Dear New World Investor:

We’ve made a lot of money by being early to the AI boom, and there may be many months or even years to go. But I have two big problems with the current speculation.

First, you have to realize that the current Large Language Models (LLMs) are an amazing advance, but they aren’t intelligent and they don’t think. They do store more data than any human could, and then use it to predict the next word in a sentence way faster than any human could. That’s a great application of current semiconductor technology, but the only thinking that’s going in is from the brilliant programmers that wrote the code that controls the LLM process.

Second, thought leaders like Sam Altman of OpenAI, Jensen Huang of Nvidia, and Masayoshi Son of SoftBank all say the next great leap in AI to Artificial General Intelligence (AGI) is coming real soon now. AGI means a computer is as smart as the human brain. I think that’s hooey.

I asked Copilot: “How many neurons are in the human brain and how many estimated connections are between them?” After assuring me that Copilot was “Thinking,” it replied:

So, OK, maybe when Jensen builds a computer with 86 billion semiconductors and 100 trillion connections it might be able to “think.” But I doubt it, because no one knows exactly what “intelligence” is. There are a lot of people who think “intelligence” is disbursed throughout the body. They talk about things like “gut intelligence.” If you can’t exactly describe intelligence, how can you develop an artificial version of it?

Third, the ever-thoughtful Harris Kuppernan – Kuppy – wrote a pretty devastating analysis of the economics of the current race to build huge AI datacenters. I encourage you to read it and this follow-up, but to summarize his argument:

* * The total AI datacenter spend for 2025 will be around $400 billion

* * There is at most a 10-year depreciation curve on average for an AI datacenter.

* * So AI datacenters built in 2025 will have $40 billion of annual depreciation, while generating somewhere between $15 and $20 billion of revenue

* * Generously assume the gross profit margin of the data center can eventually get up to 25% (electricity and tech nerds to manage the equipment are expensive)

* * You need $160 billion of revenue at a 25% gross margin to get $40 billion of gross profits to cover $40 billion of depreciation.

* * Revenue today is running at $15 to $20 billion. You need revenue to grow roughly 10x just to cover the depreciation.

* * For a new technology like this, with huge obsolescence risk, you’d want at least a 20% return on invested capital (ROIC). That’s still dilutive to the ROIC for most of the largest capex spenders – the hyperscalers.

* * Even at that dilutive ROIC, you’d need $480 billion of AI revenue to hit your target return.

* * $480 billion in revenue isn’t for all of the world’s future AI needs, it’s the revenue simply needed to cover the 2025 capex spend. (Goldman Sachs thinks US big tech hyperscalers’ capital spending will almost triple to $1.4 trillion by 2027. Citi says $2.8 trillion by 2029.)

Kuppy asked: “What if they spend twice as much in 2026? What if you need almost $1 trillion in revenue to cover the 2026 vintage of spend? At some point, you outrun even the government’s capacity to waste money. Simply put, at the current trajectory, we’re going to hit a wall, and soon. There just isn’t enough revenue and there never can be enough revenue. The world just doesn’t have the ability to pay for this much AI. It isn’t about making the product better or charging more for the product. There just isn’t enough revenue to cover the current capex spend.”

His conclusion is that the AI datacenter spend is like optical fiber in the second half if the 1990s. “It was companies like Global Crossing, spending tens of billions on fiber, that facilitated all of this. That fiber, amazingly, is still in use. Global Crossing went bankrupt along the way, as did many of its peers. They overestimated what people would pay for this fiber, not that it would eventually be used or valuable.”

To paraphrase Kuppy, AI is real, even transformative. At the same time, the capital cycle is brutal, the math is unforgiving, and the equity holders will ultimately be incinerated. When investors realize that AI isn’t generating cash flow, only burning it, the guillotine will fall on management, on the stocks, and on the broader market. The important question is how long the current trend in AI spending will last and how bad the fallout will be when it ends. The only question for us investors is when will we exit.

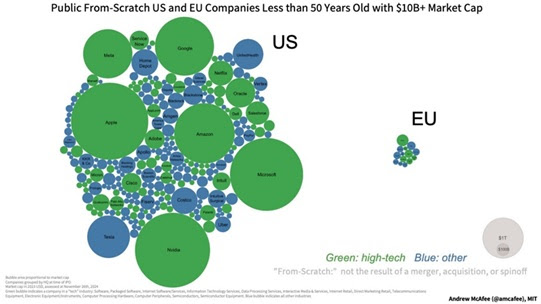

What Kuppy is missing is that there are many big data center buyers besides the hyperscalers who (1) don’t care about profitability; and, (2), can print the money to build them. I refer, of course, to governments and sovereign AI. Governments around the world missed the Internet boom. Look at the number of $10 billion companies created in the US (left) and Europe (right) in the past 50 years:

Source: Andrew McAfee, MIT

Click for larger graphic h/t @MITSloanIDE

As a result of missing the Internet Age, most countries are paying American companies for cloud storage, operating systems, and the data infrastructure that runs their economies. But they know that

AI is too transformative and too tightly linked to national security to leave in someone else’s hands. They are not going to repeat their Internet Age mistake.

Up front, that means buying GPUs, networking, and some other pieces from American companies. Then they can run AI on their own computers, using their own data, with their own people. As Jensen Huang, CEO of Nvidia said: “Every country will have an AI factory, just like every country has a telco.”

The big risk is selling AI stocks too early. Disruption usually runs longer than most investors can imagine. At some point – not yet – we will exit everything AI and many things that are not. Sure, Meta has a better chance of capturing more AI-assisted advertising revenue than Snap. Corning will execute their Springboard plan while Micron gets devastated by DRAM competition. Companies will turn in droves to Palantir to get useful work out of AI. But all their stocks will get killed together as valuations adjust to mid-single-digit price/sales ratios. Google co-founder Larry Page, said: “I’m willing to go bankrupt rather than lose this race.”

Well, Larry, we’re not.

So, when do we exit? On the “higher for longer” side, in addition to the coming wave of sovereign AI spending, passive investing is now more than 50% of new investment flows and that supports the Mag 7 stock prices. Plus, as I said in the last Issue, if the AI revolution plays out like the dotcom revolution, as I expect it will, the underinvested have a few years of pain ahead:

Or at least pain for the rest of this year. The AI bubble boom may still be dead ahead of us, as this chart would seem to indicate.

What’s amazing is that AI-related investments contributed the exact same amount to GDP as consumer spending in the first half of 2025 – 1.05 percentage points on average per quarter. Keep in mind that consumer spending makes up 68% of the economy, whereas the AI-related categories account for just 4.4% of GDP. That’s actually as high as it got during the dot-com boom.

Yet the bust is not going to happen anytime soon. According to Goldman Sachs, six sectors are expected to post positive earnings growth in the September quarter, led by Tech (20%), Financials (10%), and Materials (9%). The median stock for each of those sectors is expected to post double-digit EPS growth.

