Dear New World Investor:

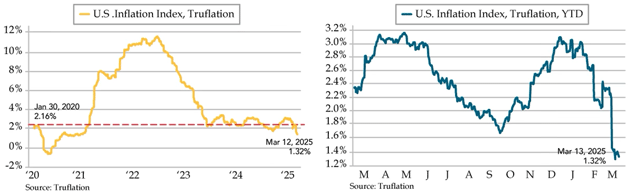

Inflation is collapsing. @DiMartinoBooth wrote: “Per Truflation, on a time continuum, their metric tells you with near-perfect accuracy where the CPI will be 45 days hence. There was thus no irony in TJM Institutional Services’ Mark Gomez sharing first thing this morning that Truflation had printed at 1.32%, down from 2.70% when Federal Reserve policymakers last convened on January 31.”

Does that mean the economy is slowing? Yes. Into a recession? Too early to tell, but a short,shallow recession would make a lot of sense, even though the third estimate of December quarter real Gross Domestic Product growth was raised a bit to +2.4% thanks to a yearend surge in consumer spending. That still was below the September quarter’s +3.1%. It brought the full 2024 year in at +2.8%, virtually the same as 2023’s 2.9%.

The Atlanta Fed’s GDPNow model forecast for March quarter real GDP projects a 1.8% decline. Adjusted for imports of gold, which can be treated as a one-time effect, it shows a measly 0.2% advance. The Blue Chip economists are starting to cut their forecast but still average +1.6%. We’ll see the first estimate on April 30 and it sure looks like it will be low. The government employment and spending that DOGE is targeting supported growth in 2023 and 2024, and that is going away.

Market Outlook

The S&P 500 added 0.5% since last Thursday as tariff fears and hopes alternated. The Index still is down 3.2% year-to-date. The Nasdaq Composite edged up 0.6% but is down 7.8% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 1.2% even though biotech is not affected by the tariffs. It is down 5.0% year-to-date. The small-cap Russell 2000 was virtually unchanged, dropping 0.1%, and is down 7.4% in 2025.

The fractal dimension still isn’t showing a new trend as it continues to consolidate the big Trump rally. It won’t take much of an upmove to set off the next leg of this bull market.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX – ScyNexis – Announce resolution of the manufacturing problem, lifting of clinical hold, restart of MARIO trial, maybe GSK files for hospital use approval

EQT EQT –natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Coming Events

All times below are ET.

Monday, March 31

AG – First Majestic – Through 4/2 – Investment U Conference

Tuesday, April 1

AG – First Majestic – Through 4/2 – Mining Forum Europe

Friday, April 4

March payrolls – 8:30am

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple‘s (AAPL – $222.85) Worldwide Developers Conference is scheduled for the week of June 9-13. I expect significant enhancements to Apple Intelligence. AAPL is a HOLD – I expect to move it back to Buy under $175 for new iPhones.

Corning (GLW – $46.56) introduced Gorilla Glass Ceramic, a transparent, strong, glass-ceramic material that significantly improves drop performance on rough surfaces compared to competitive aluminosilicate glasses.

They also introduced GlassWorks AI solutions, a one-stop shop of customized data center products like cable and connectivity solutions plus network planning, design, and deployment support services to help operators build the dense fiber infrastructure required for generative AI both inside the data center and in the long-haul networks that connect them.

Inside an AI data center, increasingly large clusters of graphical processing units (GPUs) require a dense optical infrastructure on a massive scale. Corning’s new high-density cables and connector assemblies can accommodate 36x more fiber connections within a data center rack unit than a legacy LC connector. GLW is a Buy under $33 for a $60 target in 2025.

Micron (MU – $91.16) confirmed they sent a letter to customers on Tuesday raising memory prices. On the recent earnings conference call, they forecast third-quarter adjusted gross margin of about 36.5%, marginally below analysts’ average estimate of 36.9%. But that forecast was a sequential drop of three percentage points, which hurt the stock. The margin weakness is in NAND flash memory, where customers are working through the last of their inventories. I’m sure the price increases are for DRAM and especially high-bandwidth memory (HBM). MU is a Buy under $102 for a $140 first target.

