Dear New World Investor:

Surprise! – not. The Fed cut the funds rate another 25 basis points (bps, or ¼ of 1%), bringing it down to 3.50%–3.75% after a relatively calm inflation report and relatively weak employment reports. It was their third cut this year and 1.75% in total since late 2024. Two Fed presidents voted to hold rates steady while President Trump’s appointment, Stephen Miran, wanted to cut rates by a half percentage point. That was the first time since 2019 that three Fed officials voted against a policy action.

The dot plot forecast is for only one cut in 2026. Danielle DiMartino Booth is advocating for the Fed to ignore President Trump’s wishes and pick their own next chairman at their next meeting on January 28, so early next year could turn into interesting times.

The headline Personal Consumption Expenditures Index for September, delayed five weeks by the government shutdown, rose 2.8% year-over-year, a slight uptick from August’s +2.7%. It was up 0.3% month-over-month, the same as August.

The core PCE, the Fed’s favorite inflation indicator, also rose 2.8% year-over-year, but that was a slight downtick from August’s +2.9%. It was up 0.2% month-over-month, again the same as August. At that rate, the value of the dollar will take 37 years to fall in half, or, as the Fed thinks of it, a win.

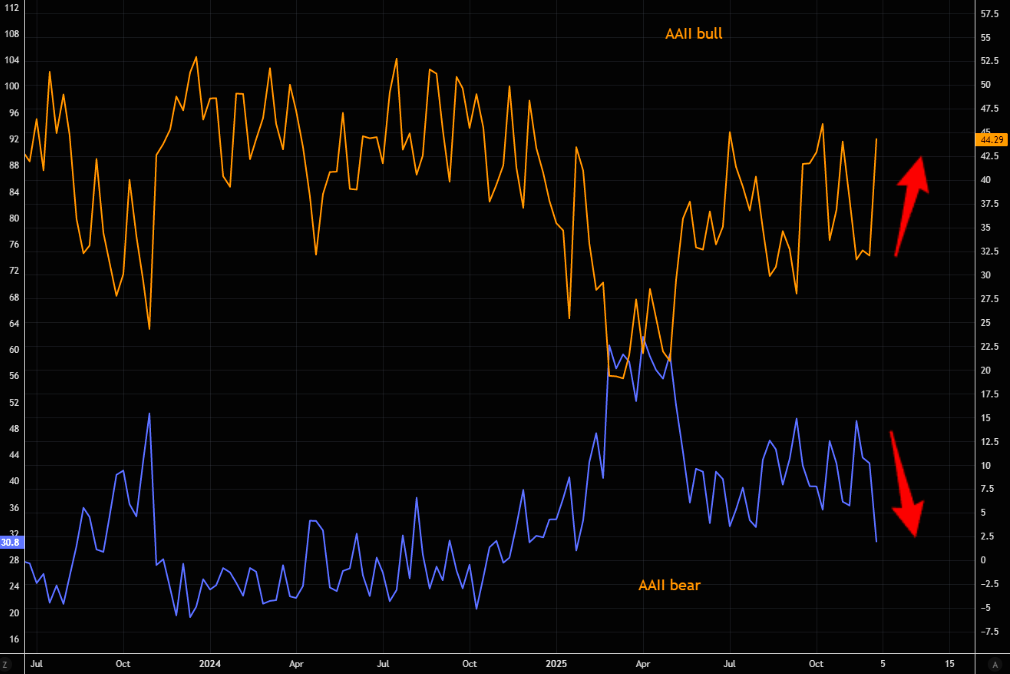

People are getting more bullish. AAII investors increased their allocation to stocks to 71.2%, the highest since November 2021. Their cash allocation of 14.8% remains near four-year lows. The AAII bull is getting very bullish while bears throw in the towel, printing close to lowest levels of the year.

Click for larger graphic h/t @TheMarketEar

Historically, midterm years like 2026 are the weakest of the Presidential cycle by a wide margin. The S&P 500’s average return in midterm years is only about 5%. The last midterm, 2022, was the worst market year since 2008. Even though everyone knows that, most Wall Street brokers will just extrapolate 2025’s performance and forecast 2026 as a solid year. While that will help drive the Santa Claus rally, I wouldn’t be surprised to see meaningful market weakness in the March quarter.

Market Outlook

September quarter earnings reports were strong as 76% of S&P 500 companies beat the consensus expectation for revenues and 83% beat on earnings. The S&P 500 added 1.3% over the last two weeks to new intraday and closing highs today. The Index is up 17.3% year-to-date.

