include the ongoing shift to cleaner energy sources such as solar panels and wind turbines, growing adoption of electric vehicles, and the expansion of power grids.

US copper futures hit an all-time weekly closing high.

FCX is a Hold for higher prices.

Primary Risk: Copper prices fall.

* * * * *

Is Angel Blue The Next Anna Netrebko Or Maria Callas?

* * * * *

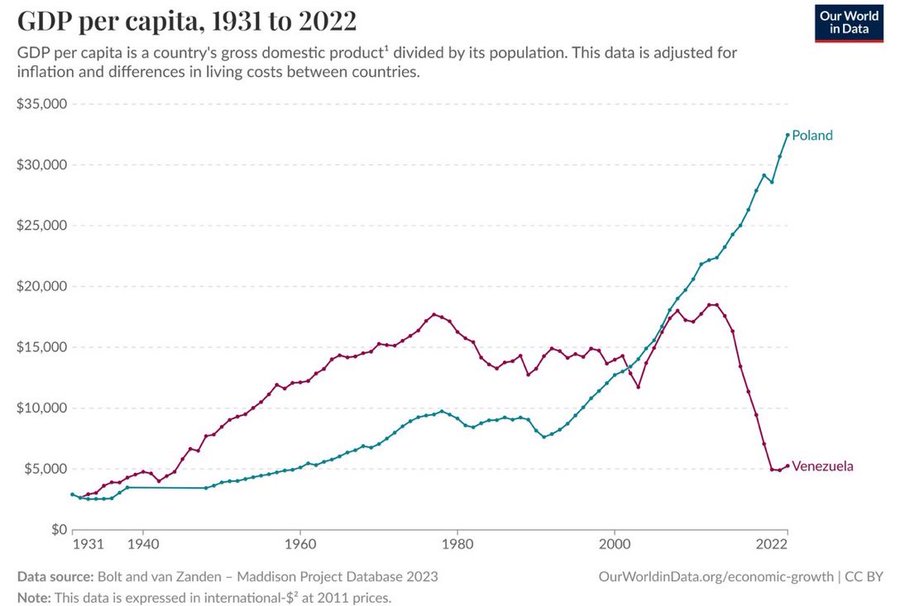

Venezuela used to be much wealthier than Poland, which was suffering under socialism. Then Poland implemented free-market and capitalist principles and enjoyed an economic boom. Venezuela chose socialism, which brought poverty and misery to its people.

* * * * *

Your listening to Ray Dalio Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 1/8/26. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $259.04) – Buy under $205

Gilead Sciences (GILD – $120.67) – Buy under $115, first target price $150

Meta (META – $646.06) – Buy under $705 for a long-term hold

Onsemi (ON – $60.89) – Buy under $60, first target price $130

Palantir (PLTR – $176.86) – Buy under $160 for $200 first target price

PayPal (PYPL – $58.27) – Buy under $75, target price $150

Snap (SNAP – $8.40) – Buy under $11, target price $17+

Small Tech

Enovix (ENVX – $7.91) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $72.38) – Buy under $75; 3- to 5-year hold

Fastly (FSLY – $9.95) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $12.67) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $7.45) – Buy under $10, target price $40

ARK Venture Fund (ARKVX – $46.25) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $4.11) – Buy under $6, target $30+

Akebia Therapeutics (AKBA – $1.49) – Buy under $4, target $20

Compass Pathways (CMPS – $7.62) – Buy under $10, hold a long time for a 20x return

Editas Medicines (EDIT – $2.14) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.61) – Buy under $5, hold a long time

Medicenna (MDNAF – $0.68) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.67) – Buy under $2.50, target price $20, then $50

TG Therapeutics (TGTX – $30.50) – Buy under $30 for buyout at $40+

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($76.30) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $74.00) – Buy under $50, target price $75

Sprott Junior Gold Miners ETF (SGDJ – $88.56) – Buy under $60, target price $100

Sprott Physical Gold and Silver Trust (CEF – $48.01) – Buy under $35, target price $60

Global X Silver Miners ETF (SIL – $87.50) – Buy under $60, target price $100

Coeur Mining (CDE – $19.62) – Buy under $10, target price $20

First Majestic Mining (AG – $17.90) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $1.18) – Buy under $1, first target price $10