Nvidia‘s (NVDA – $111.43) next major AI innovations will be in robotics, according to CEO Jensen Huang. Humanoid robots are going to transform life over the next decade, and NVDA is an excellent way to invest in them.

The stock has been weaker than I expected after the GTC Conference. As long as it’s trading below the 50-week moving average, now at $120, it’s possible that the downside isn’t over. The big traders often try to push a stock trading under the 50-week MA down to the 100-week MA to scoop up cheap stock from panicked retail holders. The 100-week MA is at $85. It probably would take three to six months to get there. As long as NVDA holds above $90.69, it’s still in a bull market.

In response to a question on X about the DeepSeek AI model that caused NVDA to drop sharply – “What’s the best explanation you’ve heard for why China is leaning so hard into open source?” – @balajis wrote a thought-provoking response: “China seeks to commoditize their complements. So, over the following months, I expect a complete blitz of Chinese open-source AI models for everything from computer vision to robotics to image generation.

“Why? I’m just inferring this from public statements, but their apparent goal is to take the profit out of AI software since they make money on AI-enabled hardware. Basically, they want to do to US tech (the last stronghold) what they already did to US manufacturing. Namely: copy it, optimize it, scale it, then wreck the Western original with low prices.

“I don’t know if they’ll succeed. But here’s the logic:

(1) First, China noticed that DeepSeek’s release temporarily knocked ~$1T off US tech market caps.

(2) Second, China’s core competency is exporting physical widgets, more than it is software.

(3) Third, China’s other core competency is exporting things at such massive scale that all foreign producers are bankrupted and they win the market. See what they’re doing to German and Japanese cars, for example.

(4) Fourth, China is well aware that it lacks global prestige as it’s historically been a copycat. With DeepSeek, becoming #1 in AI is now something they actually consider possibly achievable, and a matter of national pride.

(5) Fifth, DeepSeek has gone viral in China and its open source nature means that everyone can rapidly integrate it, down to the level of local officials and obscure companies. And they are doing so, and posting the results for praise on WeChat.

(6) Finally, while DeepSeek was obscure before recent events, it’s now a household name, and the founder (Liang Wengfeng) has met both with Xi but also the #2 in China, Li Qiang. They likely have unlimited resources now.

“So, if you put all that together, China thinks it has an opportunity to hit US tech companies, boost its prestige, help its internal economy, and take the margins out of AI software globally (at least at the model level).

“They will instead make their money by selling inexpensive AI-enabled hardware of increasing quality, from smart homes and self-driving cars to consumer drones and robot dogs. Basically, China is trying to do to AI what they always do: study, copy, optimize, and then bankrupt everyone with low prices and enormous scale.

“I don’t know if they’ll succeed at the app layer. But it could be hard for closed-source AI model developers to recoup the high fixed costs associated with training state-of-the-art models when great open source models are available.

“Last, I agree it’s surprising that the country of the Great Firewall is suddenly the country of open source AI. But it is consistent in a different way, which is that China is just focused on doing whatever it takes to win — even to the point of copying partially-abandoned Western values like open source, which seemed like the hardest thing to adopt.

“On that point: they did build censorship into the released DeepSeek AI models, but in a manner that’s easily circumvented outside China. So, you might conclude they don’t really care what non-Chinese people are saying outside China in other languages, so long as this doesn’t “interfere with China’s internal affairs.”

“Anyway —this is an area I’ve been watching, and my reluctant conclusion is that China is getting better at software faster than the West is getting better at hardware.”

I still think NVDA is a Buy under $125 for a $180 first target.