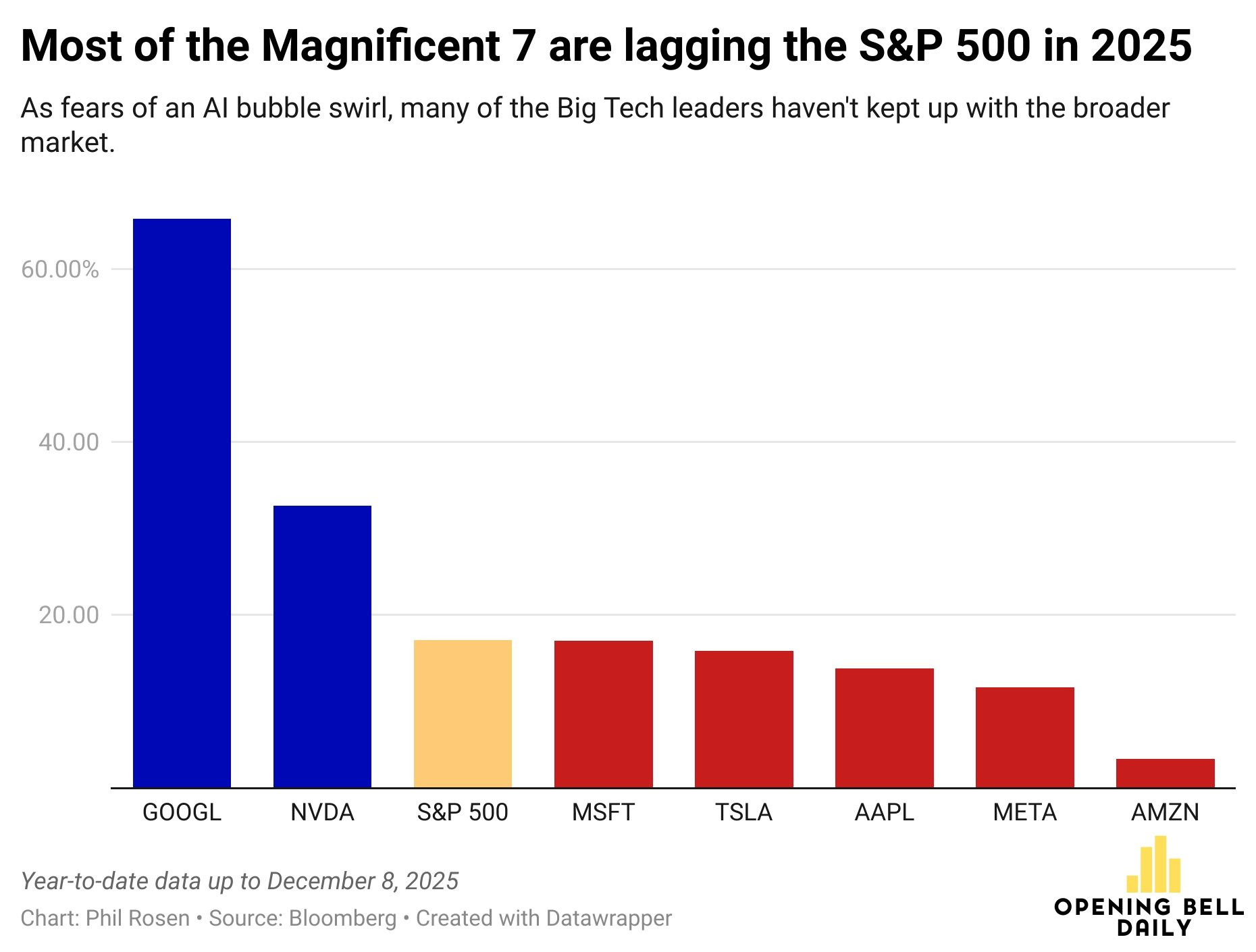

It isn’t widely recognized that only two of the Magnificent 7 stocks are beating the S&P 500 this year. For all the talk of concentration risk, stocks are at record highs even with Big Tech losing momentum. This is a broad and healthy bull market.

Click for larger graphic h/t @philrosenn

The Nasdaq Composite gained 1.6% and set new intraday and closing highs yesterday. It is up 22.2% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) added only 0.1% but still leads the 2025 performance derby, up 36.6% year-to-date. The small-cap Russell 2000 soared 4.2% and is now up a respectable 16.2% in 2025.

The fractal dimension is almost out of energy, although as we have seen with the gold fractals, rallies can continue on fumes. S&P seasonality is our friend for three more weeks.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model estimate of September quarter real GDP growth – still not reported – slipped a bit to +3.5% due to a reduction in the forecast of personal consumption expenditures growth. The Blue Chip economists should be over +3.0% by the time it is reported. That’s a far cry from a recession.

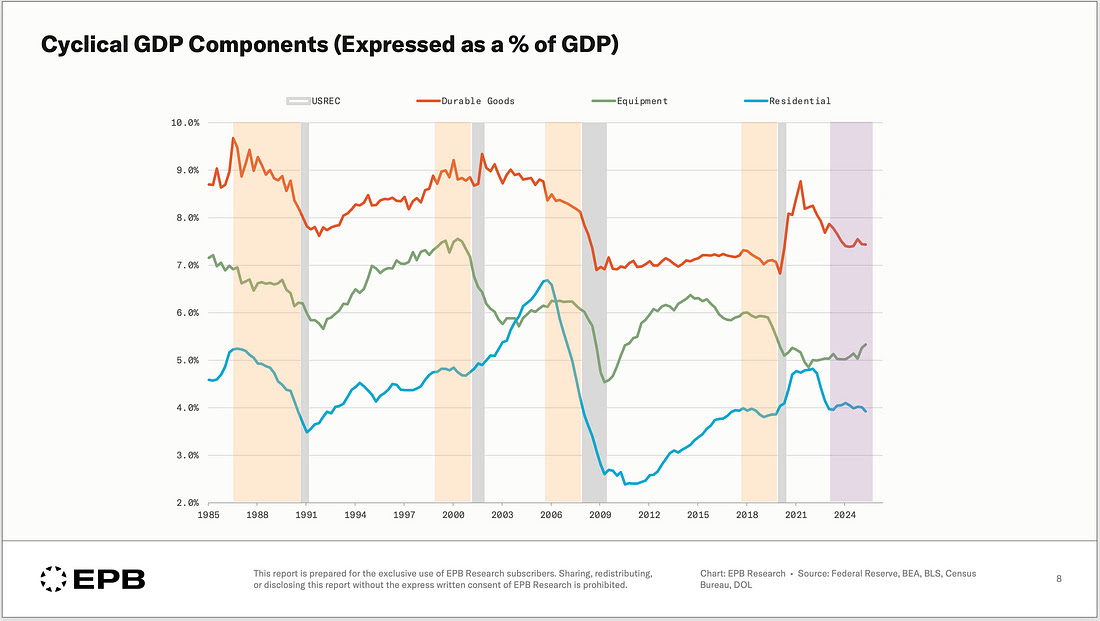

Eric Basmajian of EPB Research pointed out that 20% of the economy drives 10% of the recessions. Yes, we are a consumer economy, with consumption accounting for about 70% of GDP – but that doesn’t vary much. Three sectors – durable goods consumption, residential investment, and business equipment investment – account for most of the cyclical swings. Since 1960, the total of these three has contracted in 21% of all quarters. Total GDP has contracted in just 4.2% of quarters. And the non-cyclical remainder? Just 3.8%.

