Dear New World Investor:

Right now, it’s jobs, jobs, jobs and inflation, inflation, inflation.

Jobs: US nonfarm payrolls rose by 64,000 in November. That wasn’t much, but it was higher than the 45,000 jobs Wall Street expected, and up from October’s sharp decline of 105,000 jobs, It was probably just a blip up in the clear downtrend in job growth from its 2022 post-Covid high of 900,000. The unemployment rate unexpectedly ticked higher to 4.6%, its highest level since 2021, and up by 1.2 percentage points from its trough 30 months ago. Since 1950, this has never happened without the economy already being in a recession.

A bigger problem I’ve talked about is the quarterly Business Employment Dynamics report revisions. We have to wait until the January 2026 jobs report to get the final benchmark for the year ended March 2025, but last week’s updated BED report helped confirm my prediction as to where nonfarm payrolls are headed once the annual revision is released (hint: down).

Click for larger graphic h/t Danielle DiMartino Booth

Inflation: The headline November Consumer Price Index was expected to be up 3.1% from last year, but rose only 2.7%. Maybe. The October 1 through November 12 government shutdown had a big impact on data collection. The October inflation number was not calculated at all, and collection efforts for November started late. Anyone who has been to the grocery store or paid a utility bill knows inflation did not suddenly improve a lot between September and November.

On a two-month basis, consumer prices rose 0.2% from September to November, an average rate of 0.1%. In September, prices rose 0.3% on a monthly basis. Excluding food and energy, the core CPI index also rose 0.2% from September to November, slowing the annual rate from 3% in September to 2.6%. If we, or more importantly, the Fed believed it, that was the lowest annual rate since March 2021.

While I don’t think the Fed believes the CPI numbers, I do think they still believe the labor markets are super weak. That’s a big reason they are restarting Quantitative Easing. They gave themselves the flexibility to purchase Treasury note maturities out to three years. It’s a mistake in my view, but it means higher prices in 2026 for precious metals, real estate, other hard assets, and stocks.

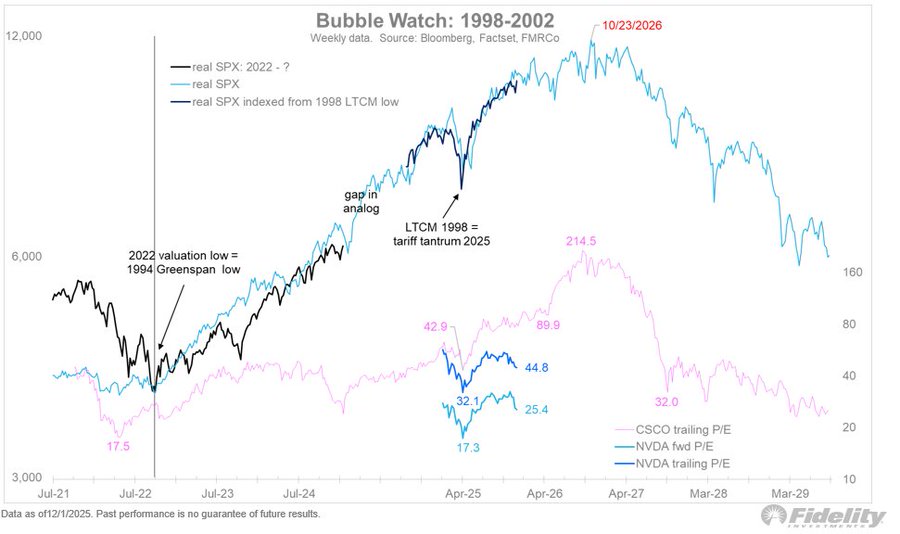

We are far from bubble-like extremes, measured as either time, price, or valuation.

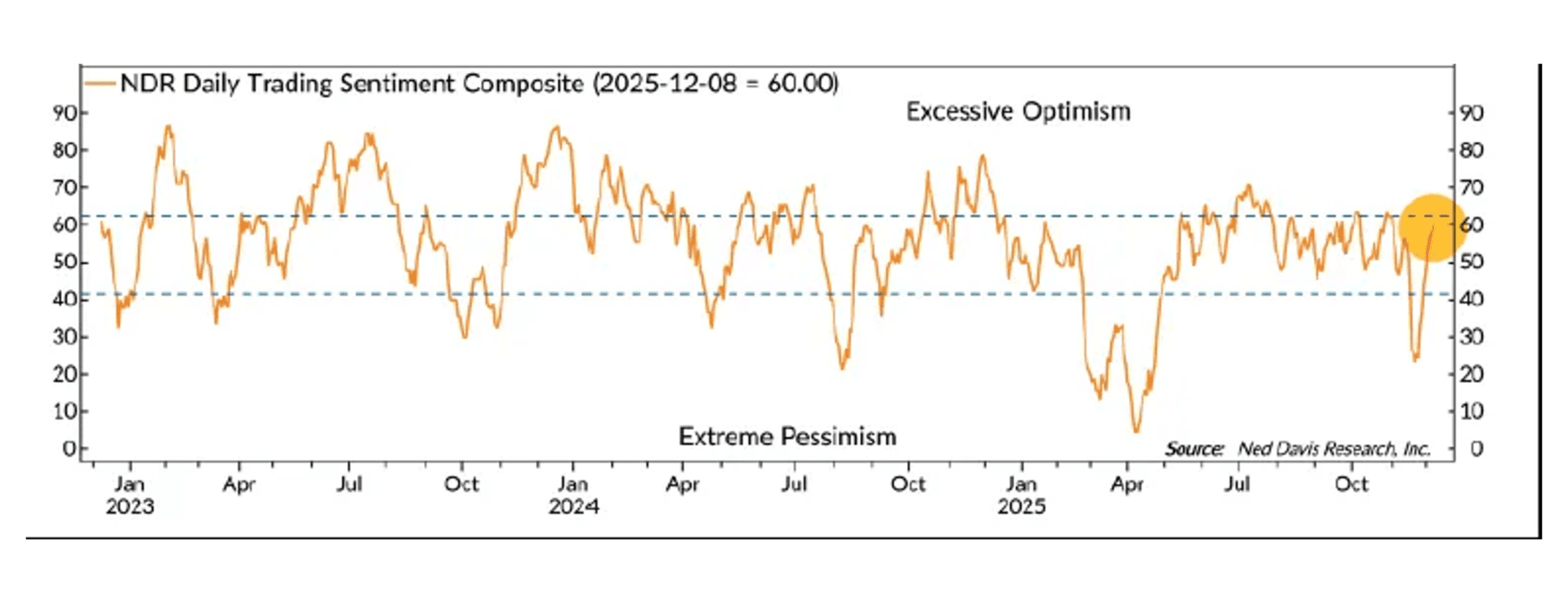

A sentiment gauge compiled by Ned Davis Research, which tracks 20 indicators including volatility, investor positioning, and institutional investor surveys, is sitting below 62.5, the bottom of a range that’s been associated with extreme optimism. Until both institutions and retail are fully on board, stocks can work their way higher.

Market Outlook

The Santa Claus rally is here. The S&P 500 added 4.5% over the last two weeks to a new high today, and is on track for an eight-month winning streak. After similar streaks, three months later the Index was higher 10 out of 11 times, with an average gain of 5%. The S&P is up 17.9% year-to-date.