There are fewer underinvested as the American Association of Individual Investors Sentiment Survey showed that two weeks ago, bullish sentiment among this cohort (average age of 70, average portfolio size of $4.3 million) rose for four consecutive weeks – the first time that’s happened since May 2024 – to the highest reading year-to-date. That pushed the bull-bear spread up to a three-month high. They turned bearish again this week after last Friday’s wipeout, but I suspect they’ll snap back quickly. FOMO is a powerful driver.

Retail demand has finally hit. We just witnessed the largest retail investor buying EVER. Retail bought over $100 billion of US stocks in the last month, the largest one-month buying on record.

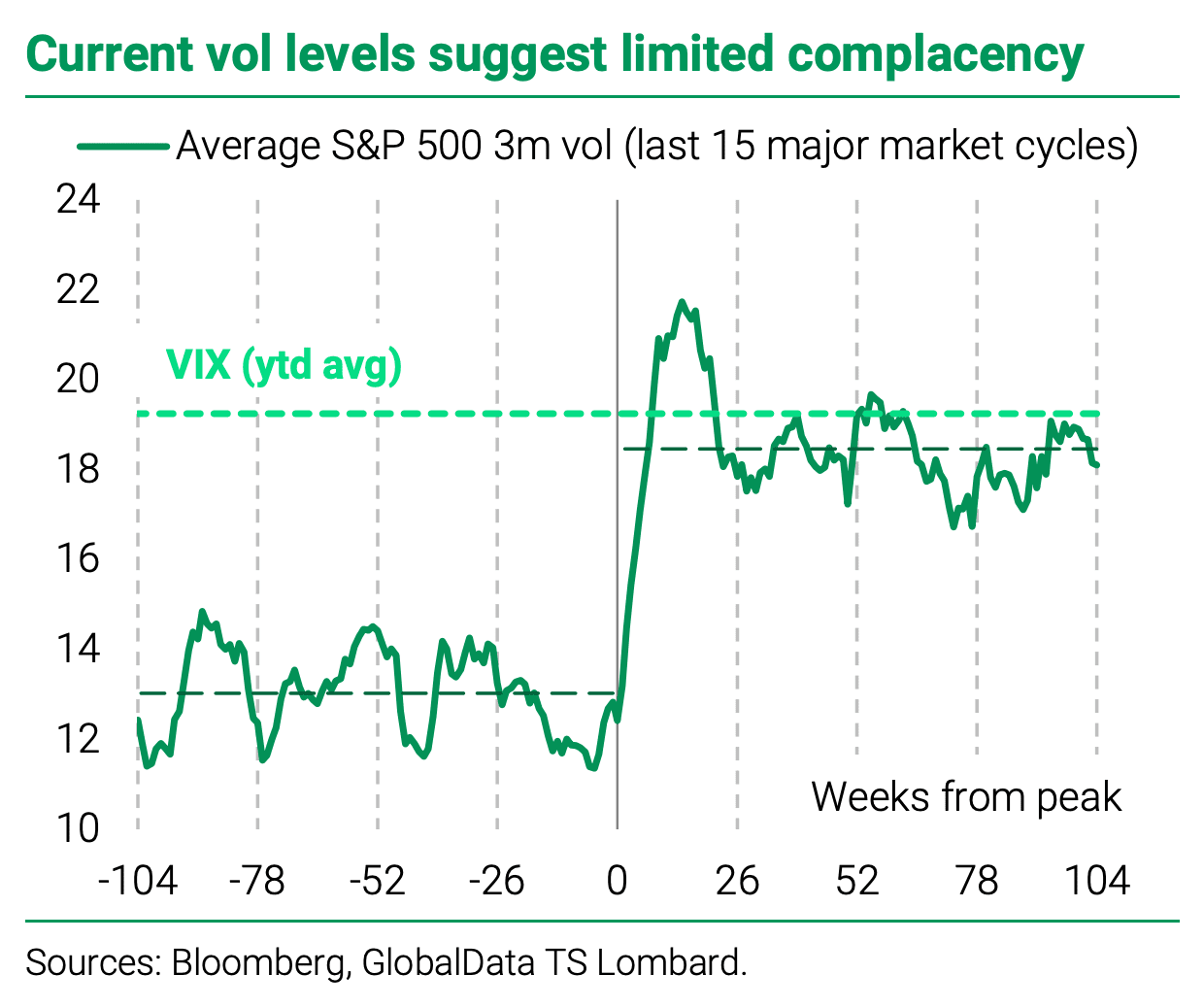

This is really important. The VIX Fear & Greed Index has a lot of information if you know how to see it. There tends to be two distinct VIX regimes: a low VIX range (11-15) when investors are complacent before the market peak and a high VIX range (17-19) thereafter. The high average level of the VIX so far in 2025 tells us that investors are not overly complacent and the ground is not about to fall out from underneath the market’s feet.

The truth is with billionaire hedge fund manager Paul Tudor Jones, who said: “My guess is that I think all the ingredients are in place for some kind of a blow off. History rhymes a lot, so I would think some version of it is going to happen again. If anything, now is so much more potentially explosive than 1999. It will take a speculative frenzy for us to elevate those prices. It will take more retail buying. It’ll take more recruitment from a variety of others from long/short hedge funds, from real money, etc.

“You have to get on and off the train pretty quick. If you just think about bull markets, the greatest price appreciations always occurs in the 12 months preceding the top. It kind of doubles whatever the annual averages, and before then, if you don’t play it, you’re missing out on the juice; if you do play it, you have to have really happy feet, because there will be a really, really bad end to it.”

Indeed.

Market Outlook

The S&P 500 lost 1.2% over the last two weeks, recovering only part of the drop on October 10 that was the largest in six months. The Index is still up 12.7% year-to-date. After a strong September quarter that is up at least 7.8%, as this one was (it was the 13th largest quarterly gain for the Index going back to 1950), on average, the December quarter tends to be about as strong (+7.7%). But most of the gains come in November and December.

Five out of the 12 prior instances saw the December quarter higher by double digits. Four of the 12 saw gains between 5% and 10%. The other three saw sub-5% gains, but every one of the 12 was up.

The Nasdaq Composite also lost 1.2% but remains up 16.8% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 5.2% as the new biotech bull market rolled on. It is up 19.8% year-to-date. The small-cap Russell 2000 squeaked through with a 0.3% gain and is up 10.6% in 2025.

The fractal dimension still has enough energy to overcome the recent drop and rally for a month or two.

Top 5

Changes this week: Removed SCYX from Near-Term because the GSK situation was resolved

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model projects 3.7% growth in the September quarter, more than double Wall Street’s expectation. We get the first estimate on October 30.

