Dear New World Investor:

The shutdown-delayed September Consumer Price Index rose 3% year over year, up a tenth from 2.9% in August but slightly below consensus expectations for a 3.1% increase. It was the highest reading since May, but much of the gain was in food, gasoline, and energy. So the core CPI rose 3% year over year in September, down a tenth from 3.1% in August and below expectations. On a monthly basis, core prices increased 0.2%, below August’s 0.3% gain, which was the strongest monthly rise in six months.

In general, tariffs are still pushing up goods prices and the pass-through is broadening, with clothing, furniture, and personal goods prices all posting strong gains. But softer shelter and services readings showed progress where it matters most. The shelter index rose 0.2%, half of August’s 0.4%. Owners’ equivalent rent, the hypothetical rent homeowners would pay for their own homes, climbed just 0.1%, the smallest monthly gain since early 2021. Although inflation is still around 3%, the disinflation trend is intact, so the Fed cut another quarter-point this week.

This probably was the last hard inflation data we’ll get until early next spring because of the government shutdown – now the second-longest ever. The Bureau of Labor Statistics is going to be guessing at a lot of the estimates that they’re making for the next few months. The Fed, also, doesn’t have nearly as much good data as they are used to. Chairman Powell said a December 10 rate cut is “far from certain,” which I think is baloney. The ADP numbers show the labor market is quite weak, so, yeah, they’ll cut.

After the inflation report, stocks rallied and put the major averages back at levels last seen before the sharp pullback on October 10. It’s been a different kind of bull market, as AI and growth stocks have gone up at the same time fear-based investments like gold and silver have been strong. It could be that fear-based assets have been able to do relatively well because the Fed has kept inflation fears and recession fears perpetually stoked. But I think what’s really going on is what I expected years ago: As the real value of the dollar falls, both stocks in growing companies and precious metals go up.

According to Bloomberg, about 85% of the reporting S&P 500 companies have beaten revenue and earnings expectations, the highest percentage since 2021, even though analysts had set the bar higher by very unusually raising projections heading into the reporting period. The average growth rate is 9.2% – the ninth consecutive quarter of growth.

So with the S&P 500 within 1.5% of it’s all-time high, how are investors feeling? Wrong-footed, as usual.

The San Francisco Fed’s Daily News Economic Sentiment Index declined last week to a level lower than 85% of the time since its inception in January 1980. And the overall OECD U.S. Consumer Confidence Index is more depressed today than it has been 99.3% of the time since 1960.

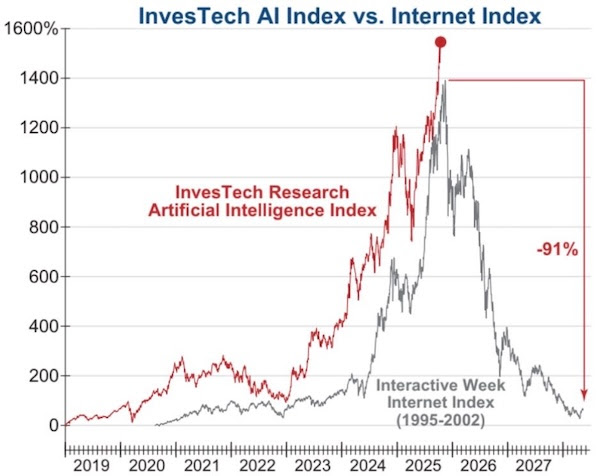

I’m still watching the AI thesis closely, because that’s probably where a near-term sharp market decline would start. Unlike the dotcom experience in 1999 and early 2000, most of the AI leaders are big, profitable companies gushing cash. Also unlike the dotcom era, Wall Street seems to hate AI – mostly because they’re underweighted and their yearend bonuses are in jeopardy.

Money managers finally are getting invested – the percentage of cash held in portfolios of money managers fell to just 3.8% in October, according to Bank of America’s Global Fund Manager survey – the lowest level in 12 years. The survey also revealed that 60% of fund managers believe global stocks are overvalued, a record high in the history of the survey, and 20 points above the peak levels of the dot-com bubble. They say stocks are overvalued, but they keep buying and buying because they don’t want to get fired after the 2025 performance reviews.

I’m worried about something else entirely. I think the AI we’ve got will get better and better and eventually help many people do their jobs. But I agree with OpenAI co-founder Andrej Karpathy, who thinks AI agents are nowhere near ready to begin stealing jobs and described the output of AI agents as “slop.” That’s about right. And, as I’ve said, I think Artificial General Intelligence – AGI – is a long way away. Really smart people like Open AI CEO Sam Altman and SoftBank CEO Masayoshi Son disagree with me, but I think its main use is raising money from suckers.

And money is needed. One of the biggest attractions of Big Tech has been that they gush free cash flow, but AI is making them more capital-intensive. The hyperscalers – Amazon, Google, Grok, Meta, Microsoft, OpenAI, Oracle, and SoftBank – are now spending about 60% of their operating cash flow on capital expenditures for AI infrastructure like data centers. OpenAI has already committed to spending $1.4 trillion on infrastructure.

As a result, analysts expect an average year-over-year earnings increase of 29%. But free cash flow is expected to drop by an average of 31% year-over-year.

The hyperscaler capex binge can’t possibly generate sufficient returns on investment for everyone. We just learned that Alphabet, Meta Platforms, and Microsoft together spent about $78 billion in capital expenditures last quarter, up 89% from a year earlier. What’s worse, they’re turning to leveraged debt financing, circular investments (Nvidia invests $100 million in Open AI, which then buys $100 million of Nvidia GPUs), vendor financing, and off-balance-sheet deals – some of the very factors that killed the dotcom boom.

Will the hyperscalers continue to increase their spending on AI infrastructure regardless of their cash flows or will they become more cautious in their investments? The end of AI FOMO (Fear of Missing Out) at Big Tech would probably mean the bursting of the AI infrastructure bubble.

And the problem, of course, is that a hyperscaler crack-up will drag the whole market down. Selling the hyperscalers to buy companies applying AI, like Palantir (PLTR) or Twilio (TWLO), is totally logical – but probably means you only lose 67% of your money instead of 85%. No, thanks. Even S&P index funds will get killed, down 35% to 50%.

People don’t remember that the 2000 dot-com crash not only wiped out the earnings-less Internet Index stocks, it triggered eventual losses of 49% in the S&P 500 and 78% in the Nasdaq Composite Index. As former IMF chief economist Gita Gopinath pointed out, because the whole world has become dependent on American stocks, a market correction of the same magnitude as the dotcom crash could wipe out over $20 trillion in wealth for American households, equivalent to roughly 70% of US GDP in 2024. This is several times larger than the losses incurred during the crash of the early 2000s.

The question remains: When do we get off the bus? And the answer is still: Not Yet. US companies have authorized a record $1.15 trillion in share buybacks year to date – a 16% increase from 2024’s then-record $989 billion. This trend has provided a relentless tailwind to the equity market in recent years, with current authorizations generating roughly $6 billion to $7 billion in daily buying power.

Click for larger graphic h/t @GoldmanSachs

Plus, not only is the Fed cutting, but President Trump met with Chinese President Xi today and then announced that the US would halve its 20% fentanyl-related tariffs on Chinese goods as part of a reset in relations that includes China stepping back from its threat to restrict rare earth mineral exports for a year. China will also increase purchases of US soybeans and take more (unspecified) actions on the issue of fentanyl. Both countries will suspend the tit-for-tat shipping fees on each other’s vessels for one year. The US will ease the 50% export control rules that apply to foreign nationals subject to US sanctions. President Trump will visit China again next April, and we’ll all go through the bombast from both sides again.

Market Outlook

The S&P 500 added 2.9% over the last two weeks, setting new record highs after the benchmark ended above 6,800 for the first time and above 6,900 intraday. The Index is up 16.0% – nearly 1,000 points – year-to-date. The Nasdaq Composite gained 4.5% in spite of today’s thrashing, including another all-time high after the Fed decision. It is up 22.1% – more than 4,000 points – for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 3.7% and is up a respectable 24.3% year-to-date. The small-cap Russell 2000 was flat for the two weeks and is up a hard-fought 10.6% in 2025.

The fractal dimension is nearing the end of the uptrend, but it isn’t there yet. We should have a few more weeks of upside (and I need a bigger chart).

Top 5

Changes this week: I did not remove AKBA because the November 10 earnings conference call should be very positive.