Royal Gold (RGLD – $243.84) – Buy under $180

Cryptocurrencies

Bitcoin (BTC-USD – $91.008.57) – Buy

iShares Bitcoin Trust (IBIT – $51.52) – Buy

Ethereum (ETH-USD – $3,107.73)– Buy

iShares Ethereum Trust (ETHA- $23.45) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $57.96) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $33.90) – Buy under $40; $100+ target

Vermilion Energy (VET – $8.13) – Buy under $11; $24+ target

Energy Fuels (UUUU – $18.59) – Buy under $18; $30 target

EQT (EQT – $52.20) – Buy under $70; hold for much higher prices ($100+)

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Nvidia (NVDA – $185.04) – Hold

SoftBank (SFTBY – $13.87) – Hold

Dakota Gold (DC – $5.82) – Hold for $6 target price

Freeport McMoRan (FCX – $54.22) – Hold for an exit in the mid- to high-$40s

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2026

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

Thank you for a good year!

Message to JGMD. Sorry I missed your message on 12/24 RR. I went thru my statement and found I bought VELO 493 shares @ $4.05 just after the reverse split in July. Like everyone else , I was underwater. But I thought they were unfairly beat up and I like the product. So I took a leap of faith and bought and additional 493 shares. Plus my after split shares and had 570. Since then I am now in the black. $11,500. It was up again today 10 percent plus. Also military stocks are getting some love. My L3Harris stock is up $15.48 today. My 13 k stake is now 43k. That’s what I call a winner!!

Was the 35 split the only one in the last few years? If so, then the NWI reco, buy below $10 becomes buy below $350. Was there an additional RS in July 2025? How much? Can’t do the math without enough data, but it appears you were nearly wiped out at your original buy. Maybe you hit the jackpot on your recent buy, but are you really in the black with all the downs on your original buy and ups on the recent buy?

Yes , I was in the RED, over $7,000 . My 1100 something shares were chopped off at the knee, leaving me with 72? Before my last buy at the $4.00 price. I went from minus $7,000 to plus $11,000. In the black. A $18,000 swing. Unreal!

MM, double check your formula on the Small Tech table. I get an average of 13.4% verses your 6.5%. That also appears to impact your overall average. I get an overall average of 54.0% verses your 52.9%.

Congratulations on a very good year! Precious metals had a huge year.

Chris,

I see that NGEN is now on NASDAQ. I was surprised we didn’t get a huge bump from this. Was this already priced in?

Also, I see that ACHV has done well the last few weeks. Any chance they could get approval before June?

One more thing. Any concern with CAPR? We have dropped almost $5 a share in a week. Seeing a lot of chatter on ST about not hearing back about the resubmission by the end of the year.

I’m not concerned about CAPR. Check out the options market. Right now folks are offering $5.00 for the CAPR Jan 2028 $60 Call. That means you could buy 100 shares of Capricor today for $2400 and turn around and sell that contract for $500 (net cost $1900). 2 years form now you will either still have your 100 shares at a net cost of $1900 (and a value of who knows?) OR someone has bought your 100 shares for $6000 (plus the $500 you got in January 2026).

In the first Radar Report of last year I thought CAPR would triple from $15 to $45 and then double that in 2026. It only got to $40 in 2025, but I still think it goes to $45 this year and double that next year.

I also predicted NervGen to gain more than 254%. It was about $2.10 a year ago so it had a 270% gain to date. Glad I sold almost everything else when Trump first started talking tariffs and wen “all in” to NervGen under $2.00.

Medicenna? Well, it’s 5% cheaper than last year, but has another year of excellent data. Will 2026 be the year?

I don’t expect ACHV to get approval before June, but they are getting excellent treatment from the loony-tunes MAHA FDA. I wouldn’t be surprised if FDA even throws in approval for vaping. Marketing success will depend on their plan to rely on the world’s #1 internet marketer. I am betting my good money that their plan will succeed.

Chris, thanks for the follow up. Interesting you mentioned about Medicenna, because I’ve been in it a few times and have never done well. What I don’t understand is if these results are so good, why is it trading under a dollar?

Great job, thanks

I’m curious to hear from you and others what you are aware of that could be your next big thing.