Dollar Death Watch

Commercial hedgers are the smart money. They are taking their largest net long position in the US dollar in over four years. It’s not a trade signal on its own, but it’s a powerful way to gauge market sentiment and positioning.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Tuesday, October 21

AG – First Majestic – Unspec. – Canaccord Genuity 1st Annual Silver Conference

CDE – Coeur Mining – Unspec. – Canaccord Genuity 1st Annual Silver Conference

EDIT – Editas – 8:45am – Chardan Genetic Medicines Conference

EQT – EQT – After the close – Earnings release; call tomorrow

Wednesday, October 22

EQT – EQT – 10:00am – Earnings conference call

Thursday, October 23

No Newsletter This Week

AG – First Majestic – Unspec. – SCP Global Silver Conference

CDE – Coeur Mining – Unspec. – SCP Global Silver Conference

FCX – Freeport McMoRan – Before the open – Earnings release; call postponed to November update

Friday, October 24

INO – Inovio – 3:40am – International Papillomavirus Society Conference

Short Interest – After the close

Tuesday, October 28

PYPL – PayPal – 8:00am – Earnings conference call

GLW – Corning – 8:30am – Earnings conference call

Wednesday, October 29

INO – Inovio – 5:10am – World Orphan Drug Congress

Business Employment Dynamics – 10:00am – Corrected numbers for March 2025 quarter

Fed Meeting – 2:00pm press release; 2:30pm press conference

CDE – Coeur Mining – After the close – Earnings release; call tomorrow

META – Meta Platforms – 4:30pm – Earnings conference call

Thursday, October 30

Next New World Investor

INO – Inovio – 4:20am – International Society for Vaccines Annual Congress

September quarter GDP – 8:30am – First estimate

CDE – Coeur Mining – 11:00am – Earnings conference call

GILD – Gilead Sciences – 4:30pm – Earnings conference call

AAPL – Apple – 5:00pm – Earnings conference call

Friday, October 31

Personal Consumption Expenditures Index – 8:30am – The Fed’s favorite inflation indicator just two days after their next meeting

Sunday, November 2

Clocks 1 Hour Back to Standard Time – 2:00am

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $246.51) reports September quarter earnings two weeks from today. The consensus expects revenues to be up 7.14% from last year to $101.71 billion, with earnings up 62% to $1.76 per share. iPhone 17 sales seem to be OK – BofA said lead times are longer than last year – so they’ll probably neither surprise nor disappoint. Jefferies downgraded the stock from Hold to Underperform because expectations surrounding how fast customers will upgrade their iPhones have become excessive.

They slashed their target price from – I am not kidding – $205.82 to $205.16. Then they said Apple’s profit margin is at risk due to the iPhone 17 product mix and tariffs, while separately noting that the new iPhone “momentum continues to cool off.” That caused them to really slash their target price again, from $205.16 all the way down to $203.07. I would not be surprised to see that cut io $203.06 pretty soon.

In the real world, Apple continues to lose AI momentum, with the head of their AI search project leaving for Meta. But it doesn’t seem to matter much as the huge installed base patiently waits for more AI features. Those features only work on the iPhone 16 or 17, so over the next few years there should be a very large wave of upgrades. AAPL is a Buy under $205.

Corning (GLW – $87.14) keeps setting 52-week highs and has blown past my target price. They will report on the 28th, and Wall Street is looking for revenues up 13.54% from 2024 to $4.24 billion, with earnings up 22.2% to 66¢ per share. Management is sure to say the Springboard program is on or even ahead of track. We’ll be selling GLW soon. GLW is a Hold.

Gilead Sciences (GILD – $117.45) reports the September quarter on October 30. Analysts expect revenues to be down 1.24% from last year to $7.45 billion due to the Medicare price reductions, but earnings should be up 6.4% to $2.15 per share. The company expects $170.4 million in acquired R&D expenses in the quarter, approximately an 11¢ hit to both GAAP and pro forma earnings.

GILD is a Long-Term Buy under $115 for a first target of $150.

Meta Platforms (META – $708.88) reports on the 29th. The consensus expects revenues to be up 21.66% from last year to $49.38 billion, with earnings up 11.3% to $6.71 per share. Zuckerberg likes to beat on the bottom line. I expect some questioning of how Meta’s AI investments will ever pay off, but Zuck will just say: “Advertising.” And he’s right.

Meta is kicking Apple’s butt in augmented reality glasses and there is no love lost between Zuck and Apple CEO Tim Cook. META is a Buy under $705 for a long-term hold.

Micron (MU – $202.31) was upgraded by Morgan Stanley from Equal-Weight to Overweight, and they raised their target price from $160 to $220. With the stock over $200, you either raise the $160 target or have to say the “S” word and lose out on future investment banking business. They wrote: “Micron is pushing the envelope on valuation as the group rallies, but we believe we are looking at multiple quarters of double digit price increases which can lead to substantially higher earnings power – and resolve any lingering questions on specialty high bandwidth memory for AI.”

They noted that momentum on core DRAM pricing continues to surprise them, at the same time, near-term worries on specialty memory for AI – High Bandwidth Memory (HBM) – are being solved by DRAM economic improvement. They added that concerns about HBM are easing, as the stronger DRAM backdrop helps negotiations for HBM3e, and “Our checks in DRAM continue to get stronger, with potential for double digit sequential price improvement calendar 4q and 1q, and while the direct causes are hard to pinpoint, sentiment from our industry contacts that DRAM may be tight for several quarters is increasingly widespread amongst our contacts in the purchasing world.”

Well, my concerns about HBM pricing are increasing because both SK Hynix and Samsung are back in the game. Nvidia CEO Jensen Huang sent a letter to Samsung saying he plans to equip the GB300 system with Samsung’s 12-layer, third-generation high-bandwidth memory chips, or HBM3E. This is Jensen pressuring Micron to cut prices.

I’ve been following Micron since the Stone Age, i.e., the IPO, and I can guarantee you that DRAM price competition is brutal. New Street downgraded Micron from Buy to Neutral with a $190 price target. While acknowledging that demand for HBM is ramping, New Street believes that while Micron earnings beats will be offset by continued multiple compression.

I think we’ll see both earnings disappointments and multiple compression, so we’ll be selling Micron soon. For now, I’m moving MU to a Hold.

Nvidia (NVDA – $181.15) rose to an all-time high after announcing that Meta and Oracle will use Nvidia Spectrum-X Ethernet networking switches to boost their AI data center networks. Nvidia also got US government export licenses to sell billions of dollars’ worth of AI chips – up to 500,000 of Nvidia’s most advanced processors each year – to US companies building new AI data centers and infrastructure in the United Arab Emirates and across the region. The first 200 megawatts of a planned 5-gigawatt AI campus for the Stargate project in the United Arab Emirates is expected to come online next year. Can you say “Sovereign AI?”