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model estimate of September quarter real GDP growth is steady at +3.9%, far above the (rapidly increasing) consensus estimate.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Sunday, November 2

Clocks back one hour to Standard Time – 2:00am your local time

Monday, November 3

MDNAF – Medicenna – 1on1s through 11/5 – BIO-Europe 2025

AG – First Majestic – Through 11/5 – New Orleans Investment Conference

DC – Dakota Gold – Through 11/5 – New Orleans Investment Conference

ON – Onsemi – 9:00am – Earnings conference call

PLTR – Palantir – 5:00pm – Earnings conference call

Tuesday, November 4

CMPS – Compass Pathways – 8:00am – Earnings conference call

UUUU – Energy Fuels – 11:00am – Earnings conference call

INO – Inovio – 3:00pm – Stephens Biotechnology Virtual Fireside Chat Conference

Wednesday, November 5

FSLY – Fastly – 4:30pm – Earnings conference call

SNAP – Snap – 5:00pm – Earnings conference call

ENVX – Enovix – 5:00pm – Earnings conference call

Thursday, November 6

MDNAF – Medicenna – Unspec. – Oppenheimer Miami Oncology Summit

VET – Vermilion Energy – 11:00am – Earnings conference call

RGLD – Royal Gold – 12:00pm – Earnings conference call

ABCL – AbCellera 5:00pm – Earnings conference call

AKBA – Akebia Therapeutics – 5:30pm – Oral presentation at American Society of Nephrology Kidney Week (also 4 poster presentations)

Friday, November 7

October payrolls – 8:30am – Scheduled but might not happen

Monday, November 10

AKBA – Akebia Therapeutics – 8:00am – Earnings conference call

SINO – Inovio – 4:30pm – Earnings conference call

Tuesday, November 11

The end of World War I at 11:00am – “the eleventh hour of the eleventh day of the eleventh month” – 108 years ago and Veterans Day

SFTBY – SoftBank – 3:30am – Earnings conference call

Short Interest – After the close

QUIK – QuickLogic – 5:30pm – Earnings conference call

Thursday, November 13

Consumer Price Index – 8:30am – Scheduled but might not happen

Friday, November 14

AG – First Majestic – Through 11/15 – Deutsche Goldmesse Fall Conference

INO – Inovio – 1:45pm – World Federation of Hemophilia Global Forum

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $271.40) reported a slight double beat for their September fourth quarter. Revenues rose 7.9% from last year to $102.47 billion, just above the $102.25 billion estimate. GAAP earnings per share of $1.85 also beat the $1.77 estimate.

iPhone sales rose 6.1% to $49.025 billion, below the $50.2 billion estimate, while Services rose 15.1% to $28.75 billion, above the $28.18 billion forecast.

Click for larger graphic h/t Seeking Alpha

Apple joined Microsoft in the exclusive $4 trillion market capitalization club (Nvidia has moved on to $5 trillion) following a Reuters story that iPhone 17 sales are up 14% compared to last year’s iPhone 16 during the first 10 days of release — with China and the US leading the buying. But due to weakness before the iPhone 17 introduction, September quarter China sales were lower by 5.7% from the June quarter and down 3.6% year-over-year.

On the conference call (AUDIO HERE and TRANSCRIPT HERE), CEO Tim Cook said December quarter revenue is expected to rise 10%-12%, to $136.7-$139.2 billion. That is above the $131.82 billion consensus estimate. He said that iPhone revenue during the quarter should reach double-digit growth, and China should return to growth.

Loop Capital upgraded the stock to Buy from Hold with a $315 target, while Evercore ISI added the stock to its Tactical Outperform list. AAPL is a Buy under $205.

Corning (GLW – $90.28) just barely beat estimates with revenues up 14.5% from last year to $4.27 billion versus the $4.24 billion estimate and pro forma earnings of 66¢ a share, a penny ahead of the 66¢ estimate. On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Wendell Weeks guided the December quarter to $4.35 billion in sales with 68¢ to 72¢ earnings. Both were above Wall Street’s expectations for $4.24 billion and 66¢.

Optical Communications enterprise sales grew 58% year-over-year, driven by continued strong sales of AI products for data centers. Wendell said the company’s Springboard plan has delivered a 31% increase in sales and a 72% increase in EPS since launch, with significant expansion in operating margin and return on invested capital (ROIC). He expects continued strong performance, including hitting the 20% operating margin target a year early in this December quarter. He said: “Beyond our strong third-quarter performance, we see significant growth ahead, fueled by powerful secular trends. To share just a few examples, we are ramping to meet remarkable demand for both our new Gen AI and U.S.-made solar products, and Apple’s recent $2.5 billion commitment to produce 100% of iPhone and Apple Watch cover glass at our Kentucky facility creates a larger, longer-term opportunity.”

He revealed the launch of the largest solar ingot and wafer facility in the US, with more than 80% of its capacity committed for the next five years, saying: “We expect to triple our solar run rate by 2027, adding $1.6 billion of new annualized revenue to Corning’s earnings power as we march towards our goal of building a $2.5 billion revenue stream by the end of 2028.”

Corning is doing a great job. I recommended the stock on June 14, 2018, at $28.89, and it has tripled. But they are vulnerable to a consumer recession and any slowdown or increased competition in data centers, so it is time to Sell GLW.

Gilead Sciences (GILD – $118.44) also reported a double beat for their September quarter. Revenues increased 2.9% from last year to $2.77 billion, in spite of the Medicare price reductions. That was a bit above the $2.46 billion expected. Pro forma earnings of $2.47 a share were well ahead of the $2.14 estimate.

On the conference call (AUDIO HERE and SLIDES HERE and PREPARED REMARKS HEREand TRANSCRIPT HERE), CEO Daniel O’Day raised the low end of 2025 guidance to a new range from $28.4 billion to $28.7 billion. He raised the lower end of pro forma earnings guidance from $7.95 to $8.05, while keeping the high end at $8.25. The Street is too low at $8.04.

Even though Dan kept their Veklury (remdesivir) guidance at $1.0 billion for the year, Wall Street looked at the 60.0% year-over-year decline and panicked. I don’t know about you, but there isn’t any Covid panic in Oregon so far this year.

The company ended the quarter with $9.4 billion in cash. GILD is a Long-Term Buy under $115 for a first target of $150.

Meta Platforms (META – $666.47) reported a very strong quarter with a one-time tax charge to earnings that caused the computer bots to freak out and dump the stock. September quarter revenues rose 26.2% from last year to $51.24 billion, nicely ahead of the $49.41 billion estimate. Family daily active people averaged 3.54 billion for September, an increase of 8% year-over-year. Ad impressions delivered across increased by 14% while the average price per ad increased by 10% year-over-year. For the December quarter, Zuck guided in line with the consensus, forecasting revenues in a range from $56 billion to $59 billion.

Now, here’s the confusion. The Street’s per share estimate was $6.71 and excluding the one-time charge, Meta would have reported $7.25, but a $15.93 billion one-time, non-cash tax charge cut reported GAAP earnings to $1.05 a share. They expect a significant reduction in their US federal cash tax payments for the remainder of 2025 and future years due to the implementation of the One Big Beautiful Bill Act. However, the implementation also led to the recognition of a $15.93 billion valuation allowance.

One other important item: on the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE and FOLLOW-UP TRANSCRIPT HERE), Zuckerberg said that for 2025, the company now expects capital spending in the range of $70-$72 billion, increased from its prior outlook of $66-$72 billion, and they will “spend aggressively” next year. He warned that capital expenditures will be “notably larger” in 2026 and total expenses will grow at a “significantly faster percentage rate.”

I am not the only one worried about the hyperscalers ever earning a decent return on these investments, and that was what depressed the stock today. Bloomberg reported that Meta is planning to sell $25 billion in bonds to fund the data center buildout. They just did a $27 billion financing deal with Blue Owl Capital to fund its biggest data center project globally in Louisiana. Under the agreement, Meta will retain about 20% equity in the project, with the majority owned by funds that alternative asset manager Blue Owl Capital manages. For now, META remains a Buy under $705, where it is today, for a long-term hold.

Micron (MU – $224.01) has more than doubled in less than a year since my recommendation at $99.41 on January 9 of this year. People always forget that MU is not an eating sardine, it’s a trading sardine. As Seth Klarman wrote in Margin of Safety:

“There is the old story about a market craze in sardine trading when the sardines disappeared from their traditional waters in Monterey, California. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, ‘You don’t understand. These are not eating sardines, they are trading sardines.’”