For example, I’m looking at a company called VIVOS Inc (RDGL) that is getting close to resubmit for FDA approval for Human trials of their product RadioGel that allows cancer fighting agent to be injected into a solid tumor to kill it from the inside, and does not have a negative impact on any organ outside of the tumor. This is already marketed for animals as Isopet successfully. Their first FDA submission wasn’t organized to satisfy the FDA so they hired a consultant (former FDA) to help them prepare for resubmission in a manner the FDA is more likely to appreciate. That resubmission is expected to be presented within 2-3 months I understand.

Thanks for the great RR and end of year review. Overall, great results. Looking forward to 2026

MM- Im trying to decipher your comments on MU are you saying there is downside risk because of the thin margin cyclicality of the business? Everything I read shows they already have orders fulfilling capacity for 2026, and close to sold out for 2027, and are building new facilities, and finally their P/E is well below competitors. So, looks like a smart buy to me but please share your thoughts.

MM could you please clarify your comments and if your pro MU or not? Thank you

NervGen (NGEN) has a new corporate presentation out on their website:Corporate Overview ; https://nervgen.com/wp-content/uploads/2026/01/NervGen-January-2026-Corporate-Overview.pdf

Thanks.

According to the Next Steps slide (slide 33) NGEN isn’t expecting Phase 3 topline data until the 1st half of 2028. That means approval isn’t likely to occur until early 2029 given the time it takes for data analysis, BLA submission & FDA review. And that’s a best case scenerio as we know how trial timelines tend to push out. No guidance regarding Phase 3 cost & plans for funding it. Phase 3 funding could also delay the timeline.

Projected FDA approval appears to be a long way away with a lot of financial uncertainty related to the Phase 3 trial.

Early 2029 approval, 3 years away is why there is financial and trial expense risk. I don’t like artificial bumps from under $4 to almost $6 from uplisting. Sure, US listing may help with financing, but the fundamental risk is whether NGEN will prove significant benefits, not just slight awakening of dead neuro functioning. Much tweaking of treatment protocols is needed. Maybe they can do small trials for tweaking. Lots of tweaking with small trials is better than gambling on large phase 3 trials using merely a 2nd try. I will add only on a big pullback to 3-4, certainly not in the high 5’s from the Nasdaq fluff.

Brent, BSMD, Chris–Slides 21, 22 are merely positive electrophysiological (EP) results. Positive EP results are useful confirmations, but what real counts are actual clinical measurements, such as GRASSP. P values for significance are given for EP, not for GRASSP. This positive SCI study was for very small numbers, and I remember how much longer than expected it took to get about 20 patients enrolled. Phase 3 is for 150 patients. Do we believe it will take only 1 year to get 150 patients selected and enrolled when it took that length of time for get 20? It could take 3 years longer than that. Most of the % gain in this stock will be made upon reporting the top line in 2028 or possibly 2031. As with CAPR, the big gain will happen with great top line results. FDA approval is always a risk, so maybe another 100% on approval 2029 or 2032. That’s why the stock may correct to 3-4 while we wait a longer time than expected for full enrollment.

The good aspect is that 70% of the active drug group had clinically meaningful results. Tweaking of the protocol should be done. I would do 5 patients getting treatment for 20 weeks, 5 for 28 weeks, 5 for 36 weeks, no controls needed because 70% responded at 12 weeks. Do the same for different doses. Add 4 weeks for analysis. This refinement of dose and duration if highly informative, could be used to more rapidly recruit 150 patients for an optimized double blind placebo controlled trial. I am optimistic about success, whenever it happens, but the stock needs a correction for better returns. This is a long haul journey, not for short term traders.

JGMD brings up a lot of interesting points for discussion. So let’s discuss:

“Early 2029 approval, 3 years away is why there is financial and trial expense risk.”

Management has said many times that they will seek Accelerated Approval (AA). What is AA? https://www.fda.gov/drugs/nda-and-bla-approvals/accelerated-approval-program

If FDA grants AA, share price will quadruple, but I am not counting on AA. As soon as Trump started talking about tariffs last Spring, I sold almost every stock I had and poured it into NervGen which was a few months away from announcing Phase 2 results. I figured a couple years ago that if NVG-291 worked in humans, news about successes would leak out before results were announced and several such leaks had occurred. With a trial 7.5 times larger, leaks are inevitable.

“I don’t like artificial bumps from under $4 to almost $6 from uplisting.”

It’s not an artificial bump. It was inevitable. That’s why I was touting the uplist. Maybe instead of saying that uplisting caused an artificial inflation, the more accurate view is that the share price was artificially deflated due to shares NOT being on a major exchange.