All the signal is in these three. All the noise and the narrative is everywhere else. Focusing on “the consumer” is focusing on an area of the economy that doesn’t often contract, other than the narrow slice of durable goods, which is the only segment of consumer spending worth devoting extra attention. Look at Eric’s graphic of these three as leading indicators:

The surge in business equipment spending on AI data centers is keeping the US economy out of a recession.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Sunday, December 14

Happy Hanukkah! – Sundown through sundown 12/22

Tuesday, December 16

QUIK – QuickLogic – Unspec. – NYC Summit

RGLD – Royal Gold – 12:00pm – Renmark Financial Communications Virtual Non-Deal Roadshow Series (their second Renmark presentation)

Wednesday, December 24

Next New World Investor

Market closes early – 1:00pm

Short Interest – After the close

Thursday, December 25

Merry Christmas!

Friday, December 26

Kwanzaa Cheers! – Through January 1

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $278.03) shipped a record 247.4 million smartphones in 2025, 6.1% year-over-year growth, according to market research firm IDC. They gained market share as the worldwide smartphone market grew just 1.5%.

But Apple’s highly touted AI updates to Siri have been delayed until 2026, so they announced a major personnel shake-up last week as they changed their AI strategy. Their top AI leader, SVP for Machine Learning and AI Strategy John Giannandrea, who managed Apple’s unsuccessful effort to release a cutting-edge AI product, is stepping down and will retire.

He’s being replaced by Amar Subramanya, an AI exec from Microsoft, who previously was head of engineering for Google’s Gemini AI assistant. According to Bloomberg, Apple is going to pay Google about $1 billion a year for a Siri AI model.

I just bought my second and third iPhone 16e this year for Christmas stockings. Doing my part. AAPL is a Buy under $205.

Gilead Sciences (GILD – $123.21) made a big splash at the American Society of Hematology (ASH) annual meeting. Kite announced new positive data from its pivotal iMMagine-1 Phase 2 study of anito-cel in relapsed or refractory multiple myeloma patients who had received at least three prior lines of therapy. The 117 patients followed for a median of 15.9 months showed an overall response rate (ORR) of 96%, with 74% achieving a stringent complete response or complete response. Median time to best response was 4.8 months and median time to sCR or CR was 3.2 months. 95% of patients evaluable for minimal residual disease (MRD) achieved MRD negativity at a median time of 1 month, meaning no cancer cells could be detected even with highly sensitive tests.

Kite also showed that second-line Yescarta therapy offers consistent benefits in patients with relapsed/refractory large B-cell lymphoma, even among those ineligible for the previous standard of care, high-dose chemotherapy followed by an autologous stem cell transplant. GILD is a Long-Term Buy under $115 for a first target of $150.

Meta Platforms (META – $652.71) CEO Mark Zuckerberg is cutting up to 30% of the budget for the metaverse unit and moving funding over to the company’s AI and smart glasses initiatives. If Wall Street wants to rally the stock because they believe Zuck is giving up on the metaverse – let them. I think this is just a timing issue. AI and agents are here today, smart glasses are immediately ahead, and the metaverse is a 2028-2030 initiative that is enabled by AI and much of smart glasses technology.

The stock was upgraded from Neutral to Buy at Arete with a $718 target price. META is a Buy under $705 for a long-term hold.

Nvidia (NVDA – $180.93) can export its H200 artificial intelligence chips to China after all, according to President Trump. The US government will receive 25% of the revenue from sales, which is outright theft with no basis in any law I know. I assume Nvidia was told to take it or leave it. Supposedly, the Department of Commerce is finalizing the details, and the same approach will apply to AMD and Intel.

Trump said that he had informed President Xi Jinping of China, where Nvidia’s chips are under government scrutiny, about the move and he “responded positively.” Yeah, right. Nvidia’s current Blackwell and next-generation Rubin processors are not part of the deal, so Xi Jinping knows he is getting yesterday’s technology. I expect him to continue to gently suggest that companies commit to using Huawei AI chips as an excellent way to keep the CEO from disappearing into a labor camp.

We are in a phase of the AI revolution where AI infrastructure, semiconductor supply chains, and data-center buildouts require vast amounts of capital, much of which will wind up in Nvidia’s pocket. Firms with deep liquidity can commit to multiyear investments without being held hostage by funding conditions. The cash reserves of the Mag 7 are huge and growing:

NVDA is a Hold for a $180 first target.

Onsemi (ON – $55.97) signed a memorandum of understanding with Innoscience to explore expanding production of gallium nitride (GaN) power devices using Innoscience’s proven 200mm GaN-on-silicon process. The collaboration would combine onsemi’s system integration, drivers, and packaging expertise with Innoscience’s GaN wafers and high-volume manufacturing leadership to bring cost-effective, energy-efficient solutions to market faster and accelerate GaN adoption. They are targeting the projected $2.9 billion total addressable market by 2030 for GaN power devices. ON is a Buy under $60 for a $100 first target.

Palantir (PLTR – $187.54) launched Chain Reaction to build American AI infrastructure. They said the bottleneck to AI innovation is no longer algorithms, it is power and compute. America is at an inflection point in the energy infrastructure buildout, and it requires software built for an entirely different scale. Chain Reaction is designed to address this directly by accelerating the AI buildout with energy producers, power distributors, data centers, and infrastructure builders. Founding partners include CenterPoint Energy, a major electric and gas utility headquartered in Houston, and Nvidia.