Nvidia continues to help other companies sell more Nvidia GPUs:

I am not worried about Advanced Micro Devices (AMD) and OpenAI announce a 6-gigawatt agreement to power OpenAI’s next-generation AI infrastructure across multiple generations of AMD Instinct GPUs, nor about AMD’s deal with Oracle (ORCL) to deploy 50,000 GPUs for the Oracle Cloud Infrastructure. Note that AMD will provide Oracle with its future MI450 AI chip in the second half of 2026. These are paper deals meant to put pricing pressure on Nvidia. We’ll see if AMD can actually deliver a competitive GPU before I even start worrying.

Cantor Fitzgerald reiterated its “Top Pick” Overweight rating and raised their target price on NVDA from $240 to $300. They were promptly topped be HBSC raising their rating from Hold to Buy and their target from $200 to a Street-high $320 – an $8 trillion market capitalization, for those keeping score. NVDA is a Hold.

And for my fellow Jensen junkies, a full hour on AI and the next frontier of growth:

Palantir (PLTR – $179.70) and Snowflake (SNOW) announced a partnership on Thursday to integrate Snowflake’s AI data cloud with Palantir’s artificial intelligence platform. Customers will have more efficient and trusted data pipelines, as well as faster access to data analytics and AI applications.

Piper Sandler maintained its Overweight rating and raised its target price from $182 to $210,. They said there is no argument that Palantir’s valuation leaves no margin for error, particularly if any signs of moderating growth emerge. But they noted that with tremendous visibility on future revenue (more than $7 billion of defined contract value plus an estimated nearly $4 billion of Indefinite Delivery/Indefinite Quantity Federal government contract value), accelerating triple digit growth in Commercial bookings year-to-date, and an unparalleled wallet share opportunity across $1 trillion of US defense spending, they don’t think Palantir has reached peak growth, and thus they do not see a catalyst to halt current momentum.

They wrote: “We pose this scenario to investors. If 0.5% of defense spending moved in the favor of Palantir, the company’s overall government business could increase 5x and would still be 7x smaller than Lockheed Martin.” They added: “Following aggressive investment in AIP, we think Commercial traction is reaching a distinct inflection point built on demand for fast, transformative delivery of AI. With management guiding to an implied 89% US commercial growth in the second half and 145% year-over-year growth in US commercial remaining deal value in the most recent quarter, we do not think PLTR has reached peak commercial growth.”

That pretty much nails it. Palantir the company looks like a sure winner from the AI revolution. But at some point we’ll need to sell PLTR for investors to win, too. PLTR is a Buy under $160 for a $200 first target.

PayPal Holdings (PYPL – $66.19) is our second recommendation reporting September quarter earnings on Tuesday, October 28. Analysts are forecasting revenues to be up 4.68% year-over-year to $8.21 billion, with earnings flat at $1.21 a share. I expect them to beat on the top and bottom lines.

The company is changing rapidly now and The Street isn’t keeping up. For example, they introduced 5% cash back on Buy Now Pay Later purchases this holiday season, just as people are looking for deals. The next day, they announced PayPal Ads Manager, a retail media network that enables businesses to sell advertising on small business websites and apps, earning money from their existing store traffic.

The stock was downgraded from Neutral to Sell at Goldman Sachs with a $70 target price. PYPL is an Immediate Buy under $75 for a double in three years.

Snap (SNAP – $7.72) will restructure internally to create five to seven groups of 10 to 15 people, or “squads,” to operate as “startups” inside Snap. This move follows a challenging second quarter for the brand, in which ad revenue “stumbled,” as CEO Evan Spiegel said in his annual letter to employees. He compared the company’s position to that of a middle child — bigger than its smaller rivals but dwarfed by the big guys. He wrote: “Squeezed between the tech giants and smaller competitors, on the verge of greatness, we find ourselves in a crucible moment.”

He added: “That same energy and willingness to move fast, risk failure, and build the impossible is the only way we’re going to win against competitors ten times our size and startups ten times more fearless.”

This is good news. He gets it, he knows what has to happen, and I believe SNAP can pull it off. JPMorgan disagrees – they just named Snap one of their top four media short sale ideas for the December quarter. The other three, in case you are curious, are SBA Communications (SBAC), Bumble (BMBL), and SiriusXM (SIRI). SNAP is a Buy under $11 for a $17+ target.

SoftBank (SFTBY – $77.65) acquired ABB’s robotics business for $5.375 billion. ABB’s robotics business is a globally recognized brand, known for its reliability and high performance, supported by extensive sales channels and customer relationships. Following the acquisition, the robotics platform, expertise, and existing local footprint will be complemented by the technological foundations of SoftBank’s existing robotics-related investments—SoftBank Robotics Group, Berkshire Grey, AutoStore Holdings, Agile Robots, and Skild AI—to accelerate innovation in AI robotics.

I think robots are a lot longer away than Masa thinks, and I ‘m thinking about selling SoftBank after the coming PayPay IPO. PayPay will be valued north of $20 billion – a huge win for Masa. But he is in talks to borrow $5 billion from global banks for a margin loan secured by its shares of Arm Holdings (ARM) to fund additional investment in OpenAI. Yuck. SFTBY is a Buy under $35 for a first target of $50 and then higher as the discount to hard book value disappears.

Small Tech

Enovix (ENVX – $12.20) was named to Fast Company’s Next Big Things in Tech list. ENVX is a Buy up to $20 for a 4-year hold to $100+ as their BrakeFlow lithium-ion battery takes market share.

Primary Risk: A new competitor invents a better battery.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

Compass Pathways (CMPS – $6.64) rose after Bob Brinson, a retired U.S. Army aviation officer and Republican state senator in North Carolina, said that his state could “lead the nation” in expanding access to psychedelic drugs. Referring to the significant veteran population in North Carolina, he said: “We have the people that are here and the retirees that are here that—if we can figure out how to establish it—we can lead the nation in this concept. It’s a matter of figuring out how.”

CMPS is a Buy under $10 for a very long-term hold to $200.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2028

Probable time of next financing: Late 2025

Editas Medicine (EDIT – $3.99) reported its in vivo proof-of-concept data for EDIT-401 to significantly reduce LDL cholesterol at the European Society of Gene and Cell Therapy 32nd Annual Congress. Unlike most gene therapy programs targeting rare diseases, reducing LDL cholesterol is a HUGE market that tilts the risk/reward calculation in Editas’ favor. EDIT is a Buy under $6 for a double in 12 months and a long-term hold to much higher prices.

Primary Risk: Other companies’ gene-sequencing drugs fail in the clinic.

Clinical stage of lead product: Partnered: Approved. Owned: Going into the clinic mid-2025.