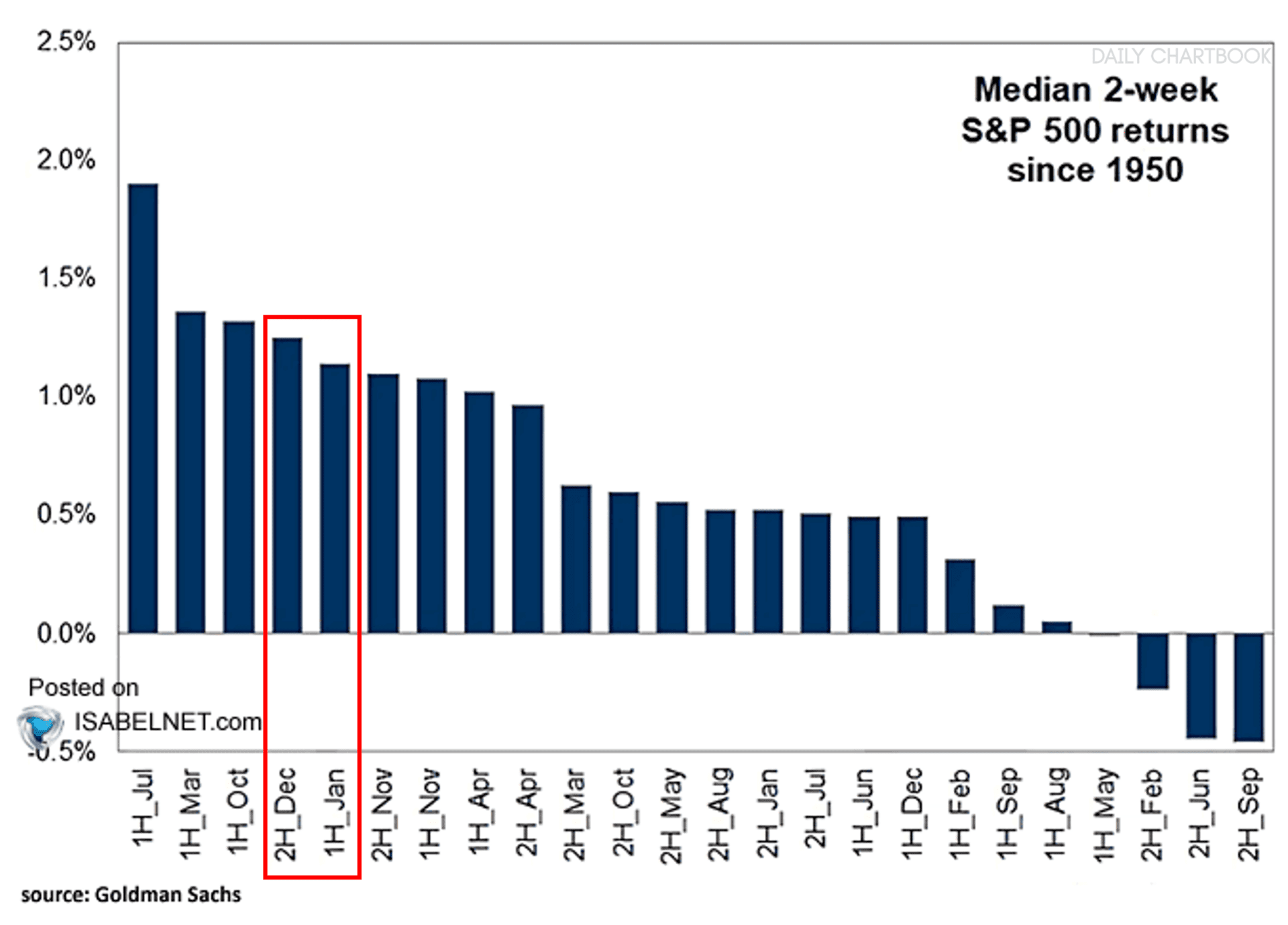

As you probably know, the second half of December ranks as the fourth-best half-month period of the year. The first half of January ranks fifth.

The Nasdaq Composite gained only 0.1% as Wall Street urged institutions to sell AI stocks and buy old economy stuff. They don’t care if they’re right or wrong, they only care that they write a couple of trade tickets. The Naz is up 22.3% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 2.2%, including a 41¢ dividend yesterday. Including the dividend, it is up 39.1% year-to-date. The small-cap Russell 2000 dropped 1.6% but is up 14.3% in 2025.

The fractal dimension went through full consolidation as the Santa Claus rally hit. The year-end corporate contributions to pension plans and personal contributions to 401-Ks can keep the rally going for a week or two, but it is out of energy and on fumes. I expect a pullback early in 2026 when I’ll move a couple of Holds back to Buys.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

SCYX ScyNexis –First new antifungal in 20 years

Economy

The delayed first estimate of September quarter GDP was a robust +4.3%, a full percentage point above the +3.3% consensus. It even was above the Atlanta Fed’s +3.5% estimate, which probably means it will be revised down a bit in the next two estimates. Still, it was a strong number. And, although it’s early days, the Atlanta Fed’s GDPNow model’s first estimate of December quarter GDP is +3.0%.

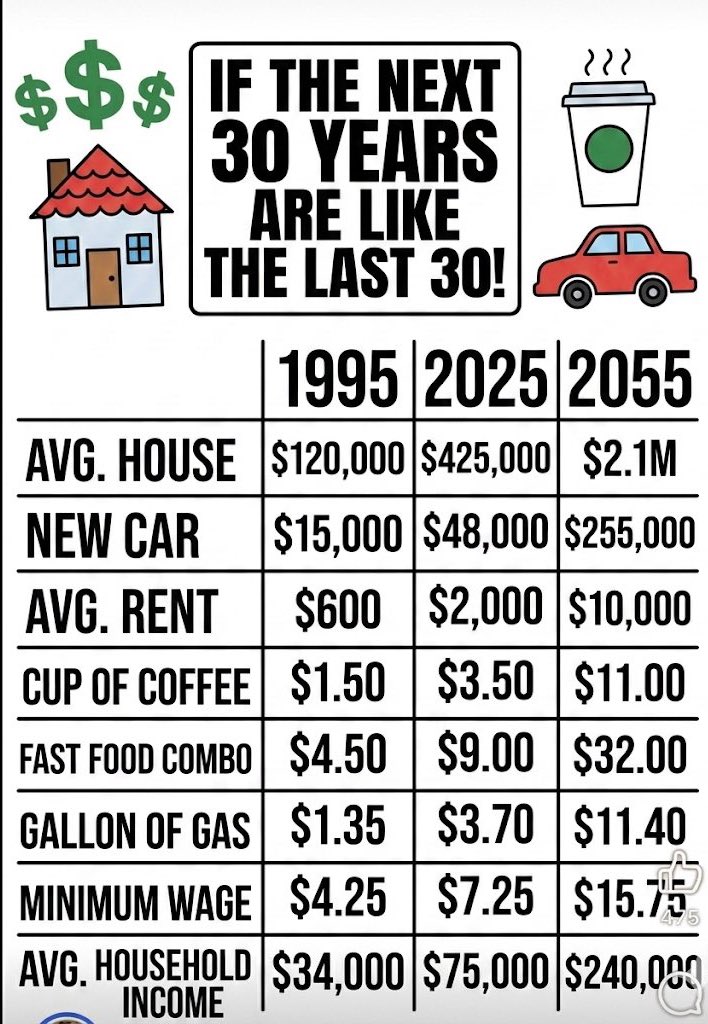

What is going on? Not to get too deep in the weeds here, but in 2026, I think the surprising story will be about the velocity of money (say what?). The Trump Administration clearly thinks the Fed’s monetary policies have facilitated unsustainable government spending growth, malinvestment, the K-shaped economy, and exacerbated the wealth divide. I don’t think that’s the whole picture because it was the President and Congress that gave us the unsustainable government spending growth in the first place. I do fault the Fed for funding it at very low interest rates.

The Trump Administration plan is to reduce the Fed’s role primarily by offering bank regulatory relief to reduce state control over capital allocation. Less or looser regulation means easier lending standards, which will increase the velocity of money. An increase in the velocity of money should finance a strong capital investment cycle, similar to the 1960s.