PayPal Holdings (PYPL – $68.86) has passed $30 billion in global loan originations and has extended more than 1.4 million loans and cash advances to more than 420,000 business accounts globally since 2013. This little-known facet of PayPal’s business works because they have detailed, accurate data on a company’s revenue history. PayPal Business Loans are term loans with fixed repayments and not exclusively for businesses that use PayPal to process payments, while PayPal Working Capital loans are repaid as a percentage of a business’s PayPal sales. PYPL is a Buy under $68 for a double in three years.

Small Tech

Fastly (FSLY – $6.69) announced a new update to Fastly Bot Management, delivering three key features that help organizations defend against fraudulent transactions, scraping, account takeovers, and spam without relying on the always annoying CAPTCHA that leads to poor user experiences and lost conversions. CAPTCHA is practically designed to drive customers away. Fastly’s new Dynamic Challenges, Advanced Client-Side Detection, and Compromised Credential Checking capabilities help organizations stop even the most evasive bots without creating unnecessary friction for paying customers and legitimate users. FSLY is a Hold for March quarter results.

Primary Risk:Content and applications delivery networks are a competitive area.

Redwire (RDW – $9.86) won a NASA contract to launch four additional pharmaceutical drug investigations to the International Space Station using their innovative Pharmaceutical In-space Laboratory (PIL-BOX). They’ve already flown 28 PIL-BOXes to provide drug researchers the ability to leverage the microgravity environment to grow small-batch crystals of protein-based pharmaceuticals. Previous spaceflight investigations showed that growing crystals in space yields a more uniform product with fewer imperfections, which can improve the drug discovery and development process.

The only reason I can think of for the declining stock price is the pending Edge Autonomy acquisition. They just announced that they have received all regulatory approvals required to complete the acquisition, including the Hart-Scott-Rodino antitrust review. The deal will close in the June quarter. Edge is not a “space” company, but Redwire already covers everything from deep space to Low Earth Orbit (LEO) to Very Low Earth Orbit (VLEO). They do a lot of defense business, so adding autonomous drones to their skill set makes sense to me. By this time next year, I think it will make sense to Wall Street, too.

The warrant redemption brought in $82.9 million in fresh cash and some of those holders may be selling. RDW is a Buy under $18 for a $36 first target as space exploration grows.

Primary Risk: A new competitor emerges.

Rocket Lab USA (RKLB – $18.42) went from contract to launch in four months for their fifth Electron launch of 2025 and 63rd launch overall. This one deployed five satellites to expand OroraTech’s constellation connected to a network of advanced thermal sensors for continuous real-time monitoring of wildfires and hotspots. It brings the total count of satellites deployed by Electron to 224. Twenty-one of those satellites were deployed in the March quarter.

This was the third launch from Launch Complex 1 in three weeks. They are targeting more than 20 Electron launches in 2025. Upcoming missions include the next launches in multi-launch contracts to build constellations in space for Synspective, iQPS, and BlackSky, plus launches of Rocket Lab’s Hypersonic Accelerator Suborbital Test Electron (HASTE) for hypersonic technology advancement from Rocket Lab Launch Complex 2 in Virginia. RKLB is a Buy up to $13 for my $30+ target as low earth orbit satellites and space exploration grow.

Primary Risk: A new competitor emerges.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

Akebia Therapeutics (AKBA- $1.93) weakened as the recent stock offering gets absorbed. Usually, short-term traders sell the bounce and long-term investors use the weakness to complete their positions. The deal closed last Friday. Buy AKBA up to $2 for the Vafseo launches in the EU, UK, and US.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Compass Pathways (CMPS – $3.09) completed recruitment in the COMP005 Phase 3 trial for treatment resistant depression. The final participants are completing pre-dosing activities, including a required washout from anti-depressant medications, and those eligible will be enrolled to receive a dose of either 25 milligrams of COMP360 or placebo. After they dose the last patient, a milestone they will announce in the coming weeks, they’ll set the date for sharing the results of the 6-week primary endpoint in June. CMPS is a Buy under $20 for a very long-term hold to a 10x.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2027

Probable time of next financing: Late 2025

Editas Medicine (EDIT – $1.30) CFO Erick Lucera was recruited away, so they named their SVP: Finance Amy Parison as CFO. It’s nice to have a deep bench when you are a small company. EDIT is a Buy under $6 for a double in 12 months and a long-term hold to much higher prices.