Both SK Hynix and Samsung will shortly have viable High Bandwidth DRAM memory to compete with Micron, if they don’t already. Will it be as good as Micron’s? Maybe not. Will they be able to produce as much of it as Micron? Probably not. Will Micron’s customers use it to beat down Micron’s price and profit margin? You betcha! It’s time to Sell MU.

Nvidia (NVDA – $202.89) CEO Jensen Huang gave the keynote speech at the company’s GTC conference.

The partnership with Palantir is a big deal for both companies.

As is the one with Nokia:

Jensen also announced a slew of partnerships with the US Department of Energy, Uber, Eli Lilly, CrowdStrike, and others. Deutsche Telekom (DTEGY) and Nvidia are planning to build a data center in Germany that will be valued at one billion euros, according to Bloomberg. Nvidia has become the most valuable business in the world, representing an astounding 8% of the S&P 500 Index. NVDA is a Hold.

Onsemi (ON – $50.85) reports September quarter results on Monday before the open. Consensus expectations are for revenues down 13.93% from last year to $1.52 billion, with earnings per share down 40.4% to 59¢. December quarter guidance should be for $1.53 billion and 62¢.

The stock was up after they signed partnerships with Xiaomi in electric vehicles and Nvidia in data center power infrastructure. They also introduced vertical gallium nitride (vGaN) power semiconductors, setting a new benchmark for power density, efficiency, and ruggedness. These proprietary next-generation GaN-on-GaN power semiconductors conduct current vertically through the compound semiconductor, enabling higher operating voltages and faster switching frequencies, leading to energy savings to deliver smaller and lighter systems across AI data centers, electric vehicles (EVs), renewable energy, aerospace, defense, and security. ON is a Buy under $60 for a $100 first target.

Palantir (PLTR – $194.55) will report September quarter results on Monday after the close. The consensus expects revenues to be up 50.46% from last year to $1.09 billion, with earnings per share up 70% to 17¢. Guidance should be for $1.18 billion and 19¢.

When Jensen Huang calls your ontology “probably the single most important enterprise stack in the world today,” I think it’s safe to say you’ve won. Piper Sandler raised their target price to $201. The company signed a letter of intent with Poland’s Ministry of Defense and a $200 million deal with Lumen to help enterprises across every industry deploy AI faster and more securely in complex, multi-cloud environments. As Alex Karp says, we’re in an AI arms race:

PLTR is a Buy under $160 for a $200 first target.

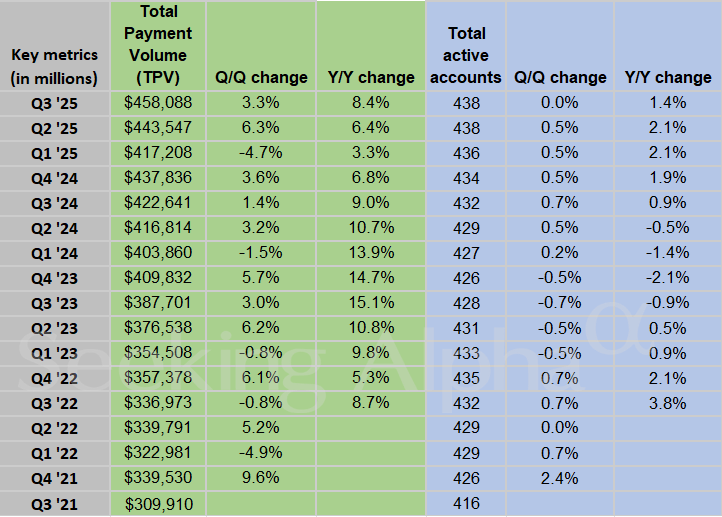

PayPal Holdings (PYPL – $67.93) reported a good September quarter with a double beat, started a 14¢ quarterly dividend, and signed what is going to be a very lucrative deal with OpenAI. As a result, the stock is down (!!!????) a couple of dollars.

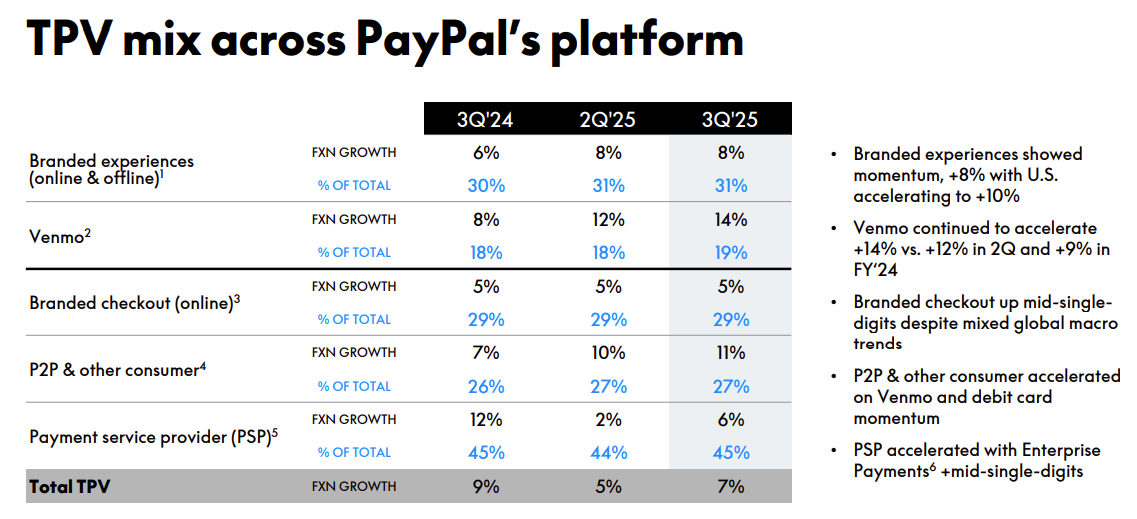

September quarter revenues grew 7.0% from last year to $8.40 billion, just beating the $8.23 billion estimate. Pro forma earnings per share hit $1.34, nicely above the $1.20 estimate and last year’s $1.20. Transaction margin dollars, the key growth statistic I watch to monitor the turnaround, increased 6.0% to $3.9 billion. It will be up 6% to 7% for the full year.

Total payment volume increased 8.4% to $458.1 billion.

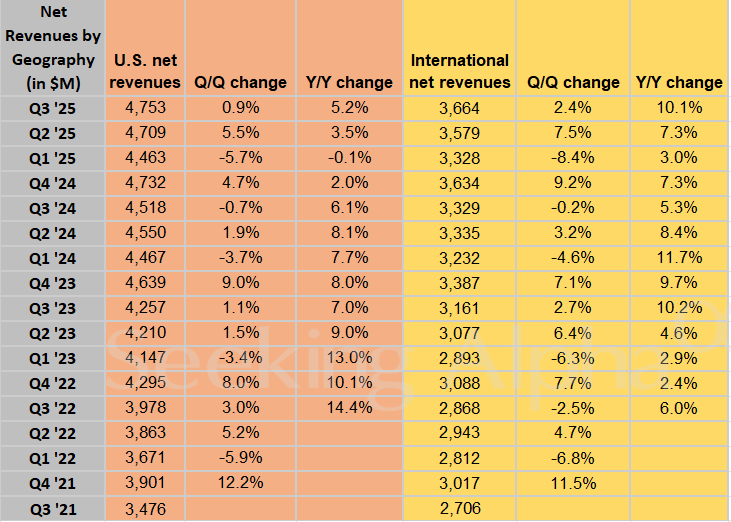

International revenue is growing and was up 10.1% from last year.

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Alex Chriss guided December quarter earnings to $1.27-$1.31, a skotch below the $1.31 consensus estimate. That would bring them in at $5.35 to $5.39 for the year versus the $5.24 consensus. PYPL is selling for only 12.6x 2025 earnings.

Alex said the company will deliver “at least 15% non-GAAP EPS growth this year” and has “confidence in the business’s longer-term growth potential and ability to deliver high single-digit transaction margin dollar growth and non-GAAP EPS growth in the teens or better over the longer term.” He added that they will target a dividend payout of 10% of pro forma net income for now.