Their plan, if executed effectively, will increase capital spending and productivity growth, while reducing inflation and stabilizing the federal debt through higher tax receipts. It worked in the 1960s and it can work again. The challenge will be avoiding a repeat of the 1970s

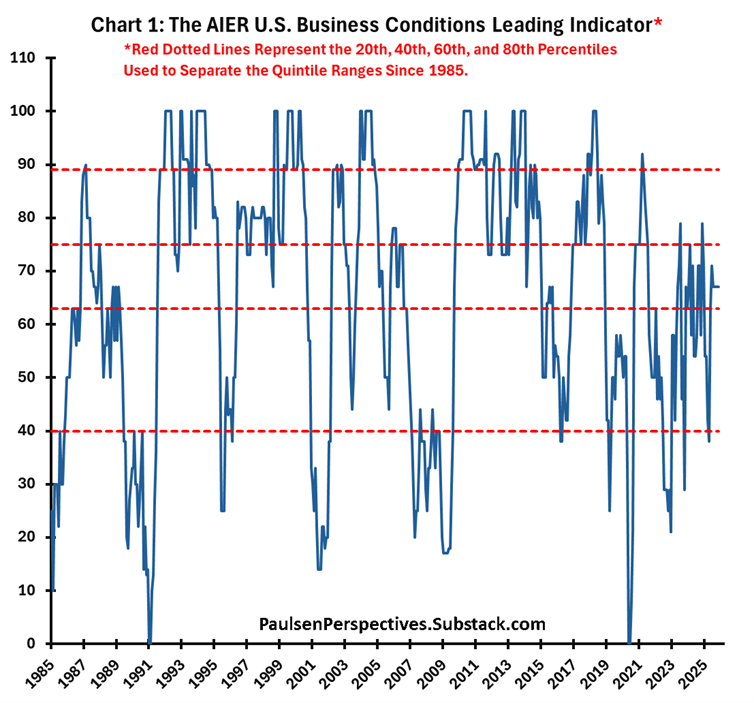

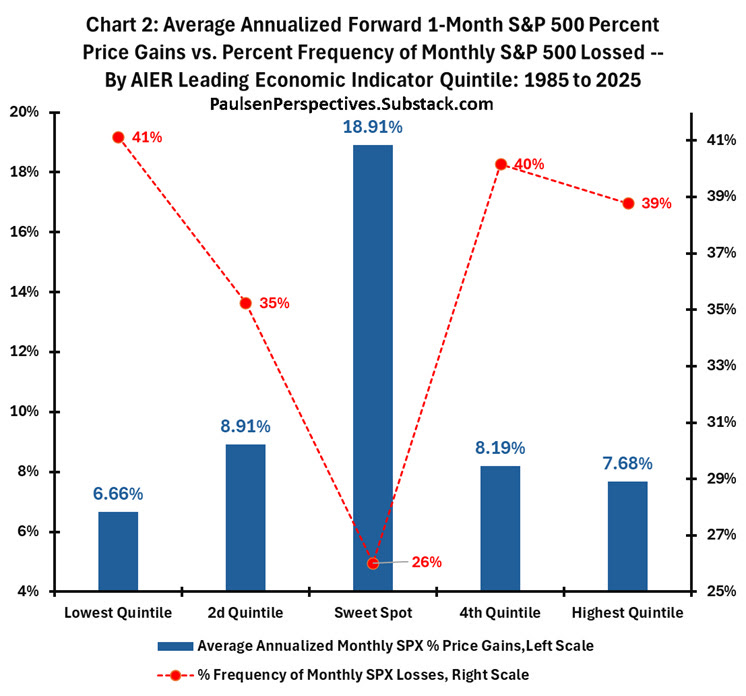

The always-interesting Jim Paulsen found the Sweet Spot Index, which highlights the concept of a sweet spot in the economy for stocks. The American Institute for Economic Research (AIER) publishes a monthly business conditions leading indicator, composed of 12 forward-looking economic metrics that tend to change direction before the overall economy does.

The red dotted lines separate the index into quintiles. The index reached its bottom quintile lows during the recessions of 1990, 2001, 2009, and 2020. Top quintile readings were generally either when economic growth surged early in new economic expansions just coming out of recessions (1992-93, 2003, 2010-11) or near the end of economic expansions when overheat conditions often emerged (1999-2000, 2018-19).

But it has only been the more moderate middle quintile that has truly been “sweet” for investors.

For all months since 1985, when this leading economic index was in its middle quintile sweet spot, the forward one-month average annualized S&P 500 percent price gain was 18.91%, much better than the average annualized percent price gains of only 7.86% during the rest of the time.

Plus, the risk of suffering monthly S&P declines was also notably less. When the economy was in the sweet spot, the S&P suffered monthly declines only 26% of the time compared to nearly 39% when the economy was not in the sweet spot quintile. Historically, since 1985, a sweet spot economy has delivered almost 2.5x higher returns with 33% less risk of losses.

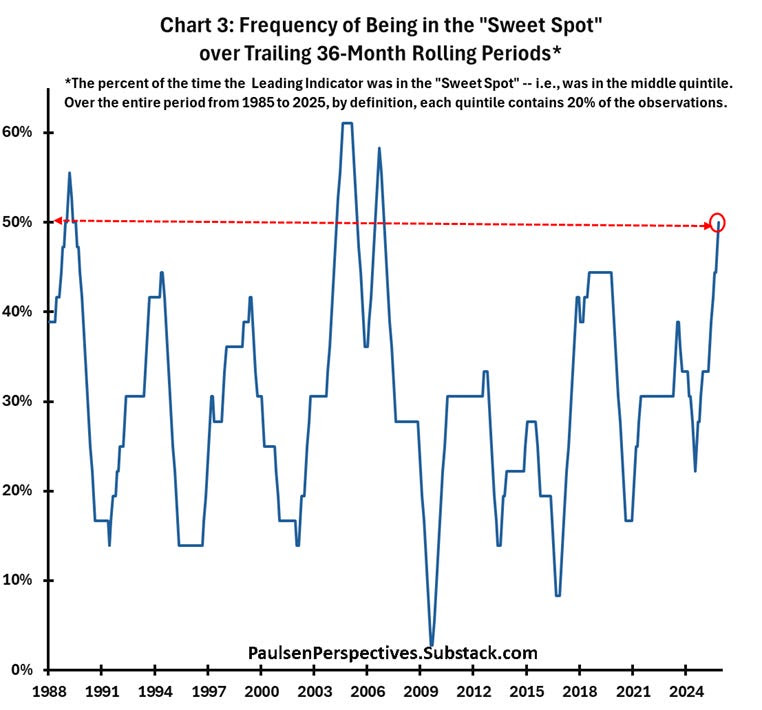

The Fed is afraid of inflation, Wall Street and consumers are afraid of a recession, yet during the last 36 months, the economy has been in its sweet spot quintile 50% of the time. Despite all the hand wringing, the stock market has been rising steadily at an almost 20% annualized pace during the last three years. Maybe investors just need to chill.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Thursday, December 25

Merry Christmas! – markets closed

Thursday, January 1

Happy New Year! – markets closed

Saturday, January 3

Happy anniversary to bitcoin! The first bitcoin block was mined on January 3, 2009, around 6:15pm server time. It would take another six days for the second block to be mined. Bitcoin founder Satoshi Nakamoto left a message in the code for the block, commonly referred to as Block #0 or the Genesis Block. The message read, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” That line comes from a London Times article from the same day that detailed a bailout of banks from the British government. While Nakamoto never stated the meaning of the message, many believe it is a reference to why bitcoin was started in the first place: To cut banks out of the financial process.

Wednesday, January 7

CMPS – Compass Pathways – 10:00am – Webinar on Commercial Preparations for Treatment-Resistant Depression (TRD) and Clinical Trial Plans for Post-Traumatic Stress Disorder (PTSD)

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Gilead Sciences (GILD – $125.67) exercised an option to license Assembly Biosciences (ASMB) herpes simplex virus helicase-primase inhibitor programs for recurrent genital herpes. The deal covers two Phase 1 oral candidates that inhibit the enzyme viral helicase-primase, which is necessary for herpes virus replication.

The company signed a three-year agreement with the US government that addresses all requests by President Trump to implement a new pricing strategy that prioritizes American patients, ensuring the US no longer bears a disproportionate share of global healthcare costs. It includes discounts for Medicaid similar to what is paid in comparably developed nations, including select medications to treat HIV, hepatitis C, hepatitis B, and COVID-19. Gilead will price future medicines at parity with other developed nations. They launched a Direct-to-Patient Program to buy Epclusa, their hepatitis C treatment and cure, at a discounted cash price via TrumpRx.gov.

In return, Gilead gets an exemption from the pharmaceutical tariffs for three years, provided they further invest in manufacturing in the US. GILD is a Long-Term Buy under $115 for a first target of $150.

Meta Platforms (META – $667.55) did a software update for their AI glasses that lets users hear people talking more easily in a noisy environment. The update also includes a new Spotify feature that plays a song that matches what’s in a user’s view.

The company announced the launch of Disney+ on Meta Quest. META is a Buy under $705 for a long-term hold.

Nvidia (NVDA – $188361) will start H200 shipments to China by mid-February, before the lunar New Year, according to Reuters. Initial shipments of 40,000 to 80,000 chips will come from inventory that I believe has been written down to $0.

