Dear New World Investor:

There are two things I realized about President Trump before his first term started in 2016:

1. In a complex situation, he likes to shake everything up, see where things land, and then decide what to do next.

2. He actually follows The Art of the Deal:

a. Make a ridiculously large ask

b. Pay attention to how loud they squeal

c. Reduce the ask as necessary to get more than what you wanted in the first place

It’s not “nice” and certainly not subtle, but it seems to work over and over. Trump also rarely insults the person he is negotiating with or, if he does, almost immediately walks it back. Thus, when his first term started people had been afraid that North Korea had a missile that could hit California. Trump called Supreme Leader Kim Jong Un “little rocket man” before negotiating a deal with “I have great respect for Kim Jong Un.”

In fact,“I have great respect for” is something he’s said about Chinese Chairman Xi Jinping. Russian President Vladimir Putin, and pretty much everyone else he has out-negotiated. I confidently predict you will hear “I have great respect for President Zelenskyy” just after Ukraine cedes two provinces to Russia and agrees not to join NATO to end the war.

As we’ve seen, this negotiating style creates real confusion among many and an opportunity for Wall Street to fake confusion and issue dire warnings of disaster, with the goal of shaking loose some cheap stock to be sold in May to fund their kids’ summer camps. We do see real confusion among businesses that has suddenly made them very pessimistic about their future:

Consumers, too. The University of Michigan Consumer Survey showed a sudden jump in those expecting business conditions in one year to be bad or uncertain, accompanied by a collapse in those expecting conditions to be good.

The establishment economists are equally pessimistic. For the ZEW Financial Market Survey, up to 300 experts from German banks, insurance companies, and financial departments of selected corporations have been interviewed about their assessments and forecasts for important international financial market data every month since 1991. Participants are asked about their six-months expectations concerning the economy, inflation rates, interest rates, stock markets, and exchange rates. The ZEW Indicator of Economic Sentiment is a leading indicator for the German economy and probably reflects the sentiment of most countries.

As we know, retail investors have been saying they’re worried or bearish, with the CNN Fear & Greed Index bottoming at 3 (up to 21 today, still Extreme Fear) and AAII bullish sentiment bottoming at 19.3% (up to 25.4% today). But what are they doing? They’re buying stocks.

Bank of America said their clients were net buyers of $8 billion worth of stock during the week of the initial tariff announcements. That was the fourth-largest weekly inflow in Bank of America’s data going back to 2008. Deutsche Bank also showed global equity inflows of nearly $50 billion, the largest amount in 2025, including $31 billion flowing into US stocks.

As a contrarian, I would rather see them selling stocks, but while historically retail traders not buying the dip is a reliable sign of equity market bottoms, it’s not a necessary condition for every market bottom. Sometimes they get it right.

This morning’s report of new unemployment claims fell to 215,000, just below the consensus for 225,000 and the lowest weekly amount since early February. Even though the reported labor numbers aren’t bad, all of a sudden, everyone thinks the Fed is going to cut…a lot. The market expectations for each meeting are:

* * May 7: Hold

* * June 18: 25 basis point (bps) cut to 4.00%-4.25%

* * July 30: 25 bps cut to 3.75%-4.00%

* * September 17: 25 bps cut to 3.50%-3.75%

* * October 29: Hold

* * December 10: 25 bps cut to 3.25%-3.50%

The yield curve has re-inverted (long rates back above short rates) during the recent market decline. That’s the EXACT opposite of what we see before an economic downturn. This also happened in the mid-1990s and the unemployment rate remained low, no recession hit, and stocks rose for much longer than most anticipated

The intellectual underpinnings of President Trump’s tariffs are in A User’s Guide to Restructuring the Global Trading System by Stephen Miran, former Senior Strategist at Hudson Bay Capital and current Chairman of the Council of Economic Advisers. TL:DR Cheapen the dollar relative to other currencies to make their exports more expensive for US consumers and make our exports cheaper for their consumers, thus shrinking the trade deficit.

Market Outlook

The S&P 500 eked out a 0.3% gain since last Thursday. Coming into last Friday (April 11), the S&P 500 went six straight days with a trading range over 5%. You have to go back to 2020, 2008, and 1987 to find the last time that’s happened for four straight days, let alone six. That’s during COVID, the financial crisis, and Black Monday.

The Index is down 10.2% year-to-date. Last week’s volume was the second biggest volume of the last decade. The #1 spot belongs to the August 2015 low, and the #3 spot to the February 2016 low. At the March 2020 low, the biggest volume was a bit smaller. That’s another factor that supports this low being a major low.