The deal with OpenAI is a big one. PayPal’s digital wallet will be embedded in Chat GPT. ChatGPT users searching for or comparing products will be able to check out instantly using PayPal, while PayPal will also handle payment processing for merchants using OpenAI’s Instant Checkout feature. PayPal becomes one of the early partners in OpenAI’s push to expand ChatGPT’s role in e-commerce. The goal is to let ChatGPT’s 700 million-plus weekly users rely on AI to discover and purchase products, much like a personal shopper would. I expect OpenAI to follow Google’s lead and cash in on advertising.

They ended the quarter with $14.4 billion in cash, after buying back another $1.5 billion in stock. PYPL is a Buy under $75 for a double in three years.

Snap (SNAP – $7.60) will report September quarter results next Wednesday after the close. Analysts are looking for revenues to be up 8.58% from last year to $1.49 billion, with a per share loss of 12¢ compared to 9¢ last year. Guidance should be for $1.69 billion and a 5¢ loss. SNAP is a Buy under $11 for a $17+ target.

SoftBank (SFTBY – $85.00) reports on 11/11 with the usual 3:30am conference call. The Street expects revenues to be up 6.02% from last year to $12.14 billion, but there is no earnings estimate. Guidance should be for $12.4 billion in revenues. According to The Information, they just approved a $22.5 billion investment in OpenAI. SFTBY is a Buy under $35 for a first target of $50 and then higher as the discount to hard book value disappears.

Small Tech

Enovix (ENVX – $11.37) reports their September quarter results next Wednesday after the close with a conference call at the same time as Snap. Analysts are looking for revenues to be up 83.82% from last year to $7.94 million, with a 17¢ per share loss, about the same as last year’s 16¢. Guidance should be for $12.05 million and a 14¢ loss. ENVX is a Buy up to $20 for a 4-year hold to $100+ as their BrakeFlow lithium-ion battery takes market share.

Primary Risk: A new competitor invents a better battery.

Fastly (FSLY – $7.98) reports September results next Wednesday with a call a half-hour before SNAP. The consensus expects revenues to be up 10.08% from last year to $151.04 million, with breakeven earnings per share. December quarter guidance should be for $153.93 million and a 1¢ profit. FSLY is a Buy under $10 for a 3- to 5-year hold to $50+.

Primary Risk:Content and applications delivery networks are a competitive area.

QuickLogic (QUIK – $7.10) also reports on September 11. The two publishing analysts are predicting revenues to fall 52.02% from last year to $2.05 million due to delayed shipments by customers, with a 2¢ per share loss compared to a 6¢ loss last year. Guidance should be for revenues to snap back to $5.2 million and a 3¢ loss. QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

AbCellera Biologics (ABCL- $5.36) will be our second biotech reporter next Thursday after the close. Wall Street expects revenues to be down 2.68% from last year to $6.33 million, with a 16¢ per share loss, about the same as last year’s 17¢ loss. Guidance, if any, should be for $6.87 million and another 16¢ loss. Buy ABCL up to $6 for a long-term hold to $30 or more.

Primary Risk: Partnered and owned drugs fail in the clinic.

Clinical stage of lead product: Partnered: Various Owned: Preclinical

Probable time of next FDA approval: 2027-2028

Probable time of next financing: 2026-2027 or never

Akebia Therapeutics (AKBA- $2.10) was the subject of an October 29 Flash Alert after they announced that they are not going to pursue a broad non-dialysis chronic kidney disease (NDD-CKD) label for Vafseo because the FDA would require a larger, more expensive trial than Akebia proposed. But they said they “were encouraged by the discussion with FDA on smaller subgroups of CKD patients where we may be able to align on a potential clinical trial design and path forward.”

As I said in the Flash Alert, I expect Akebia to pursue a smaller subgroup that most needs Vafseo and get approval. Then he’ll leverage that into a series of label expansions that eventually cover everyone with NDD-CKD who can be helped by Vafseo. But that will take many years compared to the two to three years a broad NDD-CKD label would have taken.

Near-term, this doesn’t reduce the value of the business much. We’ll see strong Vafseo growth in the coming September quarter earnings release, and perhaps guidance for a significantly stronger December quarter. The September quarter conference call is November 10 before the open. Analysts expect revenues to shoot up 49.78% from last year to $56.06 million, with a 2¢ per share loss. If John gives guidance, it should be for $58.84 million and a 3¢ loss.

As I said, this does reduce the likelihood of a near-term Amgen (AMGN) acquisition bid, because I doubt Butler would sell the company for less than $10 a share, and although Amgen could bid $10 for a stock selling for $5, they probably can’t do that for a stock selling for less than $3. So we’ll have to wait for the quarterly results to get the stock up, which I expect to happen. Buy AKBA up to $4 for the Vafseo launches in the EU, UK, and US. I think GSK and/or Amgen will make a bid for the company.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Compass Pathways (CMPS – $6.30) is our first biotech reporter next Tuesday before the open. There are no revenue estimates, but the two publishing analysts expect a 41¢ loss per share. Guidance should be for another 41¢ loss. CMPS is a Buy under $10 for a very long-term hold to $200.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2028

Probable time of next financing: Late 2025

Editas Medicine (EDIT – $3.01) participated on a panel at the Chardan Genetic Medicines Conference (WEBINAR PANEL HERE) on Genome Editing: Next Wave Technologies. CEO Gilmore O’Neill pretty much dominated the panel and said they will be in human trials in 2026. EDIT is a Buy under $6 for a double in 12 months and a long-term hold to much higher prices.

Primary Risk: Other companies’ gene-sequencing drugs fail in the clinic.

Clinical stage of lead product: Partnered: Approved. Owned: Going into the clinic mid-2025.

Probable time of next FDA approval: 2028

Probable time of next financing: Late 2026 or never

Medicenna (MDNAF – $1.01) presented at the Planet MicroCap Showcase: TORONTO 2025 (AUDIO HERE and SLIDES HERE). It was the standard corporate backgrounder for people not familiar with the company. There was a new slide on the history of IL-2 therapies:

And they are emphasizing the trial with Keytruda more and more:

Buy MDNAF under $3 for a first target of $20.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Entering Phase 3

Probable time of first FDA approval: 2026

Probable time of next financing: 2025

TG Therapeutics (TGTX – $34.02) completed enrollment in the Phase 3 ENHANCE trial evaluating a consolidated Day 1 and Day 15 dosing schedule for IV Briumvi. Buy TGTX under $30 for a target price in a buyout of $40 or more.

Primary Risk: Briumvi, the MS drug, fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: NM

Probable time of next financing: Never

Inflation MegaShift

Gold‘s ($4,031.60) parabolic run is finally catching its breath as it just suffered one of its largest two-day drops (almost 8% from the October 20 intraday high to the October 22 intraday low) of the entire bull market. JPMorgan called it a “healthy reset” within an ongoing bull trend, with dip demand from central banks and China likely to kick in near $4,000. The bank still sees the metal averaging above $5,000 by late 2026. I think this is just a much-needed pause before the next leg higher. No doubt gold has become a crowded trade, but governments worldwide are almost competing to debase their currencies. It’s one way to reduce the debt burden – not a very good way, but one way.

While Western speculators panicked, China executed the largest physical gold grab in financial history. Shanghai gold warrants traded 190,843.25 pounds this week and volume is up +570% year to date – equivalent to 7% of annual global gold production.

It is true that speculative bubbles become momentum trades. People start buying into them because stuff has been rising and so stuff rises more. That’s why this pullback in precious metals is so important. Momentum is broken, which will kill demand for this speculative bubble for a while.

But gold has been consolidating since 2011, and you don’t want to sell something that has been consolidating for 14 years just a few months after it breaks out. We’re in an environment where inflation is rising and the Fed is cutting. Hence the debasement trade…

Magnified by a coming European Union huge policy error. EU leaders are set to instruct the European Commission to design a legal proposal to release up to $160 billion in Russian frozen state assets to fund Ukraine’s war effort for another two to three years, after Belgium signaled it would not stand in the way. This would cause a multi-year bull market in gold as countries bring foreign assets, especially US Treasury bills and precious metals, home.

The fractal dimension tagged the end-of-trend 30 level and reversed spectacularly, confirming that this is just a necessary consolidation. The next trend doesn’t have to resume in the same direction (up), but almost all the time, it does. I remain bullish.

Miners & Related

Coeur Mining (CDE – $17.70) reported record September quarter revenues up a whopping 76.9% to $554.6 million, nicely above the $549.47 million estimate. Pro forma earnings of 23¢ a share – another record – were in line with estimates.