Probable time of next FDA approval: 2028

Probable time of next financing: Late 2026 or never

Inovio (INO – $2.49) has a number of scientific presentations scheduled, as you can see from the calendar. They are laser-focused on filing the Biologics Licensing Application for INO-3107 by yearend, which will lead to approval in mid-2026. INO is a Buy under $5 for a very long-term hold.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: Mid-2026

Probable time of next financing:After FDA approval in 2026

Medicenna (MDNAF – $0.63) did 1-on-1 presentations at the Roth Healthcare Opportunities Conference, so there’s no video or transcript. They did use THIS PRESENTATION, which we’ve seen before. Buy MDNAF under $3 for a first target of $20.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Entering Phase 3

Probable time of first FDA approval: 2026

Probable time of next financing: 2025

ScyNexis (SCYX – $0.82) and GSK resolved their dispute related to the restart of the Phase 3 MARIO trial on invasive candidiasis. ScyNexis gets a $22 million payment from GSK and will terminate the trial. They will receive an additional $2.3 million to wind down the trial. The payments from GSK, combined with cash in hand and removal of future MARIO expenditures, extends ScyNexis’ cash runway to more than two years.

GSK remains committed to the commercialization of Brexafemme. ScyNexis continues to progress the transfer of the Brexafemme NDA to GSK by the end of 2025. GSK anticipates being able to initiate regulatory interactions with the FDA in 2026 to discuss the relaunch of Brexa for VVC and rVVC in the US.

I have no idea why GDK would walk away from the lucrative hospital drugs to take on an always-expensive consumer product launch, except to say the current CEO is being replaced at the end of this year. Maybe the new one will have more sense.

For now, I’ve been saying: “Buy SCYX under $2.50 for a first target price of $20 after ibrexafungerp is approved for hospital use and a buyout at $50.” It’s not going to be approved for hospital use any time soon, so that’s off the table. Unlike subscriber JGMD, I think GSK will make Brexafemme a success by spending a ton of money to market it. ScyNexis gets royalties based on sales, not GSK’s profits, that I think will fund the company without the need to sell equity. My new advice is Buy SCYX under $2.50 for a target price of $20.

Primary Risk: Ibrexafungerp fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: 2026

Probable time of next financing: Never

Inflation MegaShift

Gold ($4,344.30) set intraday and closing highs today as the currency debasement/safe haven trade rolled on. Societe Generale’s head of commodity research, Ben Huff, said gold’s ascent toward $5,000 an ounce looks “increasingly inevitable.” BofA’s Global Research team said it expects further upside in 2026, with gold potentially rising to $5,000 an ounce and silver to $65 an ounce. Morgan Stanley is recommending a 20% allocation to gold.

Global gold ETFs gained another $2 billion (~14 tonnes) in net inflows last week – the seventh consecutive week of positive flows. They had their biggest monthly inflow in more than three years in September, according to Bloomberg. Year-to-date net inflows of $68 billion outpace any previous annual total, while year-to-date demand of 645 tonnes is now second only to 2020’s annual total of 892 tonnes. At the same time, central banks have continued to buy gold at an elevated pace

Rabobank said we have passed the global fiscal event horizon – letting inflation run amok in hopes of inflating away the $330 trillion in global debt.

Silver finally hit an all-time record, its first since January 1980, on the back of a short-squeeze in London. Silver was designated a “critical mineral” by the US government in August, which might help spur mine development and permitting. Recently, Russia has begun adding silver to its official central bank reserves, not just gold. Not much so far, but central banks have historically not used silver in their reserves.

In the last 30 years, the ratio of the gold price to the silver price has been as low as 31.64x and as high as 125.89x. Today, it is at 80.73x. But silver’s weekly relative strength index (RSI) is at 86, one of the highest readings ever. Here’s what silver did after similar spikes. Not good.

The fractal dimension used up most but not quite all of its energy in the spectacular rally over the last two weeks. It will need the pause that refreshes soon.

Miners & Related

Coeur Mining (CDE – $23.27) sets one 52-week high after another. Coeur reports after the close on October 29 with a conference call the next day. The consensus expects revenues to be up a whopping 74.5% from last year to $547 million, with earnings nearly doubling to 23¢ per share. Nothing like being a miner in a commodity boom!

They presented at the John Tumazos Very Independent Research Virtual Metals Conference and maybe my constant nagging about violating Regulation FD had an effect, because they posted a webcast link for the first time (AUDIO HERE and SLIDES HERE). It was the same ol’/same ol’ presentation, but one thing that caught my eye is that their inflationary cost pressures are easing:

CDE is a Buy under $10 for a $20 target as gold goes higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Dakota Gold (DC – $5.36) announced assay results from a further 32 infill and metallurgical drill holes from its ongoing 2025 campaign for the Richmond Hill Oxide Heap Leach Gold Project. Drilling continues to intercept high-grade gold in the northern Project area. supporting their plan to initiate the first years of mining in the north. DC is a Hold for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

First Majestic (AG – $15.53) reported record third-quarter 2025 production, processing 997,002 tonnes of ore and producing a record 3,863,673 ounces of silver, a 96% increase from the prior year, alongside 35,681 ounces of gold; 13,894,548 pounds of zinc, and 7,653,733 pounds of lead.

TD Cowen raised its rating from Hold to Buy and raised its target price from C$14 to C$22. AG is a Buy under $11 for a $23 next target price as production increases and the price of silver rises.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Sandstorm Gold (SAND – $12.93) shareholders approved the merger into Royal Gold and the Supreme Court of British Columbia granted final approval. The merger closes on October 20. SAND is a Hold for the Royal Gold acquisition.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $108,039.01) reached an all-time high around $126,000 last week, and then Friday marked the largest liquidation event in crypto history. More than $19 billion in leveraged crypto positions were wiped out across centralized exchanges, instantly liquidating over 1.6 million traders whose accounts went to zero. Within an hour of the market close, Bitcoin plunged 13% to $106,128.

The scale of this liquidation dwarfs previous major selloffs. It was 19x larger than both the FTX collapse and the March 2020 crash. The cascade was triggered by President Trump’s threat to impose 100% tariffs on Chinese imports, sparking a global risk-off move that has rattled digital assets.

Morgan Stanley just dropped all restrictions on which wealth clients can own crypto funds. Starting October 15, advisors can pitch bitcoin, ether, and solana to anyone — even in retirement accounts. As we know, bitcoin is extremely volatile. You can turn that to your advantage by buying the dip. It has strong support around $107,000, and should be able to get back to $123,000 or so fairly quickly.

JPMorgan thinks bitcoin could climb as high as $165,000 based on volatility-adjusted comparisons with gold. September has often been a difficult month for bitcoin, but when it has finished higher, as it did this year, the December quarter has tended to deliver outsized gains. Data shows that in years such as 2015, 2016, 2023, and 2024, positive September closes were followed by fourth-quarter rallies averaging more than 50%.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $61.44) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $29.66) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $57.42

Oil was killed after OPEC+ decided to implement a production increase of 137,000 barrels per day from the 1.65 million barrels per day additional voluntary cuts announced in April 2023. So now the International Energy Agency is forecasting an oil surplus near five million barrels a day for Q1 and Q2 2026, implying OPEC is stupid. That is ridiculous. There is no physical space for such a build.