The US Navy will deploy Palantir’s Foundry and Artificial Intelligence Platform (AIP) across the nation’s Maritime Industrial Base (MIB). The ShipOS initiative authorizes up to $448 million to accelerate the adoption of artificial intelligence and autonomy technologies across the industrial base. Secretary of the Navy John Phelan said: “For decades, Americans have watched billions of their tax dollars poured into a maritime industrial base plagued by bureaucracy, delays, and chronic shortfalls. Today, we are finally delivering real change for the American taxpayer, for our world-class workforce, and for the Sailors and Marines they keep in the fight and support.”

PLTR is a Buy under $160 for a $200 first target.

PayPal Holdings (PYPL – $61.69) was downgraded by BofA from Buy to Neutral. They cut their target price from $93 to $68, saying efforts to reinvigorate growth in its core branded checkout are taking longer than expected and limits near-term upside.

JPMorgan piled on, downgrading from Overweight to Neutral. They cut their target price from $85 to $70 because they view 2026 as a “show-me execution year and an investment year” for the company.

They’re right! 2026 is a show-me execution and investment year, and I expect the stock to “show them” and exit the year over $100 a share. PYPL is a Buy under $75 for a double in three years.

Small Tech

Fastly (FSLY – $10.43) sold $160 million of 0% convertible senior notes due in 2030, with a $20 million “green shoe.” 0% interest and a $15.26 conversion price? Me likee! FSLY is a Buy under $10 for a 3- to 5-year hold to $50+.

Primary Risk:Content and applications delivery networks are a competitive area.

PagerDuty (PD – $13.03) achieved the Amazon Web Services (AWS) Resilience Services Competency in the software category, becoming one of the first AWS Software Partners to earn the designation. This validates PagerDuty’s ability to help enterprises architect, deploy and maintain mission-critical systems that can withstand failures and recover rapidly with minimal business disruption.

Even so, BofA initiated coverage with an Underperform rating because it sees “limited catalysts” ahead. They wrote: “Facing demand headwinds, a pricing model change, and an impending CFO transition, we think it could take multiple quarters for stabilization in key growth metrics, which could constrain investor sentiment and drive relative underperformance versus infrastructure software peers.”

Well, I guess we can all be glad that hackers have stopped hacking and all’s right with the world. And save us from CFO transitions, which in the past have killed stocks like – um – ah – anybody? PD is a Buy up to $30 for a 2- to 5-year hold as their digital operations management Software-As-A-Service gains market share.

Primary Risk: Digital operations management is a competitive area.

QuickLogic (QUIK – $6.41) sold its eFPGA Hard IP to Idaho Scientific, a leader in cryptographic semiconductor solutions. The eFPGA IP enables rapid iteration of new cryptographic techniques and security solutions without the need for multiple tapeouts, helping to reduce design risk and cost, accelerate development schedules, and deliver competitive products to market. Idaho Scientific is flipping the script to deliver a robust cryptographic solution that can adapt faster than external threats.

They also booked an eFPGA Hard IP sale to the University of Saskatchewan’s Semiconductor Technology and Rad-Effects Research Lab (STARR-Lab) to support personalization of its next-generation StarRISC Rad-Tolerant RISC-V Microcontroller. The project is also partially supported by Globalfoundries’ University Research Program and will be taped out with GF 12nm FinFET technology node.

IP sales carry very high profit margins, and these can be booked in the December quarter revenue. QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

ARK Venture Fund (ARKVX – $41.16) has 7.42% of its assets in SpaceX. According to the Wall Street Journal, SpaceX is launching a secondary share sale that values the company at $800 billion — double its recent $400 billion valuation. ARKVX will be able to write up the value of its position. Then, next year SpaceX is planning a mid-2026 IPO as Starlink drives its valuation toward $1.5 trillion, according to Bloomberg. Plus, ARKVX has 4.17% of assets in OpenAI and 3.22% in Anthropic, two other potential IPOs next year.

ARKVX is a Buy for the SpaceX IPO.

Primary Risk: Cathie sells the stock before the IPO.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

Akebia Therapeutics (AKBA- $1.66) CEO John Butler presented at the Piper Sandler Healthcare Conference (AUDIO HERE). For the first time, he said there could be a drop in revenue in 2027 when they go off TDAPA. He said the big clinics pay about $2,000 per patient per year for ESAs while the smaller clinics pay $2,500. Akebia has to match those prices when TDAPA ends – that’s a $1 billion market.

They established a rare kidney disease pipeline comprised of two core product candidates and will enroll patients in Phase 2 trials with each product candidate in 2026.

They acquired all rights to the first product, AKB-097, a tissue-targeted C3d-Factor H fusion protein complement inhibitor, from Q32 Bio. They think the drug has applicability across a wide range of complement-mediated rare kidney diseases. The body’s complement system, a series of proteins that work together as part of the immune system, can become dysregulated, resulting in numerous inflammatory and autoimmune conditions, including multiple diseases of the kidney. Complement inhibitors work by binding to and preventing the activation of specific complement proteins, halting the cascade of inflammatory responses and reducing the destruction of cells. AKB-097 is targeted to the sites of complement activation in tissues and is not expected to result in systemic complement inhibition seen with other inhibitors.

The second drug, praliciguat, is a soluble guanylate cyclase (sGC) stimulator. They are evaluating praliciguat initially in a Phase 2 clinical trial in the treatment of FSGS, a rare kidney disease, and also plan to assess its use in other rare podocytopathies. Buy AKBA up to $4 for the Vafseo launches in the EU, UK, and US. I think GSK and/or Amgen will make a bid for the company.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Compass Pathways (CMPS – $6.94) will host a webinar on January 7 to discuss their commercial preparations for treatment-resistant depression and clinical trial plans for post-traumatic stress disorder. Wall Street still doesn’t realize COMP360 will (1) be approved and (2) be immediately successful. CMPS is a Buy under $10 for a very long-term hold to $200.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2028

Probable time of next financing: Late 2025

Medicenna (MDNAF – $0.87) updated MDNA11 clinical trial results at the European Society for Medical Oncology – Immuno-Oncology (ESMO-IO) Congress and presented an investor webinar (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE).