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Mitchell Krebs substantially increased the expected 2025 metals production from the Las Chispas mine that they acquired. Instead of 42,500-52,500 ounces of gold, they now expect 50,000-58,000 ounces. Instead of 4.25-5.25 million ounces of silver, they now are guiding to 5.0-5.5 million ounces.

Mitch said: “Based on recent price levels, we now expect our full year EBITDA to exceed $1 billion and our full year free cash flow to top $550 million, both of which are higher than our prior estimates.”

He expects to have more than $500 million in cash at year-end after spending about $7.5 million buying back stock and paying off all of their debt.

The company presented at the SCP Global Silver Conference and went back to their old bad ways, posting the presentation (SLIDES HERE) but not the audio. I can’t complain too much, though, because it was the standard corporate presentation with maybe one nod to this being a silver conference:

CDE is a Buy under $10 for a $20 target as gold goes higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Dakota Gold (DC – $4.23) CEO Robert Quartermain had a brief interview with Metals & Mining Scoop:

DC is a Hold for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

Royal Gold (RGLD – $177.82) completed the acquisition of our Sandstorm Gold shares. The September quarter conference call is next Thursday. In the quarter, they sold 38,600 ounces of gold at an average price of $3,415 an ounce, 594,500 ounces of silver at $37.90 an ounce, and 1,200 tonnes of copper at $9,660 per tonne or $4.38 per pound. At the end of September they had approximately 19,000 ounces of gold and 379,200 ounces of silver in inventory. Cost of sales was approximately $653 per gold equivalent ounce. RGLD is a Buy under $180.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $106,731.10) is going through one of its periodic and very necessary consolidations. Over the last 10 years, on average 60% of Bitcoin’s full-year performance occurs after October 3rd.

Last Friday morning, JPMorgan Chase (JPM) announced it will allow institutional clients to borrow against their bitcoin and ethereum holdings. Just as loans can be collateralized by stocks, bonds, or gold, this move recognizes bitcoin and ethereum as legitimate lending collateral. It marks a continued shift for JPMorgan and CEO Jamie Dimon, who once dismissed Bitcoin as a “pet rock,” and underscores how deeply digital assets are being integrated into the traditional financial system. This latest step signals that high-quality crypto adoption is not only accelerating but becoming mainstream.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $60.40) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

Ethereum (ETH-USD on Yahoo – $3,836.18) is, as Tech Frontiers editor Erez Kalir wrote: “Over the coming decade, as stablecoins, tokenized assets, and digital securities become mainstream, ethereum will be a major winner – almost certainly joining gold, bitcoin, and US Treasuries as a core monetary asset of the modern era. For investors building a Forever Portfolio of blockchain blue chips, ethereum isn’t an optional speculation but instead a core must own.”

ETH-USD is a Buy.

Primary Risk: Bitcoin extensions outperform Ethereum.

iShares Ethereum Trust (ETHA- $27.83) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $60.24

Oil jumped last Thursday after the Treasury Department announced sanctions on Russian oil giants Rosneft and Lukoil. But NO past round of Russia sanctions has led to a sustained spike in oil prices, even with OPEC+ production cuts. The latest US sanctions won’t either. The best example is the huge wave of shadow fleet sanctions by Resident Biden in January 2025 (green line below).

Sanctions against Rosneft and Lukoil will fail. Sanctions against Russian energy failed when Biden did it, and they’ll fail now. The world needs the energy more than it needs to transact in the US dollar system. Energy is critical to life, while the US dollar system merely facilitates its smooth delivery to end users. Sanctions won’t stop energy’s delivery to end users; they’ll just make it more expensive (temporarily). The net result will be a global calling of the bluff.

The July 2026 Crude Oil Futures (CLN26.NYM – no trades – June was $59.66) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $34.65) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $7.41) will report September quarter results next Thursday. The lone publishing analyst expects revenues to be up 6.88% from last year to $523.8 million, with two analysts wildly divergent on earnings. One is expecting 5¢ a share and the other 32¢ a share. Only one of them has a December quarter forecast for $544.8 million and 19¢ a share. VET is a buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $21.82) jumped $1.42 today after the Trump/Xi trade and rare earths announcement. The company reports September results next Tuesday morning. The two publishing analysts expect revenues to be up 142.41% from last year to $13.67 million, with a 5¢ per share loss. December quarter guidance should be for $18.75 million and breakeven.

We have to get off our China dependence on rare earths as fast as possible. The one-year window provides the US a bit of time to get our house in order. Rare earths are too important, and there’s no putting the genie back in the bottle. US/the West has to invest, and fast. Energy Fuels is an obvious beneficiary. We bought it at $10.45 on March 10, 2022 and I’m raising the UUUU buy limit to $18, still for a $30 target.

Primary Risk: Uranium prices fall.

EQT (EQT – $52.45) reported an excellent September quarter, with revenues up 36.7% from last year to $1.75 billion and pro forma earnings of 52¢ a share. The consensus expected $1.78 billion in revenue but only 36¢ per share. On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Toby Rice said production of 634 billion cubic feet equivalent (Bcfe) was toward the high end of their guidance, driven by strong well performance.

But the stock slipped a bit after Toby guided December quarter total sales volume of 550 to 600 Bcfe, which includes 15 Bcfe to 20 Bcfe of strategic curtailments. He narrowed his 2025 sales volume forecast to 2.325-2.375 Bcfe from the prior guidance of 2.3-2.4 Bcfe, while raising the annual liquid sales forecast to 16,400-16,700 million barrels and the ethane sales forecast to 7,150-7,300 million barrels.

He said the company expects to maintain natural gas production in 2026 at levels consistent with its 2025 exit rate. That was below the Street’s expectations, but he’s always conservative and this is just the same old game – guide low and then beat. Traders know to drop the stock, fleece the weak hands, and then go long.

This quarter showed strong operational and financial performance, with significant progress in advancing direct-to-customer LNG and data center strategies. Their focus on low-cost execution, strategic capital allocation, and capturing new demand positions them for strong free cash flow and long-term growth.

In addition to being the best-managed natural gas company in America, EQT is putting the pieces in place to sell lots of liquefied natural gas (LNG) in Europe, where prices are much higher. North America is going through a boom in LNG export facilities, and EQT will happily supply many of them…at substantially higher prices.

EQT is a buy under $70 for a long-term hold for much higher prices.

Primary Risk:Natural gas prices fall.

Freeport McMoRan (FCX – $41.73) reported better than expected September quarter results as higher copper prices offset the Indonesian mine closure, as I expected. Revenues were up 2.7% from last year to $6.97 billion, just above the consensus estimate for a year-over-year decline to $6.73 billion. Pro forma earnings of 50¢ a share clobbered the 41¢ estimate.

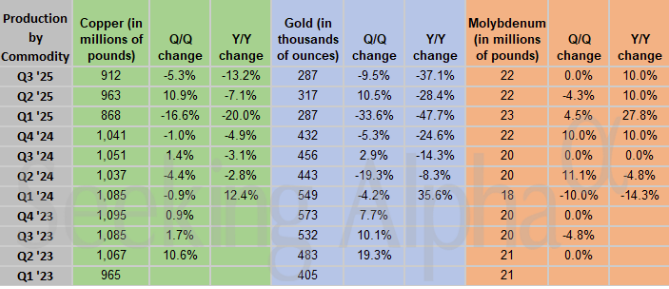

Obviously, consolidated production was impacted by the temporary suspension of operations in Indonesia since the deadly September 8 mud rush incident. Production totaled 912 million pounds of copper, 287,000 ounces of gold and 22 million pounds of molybdenum.

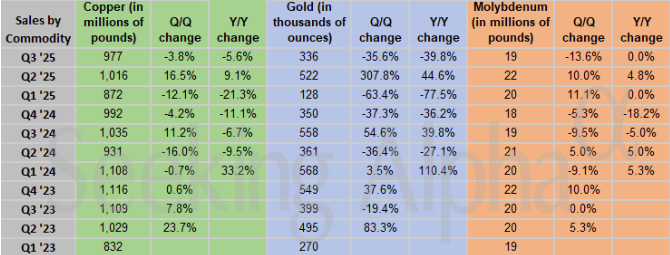

But they were able to sell some extra copper and gold from inventory. Copper sales were only 1% lower than their July guidance, and gold sales were approximately 4% below guidance.