Primary Risk: Other companies’ gene-sequencing drugs fail in the clinic.

Clinical stage of lead product: Partnered approved. Owned: Going into the clinic mid-2025.

Probable time of next FDA approval: 2028

Probable time of next financing: Late 2026 or never

Inflation MegaShift

Gold ($3,069.10) will hit $3,300 an ounce by year-end, according to Goldman Sachs. They increased their gold price forecast due to stronger-than-expected central bank demand and solid inflows into bullion-backed exchange traded funds. They wrote: “Central banks — particularly in emerging markets — have increased gold purchases roughly five-fold since 2022, following the freezing of Russian reserves. We view this as a structural shift in reserve management behavior, and we do not expect a near-term reversal.”

They added that inflows into gold-backed exchange-traded funds had “surprised to the upside” – see the Sprott writeup below. The fractal dimension is nearly fully consolidated. I expect the rally to pause for a couple of months before resuming.

Miners & Related

Dakota Gold (DC – $2.70) issued a corporate update after they closed a $35 million financing. They said they now are fully funded through the end of the feasibility study for the Richmond Hill Oxide Heap Leach Gold Project, so they suspended their At-The-Market equity sales program.

CEO Robert Quartermain said Richmond Hill is one of the largest undeveloped gold resources in the US being advanced by a junior mining company. Once they completes the feasibility study in mid-2027 they will start the permitting process. They expect production as early as 2029. With gold trading at record prices and now included as a strategic metal in the latest executive order from President Trump, resource projects that are on the development track to production should benefit from a positive government-supported permitting process. DC is a Buy under $2.50 for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

Paramount Gold Nevada (PZG – $0.38) said the Oregon state agencies voted unanimously to approve all components of Paramount’s mining, processing, and closure scenarios for the Grassy Mountain mine. They will receive draft permits in the June quarter. PZG is a Buy under $1 for a $10 target as gold moves higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Probable time of next financing: 2023

Sandstorm Gold (SAND – $7.65) renewed its stock buyback program to buy up to 20 million shares or 7% of th public float. CEO Nolan Watson said the gold cycle has reset upward, with the price high and going higher.

SAND is a Buy under $10 for a $25 target.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Sprott Inc. (SII – $45.18) said assets in the the Sprott Physical Gold Trust (PHYS) have surpassed $10 billion. Buy SII under $40 for a $70 target price.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