“Sure, US listing may help with financing, but the fundamental risk is whether NGEN will prove significant benefits, not just slight awakening of dead neuro functioning.”

Phase 2 participants who responded well to the drug have expressed great enthusiasm for the benefits they experienced, not “just slight awakening.”

“Much tweaking of treatment protocols is needed. Maybe they can do small trials for tweaking. Lots of tweaking with small trials is better than gambling on large phase 3 trials using merely a 2nd try.”

I agree that the proposed Phase 3 is not the best design. At a minimum, I’d like to see a 2:1 randomization of drug to placebo rather than the proposed 1:1.

“I will add only on a big pullback to 3-4, certainly not in the high 5’s from the Nasdaq fluff.”

If you missed the many opportunities to load up in 2025, I am sorry, but that may be the best way to proceed at this point. If AA doesn’t happen, I believe there will be opportunities to add over the next couple years in the $3-4 range. It is rare to have a multi-year period without any significant pullbacks. Admittedly, I have lightened up on my load of NervGen as I see other options that look better for the next year. But I still have enough NervGen that I will have no regrets if AA occurs and shares go to $20.

“Phase 3 is for 150 patients. Do we believe it will take only 1 year to get 150 patients selected and enrolled when it took that length of time for get 20?”

A major difference is that Phase 2 was a single center trial. Participants had to travel to Chicago for four months. Phase 3 will be conducted at more than 50 sites in the US and Canada so that participants won’t have to travel. Also, enrollment should be faster since now everyone knows the drug works and the odds of improvement are better than they were for Phase 2 participants..

“Most of the % gain in this stock will be made upon reporting the top line in 2028 or possibly 2031. As with CAPR, the big gain will happen with great top line results.”

Always true with biotech (except in the case of AA or a buyout).

Good points. I still wonder about what the appropriate bump should be for uplisting. Usually, to get a doubling in a stock, there has to be a surprise, with FUDSTERS writing convincing articles in SA with “expert” analysis and prestigious trader shorts like Martin Shkreli beating down the price. Then when fundamentals assert themselves, the stock doubles or better, as with CAPR. My view is that uplisting merits a 30% bump only. Most startups can’t afford the extra expenses of maintaining a home in a more prestigious neighborhood like a major exchange. So the prestige better be worth it, limiting gain to about 30%. That’s why my original buy at $1.75, still holding, equates to $3-4 now with more good data and less risk. Acceptance for AA pathway may be good for $8, and actual AA approval may be good for $20, but before full phase 3 is done? If NGENF goes to $20 after AA, are you going to sell all, or hold for $50?

Which options (stocks, not options) look better than NGENF for 2026? I stay away from options because of timing uncertainties. At the moment, I am short term bearish on AKBA, medium/long term bullish. Q4 Vafseo sales will show declines vs Q3, already PR’ed by Butler. On ST, Yamauchii got an email from Davita’s Steve Brunelli, saying that docs are conservative and are slow to switch from ESA to V. Brunelli likes V and will try to get Davita moving. So we might not see V sales greatly increase until 2H 2026. USRC, an early V enthusiast, may greatly increase V in Q1 from the new TIW (3x/week) protocol more aligned with dialysis. The timing of V uptake is anyone’s guess. I have warned NWI subscribers not to follow MM’s “buy below $4” advice in view of the news of the last several months. AKBA may not ever get back to $4, or it might take many years to get there again.

Medicenna Therapeutics Announces Key Program Updates and 2026 Outlook – Medicenna Therapeutics

Thanks for providing the link to the update.

MDNAF currently has cash to get them into Q3. One of their expected 2026 milestones is:

Strengthen the balance sheet through partnership and/or financing by mid-2026 in preparation for registrational trial for MDNA11 and commence FIH trial for MDNA113.

The Phase 1/2 trial of MDNA11 kicked off in Sept 2021 and is still ongoing. Their hope is to meet with the FDA to plan a registrational trial this year. How many years will it take to initiate and complete that trial and then get FDA approval?

MDNAF has so far operated on a philosophy of getting candidates through phase 2 and then partnering them to advance them through phase 3 to FDA approval but MDNA55 completed phase 2 in 2020-Q4 and is still without a partner to move it forward.