According to Reuters, Google is devoting more focus and resources on their TorchTPU initiative to lessen Nvidia’s advantage with its CUDA software platform, with some help from Meta Platforms. Google wants to run the AI software framework PyTorch more smoothly on its tensor processing units (TPUs). PyTorch has long been associated with Nvidia’s CUDA platform, since it was released in 2016. Last month, it was reported that Meta plans to use Google’s TPUs in order to decrease its reliance on Nvidia GPUs.

As I’ve said, GPUs are for training AI models and TPUs are for running inquiries against them. This is no threat to Nvidia’s core business.

NVIDIA joined the Department of Energy’s (DOE) Genesis Mission as a private industry partner. The Genesis Mission, part of an Executive Order recently signed by President Trump, aims to redefine American leadership in AI across three key areas: energy, scientific research, and national security. NVIDIA will integrate a discovery platform that unites the government, industry, and academia. DOE officials expect the Genesis Mission to double the productivity and impact of American science and engineering, and deliver decisive breakthroughs to secure American energy dominance, accelerate scientific discovery, and strengthen national security.

This morning, Cantor Fitzgerald pointed out that NVDA is trading at just 16x their earnings estimate, even as Blackwell-trained large language models are just starting to occur, and a rack-scale “supercycle” with Blackwell and the upcoming Vera Rubin line of GPUs kicking into gear. They wrote: “We are highly confident in reiterating NVDA as a top pick into 2026 and would recommend building positions sooner rather than later.” NVDA is a Hold for a $180 first target.

Onsemi (ON – $55.08) signed a collaboration agreement with GlobalFoundries to develop and manufacture next-generation gallium nitride (GaN) power devices using GlobalFoundries’ 200mm eMode GaN-on-silicon process, starting with 650 volts. The partnership will combine Onsemi’s silicon drivers, controllers, and thermally enhanced packaging with GlobalFoundries’ GaN technology to produce smaller, more efficient systems for applications including AI data centers, electric vehicles, renewable energy, industrial systems, and aerospace, defense, and security. Onsemi will begin sampling the new GaN products to customers in the first half of 2026.

The market is finally waking up to Onsemi’s AI-related growth opportunity. Their AI revenue has doubled year-over-year every quarter in 2025, and their guidance has increased to $250 million this year. They are still booking design wins in data centers, as well as automotive and renewable energy.

The stock is at a forward price/earnings ratio of 23.6x, below its peer average of 27x. I am raising my target price from $100 to $130. ON is a Buy under $60 for a $130 first target.

Palantir (PLTR – $194.17) and Accenture expanded their global strategic partnership and formed the Accenture Palantir Business Group to help enterprises scale artificial intelligence and improve operational decision making. Palantir named Accenture as a preferred global partner for enterprise reinvention. Eventually, I think Palantir could replace SAP and Oracle for Enterprise Resource Planning systems. PLTR is a Buy under $160 for a $200 first target.

PayPal Holdings (PYPL – $60.04) applied to the Utah Department of Financial Institutions and the Federal Deposit Insurance Corporation to establish PayPal Bank, a proposed Utah-chartered industrial loan company. This will lower the company’s cost of funding small and medium-size business loans, improving profit margins. Wall Street is afraid that in order to meet regulatory capital requirements, PayPal will have to reduce stock buybacks or even get de-rated to a bank P/E multiple.

I think that’s silly. The Utah bank will be a very small part of the total company. But PYPL received its third downgrade this month as Morgan Stanley cut the stock from Equal Weight to Underweight, citing slow progress and complexity in improving branded checkout that has yet to boost usage. They also flagged challenges including delayed monetization of Venmo, rising competitive risks, and potential downside to earnings as PayPal continues investing to defend market share.

I disagree. These big turnarounds take time. They already are showing expanding profit margins, growing free cash flow, $6 billion in stock buybacks in 2025, and a new dividend. Earnings are growing 30% a year, they just reported strong September quarter results and raised guidance. All this for a forward price/earnings ratio of 11.5x? I’ll take it! PYPL is a Buy under $75 for a double in three years.

Snap (SNAP – $7.85) is significantly undervalued, and here’s why:

* * They announced a $400 million annual partnership with Perplexity AI

* * They announced a $500 million stock buyback program

* * Their new subscription model is showing 131% annual recurring revenue growth

* * Their first profitable year is likely in 2026

* * Both user and revenue growth exceeded expectations

And the stock hasn’t moved a bit. Yet. SNAP is a Buy under $11 for a $17+ target.

SoftBank (SFTBY – $55.93) CEO Masayoshi Son seems determined to fulfill his $22.5 billion funding commitment to OpenAI by year-end. So far, he has sold his $5.8 billion stake in Nvidia, $4.8 billion of their T-Mobile holdings, and slashed the Vision Fund staff. Vision Fund deals above $50 million now require his explicit approval. He’ll probably use $11.5 billion in undrawn margin loans borrowed against their Arm Holdings stock.

Coincidentally, Goldman Sachs cut their ARM rating from Neutral to Sell with a $120 target.

Because SFTBY has nearly doubled this year, Masa has been able to reduce the number of his personal shares pledged as collateral from 173.6 million to 154.2 million. According to Bloomberg, about 31% of Son’s holdings are now pledged to banks, down from near 39% in March 2020. SFTBY is a Buy under $35 for a first target of $50 and then higher as the discount to hard book value disappears.

Small Tech

Fastly (FSLY – $10.54) was upgraded from Sector Weight to Overweight at KeyBanc with a $14 target price. They cited positive product, financial, and management factors. FSLY is a Buy under $10 for a 3- to 5-year hold to $50+.

Primary Risk:Content and applications delivery networks are a competitive area.

QuickLogic (QUIK – $6.40) said its Prime US government contract to develop Strategic Radiation Hardened high reliability Field Programmable Gate Array technology for the Department of War has been increased to $88 million over multiple years to include GlobalFoundries 12LP fabrication process. They have already taped out a test chip that will be fabricated by GlobalFoundries on its 12LP process. QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

AbCellera Biologics (ABCL- $3.72) settled their patent infringement claim against Bruker (BRKR). Bruker will pay AbCellera $36 million plus future royalty payments on their Beacon Optofluidic platform products. A federal appeals court in May rejected Bruker’s claim that the patent was prior art. Buy ABCL up to $6 for a long-term hold to $30 or more.

Primary Risk: Partnered and owned drugs fail in the clinic.

Clinical stage of lead product: Partnered: Various Owned: Preclinical

Probable time of next FDA approval: 2027-2028

Probable time of next financing: 2026-2027 or never

ScyNexis (SCYX – $0.60) was, for the second time, given six months by Nasdaq until June 15 to get its stock over $1 a share. The last time this happened, they succeeded in closing over $1 for 10 consecutive trading days. If they got the rights to the hospital use of ibrexafungerp back from GSK – this is totally unclear – they could re-license them to another Big Pharma and make Nasdaq happy. Or they could follow Medicenna’s path, tell Nasdaq to shove it, and go on the pink sheets. Or, worst of all, they could reverse split.

Six months is a long time in biotech land, and strong SCY-247 data might be enough to get the stock up. CEO David Angulo said: “In the upcoming year we expect to leverage our balance sheet to complete a Phase 1 study of an intravenous (IV) formulation for our next-generation fungerp, SCY-247, as well as generate proof-of-concept Phase 2 data in the oral formulation of SCY-247 for invasive candidiasis infections.”

Buy SCYX under $2.50 for a target price of $20.