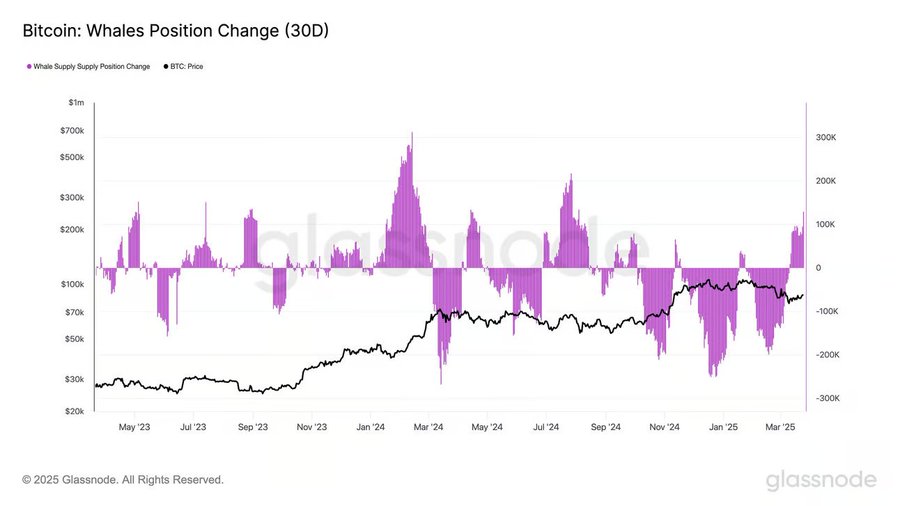

Bitcoin (BTC-USD on Yahoo – $87,286.20) is under accumulation by large (whale) accounts. According to @glassnode: “The 30-day position change for whales shows they’ve added +129,000 BTC since March 11 – with momentum picking up sharply over the past 2 days. That’s the largest accumulation rate since late August 2024, signaling growing confidence from large players.”

Click for larger graphic h/t @glassnode and @dailychartbook

Secretary of Commerce Howard Lutnick floated an idea: “I want to make the USA $2 trillion. I own $1 Billion of MSTR, $200 million of Bitcoin (that will become billions), and I have authority from the President of the United States to buy Bitcoin in ‘budget neutral fashion’ after we sold $5 billion of gold cards. And DOGE (my idea to Elon) is gonna cut $1 trillion from the deficit.”

@luke_broyless wrote:

Step 1: Cut $1 trillion

Step 2: Sell $100s of billions of gold cards

Step 3: Buy $300 billion of Bitcoin

Step 4: Force Bitcoin price up 10x

Step 5: Get Trump’s successors elected after bragging we made the USA literally trillions in Bitcoin during our administration

“Howard Lutnick has a growing probability of being the single biggest NGU contributor in Bitcoin’s history… and it seems like he wants to. You’d have to be a complete idiot to have zero exposure to Bitcoin over the next 4 years. The direction couldn’t be more clear. Pump it, Howard. “

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $49.44) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $15.17) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk:Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $69.91

Oil is edging up as my thesis that US shale crude production is flat to declining finally is going mainstream. Reuters reported that traders are assessing a tightening of crude supplies (finally!) along with new US tariffs. US inventories fell by 3.34 million barrels last week and now sit at the lowest levels in about a month. President Trump is ramping up pressure on Iranian oil exports and implemented a duty on buyers of Venezuelan crude and gas. Reuters also wrote US oil producers face new challenges as top oilfield flags about the Permian basin.

According to data from the Bridgeton Research Group, the paper oil traders who were 82% net short oil on March 17 are now “only” 54% short. I look forward to the day they are 82% long.

The July 2026 Crude Oil Futures (CLN26.NYM – no trades – June closed at $65.42) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $37.63) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $8.25) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $4.02) and Chemours formed a strategic alliance to create a domestic supply chain of critical minerals for the US. Energy Fuels is developing new heavy mineral sands projects expected to produce world-scale quantities of rare earth, titanium ilmenite, and zircon minerals. Chemours mines and separates heavy mineral sands from its mines in Florida and Georgia.

Energy Fuels also is collaborating with South Korea-based POSCO International to create a non-China rare earth magnet supply chain. The agreement links Energy Fuels’ US rare earth oxide production with POSCO’s current position as a leader in traction motor cores used in EVs and hybrid EVs sold by major OEMs all over the world. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

Freeport McMoRan (FCX – $39.98) announced another 15¢ dividend, which includes a base dividend of 7½¢ and a variable dividend of 7½¢. The variable dividend goes up with the price of copper, which has broken out to an all-time high. Freeport’s stock price will follow.

FCX is a buy under $44 for a $65 target within two years.

Primary Risk: Copper prices fall.