It is going to take a ton of additional money and a lot of years to get MDNA11 through to FDA approval. That translates into either massive dilution or a partnership like SCYX did with GSK.

Immunity bio (IBRX) up 30% today. Bladder cancer treatment approved in Saudi Arabia.

https://finance.yahoo.com/news/immunitybio-announces-positive-results-demonstrating-133000208.html

FWIW, take a moment and look at CYDY.OTC. They have a very safe effective drug for oncology and HIV. The name of their drug is Leronlimab. Positive results have been coming out for patients treated with Leronlimab and Keytruda for colon cancer and breast cancer patients.Leronlimab is showing a remarkable ability to turn cold tumors hot, which no other drug can do.

As with any promising drug, do what Brent does and analyze the cash burn situation, prospects for repeated dilution. What stage has the company completed? If only phase 2, all this applies. That is the main risk of early stage drugs. They may seem cheap, but dilutions and reverse splits are killers. Most failed NWI stocks have this problem. Very early stage bios, even things like VLD. Most people including myself bailed and suffered big losses. Maybe John Miller was the one person who had enough patience to see the real turnaround and make money on VLD.

Personally, I like investing at the phase 3 stage, but only on weakness. I bought CAPR after bad news about adcom, CRL. That way my average cost became $8.50 instead of $15-20 when Chris mentioned it. Even then, after the most recent CRL, it bottomed at $4.30. I was down 50%, but it soared to $40 and now $24. That’s why speculative stuff must be bought on weakness in quiet periods or panic, not on euphoria and technical strength.

I’ve followed gold for 35 years, bought only 3 gold coins at $382/oz, I bought Sprott 20 years ago and held. Finally, in Nov 2025, I converted my account with Rick Rule’s Global Resource Investing to a bespoke managed resource account with Eric Angeli, a new generation analyst with Sprott. I held the Sprott position, Eric sold my big losers and bought junior producers I never heard of. My account was up 7.5% in Dec after another 30% boost in the fall. Don’t try to analyze these companies yourself. Leave it to a pro, pay the 2.0% total management fee. Sprott’s standard managed accounts charge 1.5%, but the client has no input. Should I have bought more gold coins 30 years ago? To go up 15 fold in 30 years is OK, but in that time my TSM went from $8 to present $343, much better. I’m glad I finally woke up again for gold and commodities.

Michael, if you have a chance, could you see today’s NYT article regarding Strategy’s bitcoin holdings and financing challenges? Rob Copeland is the reporter.

They hold (apparently) 3.25% of mined bitcoin. Should Strategy fail, would you see the effect on bitcoin pricing lasting very long?

I don’t know whether Copeland is missing anything.

Thanks.

MM – its hard to understand why you are so absent from responding to questions from subscribers, disrespectful really

MM is 84 years old and recently he reduced RR’s to every other week. It is great that we have many astute people here providing some answers and counterpoint to his high buy and target prices.

Thanks for the opinion but I wasn’t talking to you JGMD

A paid subscriber asking for clarity about comments made should get a reply, don’t ya think??

Sure. Years ago, I realized that MM answered only a few questions. He missed the boat on VLD’s declining prospects, and bailed like most of us, but too late. John Miller is probably the only subscriber to make money on VLD. John also sold TGTX at about $35, a great move. I followed John and sold TGTX likewise.

Having contributors like you, Chris and others are a huge bonus for those of us interested in advice, opinions and suggestions. I visit this site multiple times a week looking at the comments section for recommendations of new buy opportunities in addition to discussion of MM’s ideas as well as discussion of those other ideas.

MM almost always responds to inquiries. I think most of the time he responds on days he issues reports.

Following my nearly “all in” strategy for NervGen ten months ago, I have been taking some profits and reallocating and rebalancing. Today I tried getting back into Eupraxia (EPRX) through a Schwab account. I got a message that I had to call Schwab to place the order. This was highly unusual I thought, but call I did. I asked why I had to call and was told “It was restricted due to unusual activity.” I was not told why nor how long it had been restricted although I asked. I was told that it can change at any time even during the same trading day. Anyone have more information about this?