Primary Risk: Ibrexafungerp fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: 2026

Probable time of next financing: Never

Inflation MegaShift

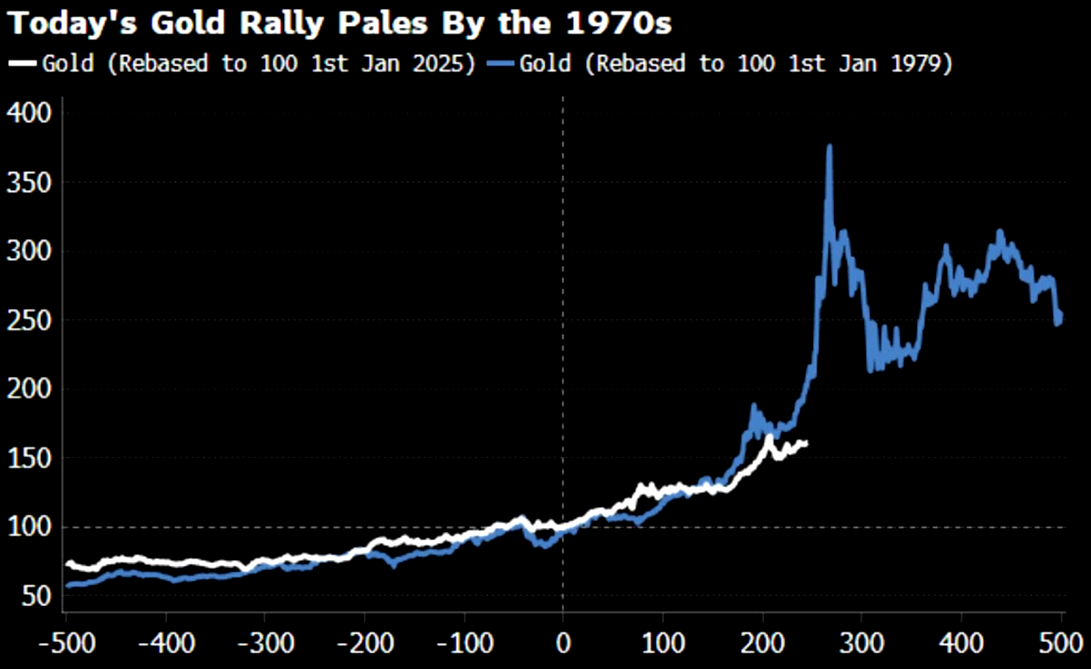

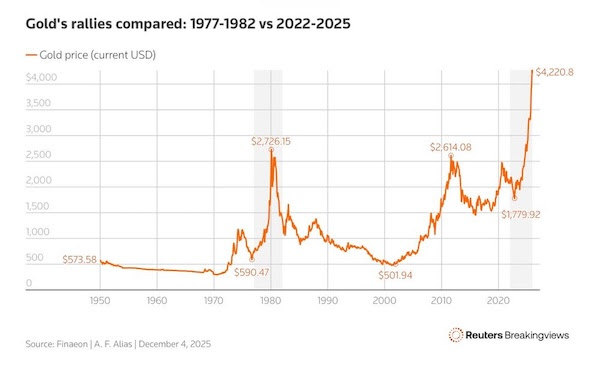

Gold ($4,502.80) set a new all-time high at $4,555.10 today, and still has room to run.

Even though it looks very stretched on a graph of actual prices:

The fractal dimension is ridiculously over-extended. A consolidation is imminent, after which the talking heads will explain that it had to happen because everything’s changed blah blah blah. Then the rally can resume.

Silver hit an all-time high of $71.685 today and has passed Microsoft to become the fifth-largest asset in the world by market capitalization. One ounce of silver is now more expensive than a barrel of oil for only the second time in history. The first was during the COVID-19 oil price panic when, as I predicted, crude oil briefly traded into negative territory. But you haven’t seen anything yet, because…

In a little-noticed decision, China has banned the export of silver slag. That’s the ashy, metallic dregs left over when you’ve finished smelting silver bars and coins. About 70% of the industrial silver that ends up in solar panels, iPhones, and AI data centers starts life as silver slag.

This matters because Wall Street has spent years suppressing the price of silver by selling a few hundred million ounces of paper silver on the Comex just before contract expiration to discourage delivery requests. There isn’t enough real silver at the Comex to meet a tsunami of delivery requests. Traders are suddenly discovering that the mountain of short positions they have sold is backed by the usual silver slag from China nothing.

When the Comex actually run out of deliverable metal – soon – the bankers can’t default. They’ll have to settle in cash at an eye-watering price high enough that some large banks will require new balance sheets. Will the Fed bail them out? Well, they won’t let them fail, but my bet is they make all the other banks pay for much of the bailout. Otherwise, the dollar would tank and surely China didn’t ban the export of silver slag to cause the dollar to lose its reserve currency status. Right? Right?!? Right??!!??

Miners & Related

Dakota Gold (DC – $6.10) will complete their Feasibility Study metallurgical testing program in the September 2026 quarter. They drilled 242 holes in 2025 and it already is obvious that the resource will be dramatically increased. They have intersected gold mineralization as far as 755 feet north of the current Measured and Indicated resource boundary. Drill results continue to confirm widespread gold mineralization and resource growth potential. DC is a Hold for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

First Majestic (AG – $17.21) announces continued exploration success at their Santa Elena Silver/Gold Mine in Sonora, Mexico. New drilling significantly expanded the gold and silver mineralization of the Santo Niño and Navidad discoveries, where they have started preliminary mine planning studies. Third-party metallurgical tests confirmed exceptional recoveries, over 95% for both gold and silver, and compatibility with Santa Elena’s existing processing plant. CEO Keith Neumeyer said these results position the Company for significant resource growth and operational upside heading into 2026.

In addition, the completed drilling at Luna will convert substantial amount of Inferred Mineral Resources to Indicated Mineral Resources for their year-end 2025 Mineral Reserves and Mineral Resources update. They have started the plant expansion project to increase throughput from 3,200 tonnes per day to 3,500 tonnes per day by the end of 2026.

They are raising cash by selling the past-producing Del Toro Silver Mine, a non-core asset, to Sierra Madre Gold & Silver for up to $60 million in cash and shares. First Majestic gets $30 million upfront, and an additional $30 million in delayed and contingent consideration. AG is a Buy under $11 for a $23 next target price as production increases and the price of silver rises.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Paramount Gold Nevada (PZG – $1.18) said the Bureau of Land Management has confirmed that the final Environmental Impact Statement and Record of Decision for the Grassy Mountain Gold Project are scheduled to be issued in January.

Ausenco Engineering Canada will update the feasibility study on Grassy Mountain in the first half of 2026 to reflect the project’s improved economics in a higher metal price environment. PZG is a Buy under $1 for a $10 target as gold moves higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Probable time of next financing: 2023

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

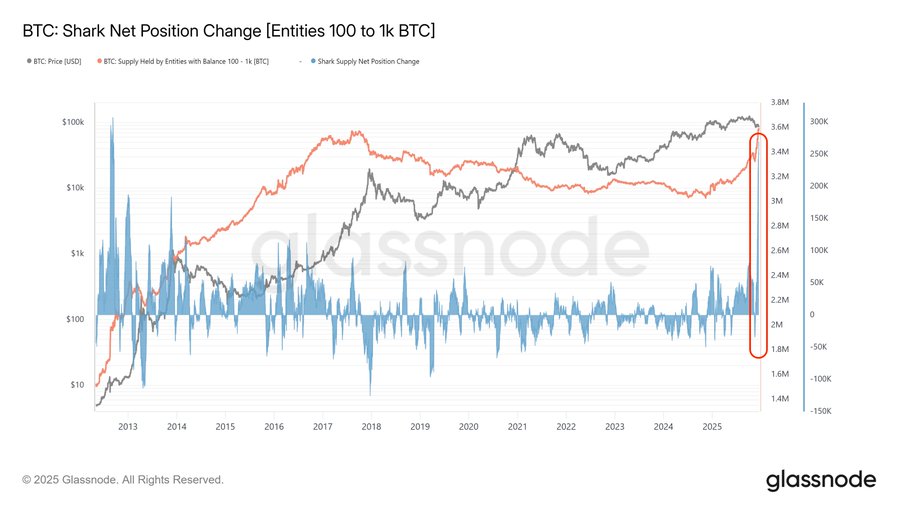

Bitcoin (BTC-USD on Yahoo – $87,257.99) whales have accumulated 269,822 bitcoins worth $23.3 billion over the last 30 days, the most in 13 years.

Click for larger graphic h/t @coinbureau

Beginning in January, Bank of America’s wealth management advisers will be allowed to recommend a 1% to 4% allocation to crypto assets using four spot bitcoin exchange-traded funds — BlackRock’s IBIT, Fidelity’s FBTC, Bitwise’s BITB and Grayscale’s BTC. This brings BofA in line with the wealth management platforms of other major institutions like BlackRock and Morgan Stanley. It also ups the pressure on the dwindling number of holdouts, including Wells Fargo, Goldman Sachs, and UBS.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $49.46) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

Ethereum‘s (ETH-USD on Yahoo – $2,943.83) blockchain was chosen by JPMorgan Chase’s $4 trillion asset-management arm to launching its first “tokenized” money-market fund. The private My Onchain Net Yield Fund (MONY), will hold baskets of short-term debt securities like a traditional money market fund. However, because these assets will be held on the blockchain, it will accrue dividends and pay interest daily. MONY investors will also be able to buy or redeem shares using cash or USDC, the US dollar stablecoin issued by Circle Internet.