111 patients with 29 different advanced stage solid tumors have been enrolled in the Ability-1 trial, either in monotherapy or the combination arm with Keytruda. They’ve seen responses in seven tumor types.

MDNA11 had durable anti-tumor activity in Phase 2-eligible expansion cohorts, enriched for immune checkpoint resistant melanoma, MSS endometrial cancer, MSI-H and TMB-H cancers. In each case, it exceeded Objective Response Rate (ORR) benchmarks in these difficult to treat populations. In the monotherapy expansion cohorts, irrespective of tumor type, patients treated with MDNA11 as the next treatment following progression on immune checkpoint inhibitors (ICI), had an ORR of 42% and a disease control rate (DCR) of 83%. This suggests that MDNA11 should be used in earlier lines of treatment.

The monotherapy expansion cohorts had an ORR of 38% and a DCR of 75% in melanoma. In MSI-H cancer, the ORR was 22% and DCR 78%. In combination with Keytruda, MDNA11 showed an ORR of 50% and DCR of 75% for MSS endometrial cancer. MSS TMB-H tumors demonstrated an ORR of 25% and DCR of 88%.

Both monotherapy and combination treatments achieve durable responses in multiple advanced metastatic tumors, including pancreatic, breast, colorectal, endometrial, bladder, anal, and melanoma. Tumor control (responders and those with stable disease) was associated with significantly prolonged median Overall Survival (mOS) in both monotherapy and combination cohorts.

These were positive results across the board. Buy MDNAF under $3 for a first target of $20.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Entering Phase 3

Probable time of first FDA approval: 2026

Probable time of next financing: 2025

Inflation MegaShift

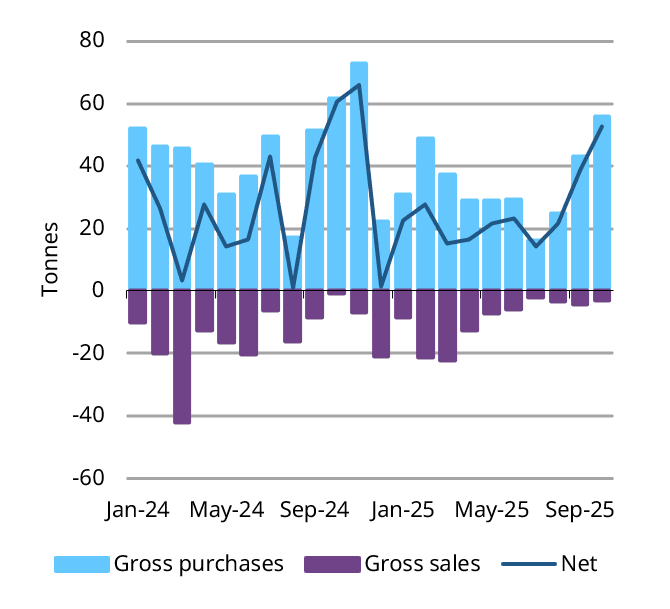

Gold ($4,279.20) rose a bit as central bank gold buying ramped up in October to 53 tonnes, up 36% from September. Year-to-date reported net purchases hit 254 tonnes. That is slower than recent years, probably due to high prices.

Following years of underperformance versus gold, silver broke decisively above its prior all-time high near $50 per ounce to an all-time high of $64.72 an ounce today. As of today, silver has gained 121.1% year-to-date versus “just” 62.8% for gold. Chinese inventories are near their lowest in a decade.

I don’t think this is speculative hype. This is the raw mathematics of supply and demand breaking through the noise. In addition to jewelry and coinage, silver is an industrial metal used in solar energy, electric vehicles, 5G infrastructure, advanced medical tech, and smart consumer electronics. Silver is essential to solar panels – every photovoltaic cell uses it. In 2024, solar panels alone used up 232 million ounces of silver. We are seeing “greenflation” in silver prices because the silver market has been in deficit for eight straight years. In 2025 alone, the shortfall was over 200 million ounces – the equivalent of an entire year of mine supply.

Over 70% of global silver production comes as a byproduct from mining other metals like copper and zinc. That means even if silver prices go to the moon, miners can’t just open the taps and flood the market with new supply. So when demand surges, the supply chain doesn’t respond quickly. The pure silver miners like Coeur and First American make out like bandits.

Right now, the United States imports nearly two-thirds of its silver supply, although much of that is imported from US-owned mines in Mexico. Earlier this year, the US added silver to its critical minerals list. That opens the door to federal action on permits, maybe subsidies or low-cost capital, and even strategic stockpiling.

The fractal dimension is extremely stretched, even for gold. This furious rally needs to consolidate starting now, either by a scary drop, which seems highly unlikely, or by thrashing in the $4,000-$4,400 range for a couple of months.

Miners & Related

Coeur Mining (CDE – $17.48) said its 2025 exploration program at the Palmarejo gold-silver complex located in southwest Chihuahua, Mexico, is its largest exploration campaign since 2012, with approximately 68,000 meters of diamond drilling by eleven drill rigs across its extensive 74,130-acre land package. Only 3% of it has been explored to date. The program has successfully identified numerous resource growth opportunities that represent mine life extension opportunities through a balance of near-mine and district-scale exploration. CDE is a Buy under $10 for a $20 target as gold goes higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Dakota Gold (DC – $5.71) announced more positive drill hole assay results from the Richmond Hill Project. One hole intersected 8.17 grams per tonne gold (g/t Au) over 11.3 meters (93 gram meters). Another intersected 1.45 g/t Au over 18.3 meters (27 gram meters) in a step-out 500 feet north of the current Measured and Indicated resource boundary. DC is a Hold for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