The Nasdaq Composite lost 0.7% and is down 15.7% for the year. Last week, the Nasdaq 100 (NDX) had the biggest weekly volume in the history of the index – much bigger than in any of the previous crashes or bear markets. That also looks like a V-shaped bottom.

The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 6.1%. Could people be catching on that biotech is dirt cheap, immune to tariffs, and will vie with AI as the most transformative technology of the next 20 years? Nah, probably not yet – it’s still down 15.7% year-to-date. The small-cap Russell 2000 added 2.8% but is down 15.6% in 2025.

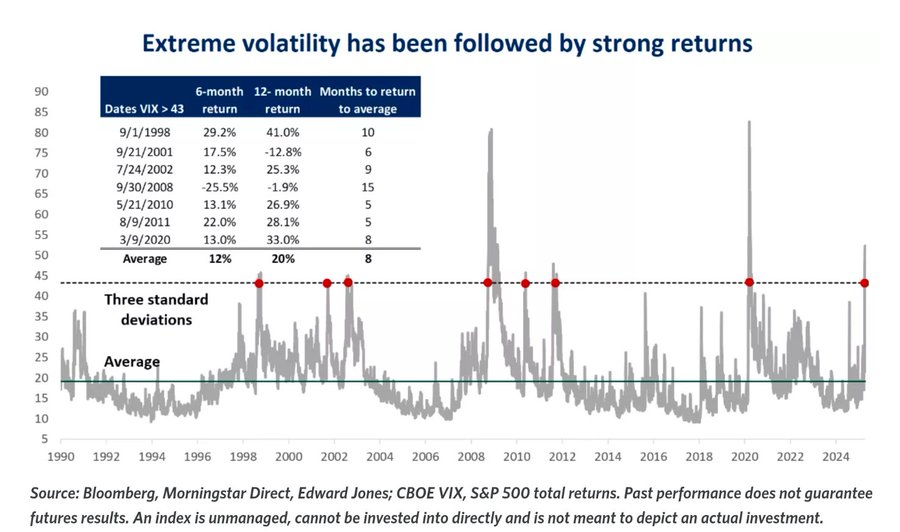

These periods of extreme volatility are difficult. I feel your pain. But in the long-run, periods of extreme volatility have led to strong returns.

The fractal dimension extended its decisive upside last Friday and then booked a down week since last Monday. So the tentative breakthrough of the 55 level signaling a new trend has been canceled for now and the fractals are back in consolidation mode. It sure doesn’t feel like it, but the action this year has been a consolidation of the post-election rally last year. At least so far.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX – ScyNexis – Announce resolution of the manufacturing problem, lifting of clinical hold, restart of MARIO trial, maybe GSK files for hospital use approval

EQT EQT –natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model improved a tiny bit to -2.2%, with the model adjusted for gold imports also still in negative territory. The Blue Chip economists are cutting their forecast rapidly.

This week, Bank of America’s latest fund manager survey of 164 participants with $386 billion in assets under management showed 82% of the respondents expect the global economy to weaken. A record number of investors intend to cut their allocation to US equities, and expectations for a US recession over the next year hit the fourth-highest reading of the past 20 years.

Dollar Death Watch

The dollar has now dropped more than 8% year-to-date, its worst start to the year since 1995.

Click for larger graphic h/t @WinfieldSmart

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Friday, April 18

Markets Closed – Good Friday

Saturday, April 19

QUIK – QuickLogic – Intel Foundry Forum

Tuesday, April 22

EQT – EQT – After the close – Earnings release; call tomorrow

Wednesday, April 23

EQT – EQT – 10:00am – Earnings conference call

Thursday, April 24

GILD – Gilead – 8:00am – Earnings conference call

FCX – Freeport McMoRan – 10:00am – Earnings conference call

Friday, April 25

Short Interest – After the close

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $196.93) is preparing additional Vision Pro headset devices, according to Bloomberg. No surprise there. I expect a lower-cost entry model to spur sales.

Like Mark Twain, Apple could say: “Reports of my death have been greatly exaggerated.” According to Counterpoint, Apple was #1 in the global smartphone market in the March quarter. There’s been a rush of iPhone buyers trying to beat increased tariffs. I’m in the market for a 16e for a birthday present in July but I’m in no hurry.

Evercore maintained their Outperform rating and $250 target price, pointing out the diversity in the iPhone supply chain as a strength in the tariff battle.