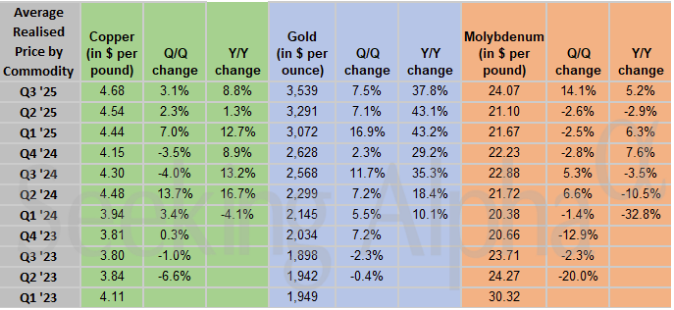

Prices were up across the board:

As a result, they booked $1.7 billion in operating cash flow in the quarter. After the investigation into the mine accident is complete, they’ll hold a conference call in November to update us on their mine reopening plan and how it will affect the December quarter and 2026 results. For now, they estimated December quarter copper sales of 635 million pounds and gold sales of 60,000 ounces.

When breakouts of this magnitude happen, they typically aren’t ones to fade.

FCX is a Hold for the mid- to high-$40s.

Primary Risk: Copper prices fall.

* * * * *

RIP Neo-Soul Singer-Songwriter D’Angelo

* * * * *

Subscriber StephKam suggested this stunning father-daughter duet with Rinat Ibragimov

and Alina Ibragimova. Sadly, Rinat had a stroke in 2014 and died of Covid-19 in 2020 at 59 years old.

* * * * *

Your thinking about Wars and Peace Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 10/30/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $271.40) – Buy under $205

Gilead Sciences (GILD – $118.44) – Buy under $115, first target price $150

Meta (META – $666.47) – Buy under $705 for a long-term hold

Onsemi (ON – $50.85) – Buy under $60, first target price $100

Palantir (PLTR – $194.55) – Buy under $160 for $200 first target price

PayPal (PYPL – $67.93) – Buy under $75, target price $150

Snap (SNAP – $7.60) – Buy under $11, target price $17+

SoftBank (SFTBY – $85.00) – Buy under $35, target price $50+

Small Tech

Enovix (ENVX – $11.37) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $76.33) – Buy under $75; 3- to 5-year hold

Fastly (FSLY – $7.98) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $15.75) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $7.10) – Buy under $10, target price $40

ARK Venture Fund (ARKVX – $42.10) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $5.36) – Buy under $6, target $30+

Akebia Therapeutics (AKBA – $2.10) – Buy under $4, target $20

Compass Pathways (CMPS – $6.30) – Buy under $10, hold a long time for a 20x return

Editas Medicines (EDIT – $3.01) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $2.36) – Buy under $5, hold a long time

Medicenna (MDNAF – $1.01) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.69) – Buy under $2.50, target price $20, then $50

TG Therapeutics (TGTX – $34.02) – Buy under $30 for buyout at $40+

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($48.87) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $59.05) – Buy under $50, target price $75

Sprott Junior Gold Miners ETF (SGDJ – $72.55) – Buy under $60, target price $100

Sprott Physical Gold and Silver Trust (CEF – $37.45) – Buy under $35, target price $60

Global X Silver Miners ETF (SIL – $67.51) – Buy under $60, target price $100

Coeur Mining (CDE – $17.70) – Buy under $10, target price $20

First Majestic Mining (AG – $13.02) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $1.11) – Buy under $1, first target price $10

Royal Gold (RGLD – $177.82) – Buy under $180

Cryptocurrencies

Bitcoin (BTC-USD – $106,731.10) – Buy

iShares Bitcoin Trust (IBIT – $60.40) – Buy

Ethereum (ETH-USD – $3,842.41)– Buy

iShares Ethereum Trust (ETHA- $27.83) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – no trades – June was $59.66) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $34.65) – Buy under $40; $100+ target

Vermilion Energy (VET – $7.41) – Buy under $11; $24+ target

Energy Fuels (UUUU – $21.82) – Buy under $18; $30 target

EQT (EQT – $52.45) – Buy under $70; hold for much higher prices ($100+)

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Nvidia (NVDA – $202.89) – Hold

Dakota Gold (DC – $4.23) – Hold for $6 target price

Freeport McMoRan (FCX – $41.73) – Hold for an exit in the mid- to high-$40s

Sells

Corning (GLW – $90.28) – Sell, fully valued

Micron Technology (MU – $224.01) – Sell, fully valued

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

Thanks for the thinking on the hyperscalers. It’s interesting since most of the software companies have had massive cashflows, in most cases for decades, paid almost no dividends and have been cash rich and “a sure thing” to invest in year after year.

I noted a while back Microsoft were signing more deals to lease data centres (Coreweave spring to mind) and not build as many themselves. Which means they and others opex’s also going up but they pass the risk on to others when the owners realise they’ll never get their money back (re. the story a couple weeks ago on the depreciation of chips & DC’s).

I can’t see any of the big guys going out of business anytime soon but I can see them reducing headcount everywhere soon …whilst eating their own AI dogfood as both the capex and opex go up and that’s definitely going to hit most in their share prices.

As you say it’s when to get off the train, not if, but that might be 1 year, 2+ from now, but definitely feels not much more than that if their cash positions deteriorate rapidly, even as revenue goes up.

I think you nailed it a few newsletters ago. Once Openai does their IPO, every man, his dog and taxi driver will be all over it. That’s the time I think I’m done.

Hoping you’ve fully recovered from your accident.

Cheers from NZ

Steve

PS. the music is sensational StephKam, what a tragedy.

Weakness in the job market is now obvious. UPS laid off 48,000 employees and Google laid off 30,000. If you calculate $20.00 an hour average for UPS workers that’s $960,000 a week in payroll checks and $540,000 for google at $18.00 an hour average. Annually that’s about $78,000,000. In lost payroll checks. And the shipping business is kind of a bellwether for the manufacturing industry. If manufacturers are not shipping as much , shipping companies lay off. Excellent RR , MM. Thanks for your insight.

I want to take a long day trip to Phoenix from NYC in Dec to hear some unique new electrostatic speakers, but am afraid of big delays due to the govt shutdown. Anyone with experience flying lately?

Phoenix is on the list:

The F.A.A. has been steadily tracking controller absences at the busy hubs that make up its so-called Core 30 list, occasionally broadcasting that data — as they did on Halloween, when the agency noted that half were experiencing staffing triggers. Those airports are, listed by urban area:

Thanks. It’s hard to find nonstop flights. The biggest problem would be missing connecting flights.

It’s getting tighter as the shutdown continues. Yes, the direct flights are hard to get. And the connecting flights can be a nightmare. I flew to Florida and got caught in that last mess. My flight went thru LaGuardia. Then got stuck there for 3 days before I could get out. Now they are talking of canceling 10 percent of the flights. So it’s kind of a crap shoot , I think.

Terrible 3 days.

AKBA–I repeat my advice not to buy up to $4 to get good returns with less risk. Many investors who bought KERX 5-10 years ago are sitting on big paper losses. Review my numbers analysis at the end of the last board. If MM or anyone think that it is OK to buy up to $4, he should do a hard numbers crunch and justify it stating assumptions. One of my uncertainties is projection of actual earnings from sales. I estimated 50%. Maybe it is 75% once sales get going, since the cost of production is low for a pill and less marketing will need to be done in a few years. VOICE and other trials will further convince more nephrologists to switch to V from ESA. V should sell itself for nephros who want to do good for patients, but Fresenius has a conflict of interest from their ESA contracts. But maybe overhead from loans and R&D for the pipeline will reduce earnings to only 25% of sales. MM used to do spread sheets which was good. Now, it is just intuition. Subscriber Brent has done balance sheet analysis and also disagrees with many of MM’s buy and target prices.

I now think that target of $20 is a pipe dream, unless NDD subgroups and then complete NDD get approved. The pipeline is interesting, but totally speculative for 5 years. $10 would still provide a great return for me, but only because my current average cost is $1.75.