First Majestic (AG – $16.91) closed its convertible senior notes offering for $350 million, which included the full $50 million over-allotment option. The notes only pay 0.125% interest and are convertible at $22.36 per share – cheap money! AG is a Buy under $11 for a $23 next target price as production increases and the price of silver rises.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Paramount Gold Nevada (PZG – $1.17) said that the Oregon Department of Geology and Mineral Industries (DOGAMI) has published the draft consolidated permit package for the Grassy Mountain Gold Project on behalf of all state permitting and cooperating agencies. DOGAMI has scheduled a public hearing for January 29, followed by public comments through February 6. DOGAMI will make any necessary revisions prior to issuing the final consolidated permit package that will provide the regulatory framework for construction, operation, closure, and monitoring of Grassy Mountain. PZG is a Buy under $1 for a $10 target as gold moves higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Probable time of next financing: 2023

Royal Gold (RGLD – $218.52) presented at a virtual non-deal roadshow, hosted by Renmark Financial Communications (VIDEO HERE and SLIDES HERE), and they’ll do another one next week. They are doing the necessary work to get the word out about how the Sandstorm acquisition has changed the company.

Royal Gold has grown their dividend 15% a year since 2000 and is the only precious metals company in the S&P High Yield Dividend Aristocrats Index.RGLD is a Buy under $180.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $91,102.92) continues to steadily rally back from the November plunge. As I said in the last issue, I think 2026 will not show the usual four-year cycle drop – and that will leave a lot of long-term bitcoin believers chasing to get back in for the 2028 halving.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $52.10) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $24.38) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $57.92

Oil has seen choppy trading as the market weighed geopolitical tensions against a price cut on Saudi Arabia’s main grade of crude to Asia. Russian President Vladimir Putin said some points in a US-backed peace plan to end Moscow’s war were unacceptable to him. That means a lifting of sanctions on Russian oil is still elusive, offering support to prices. Putin emphasized that his country’s energy cooperation with India “remains unaffected.” He added that a Russian oil company has been “continuously expanding operations” of an Indian refinery, and Moscow’s oil flows to India are running smoothly.

At the same time, President Trump reiterated that the US will start striking drug cartels on land in Venezuela very soon. Military intervention could force Venezuela’s oil production and exports to drop. Plus, OPEC will keep oil production flat for the March quarter instead of increasing it again, and they’ve agreed to a new audited regime for future oil production quotas, which means less cheating.

Having said that, it’s looking like I was wrong in expecting very high oil prices in 2026. I still think the paper oil traders are way off base on their supply estimates, and demand has held up even better than I expected. But being early is just another way to be wrong, unless we see a sharp snap back in prices directly ahead. That could happen quickly if the Energy Information Administration admits that their 2026 production forecast is way too high – as it is. But if they wait until the end of 2026 to adjust their numbers, the oil recommendations will stay under pressure. We shall see.

The July 2026 Crude Oil Futures (CLN26.NYM – $57.62) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.54) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $8.80) held an Investor Day (AUDIO HERE and REALLY GOOD SLIDES HERE and PREPARED REMARKS TRANSCRIPT HERE) to highlight their repositioned global gas portfolio and outlook for the company.

Their key growth assets are focused on generating excess free cash flow:

You really want to own Vermilion for the next five years:

They sold 30 million shares of Coelacanth Energy for $22.8 million. They still own 80.2 million shares, or 15% of the company. They’ll use the cash to pay down debt. VET is a buy under $11 for a target price of $24 or more.

Primary Risk: Oil and natural gas prices fall.

EQT (EQT – $56.07) is up because natural gas spiked to its highest price in three years – in the weakest seasonal period of the year.

Click for larger graphic h/t @Barchart

EQT is a buy under $70 for a long-term hold for much higher prices.

Primary Risk:Natural gas prices fall.

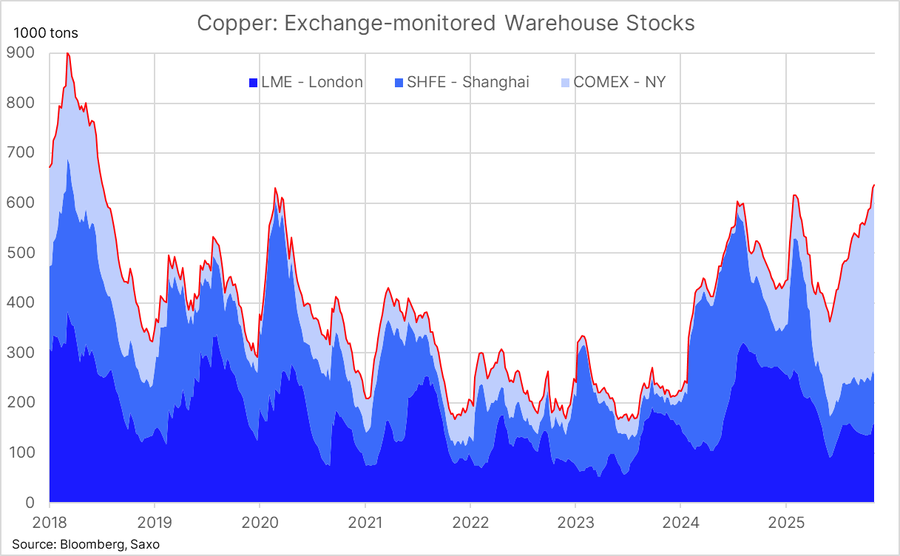

Freeport McMoRan (FCX – $48.11) is hanging in there as copper rose to an all-time high $11,771 a ton after China set domestic growth as its top economic priority for next year, and amid stockpiling of the metal in the US. New demand fueled by data centers and electric vehicles has come up against tight global supply, with smelting capacity growing faster than mines can keep up. A series of mine outages, unfortunately including Freeport’s Grasberg mine, has exacerbated a shortage of raw materials.

Global supply of refined copper could see a shortfall of 450,000 tons in 2026, partly due to this stockpiling in America, analysts from Chinese brokerage Citic Securities said. They think prices must average above $12,000 a ton next year to attract the investment needed in new mining capacity to ensure sufficient supply in the medium- to long-term.