As you know, I expect a flood of new companies and services to use the Ethereum blockchain. ETH-USD is a Buy.

Primary Risk: Bitcoin extensions outperform Ethereum.

iShares Ethereum Trust (ETHA- $22.17) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $58.35

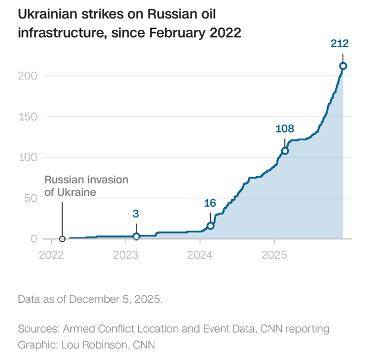

Oil fell below $55 a barrel in mid-December for the first time since February 2021. I feel like I’m Michael In Wonderland. Ukraine attacked another Russian dark fleet tanker, the Dashan, hitting it with a sea drone. Ukraine also attacked an important Russian offshore oil field, the Filanovsky oil platform in the Caspian sea. That’s after attacking the Caspian Pipeline Consortium, responsible for 1% of the world’s oil flow, twice in four days.

Click for larger graphic h/t Bonner Private Research

Not only has Ukraine stepped up its war on Russian oil exports, but the US seized a VLCC tanker near Venezuela carrying a million barrels of Venezuelan crude, and they’re threatening to seize more of them. The world is blowing up oil platforms and seizing tankers and the price of oil falls to it’s lowest level since February 2021?

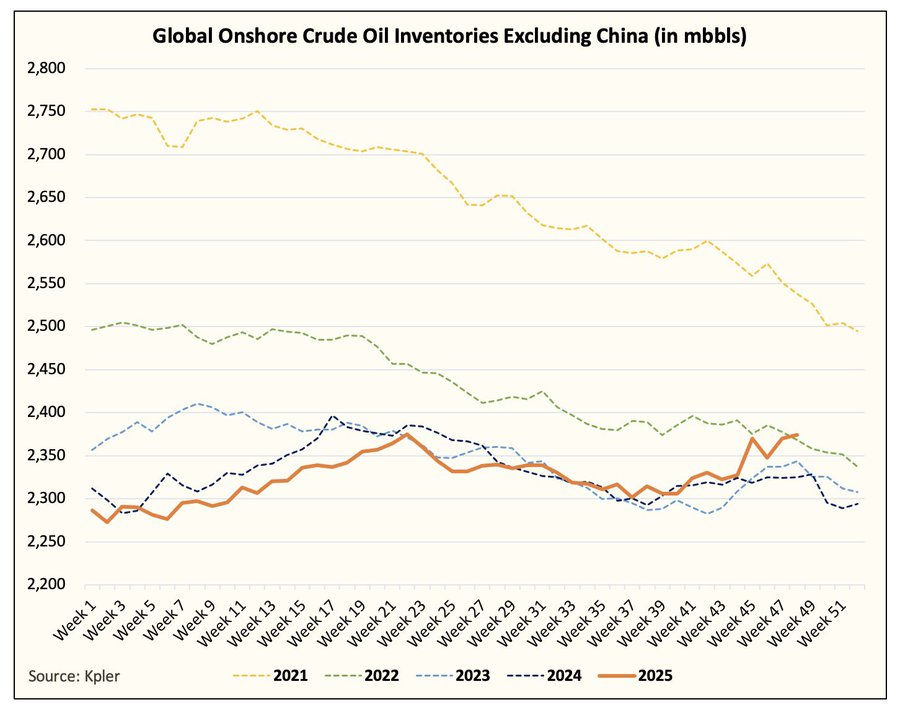

The market has the perception that global oil market balances are way oversupplied. The International Energy Agency (IEA), which has a terrible reputation, does have the potential to influence market sentiment and when it publishes estimates like a 4+ million barrels a day surplus in the March quarter, the market undoubtedly pays attention. Onshore inventories have been ticking up from a very low level.

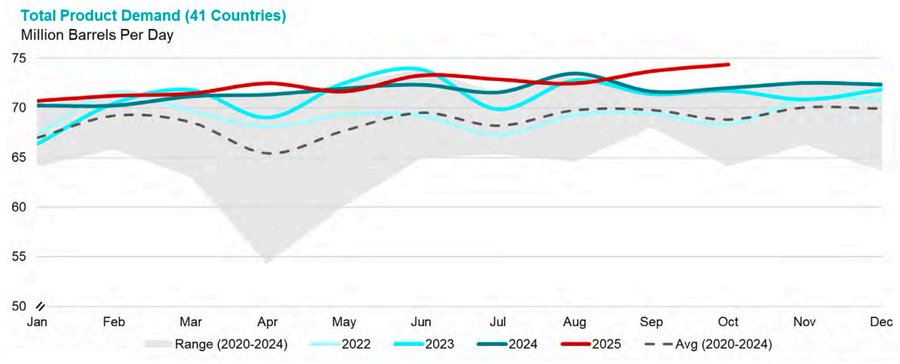

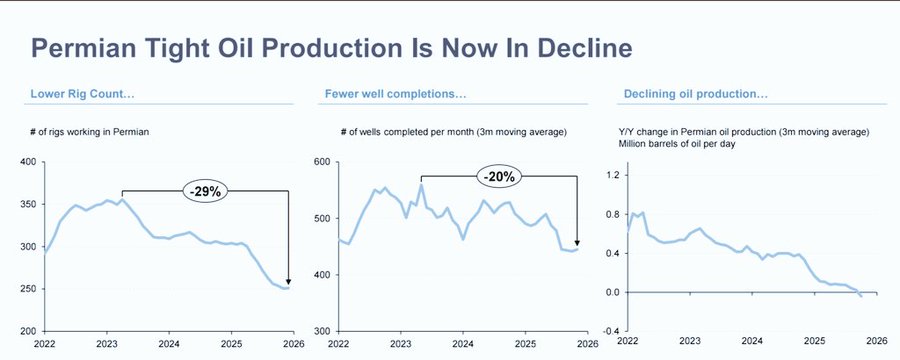

US crude oil production is falling, albeit at a slow pace in December. Here is the coming multi-year oil bull market in a single graph. 2026 is the last year of non-OPEC growth, with OPEC+Non-OPEC declines beginning in 2027 and beyond. With even the biggest bear in the world (IEA) forecasting demand growth to 2050…where’s the oil going to come from?

The Joint Organizations Data Initiative said global oil demand rose by 2.4 million barrels per day in October, year-on-year. This is more bullish than OPEC/IEA growth forecasts.

And here’s an interesting comment from a respondent to the most recent Dallas Fed Energy Survey: “There is no way that the U.S oil production data is correct.”

If we were really facing a massive oil glut, shouldn’t traders already be arbitraging the spreads and driving futures prices down to levels that fully reflect the oversupply? Talking heads confidently predict that things are going to get much worse, but if that’s the dominant, status-quo view of the oil market—one that pretty much everyone seems to share—shouldn’t that bearish outlook already be fully priced in? If the market expects conditions to deteriorate further, why isn’t that expectation already baked into current prices? Managed money is holding record net shorts as speculators bet big on a glut and weak demand. They can always get more short, but the rubber band is very stretched. There are numerous anecdotal indicators I watch in the oil market, but the most reliable one is always the crude timespreads. If the oil market were truly going to be oversupplied by +4 million barrels a day, crude timespreads would be so deep in contango that you would need a forklift.

The July 2026 Crude Oil Futures (CLN26.NYM – $57.97) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.81) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $8.25) sold another 26 million shares of Coelacanth Energy for $19.76 million. They still own 54.2 million shares or 10.2% of Coelacanth. Vermilion will use the proceeds to pay down debt. VET is a buy under $11 for a target price of $24 or more.

Primary Risk: Oil and natural gas prices fall.