* * * * *

* * * * *

Your Always Tell Me The Odds Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 3/27/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Corning (GLW – $46.56) – Buy under $33, target price $60

Gilead Sciences (GILD – $111.16) – Buy under $90, first target price $120

Meta (META – $602.58) – Buy under $655 for a long-term hold

Micron Technology (MU – $91.16) – Buy under $102, first target price $140

Nvidia (NVDA – $111.43) – Buy under $125, first target price $180

Onsemi (ON – $43.76) – Buy under $60, first target price $100

Palantir (PLTR – $90.09) – Buy under $100, target price $150

PayPal (PYPL – $68.86) – Buy under $68, target price $136

Snap (SNAP – $9.17) – Buy under $11, target price $17+

SoftBank (SFTBY – $26.27) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $8.01) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $64.61) – Buy under $60; 3- to 5-year hold

PagerDuty (PD – $19.02) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $5.71) – Buy under $10, target price $40

Redwire (RDW – $9.86 – Buy under $18, first target price $36

Rocket Lab (RKLB – $18.42) – Buy under $13, target price $30+

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $2.36) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $1.93) – Buy under $2, target $20

Compass Pathways (CMPS – $3.09) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $1.30) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.76) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.68) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $1.01) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($35.32) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $37.83) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $42.80) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $28.06) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $40.44) – Buy under $30, target price $50

Coeur Mining (CDE – $6.34) – Buy under $5, target price $20

Dakota Gold (DC – $2.70) – Buy under $2.50, target price $6

First Majestic Mining (AG – $6.97) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.38) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $7.65) – Buy under $10, target price $25

Sprott Inc. (SII – $45.18) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $87,286.20) – Buy

iShares Bitcoin Trust (IBIT – $49.44) – Buy

Ethereum (ETH-USD – $2,014.56)– Buy

iShares Ethereum Trust (ETHA- $15.17) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – no trades- June closed at $65.42) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $37.63) – Buy under $40; $100+ target

Vermilion Energy (VET – $8.25) – Buy under $11; $24 target

Energy Fuels (UUUU – $4.02) – Buy under $8; $30 target

EQT (EQT – $52.32) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $39.98) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Apple Computer (AAPL – $222.85) – Expect to move back to Buy under $175 for new iPhones

Fastly (FSLY – $6.69) – Hold for March quarter results

TG Therapeutics (TGTX – $40.20) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

beat you this week Larry

That you did Rick. Past my bedtime, even with the late ballgames.

MM,

Which is a better buy short term, AKBA at $1.93 or CMPS at $3.09?

Douglas, whsts the buy case, near term catalysts for CMPS?

There is one in June, but I think I’m avoiding both of them as the market continues to bleed!!

Great reply from rick taylor.

Thanks JGMD. Not as fishy as I originally thought. It was a green shoe. Underwriters always short 15% of the offer which is the amount of the options. They just knew it a week early.

Yes, MM said that the after offering was a green shoe. AKBA stock price is stabilizing at over $1.90, maybe. Accumulate perhaps as low as $1.70 over the next 3-6 months until sales to big dialysis organizations come on strong in 2H. What if big DO’s don’t wake up until Dec 2025? Then much lower stock price but still way over $1. Chance of a reverse split near zero.

Zero chance of a bull run at this point, we cant come close to getting back over the 200 day on SPY or QQQ. We are in a bear market down. More downside opp than upside in the US. Moving more money to cash and South America and Europe. For the first time ever, the US market wont be the leader for years/

What a doomsayer, where did you buy the crystal ball?

It’s not his crystal ball, it’s the brass ones Trump-n-Musk are using to deconstruct our once-thriving economy (and blame it all on Biden).

Interest on debt in trillions, payments larger than our military budget (sad statement on both aize of military and debt), handing over jobs and manufacturing of our largest industries to other countries, buying energy from countries that use the income to support terrorism and build nuclear weapons rather than harvest our own much cheaper energy, I could go on – is this the thriving biden economy you mean? The world has been sucking off the tit of the US for far too long while our own citizens get neglected. The fact alone that illegal imigrants got premium housing, meal cards, free healthcare while our own homeless disaster victims in the Carolinas only got a $750 check (because FEMA funds went to illegal immigrants instead) is not only an emmbasrasment but criminal – democrats couldnt run a bagel shop not to mention a country

Thanks, Steve!!!