But President Trump certainly is getting his wish on oil prices…for now. West Texas Intermediate (WTI) crude oil – the U.S. pricing benchmark – was below $60 per barrel all week, its lowest level in over four years (not counting a very brief period following the President’s April 2 tariff announcement). This week’s decline follows news of the OPEC+ production hike, a tentative peace deal between Israel and Hamas, and Trump threatening another “massive” tariff hike on Chinese imports.

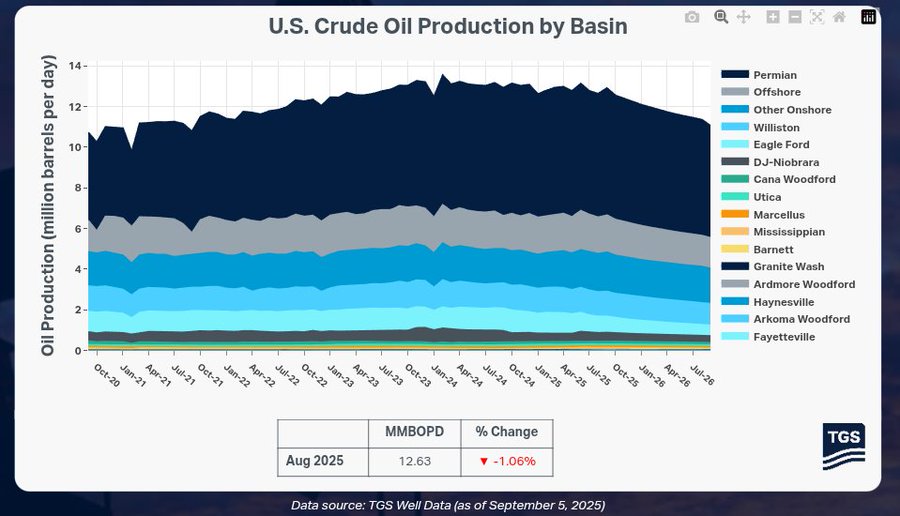

Pushing energy prices lower was a key focus of the President’s campaign. Yet despite promises that America would “drill, baby, drill” to reduce prices, the price of oil has been falling without the help of US producers. As I predicted, US crude oil production has peaked and is going into decline if more rigs aren’t added.

According to the Federal Reserve Bank of Dallas, US oil and gas production has fallen over the past two quarters as lower prices have made drilling uneconomical for many producers. While falling energy prices are great news for consumers, low prices are likely to cause further significant declines in US output as weaker producers are shuttered…which will set the stage for significantly higher prices when OPEC+ eventually reverses course.

ConocoPhillips CEO Ryan Lance said all this bearishness in the paper oil market is not evident in the physical market. US stocks are low and OECD stocks are not building. As for the OPEC plus additions, he said a lot of it are “paper barrels”. He doesn’t see this “glut” that paper oil traders are talking about.

ExxonMobil CEO Darren Woods said that without new investment, oil supply could fall 15% per year, tightening markets fast. Cheap oil today is tomorrow’s shortage. Who would drill with the IEA forecasting an oil surplus near five million barrels a day?

US inventories are very low:

So maybe global inventories are where the glut is? Nope.

The July 2026 Crude Oil Futures (CLN26.NYM – $57.46) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.24) is a Buy under $40 for a $100+ target.

Energy Fuels (UUUU – $22.46) closed its previously announced upsized offering of 0.75% Convertible Senior Notes due 2031 for an aggregate principal amount of $700.0 million, including the exercise in full by the initial purchasers of their option to purchase an additional $100.0 million. The stock shot up after China expanded export controls on rare earths, including raw materials, intellectual property, and technology.

It’s also a uranium company responding to all the nuclear and small/medium reactor talk. The US Army has launched the Janus Program for nuclear micro-reactors. The biggest portable generators for the US military these days have an output of about 800 kilowatts. The Janus Program aims to supply micro reactors to bases by 2028 that would be small enough to move by truck or aircraft. These tiny reactors will generate anywhere up to 20 megawatts of electricity. More importantly, they will not need to be refueled constantly, yielding power savings and assisting logistics in hard-to-reach areas. And they’ll need uranium. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

EQT (EQT – $53.78) reports September quarter results on October 21. The consensus is looking for sales up a strong 40.37% to $1.8 billion with earnings more than tripling from 12¢ to 40¢ a share. EQT is a buy under $70 for a long-term hold for much higher prices.

Primary Risk:Natural gas prices fall.

Freeport McMoRan (FCX – $41.92) will report earnings before the open on October 23, but they are postponing their conference call until November. Then they will report on the investigation of the September 8 mud rush incident at the Grasberg Block Cave that killed seven miners and present their multi-year operational and financial outlook, including for PT Freeport Indonesia. The stock was initiated with an Overweight rating at Wells Fargo with a $47 target price and upgraded from Neutral to Buy at Citigroup with a $48 target. FCX is a Hold for the mid- to high-$40s.

Primary Risk: Copper prices fall.

* * * * *

Click for larger graphic h/t @Market_Mind_

* * * * *

Quando m’en vo (Musetta’s waltz) from Giacomo Puccini’s La Boheme

Vitaliy Katsenelson wrote:

“Here’s some context for this aria: It takes place at the bustling Café Momus on Christmas Eve. The bohemians (the main characters) are celebrating with Mimì when Musetta enters with her elderly, wealthy “patron,” Alcindoro. She spots her former lover Marcello (who is still in love with her) and decides to win him back. She stages this entire aria as a performance – ostensibly singing to Alcindoro while really aiming every word at Marcello.”

* * * * *

Your thinking China Can’t Win Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

HERE

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

I agree with you, China can’t win. Their economy is in a deflationary spiral and has been for quite some time. They can not, not ship their products to the US. So there bluff is meaningless. Also gold is in the news. Rich people are flying gold into the US on commercial airplanes from London. The value of the dollar has fallen in the past six months more than it has in 40 years. There are rumors that Bissett will revalue the gold at Fort Knox. It’s currently on the books at $42.00 an ounce. At $3000- $4300 an ounce that will send a shock wave to the gold market. Gold guru’s are saying it could climb to $24,000. an ounce? AG is up 34 percent this week. Looks like a great buy to me. What say you MM?

As much as I distrust govt for their printing money, I am skeptical of gold’s further advance from here. Average inflation is only moderate although there’s lots of it in important things like food, rent, real estate. As bad as the fiscal situation is for the US, it is worse for ex-US, and foreigners are still buying US bonds. This is sort of a dot.com or AI boom in gold. Gold hitting $24,000 is like some investors’ over-enthusiasm for CAPR hitting $1000. I’ve been unsuccessfully waiting for a correction in gold and particularly silver.