AKBA- Gosh you went from very bullish on this one to, well, not bearish perhaps but extremely cautious. So let me ask you this, Mr. Market just took a 32% chunk out of the valuation for a potential market and sales that MAYBE would have materialized in 3 to 4 years but should not be really part of any valuation TODAY. But for some reason, the same Market would be unable to value and discount back 10 years of cash flows starting to come in right now, and push AKBA’s stock upwards to, say, above $4 to $6?? By March 2026, and $10 by June, even without NDD?? So, yes, maybe $30 in June could be overly optimistic, but $10 appears extremely doable as well as $15 on a subsequent bid by AMGN sometime in the next 12 months.

I read with interest your constant criticism of the FDA which is in general amply justified; I think we can agree that if NDD is so important to today’s valuation then the company got seriously damaged by the Gov. bureaucrats, particularly considering the plentiful data from NDD currently in use in Japan.

Lastly, I never see anybody, bulls or bears, discussing the Asia/Japan royalties or EMEA and Europe. Obviously, these markets would price V a lot lower than the US, but there are lots of sick people over there too.

AKBA–the big plunge signaled to me that the market is waking up to the false pumping by bigshots on ST, particularly Hsainu. His projections of $30 by end 2025, $100 with NDD got me excited about going in big at average $1.75. He seems to be a market maven mainly, and a doctor secondarily. I don’t know how much clinical experience he has. Even as a financial analyst, and even accepting his current estimate of $1 billion by end 2026, I have pointed out his mathematical errors of PPS estimates. He won’t listen. He applies customary price/sales of 10 in a growing biotech. But IMO this is wrong because TDAPA runs only 2 years with possibility of another year extension. Although I am not a CFA, I have common sense. A company is only worth the earnings multiplied by the number of years of those earnings. The V patent runs to only 2034, so use P/E of at most 10. P/S is only a surrogate marker, but we need to estimate the expenses to convert sales into earnings. I used 50% of sales to equal earnings, but it is all speculative, and I could be way off. What is your estimate? From my cost of $1.75, I feel confident that I will make money after holding a few more years to see how this plays out. But I absolutely have sympathy for subscribers who blindly follow MM’s mere intuitive advice to buy up to $4. I am uncertain about even $10 as a long term target, unless NDD or the pipeline come through. It may take until Q2 ER in Aug 2026 to see if Davita is going to be significant. PPS could be $1.50 to $4.00 until then.

As viber7 on ST I am well respected as an alternative thinker to super bulls like Hsainu. There are too many dumb posters that merely treat this like a football game with its cheerleaders. There are a few smart folks there who I suspect are more like me than Hsainu. Lately, someone there is questioning whether the largest DO, Fresenius will get involved at all, due to dirty business among CSL, Vifor and Fresenius that I don’t follow or understand.

Finally, I never would have gone whole hog into this without TDAPA. The rest of the world doesn’t have TDAPA incentives, and V sales for DD and NDD are good but not great. First, everyone was pissed at Butler for delaying US launch for 9 months so he could get TDAPA in place, which created great low PPS for long term investors. The 9 month wait would have been smart had he finally launched V well. But sales have been mediocre, FAR FAR from blockbuster, and now TDAPA has only 1.25 years or less to be effective as an incentive. When TDAPA is over, even 1 billion buck sales plunges to 250 million overnight, unless there is high momentum to get nearly 100% of patients on V. Even if blockbuster sales continue for many years, what is your estimate of earnings? Then for 10 or way fewer years, I see target PPS after several years to be $5-10. One year target $4 after it settles down from wild cheerleading BS. We already peaked at $4 since launch, now down to $2. This is like the chart of estradiol levels in the menstrual cycle. The monthly cycle repeats with lower highs and lows as the woman ages. At menopause the chart is flat and near zero bottom. There is a small risk of that for AKBA.

I looked at Yahoo Finance analysis today. 2026 estimates are earnings $0.45 on revenue of $314 million. The market doesn’t appreciate that Auryxia sales will continue at $40 million/Q as part of dual bundling with Vafseo under TDAPA, which goes to end 2026. Still, I’ll use YF estimates to illustrate earnings vs sales. Almost 300 million shares X $0.45/sh = $130 million earnings. That’s a little over 40% of sales = earnings. It will improve as less marketing is needed as sales momentum increases. So I was roughly correct at 50%. Don’t use P/E of 30 for growing earnings. That would be correct if those earnings were sustained. But they won’t be when TDAPA expires. Earnings will grow to more than $0.45, sustained only if post TDAPA there are 4X more sales to offset the mere post TDAPA $2500 price instead of TDAPA price of $10K. Long term target for this one trick pony V in dialysis may be only $5. Ignore Auryxia–it will be finished in 1-2 years. V for NDD and the pipeline are speculative and many years into the future.

AKBA- After reporting low of $1.62, pretty awful but it is early; one needs to see where it closes. I continue to think that your numbers seem to be in sync with the market but you, and Mr. Market, are giving little or no premium to any kind to the takeover potential and other positive news regarding re-negotiations with the FDA for NDD. I would also like to point out that any Mag7 related market dislocation in early 2026 may send some capital towards stock like AKBA with rising sales and EPS. However, today’s early decline and the one 2 weeks ago after the NDD announcement, a huge 32% one, make me think that perhaps there may actually be something inherently wrong with the CKD space in general. Seth Klarman, for many years considered one of the most successful value investors of his generation and often described as a “Younger Warren Buffett”, took a terrible bath in Keryx where he had a very large position with his Baupost Group. He described it as a very painful mistake. Well, here we are, staring at the owner of Keryx, AKBA…Keryx 2.0????

Reading ST comments from today. My view is that the biggest problem was that USRC had poor execution on V. This is a big negative because we were led to think that the highly motivated Dr Block was responsible for the good uptake of V since launch in Jan 2025. Now we see that they were stagnant in Q3. The computer glitch was supposed to have been fixed in Q2. Maybe nurses and docs are still dumb-ass by having faith in AI in managing patients. I told everyone here that AI in patient care is WRONG. Robotic health care is EVIL, morally wrong. USRC had problems titrating V doses. The only excuse is the stupid FDA mandate to wait 3 months for a patient on dialysis to start V. They get “addicted” to ESA for anemia because ESA suppresses endogenous production of EPO. V works by stimulating endogenous EPO due to the HIF concept. So when patients on ESA are stopped and switched to V, there is a drop in Hb and a need for ESA rescue. V should be continued instead of stopped. AKBA has done a poor job of educating nephrologists on this. The FDA is an idiot by delaying V for 3 months, which causes some cases for ESA rescue and delays further the implementation of the benefits of V. If there were no 3 month delay, V could be started immediately. It might take 2-4 months to get Hb up, but there would be no need for ESA rescue, and V would show benefits sooner. The 2nd way the FDA is an idiot is by having on the V label that V doesn’t increase quality of life. That is wrong–any treatment of anemia does increase quality of life. That’s the consequence of being enslaved by mandates from govt agencies.

The only positive is that the Davita pilot trial went well. Hopefully, Davita is better managed than USRC and will add many more patients than USRC, but only if their clinical team is more adept. A minor and short term positive is that AKBA’s cash balance increased by $29 million, probably from Q3 sales to Davita for the pilot. Since the pilot won’t complete until Nov 17, maybe AKBA can’t declare that as Q3 sales, although it is shown as increased cash. Flimsy searching for straws from someone on ST floating this theory.

The stock is likely to fall more in the next 3-4 weeks from tax selling, with a Xmas rally as investors return. I hold my large position, and hesitate to buy more here until management proves itself. That won’t be evident until another quarter, but I might be tempted in the low $1 area. Nearly everyone is a bag holder, except for the few people with guts who bought at 25 cents after the CRL in 2022.

Takeover? Yeah, BP may offer $2-3 which will be rejected. In summer 2026, if Butler gets death threats from his mismanagement, it might happen if sales don’t increase enough by then. Buyout may be the best thing, since a BP would competently get sales moving to capture the potential of V.

A bit off subject… sort of. One of my blue chip stocks that I’ve held at bought for many years is Caterpillar (CAT). This week the stock jumped 10% in one day on positive earnings. It didn’t seem to be warranted until I caught one article with this headline, “UPDATE 4-Caterpillar beats estimates as AI boom drives energy equipment demand”. So it appears that the need for energy for AI is driving the sales or projected sales of CAT equipment in a big way. My question is does anybody know an ETF or other vehicle that captures this part of the energy cycle?