Although some are worried about Apple’s high-margin Services growth in Europe (see Apple: Here’s The Looming Threat No One’s Talking About) due to the European Commission’s Digital Markets Act, I am not. The DMA has been in effect since November 2022 with no harm to Apple. It is targeted at American tech companies and may well be part of a comprehensive tariffs/trade barriers deal. In any event, Apple will be fine competing with European companies. AAPL is a Buy under $205.

Gilead Sciences‘ (GILD – $104.54) “HIV Franchise Woes Highlight Cancer Follies,” according to this Seeking Alpha author. Really?

Nope. Their HIV portfolio had $19.612 billion in revenues in 2024, will be flat this year due to Medicare price negotiations, and resume robust growth in 2026 as IV pre-exposure drugs take off. And while every oncology program won’t be successful – as if that could ever happen – enough will be to completely transform Gilead.

Gilead reports March quarter earnings next Thursday. Analysts expect revenues up only 1.32% (due to the Medicare price negotiations) to $6.77 billion, with $1.75 earnings per share. Guidance should be for June quarter revenues flat year-over-year at $6.95 billion and $1.94. GILD is a Long-Term Buy under $90 for a first target of $120.

Meta Platforms (META – $501.48) began defending itself against the Federal Trade Commission this week – The FTC’s Weak Case Against Meta Ignores Reality. After a six-year (!) investigation, the FTC is suing because Meta is successful acquired Instagram and WhatsApp with Department of Justice approval 11 and 12 years ago. One interesting question is whether a merger is ever “done” or the FTC can swoop in years after it’s completed and undo it.

If Meta wins, the stock will go up. If Meta loses and has to spin off Instagram and WhatsApp, the pieces will be worth more than the combined Meta. We win either way.

As long as Zuckerberg is obsessively focused on AI, we want to own the stock. But who would sell it to us this cheaply? Those who think that Zuckerberg’s AI Obsession Could Wreck The Stock, for starters. META is a Buy under $655 for a long-term hold.

Nvidia (NVDA – $101.43) was clobbered Wednesday, down $7.71 or 6.87% on the news that it will take a $5.5 billion inventory write-down in the April quarter from the US government’s surprise new controls on its semiconductor exports to China. Nvidia’s H20 chips were made specifically for the Chinese market to comply with US trade rules and the inventory is worthless if they can’t sell it to Chinese buyers. Nvidia’s other customers don’t want these less-powerful chips, although some smart person might grab them for pennies on the dollar and build cheap AI personal computers.

$5.5 billion is a lot of money and 4.2% of last year’s revenues, but this is a one-time event. It also means going forward Nvidia won’t be able to sell anything in China, so Huawei will have that market to itself.

The company said it will produce up to $500 billion of AI infrastructure in the US within the next four years. It is building two new supercomputer manufacturing plants in Texas in partnership with contract manufacturers Foxconn and Wistron that will open in 12 to 15 months. Nvidia also is partnering with Amkor and SPIL for packaging and testing operations in Arizona. They are targeting more than a million square feet of manufacturing space to manufacture and test Blackwell chips in Arizona and AI supercomputers in Texas. They said the Blackwell AI chips are already in production at TSMC’s plant in Phoenix, but I’m sure that most of them are made in Taiwan. TSMC is behind schedule in their US plant construction.

CEO Jensen Huang said: “The engines of the world’s AI infrastructure are being built in the United States for the first time. Adding American manufacturing helps us better meet the incredible and growing demand for AI chips and supercomputers, strengthens our supply chain, and boosts our resiliency.”

Nvidia will use its advanced AI, robotics, and digital twin technologies to design and operate the facilities, including Omniverse to create digital twins of factories and Isaac GR00T to build robots to automate manufacturing. Take advantage of this dip! NVDA is a Buy under $125 for a $180 first target.

Onsemi (ON – $34.64) withdrew its proposal to acquire Allegro MicroSystems (ALGM) for $35.10 per share due to ALGM Board resistance. Onsemi CEO Hassane El-Khoury carefully said: “We continue to respect both the leadership team at Allegro as well as its talented base of employees.” They intend to continue to allocate capital towards stock buybacks. ON is a Buy under $60 for a $100 first target.

Palantir (PLTR – $93.78) and Anduril are in a SpaceX-led group to build President Trump’s Golden Dome missile defense system. They are proposing a constellation of 400 to 1,000 satellites to monitor missile launches and another 200 weaponized satellites to take a missile out. SpaceX is pitching a subscription model to get around Pentagon purchase and budget issues. As my friend Keith Fitz-Gerald pointed out, that makes defense spending an annuity. The contract will be awarded later this year.