Much of gold’s recent advance has been recently with the Trump tariffs. Much of the financial press and media has been saying that tariffs are inflationary. As MM and I have been saying, this is incorrect. Tariffs take money from consumers into the paws of govt. Govts could continue to print more money, or they could pay down debt. So far, the rise of gold and silver has been much higher than the minuscule rise in inflation, so I still think that gold and silver need a major correction.

Quote from Rick Rule, “The US dollar will lose 75 percent of its value over the next 10 years “. Gold may be in for a correction, but long term it’s a winner in my opinion! I bought AG on its way to $22. on Friday. I plan to sell that and buy Wheaton Precious Metal for the long haul. Also UUUU is looking good lately.

I cashed out most of my UUUU position this week. I’d been in and out of it for a couple years but in the summer bought Jan’26 $3 calls at 3.50. When UUUU’s share price dropped I was going to buy more but Jan’27 calls had become available and I bought Jan’27 $3 calls at $3. UUUU went parabolic this month hitting $27. WSJ had an article comparing the valuations of nuclear stocks to the more obvious A I bubble. Within a day I mostly was out of UUUU. By Friday’s close it was back down near $20. I may get back in, but for now I am glad to be out.

ACHV got some good news this week as the FDA could rapidly approve its drug for Vaping as well as cigarettes.

Chris, would you mind sharing what you consider your top near term plays are? Thanks

I think CAPR and ACHV are very cheap compared to where they will be after they get marketing approval from the FDA. Both have been met with FDA delays and it is unclear which will be approved first It is even less clear when FDA marketing approval will come from the FDA for NGENF. If they get Accelerated Approval shares will soar, but they could be required to run 1 or 2 Phase 3 trials which would put share price on ice for an extended period. MDNAF seems to have some great drugs, but they have a long history with me of being just months away from shooting higher. Almost forgot: MREO should have excellent results in its P3 trial for its OI drug around New Years Day which could be a triple from here. Will have to add on any weakness.

Agree. However, even if NGENF gets accelerated approval, they still need to do more trials to refine the protocol to improve the outcomes. Actually, I prefer that once approved, docs should have the freedom to experiment on their own for the best outcomes. Trials are expensive and politically corrupt, as we have seen with CAPR. If the PPS of NGENF is on ice, I would love to accumulate more shares at $2. You probably would consider buying LEAP’s of long duration.

With ACHV, they got accelerated review for vaping cessation only, maybe late 2026/early 2027 now. Smoking cessation review still has to wait until June 2026. There is hope that smoking cessation could get earlier review. It is still remarkable that the stock jumped so much just for vaping. That portends a great long term hold for big advances. Targets range from $17 to $170.

What a difference a week makes.

In case you didn’t notice, Medicenna (MDNAF) trades fewer than 60,000 shares per day on average. Friday it traded over 577,000 shares and climbed 44% closing out the day on a high note at $1.10. My bet is that it continues higher in the coming week. Glad I loaded up 23 months ago at 36 centavos.

Thanks Chris.

I jumped in with a small bite in ACHV. 208 @$4.79. Thanks , again!

You’re welcome.

I still have an account with Rick Rule’s Global Resource Investments. It may have been renamed Sprott. Shows you how long my account has been inactive. I met Rick in 1992. At that time when many gurus were piling into gold, Rick said that it didn’t seem like a primary gold bull market. He was right for many years.

Do you have an account with Rick? Does he have a newsletter where you get gold/silver ideas?

There are youtube videos of Buffett disparaging gold/silver. He denies the value of hard assets that sit and don’t do anything. All this is to promote his stocks in great companies that make useful products. I don’t agree with his better faith in digital money which is still fiat money, and govt controlled digital currencies which invade privacy and one day may be used to control spending by people not in tune with govt dogma. The big surprise are the comments from viewers that the video of Buffett is fake AI. He looks only 70 in the video, but he is really 90 or so.

I have seen some of those You Tube videos. They are fake. His voice is obviously not his, they repeat themselves and talk about subjects he never has positions in.

Not sure about his newsletter. But if so I will probably get it.

Silver will lag in a recession, but it’s so cheap relative to gold that I think a 2.5% position in each makes sense. RGLD and SIL look good to me.

Thanks MM, for your opinion.

MM —

I’m so glad you weren’t more seriously injured and escaped relatively easily. Every other week is fine; hope you keep reading and responding as appropriate. Loved Misha Maisky on Bach’s Cello Suite 1. I grew up with Pablo Casals on 1 & 2, Janos Starker on 3 & 6, and Antonio Janigro on 4 & 5, but have learned to love Mstislav Rostropovich, Yo-Yo Ma and even Zuill Bailey as well. What I offer you in return is the Chaconne from Partita 2 for Solo Violin as played by Alina Ibragimova, who stands to play like a young Midori. She initially found it difficult to play Bach in public because it was so personal. I met and befriended her when she came to Cornell for Mayfest several years ago with her Chiaroscuro Quartet:

https://www.youtube.com/watch?v=557OWzYkHv8&list=RD557OWzYkHv8&start_radio=1

Here is a younger version with her father playing Bottesini’s Gran Duo for Violin and Double Bass (esp the delicious finale):

https://www.youtube.com/watch?v=lm8W8jMtQyA&list=RDlm8W8jMtQyA&start_radio=1

Wow. Thank you for this! I did not know Ibragimova.

Thanks for these recordings. Alina does remarkable things in the solo Bach without vibrato. She may have wanted to see what she could do with bow alone, I learned a lot from it, but I think she could have been totally outstanding by adding vibrato. Without vibrato, she misses the climax in the D major section, in which Heifetz was peerless. In the Bottesini, she excelled with both vibrato and virtuoso bowing brilliance. Milstein’s last concert 1986 included the Chaconne. At age 82, he had passion with vibrato enhancing his bowing.

I knew Aaron Rosand who didn’t like vibrato-less Baroque playing. Bach was the greatest Baroque composer. He was a man of great romantic passion, incidentally shown by having 20 children! Who says people in the 17th and 18th centuries were chaste and proper? People of all times needed romance and fun to offset life’s struggles. This Bottesini is a great passionate piece of virtuosity. Bottesini was the Paganini of the bass. Fantastic.

IONQ. Does anyone (including MM) know enough about this stuff to tell me if this achievement is actually significant. (I already own a small position and it’s up ~75% but I think most of quantum is yet to come.)

https://finance.yahoo.com/news/did-ionq-just-unlock-quantum-143944409.html

It is significant.

QTUM is a etf of quantum stocks that is up 75%. QBTS is my quantum play. Also BTQ provides security for quantum computers.

I also have QBTS which I bought on 1/8 @ 6.04, now up 440%, and plan to hold it a long time. My third quantum play was RGTI, bought based on something I heard on CNBC. I sold it for a small profit when it wasn’t doing as well as IONQ or QBTS… only to see it soar from 13.50 into the high 50’s before pulling back to just under 40.