Copper stands out as the strongest industrial metal heading into next year, according to Goldman Sachs, which described it as the firm’s favorite metal for 2026. They see “constrained mine supply growth and structural demand growth from grid & power infrastructure.”

Total exchange-monitored copper stockpiles hit a seven-year high this week – 700 tons. On paper, that is a bearish signal, but the geographical split tells a different story. A record 60% of all visible exchange-monitored inventory is now concentrated in US warehouses, despite the US only accounting for roughly 6% of global demand. This flow is being driven by speculation that the US government may revisit import tariffs next year. With tariff risks looming, these flows are effectively stranding a massive share of global stocks stateside, creating a structural supply squeeze outside the US.

FCX is a Hold for the mid- to high-$40s.

Primary Risk: Copper prices fall.

* * * * *

RIP

CAMRYN

* * * * *

Robert Schumann: Symphony nº 3 “Rhenish” – Leonard Bernstein – Wiener Philharmoniker Orchestre

“He composed it between November 2 and December 9 of 1850, in a bit more than a month. This symphony is inspired by the Rhineland, as Schumann had recently moved there with his family. The symphony was written in a happy period of Robert’s life; it is very uplifting and full of optimism. As I listen to this symphony, it makes me both happy and sad. Happy because the music is very uplifting, sad because I realize these were the last happy years for Robert, as just a few years later, overcome by depression, he would try to commit suicide.” – Vitaliy Katsenelson

* * * * *

Your wondering if we have feudalism Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 12/11/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $278.03) – Buy under $205

Gilead Sciences (GILD – $123.21) – Buy under $115, first target price $150

Meta (META – $652.71) – Buy under $705 for a long-term hold

Onsemi (ON – $55.97) – Buy under $60, first target price $100

Palantir (PLTR – $187.54) – Buy under $160 for $200 first target price

PayPal (PYPL – $61.69) – Buy under $75, target price $150

Snap (SNAP – $7.64) – Buy under $11, target price $17+

Small Tech

Enovix (ENVX – $9.00) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $75.76) – Buy under $75; 3- to 5-year hold

Fastly (FSLY – $10.43) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $13.03) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $6.41) – Buy under $10, target price $40

ARK Venture Fund (ARKVX – $41.16) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $3.74) – Buy under $6, target $30+

Akebia Therapeutics (AKBA – $1.66) – Buy under $4, target $20

Compass Pathways (CMPS – $6.94) – Buy under $10, hold a long time for a 20x return

Editas Medicines (EDIT – $2.56) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $2.13) – Buy under $5, hold a long time

Medicenna (MDNAF – $0.87) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.64) – Buy under $2.50, target price $20, then $50

TG Therapeutics (TGTX – $32.00) – Buy under $30 for buyout at $40+

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($64.04) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $70.32) – Buy under $50, target price $75

Sprott Junior Gold Miners ETF (SGDJ – $89.05) – Buy under $60, target price $100

Sprott Physical Gold and Silver Trust (CEF – $43.63) – Buy under $35, target price $60

Global X Silver Miners ETF (SIL – $83.37) – Buy under $60, target price $100

Coeur Mining (CDE – $17.48) – Buy under $10, target price $20

First Majestic Mining (AG – $16.81) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $1.17) – Buy under $1, first target price $10

Royal Gold (RGLD – $218.52) – Buy under $180

Cryptocurrencies

Bitcoin (BTC-USD – $91,102.92) – Buy

iShares Bitcoin Trust (IBIT – $52.10) – Buy

Ethereum (ETH-USD – $3,252.66)– Buy

iShares Ethereum Trust (ETHA- $24.38) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $57.62) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $33.54) – Buy under $40; $100+ target

Vermilion Energy (VET – $8.80) – Buy under $11; $24+ target

Energy Fuels (UUUU – $15.82) – Buy under $18; $30 target

EQT (EQT – $56.07) – Buy under $70; hold for much higher prices ($100+)

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Nvidia (NVDA – $180.93) – Hold

SoftBank (SFTBY – $59.10) – Hold

Dakota Gold (DC – $5.71) – Hold for $6 target price

Freeport McMoRan (FCX – $48.11) – Hold for an exit in the mid- to high-$40s

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

1st!

VELO was up over 50 percent today as word that Elon Musk was going to put data centers in the sky! And military contracts !

I lost track of further reverse splits after I sold it at a huge 90% loss about 1 year ago. Most NWI subscribers did even worse. What is the split adjusted price now? I suspect most subscribers who are still holding are still big bag holders. Just asking. I doubt I’ll be investing again.

Military contracts were lacking, so most of us bailed. If there are significant military contracts now, govt moves at a snail’s pace.

It closed at $10.83 Friday. The day it was up 50 percent. I was up $2000. and change. The next day it was down 10 percent from profit taking. Then a few days later it was up another good run. I think it has good legs, but that’s just my opinion. Merry Christmas to all and to all a good night!

Look at the chart. It’s in an uptrend. Last month it was up $5,66. Last 3 months it was up $7.72 . Last 6 months it was up $2.96.

VELO closed $15.59 today. Up 43 percent. Also HYMC $24.52 up 49 percent today!

MM – so if SpaceX IPO’s how do we get that value if we buy ARKVX now?

ARKVX is required to write up the value of its SpaceX and other holdings to reflect the latest valuations

Thanks Michael -Great RR. Will there be another before the end of the year? Thanks for the music links as well,

Yes, December 24

60 Minutes last night had a story about “Sarepta’s Elevidys costs $3.2 million for a single-dose treatment, but it may be all that’s needed to slow Duchenne muscular dystrophy.” Can anyone here tell me how that relates to CAPR’s Deramiocel (and how much that costs)? JGMD? Chris?