The company also is collaborating with DOGE on a massive IRS data project, according to Wired. They wrote: “Should this project move forward to completion, DOGE wants Palantir’s Foundry software to become the read center of all IRS systems.”

NATO is buying the Maven Smart System from Palantir. This AI-enabled warfighting system provides a common data-enabled warfighting capability to every country in the Alliance. It took only six months from outlining the requirement to acquiring the system.

The US 18th Airborne Corps used Maven to target enemies with 100x greater efficiency. Not only did the 18th Airborne match the performance of the US targeting cell in Operation Iraqi Freedom (OIF) – widely viewed as the most efficient in US military history – it did so with only 20 people in its targeting cell versus the ~2,000 in the OIF. Maven is becoming the standard AI platform for war operations (targeting, awareness, planning). Last year, the UK adopted Maven.

The White House released an executive order to reform the defense acquisition system: “The DOD should use existing authorities to the maximum extent, with a ‘first preference for commercial solutions’ and a ‘general preference’ for innovative acquisition authorities.” For the last 30 years the law has been that if a commercial item exists that meets requirements, the government must buy it. However, this law has been widely violated. With this executive order, President Trump clearly intends to reform defense to make it faster and more effective. He wants the DoD to adopt technology as fast as the commercial world and reward the best players while penalizing the leeches. That’s excellent news for Palantir..

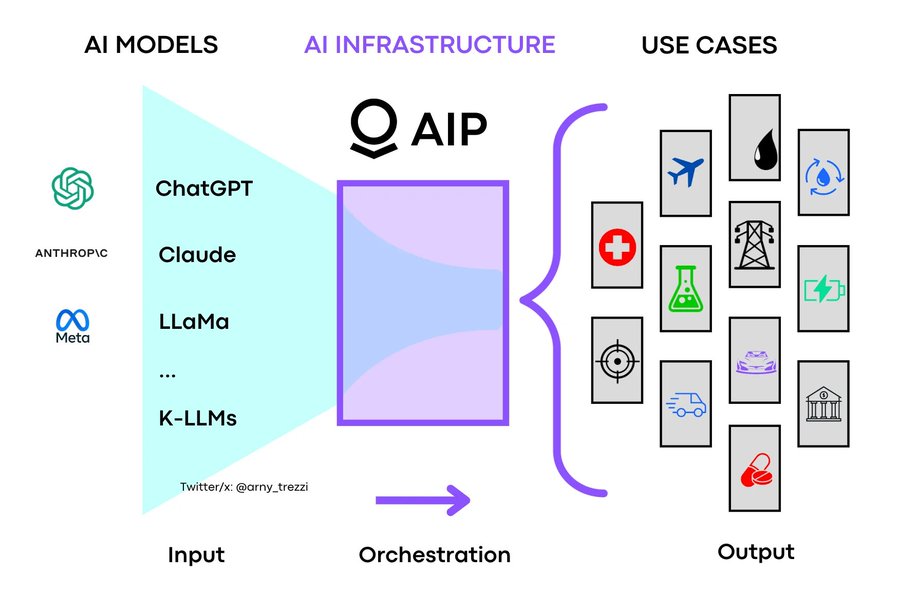

Shay Booker, the host of StockTwits, wrote “SO WHAT DOES PLTR ACTUALLY DO?

“I get this question all the time — and honestly, it makes sense. But that’s not because it lacks a story. It’s because the story doesn’t fit into the usual enterprise software narrative.

“Most software companies build tools that make business functions more efficient – better CRMs [customer relationship management], faster databases, cleaner dashboards. Palantir is building something else entirely: the infrastructure layer for AI-native decision-making in high-stakes, real-world environments.

“Palantir isn’t trying to make software that looks good in a pitch deck. It’s making software that takes real-time data from dozens of fractured systems – internal, external, structured, unstructured – and turns it into executable action at machine speed. Not ‘insights.’ Not charts. Actual execution: what to do, when to do it, and what happens if you don’t.

“This is where most people get lost, especially now that AI is being thrown around as a buzzword across every earnings call. Everyone says they ‘do AI.’ Palantir doesn’t just do it — it operationalizes it.