I manage businesses, a sick, failing company needs sharp course correct and rightsizing to survive and return to profitability and growth, thats whats happening now to the US – your children and grandchildren will thrive because of the actions being taken now. Elon cut the staff and spending of twitter by 2/3 and X is providing tge same service – the same will be done to the bureacratic, corrupt, ripe with fraud governmemt, its the only path to survival this country has

I agree Steve. He is on the wrong side of the market , IMO. As soon as Mr. Musk squeezes 1 trillion out of this overly bloated, corrupted government, ( in the next 90 days) the mood will change, Iran will cave, and Mr. Z of the Ukraine will be kicked out of office, the new head will facilitate the deal with Russia and the second half of 2025 will be quite lucrative if you are invested in the right market themes. IMO. Buy the best positions at the best lows. IMO.

John, curious to know what securities or otherwise youre looking at or buying for the rebound? TSLA, Bitcoin look particularly good to me at these prices.

Not John but my 2 cents. I think TSLA could go to 52 week low. I just don’t see how he can sell teslas. A lot of people are trying to sell or trade them in because they don’t want to drive a car with Musk name on it. Now that I said that it can soar. I like your Bitcoin idea if it can get in the 70’s. Politics, the economy, and stocks have never been so closely tied together. I believe if Trump can avert a trade war the worst we will have is a short term recession. If he takes us to a full blown world trade war it won’t be good for the economy or stocks in the US or the world. It will take a long time to turn around. I know we don’t agree on politics but I truly wish you the best of luck in your trades. My best friend loves Trump but he always says Trump says some crazy shit. I hope you have some AKBA. JGMD has done a lot of DD and thinks it has a lot of potential. Also Chris really likes NGENF. I think it’s his biggest position. Good luck!!! Good lord I think that was 4 cents.

NGENF is indeed my biggest position. They will release results of the placebo-controlled double-blinded test of its drug in a homogenous set of 20 people with chronic Spinal Cord Injury wherein 1/2 received placebo plus physical therapy and 1/2 received drug plus physical therapy. The last patient is scheduled to complete the 16 week trial at the end of THIS MONTH with results to follow shortly. Their press release Monday morning, March 31, presages (imo) good results. AKBA will do well, but in the near term, NGENF will do better. Nearly all my shares are long term now. I will sell the news and adjust my portfolio after the news is out, but will continue to hold some while I add funds to my anticipated next big-mover set to rocket with the end of August.

What’s the next big mover?

capr

Thanks

NervGen closed at 1.84 last Friday.

Since their pre-open announcement Monday. It has closed at 2.00, 2.09 and today (Wednesday) at 2.27. That’s a 23% run in 3 days. All aboard!

Chris, whats the case for CAPR in August

Also don’t buy on April 1st. I think you will get a better price on April 2nd on any stock you want.

Louis Navallier thinks Trump is using the threat of tariffs as a negotiating strategy only. Countries are slowly caving and reducing their tariffs on US goods so Trump will do less tariffs than the market thinks. Navallier is calling for a general market turnaround soon after April 2.

Trumps a great negotiator, general public isnt sasvy enough to see what hes doing. First punch is thr hardest, shows seriousness and strength and makes other countries more willing to deal, compromise, Canadas already folded saying they will remove their tarriffs

If you think the horrible Q1 2024 is not due to the Trump/Musk turmoil, I suggest you put down the pipe, dump out the Kool-Aid and look a little closer at whatever else you’ve been ingesting.

Musk (over)paid $44 Billion for Twitter and its 300 Million monthly users in 2022. He then cut half the employees and lost half the advertising revenue. Total revenue was $5Billion in 2021 and half that in 2024. Advertising revenue peaked at $4.5 Billion in 2021 and fell to 1.7B last year.

Last week he sold the company to his XAi for $33 Billion.