I didn’t listen to 60 Minutes. I haven’t followed SRPT much. From the grapevine on ST about CAPR, Elevidys got approved with questionable efficacy in studies. 3 or more deaths from its gene therapy are not large numbers, but still scary for safety. Read my (viber7) ST post of 1 week ago about CAPR Hope 3. LVEF showed 91% slowing of LVEF decline vs placebo. If this were to continue for 10 years, I predicted LVEF decline for placebos to 25%, very severe with limited survival, congruent with the natural history of DMD with life expectancy of 25-30 years. But Deramiocel treated patients’ LVEF would only decline to 43%, still with survival prospects of decades more, perhaps for a life expectancy of 60 or more. What’s the price tag? $1 million a year for 30-50 years. So is SRPT’s price for a single treatment at $3.2 million a bargain compared to CAPR’s price for 30-50 years of treatment at $30-50 million? $3.2 million for a treatment of questionable value is a waste of money compared to $30-50 million for a treatment that extends life by 30-50 years. Of course, my projections may be way off and speculative, but I can say that CAPR’s product works and SRPT’s doesn’t and has mortality risks. This is a great story that should be followed for 30-50 years. Few of us will be around at that time, but that’s one motivation for living long to follow it.

Think about it. My father was born in 1927 and introduced me to Dvorak’s New World Symphony around 1967 when RCA Victrola came out with budget $2 for the LP of Toscanini and the NBC Symphony conducting it. Still the most fiery performance of it from 1953. It was written in 1893. There were plenty of people born in 1880 who heard the premiere and Toscanini conduct it in 1953. In its own way, CAPR’s discovery to help DMD patients live a new world of life is comparable to what Dvorak did by writing that New World Symphony.

I am lucky to be a part of investing in CAPR. This fulfillment in being proud of CAPR’s accomplishment dwarfs the money made by shorts whose only goal is to make money by inventing FUD. They don’t give a damn about what CAPR has accomplished.

$1million? Is that even possible that an insurance company would consider that?

$1 million annually for the US incidence of 15,000 cases is $15 billion. Compare to very common HBP, about 100 million US cases. New branded HBP drugs could cost $1000 annually each. Most people are taking cheap generics for life, 30-50 years, but many MD’s are fashionable and like to get them on new drugs pushed by pharmaceutical companies sales reps. Even generic drugs are at least $100 annually. Most patients are taking 1-5 drugs for HBP. Say $200 average total annually X 100 million patients = $20 billion just for drugs. Add the huge hospital costs for heart attacks and stroke which are mainly caused by HBP, and the cost of HBP treatment is much higher. So the total cost for HBP is 1-10 X for DMD. DMD is untreatable except by drugs such as Deramiocel. Although I try to get HBP patients to lose weight by diet and exercise which greatly reduces need for HBP drugs, most doctors just prescribe drugs, and insurers don’t have a second thought. Of course, everyone has sympathy for tragic genetic disease, so insurers are under public pressure to pay.

Look at alternatives. Without effective treatment, these DMD patients suffer from expensive supportive care which costs several $millions over their lifetime. There are other companies competing in DMD, like Satellos mentioned by Chris, and CPIX. These treatments would be a lot cheaper than Dera, but we don’t know how effective they would be. Dera is the first effective treatment for cardiomyopathy. If one day, these prove as effective as Dera, this is the major risk to CAPR stock. But CAPR has the StealthX exosome platform which some say will be even more valuable than Dera for DMD. If Dera has competition in 5 years, StealthX may be CAPR’s value driver after 5 years.

Well said.

Chris, given your relationship with informed people on BioPub, what is your opinion regarding adding shares of NGENF and CAPR at current prices. Do you have an opinion about AKBA?

Also, do you have any other prospects that might be worthy of taking a position?

My RMD $ is coming in and I’m looking to add to current holdings or wait for new ideas to broaden portfolio.

thanks for sharing your insights. I’m sure many here appreciate your participation as much as I do.

Chris, I’m also interested in what Biopub’s has said about Fractyal Health(GUTS)

Biopub has many unanswered questions about Fractyl.

Capr should at least double from here in 2026.

nervgen over time will go way over $50. They are actively pursuing a nasdaq listing. I think nervgen could double from that uplisting.

I’m so glad I held onto half my RKLB when MM said sell. I’ve been using small amounts of the 2x ETF RKLX as trading shares and today RKLB was up 17.69% while RKLX gained 35.14% — almost twice the money gained at half the money risked. Felt so good I had to share.

Good for you, congratulations on doing your own thinking. Sometimes it pays off when you go against the call to sell. Feels great when you turn out to be right.

Chris, Am I safe selling the Jan 16 4.00 dollar calls on MREO or will they get called away?

Greedy bastard that I am, I wouldn’t sell those. I considered something similar, but at $0.50, you are capping your gain at $4.50 minus whatever you paid for shares. Yahoo shows 8 analysts have Price Targets between $5 and 48.20 with a mean of $7.21. While there is a small chance that MREO could pop AFTER Jan 16, if it pops before then, you are leaving money on the table. Suppose the data read pushes the price to $6 or $7, then you can either take profits for a double or triple or decide to sell an $8 call against your shares if you want to hold on for more. Let us know what you decide.

Thanks Chris

I don’t remember seeing this one. Is it new to this group? One we should consider taking a position?

yes

NGENF Any news. It keeps moving up.

NASDAQ uplist imminent. Stock will be “discovered” and funds will be forced to buy.

Chris,

I did so good with your CAPR recommendation that I bought 1000 shares of NGENF at $4.99 yesterday. Thanks again!!

HYMC -Hycroft Mining is on fire. I am up 426 percent. My $3700. Is now $19.540. It’s up 94 percent in the last 5 days. 178 percent in the last month! Unreal! Just FYI Also Freeport is finally getting some love. Copper is all over the web!

New World Investor for 12.24.25 is posted.

MERRY CHRISTMAS!