“We’re entering stage two of the AI economy. The first wave was all about model development and infrastructure: GPUs, cloud scaling, LLMs. That was the foundation. The second wave is where it gets real — application, deployment, and decision loops that close in seconds, not weeks. And this is where Palantir becomes the most important software company almost no one can properly explain.

“Its AIP isn’t some plug-and-play analytics tool. It’s an AI-native control layer that embeds itself across the entire operating stack of a company. In defense, that means orchestrating battlefield logistics, drone surveillance, and supply movements across thousands of nodes in real time – without human lag. In energy, it means rebalancing entire grids based on weather, usage, and geopolitical constraints. In healthcare, it means modeling drug manufacturing timelines, workforce shortages, and patient flows dynamically, down to the individual hospital level.

“AIP doesn’t surface ‘recommendations.’ It runs simulations. It allocates resources. It creates, tests, and deploys policies based on real-world constraints – and then it adapts them continuously as new data comes in. It’s the difference between a static ERP [enterprise resource planning] system and an AI-native nervous system.

“That’s why Palantir doesn’t have churn. Once AIP is deployed, it becomes core infrastructure – hardwired into procurement systems, compliance frameworks, and regulatory operations. It’s not just software anymore. It’s the brain of the organization. And there’s no alternative product on the market that offers that level of AI-governed, multi-layered operational command.

“And here’s the part the market hasn’t priced in yet: we’re about to enter a phase where most enterprises have to make the jump from insight-driven to action-driven systems. They’ve built data lakes. They’ve hired teams of analysts. They’ve run pilots on LLMs and built out dashboards. But they still can’t act fast enough. They still depend on layers of approvals and manual reconciliation between systems that were never designed to talk to each other. And while everyone else is stuck in the UI [user interface], Palantir is already deep in the backend, where real transformation happens.

“When the Fortune 500 begins to industrialize AI – not just in labs, but on factory floors, in boardrooms, and in live supply chains – Palantir will be there first, because it already is.

“So no, it’s not about ‘AI to kill enemies.’ That’s the cartoon version of the story – the one people default to when they don’t have the language for what this company actually is.

“It’s about giving decision-makers the tools to operate in environments where failure is catastrophic and time is scarce. Whether that’s in government, healthcare, logistics, or finance, Palantir is building the AI execution layer of the new digital economy.”

Click for larger graphic h/t @arny_trezzi

PLTR is a Buy under $100 for a $150 target.

PayPal Holdings (PYPL – $61.00) is providing developers with an agentic commerce toolkit. This allows popular agent frameworks like OpenAI, Agent SDK, LangChainAI, Vercel, AI SDK, and MCP Community to integrate with PayPal application programming interfaces (APIs) through simple function calling. Developers can now build sophisticated AgenticAI workflows that handle financial operations with intelligence and efficiency. This could transform online shopping as we know it. PYPL is a Buy under $68 for a double in three years.

Small Tech

Enovix (ENVX – $6.16) appointed Ryan Benton, a very experienced financial executive, as Chief Financial Officer. Never one to let an opportunity to promote the company pass, CEO Raj Talluri said: “As we get closer to achieving our top objective of commencing smartphone battery mass production, customer demand is solidifying, and we expect to see an important consumer product launch by the end of the year.”

And get this “for example” from Chairman T.J. Rodgers: “Ryan Benton is the best CFO candidate I’ve interviewed in a couple of years. He understands that investor candor is the best course, even if you have some disappointment to report. For example, he would have said about our recent Korean acquisition: We bought the second half of a well-run Korean company (Routejade) for a great price, and they will make our anode and cathode electrode sheets much cheaper and with higher quality than our current suppliers. With the turmoil in tariffs right now, we have a very competent Korean supplier that is capable of adding millions in profitable revenue — an unexpected bonus.”

I’ve invested in TJ long enough to know that bonuses he gets are rarely “unexpected.” ENVX is a Buy up to $20 for a 4-year hold to $100+ as their BrakeFlow lithium-ion battery takes market share.

Primary Risk: A new competitor invents a better battery.

Fastly (FSLY – $5.39) is a likely beneficiary of teen TikTok usage, according to Piper Sandler. Their semiannual Teen Survey showed social media use went up “materially” to 4.9 hours a day. FSLY is a Hold for March quarter results on May 7.

Primary Risk:Content and applications delivery networks are a competitive area.

ARK Venture Fund (ARKVX – $29.65) doesn’t trade at major online brokers like Schwab and Fidelity. There’s a slightly less attractive alternative, EntrepreneurShares ETF (XOVR) that has a similar 10.4% SpaceX weighting and a lower management fee, but the rest of the portfolio is in large cap companies like Alphabet and Netflix, instead of private companies like ARK Ventures’ xAI and Anthropic. ARKVX is a Buy for the SpaceX IPO.