I follow Eric Jackson EMJ Capital and Mike Alfred of bitcoin on X (twitter). Good insights into investing.

MU went up on Friday and I felt the need to take the money and run. I sold at $219. and change. I got it in September.. and it was up almost 50 percent. My $5 k turned into $7k and some in that short time frame. Insane! Thanks MM for the recommendation! Also to JGMD, the newsletter you asked about is called Rule Investment Media.com

I got in 8/22 but not having much money available put it on the much riskier 2x ETF MUU. Much riskier proved much rewardier (this time) and I’m now up just under 220%. I may not wait for MM’s signal to sell but will certainly pay attention when he gives it. Even 220% of not much money is not a fortune so I can still afford to wait and watch a bit, but my trigger finger is getting itchy.

I read one analyst opinion saying it was going to $190. So seeing it went up so fast , I got out early. I also bought the dip in crypto today. On the following news. Etherfuse is leveraging Stellar’s ( XLM/USD ) blockchain to create government backed investment products called stable bonds for countries like Brazil and Mexico: Etherfuse has reduced currency conversion fees from 7 percent to.04 percent .

Thanks. Do you have an account with Rick Rule?

Mm,not sure if you seen this news that came out on akba after hours please don’t wait until Thursday to respond,tx it’s important

Jgmd,any input on this akba,tx Ron

AKBA- Stock traded as low as $2 ah as the company announced negative discussions on VALOR with the FDA and decided NOT to pursue NDD in the future. It looks like an overreaction but it certainly diminishes the terminal value of the stock if that market had been available to Vafseo in 2027-28.

MM, JGMD comments??

Looks like an overreaction. Buried at the bottom of the PR is “We were encouraged by the discussion with FDA on smaller subgroups of CKD patients where we may be able to align on a potential clinical trial design and path forward. Importantly, everyone at Akebia will continue to work toward our goal to make Vafseo standard of care for patients on dialysis.”

I found it positive that they acknowledged the difficulty getting past the FDA on that issue and stopped the bleeding until they regrouped

Hey Michael how about a news flash on AKBA, I am holding for now buying more or selling based on your take

AKBA- The stock can now go to $15-20 based on Vafseo becoming a blockbuster just for DD patients sometime in 2026. Abandoning the NDD approval will preclude the company from becoming a “New AMGN”, though we have to see if it can get FDA approvals for subgroups of NDD patients as stated in the press release. AKBA may also be able to better concentrate on its pipeline and increase its intrinsic value that way.

sounds hopeful – fingers crossed.

Mostly agree with you and MM, but less bullish. “Buy up to $4” is NOT prudent. Lesson for most of the time in spec stocks–never buy on big uptrends. Things often go wrong, and here we are. Buy only when there is blood in the streets, such as now or the next several months. Sentiment turned negative quickly. That’s good for the long term, when sentiment turns giddy again. For DD only, assuming V achieves $1 billion in annual sales, the question is how long the sales will be maintained at that level. Under TDAPA, average annual revenue for V is $10K. So 100K patients are needed for $1 billion in annual revenue. Out of 550K DD patients, 20% have GI side effects from V, leaving 400K patients on V at best. 100K is 25% of eligible patients switched from ESA. Doable but speculative. TDAPA lasts 2 years, but now only 1.25 years left as mistakes were made by stupid computer glitches by USRC decreasing numbers from this highly motivated dialysis group. (Nephrologists who should be making clinical decisions relying on FCKing AI computers to do patient management? FCK blind reliance on AI and most tech.) TDAPA has a possibility of 1 or at most 2 years extension. After TDAPA finally expires, the V revenue plunges to $2500 to be competitive with ESA. It will take nearly complete transfer of ESA patients to V in order to preserve $1 billion. The BASE case is that $1 billion is seen only when TDAPA is on. Use price/sales of ONLY 1.25 to at most 3.25 to get market cap of $1.25-3.25 billion, or $4-13 PPS. (Forget customary valuation models using price/sales of 6-10 in growing companies. TDAPA is a unique situation for only a few years.) The BEST case is that all 400K patients eventually get on V. At $2500, that’s $1 billion annually. The V patent runs to 2034, giving only 8 years of that revenue. Use price/sales of 8 to get market cap of $8 billion, or $32 PPS. This is a long shot. Even the BASE case is optimistic but doable. Therefore, DO NOT buy up to $4. You may just break even in 1-2 years, which would still be a YUGE loss if you entered KERX a decade ago.

As for NDD, I repeat my disgust at Butler for saying for the past year that NDD use of V will get TDAPA rates of $10K when at the same time post TDAPA for DD, V will get only $2500. Insurers will PROTEST that they are being forced to pay 4X the price for the same drug given for NDD as for DD. SCAM SCAM SCAM, and insurers will say FCK you to V and not approve it for NDD, or say that both NDD and DD get the same, fair $2500. Tough shit. If you don’t like it, you can stay on ESA.

I have a large position with average cost of $1.75. I hope to add at or slightly below $2. I think Q3 ER will be good but not great. It was supposed to be Nov 6, but it is now scheduled for Nov 10 as Butler scrambles to put a positive spin on all this. Davita will complete its pilot on 9000 patients mid Nov, so they will contribute only 9000 patients for Q3. They only have half of Q4 to get lots more patients on V. It will take Q1 2026, reported in mid May 2026 to see big uptake. I think $2 PPS will linger for many more months. If the stock zooms earlier and I miss $2, I won’t complain. I just hate to be the eager fool who buys over $2.50 and regrets it later.

OOPS, my error on the BEST case PPS. I should have used price/earnings for 8 years instead of price/sales. If AKBA can keep expenses low, earnings could be 50% of sales. Even that is optimistic. The value of a company is earnings = profits. For 8 years of earnings until the patent expires, target PPS in 4 years or later when it is clear that earnings are consistent would be $16 for DD alone. NOT 2026. Maybe $6 by end of TDAPA in Dec 31, 2026. So don’t buy up to $4. From $2, a triple to $6 would be nice, still with risk. If NDD gets approved for subgroups, $9 if a small trial is done with minimal costs. That’s for 2028-9. Add the pipeline for ARDS and acute kidney injury, unknown at this point.

A big Pharma may buy AKBA. Without NDD, the ESA companies can still do well in NDD, so BO won’t happen for a while. From DD V alone, top target would still be only $16 in 2030. If BO occurs in 2027, the most it would be would be $12, a 100% premium from fair value at $6 then. The ego and greed of Butler will reject cheap $5 BO offers, but he may blow it. Again, don’t buy up to $4.

There is a Flash Alert on Akebia (AKBA)

so a near time buyout around $ 20 we were hoping for ,now a distant dream ?

Akba..unbelievable..

Too much hype by overeager Stocktwits gurus and even myself who listened to them. Mea culpa. This IS a good spec investment from here at $2.00 as I described above.

New World Investor for 10.30.25 is posted.