No answer about EPRX. Back to NGENF. I admire you for having the balls to extrapolate animal studies to humans, backing it up with good money and succeeding. Early in my medical career, I was more daring like you. But later I discovered unexpected things. I have an 80 yo patient with HBP and arthritis of the knee. She had leg swelling which we attributed to her amlodipine drug. I concurred with her stopping the drug to observe results. Now a few months later, the leg swelling has disappeared as expected, but yesterday she surprised me by revealing that her knee pain also disappeared. I had not expected relief of knee pain by stopping the drug. There doesn’t seem to be a reported reason, and I could only theorize that the drug increased fluid within the joint as well as the leg. She taught me something new and valuable. Academics don’t know everything, but patients can teach a lot from their experience.

I think expert teachers will always learn from good students who ask questions. Interesting data point on that 80 year old stopping amlodipine. As we all know, while some humans are rats, no rats are human and some things that work for rats will not work for humans. In NervGen’s case, I expected that if the drug worked, some positive news would leak from the trial. In December of 2023 the first leak came from the Blink of an Eye podcast. Others followed so that 10 months ago with data arriving shortly it seemed like a favorable bet. While I think NervGen will eventually go over $50, unless it gets Accelerated Approval share appreciation over the next year will be minimal. While NervGen is still my biggest investment, I have sold a lot and redeployed into other investments I think will more than double over the next year.

Chris, do you mind sharing those other investments you think will more than double over the next year? TIA

Do you still think NGEN go’s to 50? What broker do you use?

If not bought out NGEN goes over 50 eventually. I use Schwab and Interactive Brokers.

Thanks Chris.

Sold AG today @$22.55. Sorry couldn’t wait for $23. I am up $4300. In 2 accounts. Thanks MM

Way to take profits, JM. You may be leaving some on the table, but you took the lion’s share. Time to feast!

Yes, it’s probably going to $27 or higher but I want to take the cash and get into Franko Nevada or this other silver miner I am looking at. I haven’t decided yet. Hycroft Mining HYMC is treating me very well lately too. Data centers are going to use lots of silver and the metals are in an uptrend. Thanks. Oh Also INTC is killing it lately. Now at $54.25. I bought in at $25.00 and change. That connection to NVDA is pulling them up.

MM – if you could give an update on PZG. I’m thinking it should be on the near term movers list. Approvals pending for mining, but my recollection is that they have a handful of employees and no ability to mine without partnering or selling. Any thoughts on what a buyout price would be? Once upon a time you had a target price of $15 for this stock if gold got to $1,600 (that long ago). I’m not sure how much dilution has occurred over the years, but this really looks ready to pop.

PZG has been an inferior way to play gold. Don’t try to analyze gold and other commodity hard asset stocks yourself. Mining companies like PZG are often poorly run, like a small biotech, so it is necessary to get a managed account for this, or even a mutual fund. I’m glad I converted my hitherto losing account at Global Resource Investments to a Sprott managed account. You could choose a standard account for a 1.5% account fee complete, no commissions, or the Traditional Diversified account managed by Eric Angeli at 2.0% but which gives you freedom to advise Eric. I have the latter account and am pleased. If you try to do it yourself, you waste 100’s of hours doing DD which you aren’t qualified to do. No shame in that. Do DD on the few things you are qualified to research.

I agree that PZG has been a poor long-term performer. I had dumped it long ago when MMs prediction of $15 per share when gold hits $1,600 proved half right – gold over $2,000 and PZG not moving. At this point it’s a short-term trade that I expect to close out this year. They don’t have the ability to mine the land about to be approved for mining and I don’t see how they can avoid a buyout.

I would agree it’s much easier to buy an ETF – I bought SILJ because I thought Silver would outperform Gold and I don’t have to worry that I can be right about that trend but wrong on a single silver stock.

Good move on SILJ, but silver had its move, and other commodities might perform better going forward. Hold SILJ.

AKBA–some encouraging feedback from Holy_boy on ST today. He is a nephrologist with USRC. Vafseo TIW (3x/weekly at dialysis sessions) will be started in Feb. An anemia manager at another USRC clinic has started TIW and is comfortable with the protocol. Holy said no new patients were started on daily V awaiting TIW. Read my (viber7) response to him. I thanked him for the info, but asked why V couldn’t have been started daily for new patients, and then transitioned easily to TIW. Large centers get infested with more bureaucracy which causes inefficiency. That’s why the stock has plummeted as people think V is a failure. But V is a great drug, and I have little doubt it will succeed in time. The stock is bottoming IMO.

New World Investor for 1.22.26 is posted.