TSLA has gone from a market cap well over $1 Trillion to less than $850 Billion.

His Boring Company no longer does business. What happened to his Hyperloop?

Without all the gummint money he gets for SpaceX, where the hell would he be?

If I were you, I’d be looking for someone other than Trump or Musk as a new messiah.

And don’t give me any crap about “our debt is unsustainable”. Congress could fix it by reversing the Reagan tax cuts which got us here. Strap yourself in. The president who got almost 50% of the votes is drunk at the wheel with the Lone Muskrat as his co-Pilot.

Chris, youre too intelligent for that opinion and not to see that the US is like a sick business that either course corrects or fails. Musk and Trump are the only ones with any balls to make the hard choices. Suddenly TSLA is a shit car and company when just 6 mos ago it was the democratics darling? What a joke

BTW if Musk hadnt bought teitter all the democrstic corruption wouldnt have been revealed, thats why he bought it

I think Musk bought Twitter to have the world’s biggest megaphone. Unfortunately, people are getting to know him better. I did appreciate the WSJ automotive critic’s piece on how he chose a used Tesla as by far the best car for him to buy as his daughter is learning to drive. He doesn’t much care for Musk but said for the money, there is no greater value now than a used Tesla.

As to the US being like a sick business, the purpose of a business is to make a profit but the purpose of our government is to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity. As far as national debt, we were doing pretty well paying that down after WW2 until Ronald Reagan came along and slashed top tax rates. Very stimulative in the short term, but long term . . ?

Chris, I see why yiure a better stock picker than business man. The govts role is definately to make a profit and not to stradle coming generations with choking debt, rather its to balance the budget – who do yiu think ultimately pays off the debt? Where do you think funds for unplanned crisises will come from with no surplus? And yes Musk wanted a megaphone to reveal and disclose the democratics corruption and sensoring, also admitted to by METAs Zuck, the wimp he is waiting until he couldnt hide METAs sensoring anymore to act like he was forced to.

Correct. Also, the lofty goals of govt cannot be achieved without fiscal responsibility like a good business. Suppose central planning of big govt is perfect, akin to perfect parents of children. If parents have no fiscal responsibility and/or are unemployed with the family in poverty, nothing good can be achieved by the parents. And suppose the parents can get some infusion of steady cash from wealthy donors who voluntarily agree. That is morally OK as long as the donors agree voluntarily. BUT, if the donors don’t agree and it is forced upon them through taxes, that is INJUSTICE. Now suppose the family is barely getting by on a meager income, just enough to feed the kids in a home that provides shelter but the roof needs repair. Along comes a special interest like other children from dysfunctional parents. The latter break into the home of the former and claim that their kids need money and are more deserving than the kids of the former home. Their stealing is rightly resented by the good kids from the former home. That is one of the bad activities of most govts, aka preferential treatment and sacrifice of the interests of good families who resent govt interference in their lives through ridiculous taxes and regulations. That is NOT providing for general welfare, is certainly NOT fostering domestic tranquility and certainly is NOT justice.

All past civilizations collapsed due to fiscal irresponsibility of those govts, with demands of special interests overwhelming the capacity of govts to provide for general welfare. So much for ensuring enduring blessings of liberty for posterity. Rather, these lofty goals can only be achieved by people who are free from excessive taxes, regulations, mandates, etc. The gaps of opportunity for nearly all can be achieved through voluntary charity. Any remaining tiny gaps can be achieved by a TINY govt. The only legitimate function of big govt is to steward the use of big weapons to defend against rogue foreign govts. To foster moral character of rogue dictators, most foreign aid should be eliminated. Sink or swim on your own. If such is demonstrated with exemplary moral character, foreign aid to moral allies can be considered.

Roche’s top selling drugs new High Dose version fails in bid to increase dose of MS drug Ocrevus.

TGTX now up 8% on the news

New World Investor for 4.3.25 is posted.