Energy Fuels (UUUU – $15.10) said its high purity dysprosium (Dy) oxide produced at its White Mesa Mill in Utah has passed all initial purity and quality assurance and quality control (QA/QC) benchmarks of a major South Korean automotive manufacturer for downstream rare earth permanent magnet (REPM) production. Energy Fuels previously announced that its NdPr oxide, another key ingredient in REPMs, has also been qualified for use in NdFeB magnet applications. The supply of Dy oxide and other “heavy” REE oxides is extremely limited outside of China. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

EQT (EQT – $53.89) will be one of the biggest beneficiaries as natural gas enters a period of structural deficits driven by data center and LNG export demand. They will show over 20% average cash earnings growth from 2026 through 2028. Free cash flow will be over $4 billion, funding continued debt reduction and stock buybacks.

John Mauldin reviewed Michael Spyker’s two guest posts (Part 1 Here and Part 2 Here) for A16Z, the venture capital firm. Spyker says AI and LNG are competing for the same strategic surplus, so the era of cheap natty is over.

He makes a national-strategy argument that if gas is scarce at the margin, the US should burn it domestically to power AI, a globally strategic industry, rather than export it—especially if LNG growth is aimed at price-sensitive developing markets that could be harmed by later price spikes. Restraining LNG export growth could, in his view, nudge global consumers toward renewables while the US internalizes the economic benefit of cheap, reliable power for AI. EQT is a buy under $70 for a long-term hold for much higher prices.

Primary Risk:Natural gas prices fall.

Freeport McMoRan (FCX – $51.92) announced another 15¢ dividend, half base and half variable according to their performance-based payout framework.

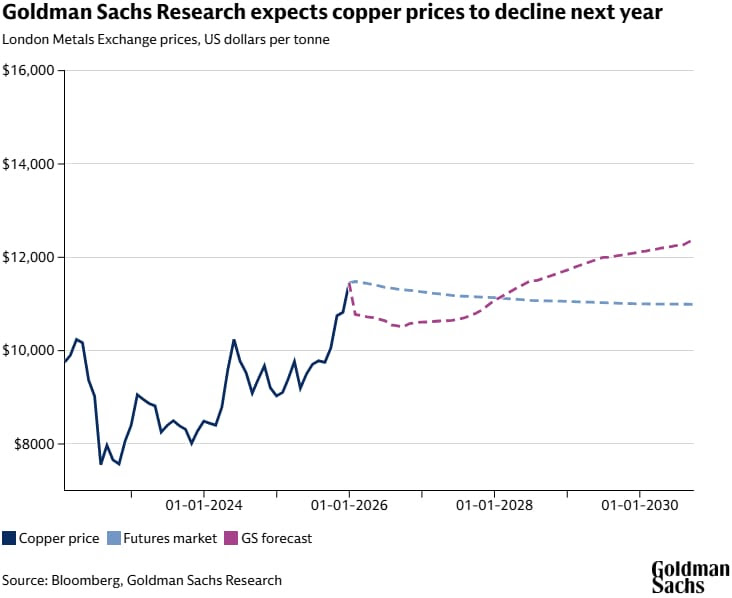

Goldman Sachs Research expects copper prices to decline somewhat in 2026 from their recent highs, but then demand from the grid and power infrastructure, combined with limited growth in supply from mines, to gradually drives prices up again in the longer term.

Copper prices topped $12,000 a ton for the first time ever due to mine outages. I expect copper prices to be up in 2026 as production again falls short of demand. FCX is a Hold for the mid- to high-$40s.

Primary Risk: Copper prices fall.

* * * * *

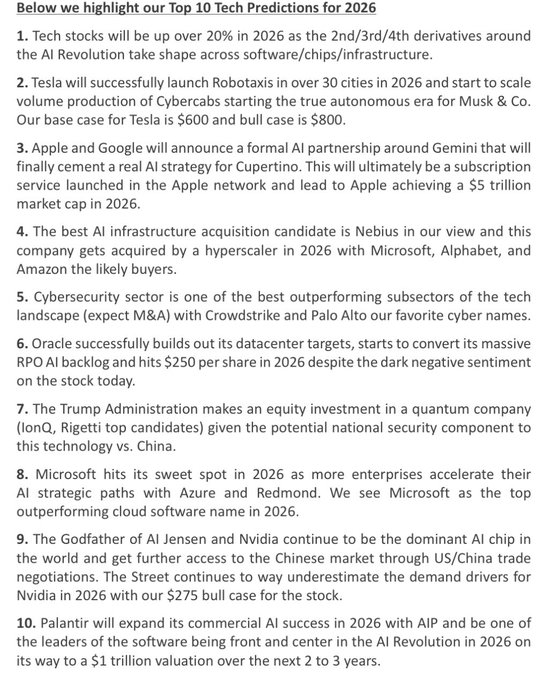

Dan Ives Top 10 Tech Predictions for 2026

* * * * *

How Is The Fed Doing?

* * * * *

Your debating if AI is a bubble Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 12/24/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $273.81) – Buy under $205

Gilead Sciences (GILD – $125.67) – Buy under $115, first target price $150

Meta (META – $667.55) – Buy under $705 for a long-term hold

Onsemi (ON – $55.08) – Buy under $60, first target price $130

Palantir (PLTR – $194.17) – Buy under $160 for $200 first target price

PayPal (PYPL – $60.04) – Buy under $75, target price $150

Snap (SNAP – $7.85) – Buy under $11, target price $17+

Small Tech

Enovix (ENVX – $8.27) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $72.85) – Buy under $75; 3- to 5-year hold

Fastly (FSLY – $10.54) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $13.04) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $6.40) – Buy under $10, target price $40

ARK Venture Fund (ARKVX – $45.88) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $3.72) – Buy under $6, target $30+

Akebia Therapeutics (AKBA – $1.70) – Buy under $4, target $20

Compass Pathways (CMPS – $6.84) – Buy under $10, hold a long time for a 20x return

Editas Medicines (EDIT – $2.21) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $2.25) – Buy under $5, hold a long time

Medicenna (MDNAF – $0.70) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.60) – Buy under $2.50, target price $20, then $50

TG Therapeutics (TGTX – $31.07) – Buy under $30 for buyout at $40+

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($73.27) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $70.32) – Buy under $50, target price $75

Sprott Junior Gold Miners ETF (SGDJ – $87.11) – Buy under $60, target price $100

Sprott Physical Gold and Silver Trust (CEF – $47.20) – Buy under $35, target price $60

Global X Silver Miners ETF (SIL – $87.67) – Buy under $60, target price $100

Coeur Mining (CDE – $18.72) – Buy under $10, target price $20

First Majestic Mining (AG – $17.21) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $1.18) – Buy under $1, first target price $10

Royal Gold (RGLD – $233.11) – Buy under $180

Cryptocurrencies

Bitcoin (BTC-USD – $87,257.99) – Buy

iShares Bitcoin Trust (IBIT – $49.46) – Buy

Ethereum (ETH-USD – $2,943.83)– Buy

iShares Ethereum Trust (ETHA- $22.17) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $57.97) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $33.81) – Buy under $40; $100+ target

Vermilion Energy (VET – $8.25) – Buy under $11; $24+ target

Energy Fuels (UUUU – $15.10) – Buy under $18; $30 target

EQT (EQT – $53.89) – Buy under $70; hold for much higher prices ($100+)

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Nvidia (NVDA – $188.61) – Hold

SoftBank (SFTBY – $55.93) – Hold

Dakota Gold (DC – $6.10) – Hold for $6 target price

Freeport McMoRan (FCX – $51.92) – Hold for an exit in the mid- to high-$40s

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

Merry Christmas everyone from New Zealand !

Let’s hope for a prosperous 2026

“Nvidia (NVDA – $188361)”

Boy I like that price on NVDA — wish I’d seen it in time to sell just a share or two… (and a chuckle as I wish you all a Happy Everything and a Merry Everything Else and a healthy and prosperous New Year).

That’s the target price I’d like to sell a 100 at ! 🙂

Merry Christmas ☃️

MM or anyone:

I want to generate cash by selling options.

Does anyone know of a good service or newsletter that recommends what stocks/contracts/strike prices, etc. ?

Retirement Millionaire

Merry Christmas and thanks to everyone for their recommendations.

MREO Hold or take your loss?

how important/Impactful are secondary endpoints with strong statistical significance? Is that just company speak?