I’m assuming it is diesel generator sales boosting CAT. What a waste of resources AI is. Reminds me of: https://youtu.be/goh2x_G0ct4?t=2

I sit here thinking about how we were kicked in the balls with John Butler and the pr staff at AKBA releasing the fda setback after the market closed to were we weren’t able to sell until it dropped 30 percent it was done on purpose if he cared about the shareholders,why didn’t he release it at the market open to where we could have sold some before such a drop,it was differently released at that time for a reason.

Despite what I wrote today, it is worth holding AKBA for a few years to see how it works out. Don’t sell when everyone is gloomy such as now.

thank you.

An addition to Coming Events: UUUU quarterly earnings call Tuesday, Nov 4 at 11 a.m. EST

Gee, MM, I’d’ve thought NWI lifetime subscribers + Boomberg would’ve been enough…:

https://www.bloomberg.com/news/articles/2025-11-03/new-world-to-issue-up-to-1-9-billion-of-new-securities-notes

Maybe you are joking. MM has Boomberg, not Bloomberg as you know. Everyone wants to use “New World.” I like it best by Dvorak, New World Symphony from 1893. Decades ago, there was a Florida orchestra, New World Symphony.

Of course I was joking, and I used the Bloomberg headline because MM styles his other letter as Boomberg. I should hope the new notes don’t fall flat…. It may not be called New World but I like Dvorak’s American Quintet (in E flat, op. 97).

I love both the American Op 96 quartet and the Op 97 quintet. The quintet Budapest 1950’s recording has Roisman the 1st violinist doing shorter strokes in the 1st variation 2nd movement. In the 1967 recording he is more smooth legato in the same passage. I like that better.

MM or anyone DOES CORNING SUPPLY WIRING FOR THESE DATA CENTERS That everyone is building now?

Corning supplies the fiber optic cable that moves data between processors and, increasingly, between data centers. That’s the main reason the stock ran up.

The actual electrical wiring is provided by many companies. It uses a lot of copper, which is one reason I recommended FCX.

I am holding VIAV . It closed Friday at$17.00 and change. It’s up 87 percent in the last six months!

John Miller–I got a letter from Sprott Global Resource Investments that in order to maintain my account, I have to convert it to a Sprott management account. Rick Rule is not managing money anymore, but provides free education at his Rule Investment Media. Plenty of great videos. The managed accounts have minimums of $100K, only fee based 1.5%, no commissions. A good option is the Traditional Diversified run by Eric Angeli. This is not on the website. I like that I can talk to Eric about my goals periodically. It is bespoke, tailored to your goals. I don’t want to wear out my welcome, since Adrian Day dumped me decades ago from his Gold account. I don’t blame him, because I was second-guessing him too much. Eric was mentored by Jeff Howard who was Rick’s expert on oil and gas. Jeff retired 3 years ago. It is weirdly interesting that about 1 year ago, Rick moved from Calif to Washington State. Rick is an intelligent free marketeer. Why would he move to leftist Wash? Wash has low or no income and capital gains taxes, unlike high tax and Commie California. Wash is less leftist.

I decided that natural resources is too specialized for me to do my own DD. If you can get professional expertise for a reasonable fee, it is worth it. Once in a while, you get opportunities like DECK. I’m not a shoe analyst, but tax loss selling is probably a good time to pick up shares. I can’t spend the rest of my life doing DD on many stocks with modest returns.

Yes, I was just wanting to get his take on gold stocks. Thanks for your input above on AKBA. Washington is full of leftist, but mostly it affects people in Seattle, which is a Mecca of them. The worst issues are now with property taxes , crazy gasoline taxes etc. And now with the money grab from capital gains. So hopefully when that all hits people’s pocket books , we can get them voted out. I am thinking of paying off my mortgage so the property taxes are a lot less of an issue and reducing my selling of stocks to a bare minimum, and buy more stuff in tax free neighboring states.

I spoke with Eric Angeli today from Sprott. His bespoke Traditional Diversified managed account has a higher fee–2.0% for under $250K, 1.5% for over that. The other managed accounts are more cookie cutter with fees of 1.5%. I decided it is worth the extra 0.5% which gives me the privilege of speaking with him by calendar appointment any time. For example, we discussed that the only stock in my account worth keeping is Sprott. Sprott participates in the gold bull market by holding bullion, and from the dramatic interest in gold investing lately. Here’s their metric–AUM, accounts under management. The other accounts have the lower 1.5% fee, but the client doesn’t have input. In those accounts, any positions would be immediately sold and proceeds re-invested immediately. The other stock in my account we discussed is Goldfields, a SA stock. It has gone up more than the gold stock indices, but he considers it a beta holding. Beta means it performs with the generic indices. He wants alpha, which is the stock picker philosophy to beat the market. Watch Rick Rule’s video about alpha/beta on Rule investment Media. By selling Gold Fields, I get 2 benefits–deducting $75,000 capital losses, and maybe getting better gold and other commodity stocks. These low quality gold stocks and mostly everything in NWI are minefields (pun intended), so pro management is worth something.

The Traditional Diversified account isn’t just precious metals. It covers commodities in general.

Other tips from Eric Angeli. First, he views Newmont Mining as a mediocre beta stock for gold. He thinks he can do better with his alpha picks. Remember, Seeking Alpha is all about finding such stocks. The average investor has many disadvantages in picking alphas. He doesn’t have the time or expertise to do this. The gold funds are a collection of beta stocks. Safe but mediocre.

Second, he doesn’t use the gold/silver ratio as a criterion for investing. Central banks accumulate gold, not silver, so that boosts gold demand.

MM, you used to talk about long economic or stock market cycles. I forgot how many years but seem to recall it was something like 23 year cycles. While we are apparently in a bubble in various ways now, can you give us your thoughts on where we are in a long cycle and how long it may take to recover from a pop of the bubble?

It’s roughly a 36-year cycle. Peaked in 1929, 1965, 2000, and due again in 2036. After the peak, 16 years of tough markets, relieved now and then by bull rallies, followed by 20 years of easy markets, hit now and then by sharp drops. We are in the 20-year period now, which is a big reason I’m reluctant to get off the AI bus too early.

But I do think the AI infrastructure buildout stocks are nearing a peak, and the next interesting group will be AI application stocks. I’m looking at some now.

AKBA earnings any thoughts about them JGMD or anyone else right now the market sure isn’t liking it

AKBA- My comments posted above as an answer to JGMD.

Ronald and El Capitan–see my long post after yours (El Cap) from today.

Vafseo sales only up $1 million from the June quarter, in spite of the Davita pilot program. Bad news. They’ll still have a much stronger December quarter, but the stock is probably stuck until that report.

Mm,one has to question if Davita paid any money towards the trail which we were all led to believe don’t you agreed

To me it’s starting to look like another nvta in the making,sure the hell hope not

I doubt it. If you have the stomach, buy AKBA during tax loss selling at lower prices than today. HOLD and be patient. When you buy at low prices, you can afford to be patient.

Yes, Davita paid. See my post from today.

Mm,feel like chiming on on the earnings report out on AKBA,

AKBA presenting at Guggenheim today. 3:00pm EST

https://event.summitcast.com/view/6h3HS7z68WnTQE5PS7Vq8J/guest_book?session_id=hbaHVv5b4ksp2pwZ3HQCZr

MM: Softbank sold its entire $5.83 billion stake in NVDA in Oct. Any comments?

Keith Fitz-Gerald’s take, plus some wise “last words” from Warren Buffet:

https://www.youtube.com/watch?v=MGKdURICKeg

I am surprised that all the discussion on this board continues to be about long shot high risk biotechs and stodgy blue chips as you are missing the 2 sectors exploding with once in a lifetime wealth building opportunities – crypto and HPC/DC. Ive made more money on ETH, BTC, IBIT (pays 13% div monthly) and BTQ, IREN, CIFR, BITF, HUT in the last year than Ive made on stocks from this mewsletter and chat board in 10 years. Wake up people, two of the most transforming movements is passing you by.

Understand that power is the new hot commodity, not chips, theres plenty of chips but a severe capacity shortage of power to run the HP computers and AI – theres a scramble now for the big techs to secure the power supplies needed to power AI and HP computers and nuclear expansion takes years – the need is now – watch IREN, CIFER, BITF, HUT, CLSK secure long term contracts to supply power now – just look at there price targets. Heres another tip – buy BMRN headed by Tom Lee as an ETH treasury stock because all the stable coins and our financial sector (see how wall street is converting to ETH blockchain will all run on ETH. Tom Lee one of the smartest tech people I follow.

New World Investor for 11.13.25 is posted.