Neither study achieved its primary endpoint of reduction in annualized clinical fracture rate compared to placebo (ORBIT) or bisphosphonates (COSMIC)

Both studies achieved secondary endpoint of improvements in bone mineral density with strong statistical significance

I remember about 20 years ago, bisphosphonates achieved both reductions in fracture rate (great) and increases in bone mineral density (BMD)(good). Fracture rate is the bottom line, most important. I can’t remember the name of a substance that increased BMD, but the quality of the bone was poor, so there was no reduction in fracture rate. Dentists have been worried about a paradoxical problem with bisphosphonates–osteonecrosis of the jaw even though BMD is increased.

INO: https://www.prnewswire.com/news-releases/fda-accepts-for-review-inovios-bla-for-ino-3107-for-the-treatment-of-adults-with-recurrent-respiratory-papillomatosis-rrp-302649910.html

FDA accepts for review BLA for INO-3107 under the accelerated review pathway with a PDUFA date of Oct 30, 2026. INO is down 24% on this news. Why is this so bad? What am I missing?

In the presser they stated that the FDA designated a Standard review classification, which is 10 months. The market was expecting an accelerated review, which is 6 months.

Given INO is now in a position where they need to raise capital roughly equal to their cash burn rate, 4 additional months for review translates into ~$30 million in additional capital they’d need to raise to cover those 4 months.

thanks, now give your assesment of MREO please.

This is a response from MREO to a question I asked. Sounds to me as if they’re unsure of their next steps

The team is continuing to analyze the data with a focus on determining the best path forward.

The two most immediate priorities are to continue the analysis and engage with the regulatory agencies to get a sense for what a potential path forward could look like.

We will provide additional information as soon as we have the necessary visibility.

Regards,

Lee Roth

Thanks Michael for the great RR.

Happy and healthy New Year!

ACHV is still up 6-7% (was 11% for half an hour after the announcement) on a new (long) analysis by Hunterbrook:

https://hntrbrk.com/achieve/

I thank those here who’ve mentioned and discussed this (Chris, JGMD). I’m now up 75% in just under 6 months and am comfortable continuing to hold.

About the same for me. I was suffering at average cost of $4.25 when Chris mentioned ACHV. I bought lots more in the low 2’s almost a year ago after a capital raise. My average is just below 3 now. The trials look airtight. Targets are $10 or way more, depending on acceptance by the large smoking and vaping population.

I knew Dr. Mary O’Sullivan in 1975 when I was a medical student and she was a resident. She was nice, likeable and smart. This is quite an endorsement from her.

JGMD based on your response, I assume you believe ACHV is still a good investment?

JGMD, CHRIS and others. I currently hold CAPR and NGENF and no ACHV. would you suggest adding ACHV for balance or increase holdings of CAPR and or NGEN?

appreciate your thoughts

I have a small stake in NGENF at $1.75. Lately it has been rising on getting uplisted to Nasdaq from Canadian. This is bullshit. The only thing that counts is their trials for the many possible neurological conditions that they might treat. So far, they have proven some benefits, but not life-changing ones. Suppose they get approval based on limited data already known (but even that is very uncertain). To get the kind of efficacy that will convince insurance companies to pay huge $, they need to do many more studies. Yes, the stock might be worth $50 some day, but meanwhile it needs to correct down to about $3 to get me interested in adding to my stake.

AKBA looks to be the best bet at these low prices. Sentiment is angry from disgruntled bulls. Everyone is angry at Butler and company, but launches take time and my bet is that Davita will deliver. The stock is priced for mediocre sales.

Read my latest post about CAPR as viber7 in Stocktwits. I don’t understand the chart on LVEF where they claimed 91% slowing. I think the vertical Y axis is mislabelled. This will have to be corrected, or else the FDA has an excuse to issue another CRL. Hopefully the delay in resubmission of the BLA is being handled properly with proper editing of that chart. The stock could slide if there are more delays of resubmission. Linda had said the goal was to resubmit by Dec 31.

ACHV has risks of sloppy application to the FDA, even though the trials look solid. Efficacy is only fair at about 20%. At least it seems safer than Chantix. If you believe most of the smoking and vaping population will go for the new drug, then the target PPS could be $100 or more. But the launch is likely to be slow. A similar pattern with AKBA, but at least AKBA is priced for mediocre uptake. I hate chasing stocks higher.

Respectfully, JGMD and I see things a bit differently.

For NGEN (formerly NGENF), the uplisting to NASDAQ gives the company much greater visibility. As many people who have tried to buy NervGen shares have experienced, it was not always as simple a task as buying shares of Ford or GM, but will be henceforth. $1.75 was the share price before Phase 2 results were released. With Phase 2 data in hand, the company is substantially de-risked. We knew their drug worked in animal models of not only SCI, but also numerous other neurological disorders. The only question was whether it would work in humans and now we see that it does. While the limited data release in the summer was poorly explained, the November data is extremely impressive . Seeing that this drug works in humans in SCI, I have a strong feeling it will also be therapeutic in humans for other neurological conditions. https://www.nasdaq.com/articles/nervgen-pharma-debuts-nasdaq. Otherwise, I’d be a seller, rather than a buyer.

CAPR? All you need to do is look at the options market to see what the future holds for CAPR. With the stock trading at $26 today, why are people willing to pay me $6 just for the OPTION to buy it at $50 2 years from now? Clearly, some think CAPR will be well over $55 in the next 24 months.

ACHV? Execution risk is always a factor. The FDA is clearly on ACHV’s side at this point. I am betting their novel internet marketing will be a bold new step that millwork. If not? They can always do it the old-fashioned way.

I think all 3 of these will average triple digit gains in 2026.

CAPR–read my (viber7) ST posts today about the 12/17 PPMD presentation. This was the most informative of all. At 23 and 26 min, slides 13 and 15 right panels show how they arrived at 91% slowing for LVEF, and 120% slowing (aka actual mild improvement vs big decline for placebo) for established cardiomyopathy with MRI confirmation with late gadolinium enhancement. LVEF well presented, fabulous. But I have a new concern. Listen at 57 min to Mark Awadalla who reveals that 20/106 patients were taking exon skippers at baseline. He hems and haws about whether the Dera and placebo patients were equally matched for exon skippers. I put in a call early this afternoon but got the voicemail. The site doesn’t reveal their emails. How to get in touch with them otherwise? It is probably too late. I should have noted this potential problem weeks ago. Do exon skippers even work? Maybe this is as irrelevant as whether the groups took showers at the same time.

NGENF–how much quality of life improvement did 291 show by that Nov PR on uplisting? Did the patients dance like Fred Astaire, or did they move 1 more finger than placebos? Much more work needs to be done for insurance to pay big bucks. They won’t pay a million bucks yearly for minor improvements.

ACHV–will most smokers and vapers go for it? For its modest efficacy with low side effects, what % have to be on it to get $100/sh or even $20? This reminds me of ARNA’s diet pill which was minimally effective and flopped. That stock crashed until it reinvented itself with autoimmune GI disease.

AKBA–I still say this is the biggest sleeper as being the most hated.

anyone have thoughts on Silver delivery squeeze sounds like contracts and real metal may be disconnecting.

How do you like Global Foundries.

Michael with gold moving higher, and PZG’s expected federal permit date three weeks away what do you read into the stock not moving up, anything? thanks

VELO is up $3.72 to $19.38. They received $32 million from the department of war. Customers include Department of War., Space X, US Navy etc. Going profitable in 2026!

With all the reverse splits, what would be the adjusted price of MM’s original “buy below $10, $1.50 is a gift? After I sold out at a 90% loss over 1 year ago, there was a reverse split at 35. Were there subsequent reverse splits? Just guessing, $10 would now be the equivalent of $1000-3000 in Third Reich hyperinflation. Anybody who held thru this Third Reich depreciation is still way under water. Did anyone except possibly you buy de novo recently before the jump?

New World Investor for 1/8/26 is posted.

Paramount Gold Nevada receives federal approval for the Grassy Mountain Gold Project

04:48:53 PM ET, 01/29/2026 – Briefing.com

The Final Environmental Impact Statement incorporates feedback received during the public comment period and reflects the BLM’s rigorous environmental, socio-economic and alternative analysis to support responsible development on federal lands for the benefit of all stakeholders.With the inclusion of Grassy Mountain on the United States Federal Permitting Improvement Steering Council FAST-41 Transparency Projects Permitting Dashboard in May 2025, the project has benefited from a streamlined and transparent review process for federal approval.

PZG up over 30% after hours.

MM: if you could weigh in on the next Radar Report. It does seem PZG will have be acquired to get the value from this mine.