Primary Risk: Cathie sells the stock before the IPO.

Redwire‘s (RDW – $10.11) wholly-owned Belgian subsidiary, Redwire Space NV, won a contract from prime contractor Thales Alenia Space to deliver four International Berthing and Docking Mechanisms for the European Space Agency’s habitation module for the lunar Gateway (the Lunar I-Hab).

The contract includes one active IBDM that will couple Lunar I-Hab to the rest of the Gateway; and three passive systems, which will be used as a docking port for other modules or visiting vehicles. The IBDM will enable safe transfers of crew and cargo, supporting continuous operations and missions within the Gateway lunar space station. The system incorporates advanced automation, precision alignment, and multiple redundancies to safeguard both the station and the crew aboard. RDW is a Buy under $18 for a $36 first target as space exploration grows.

Primary Risk: A new competitor emerges.

Rocket Lab USA (RKLB – $19.74) was selected to provide hypersonic test launch capability with its HASTE launch vehicle, engineering expertise, and other services through its participation in two multi-billion dollar government development programs for the United States and the United Kingdom.

For the US Air Force, Rocket Lab will participate in the Enterprise-Wide Agile Acquisition Contract, a $46 billion indefinite delivery-indefinite quantity contract designed for the rapid acquisition of innovative technologies, engineering services, and technical solutions that develop the Air Force’s new capabilities. The program has a contracting period through to 2031 and is designed to be broad in scope, flexible in funding, and agile for maximum use to enable the Air Force to quickly procure services and technologies across various domains.

For the UK’s Ministry of Defence Hypersonic Technologies & Capability Development Framework, a ~$1.3 billion framework to rapidly develop advanced hypersonic capabilities, Rocket Lab is now eligible to bid to provide services, technologies, and testing capabilities that support the UK’s development of sovereign hypersonic technology.

Rocket Lab’s Hypersonic Accelerator Suborbital Test Electron (HASTE) launch vehicle is a suborbital variant of Electron. It has a modified upper Kick Stage tailored for hypersonic technology tests and a larger payload capacity of up to 1,540 lbs. HASTE can deploy technologies at speeds of more than 7.5 kilometers per second to test air-breathing, glide, and ballistic payloads, as well as technologies to re-enter Earth’s atmosphere from space. RKLB is a Buy up to $13 for my $30+ target as low earth orbit satellites and space exploration grow.

Primary Risk: A new competitor emerges.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

ScyNexis (SCYX – $0.90) China partner Hansoh Pharmaceuticals got marketing approval for ibrexafungerp for vulvovaginal candidiasis (Brexafemme for yeast infections). This should trigger a milestone payment to ScyNexis plus low double-digit royalties on sales.

ScyNexis didn’t announce this and didn’t even file an 8K with the SEC, but CEO David Angelo bought 23,000 shares on April 9 for 84¢ each. He now owns 816,598 shares. Buy SCYX under $2.50 for a first target price of $20 after ibrexafungerp is approved for hospital use and a buyout at $50.

Primary Risk: Ibrexafungerp fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: 2025

Probable time of next financing: Never

Inflation MegaShift

Gold ($3,334.00) set a new all-time high of $3,371.90 today as investors slowly realize that Stephen Miran’s policy of a weaker dollar means higher prices for gold, silver, copper, natural gas, uranium, and all other internationally-traded hard assets.

The gold-to-silver ratio just spiked 15% in a week. That’s a major risk-off move as traders dumped silver (risk) for gold (safety). This kind of weekly spike has only happened a few times in the last 20 years: before the 50% crash in the 2008 Great Financial Crisis; ahead of a 20% drop in 2011; and right before the COVID crash.

But over the past 125 years, the ratio has only spent brief moments above the 100 level — extremes like this tend not to persist for long.

Goldman Sachs says gold “could plausibly” trade around $4,500 an ounce by the end of 2025, implying another +38% of upside.

According to the World Gold Council, investment flows into Chinese physically backed gold exchange-traded funds so far in April have exceeded those for the whole of the March quarter and overtaken inflows registered by US-listed funds. Gold ETFs in China increased by 29.1 metric tons in the first eleven days of April, compared to inflows of 23.5 tons registered in January-to-March. While US-listed funds led activity in the first quarter, so far in April they have lagged China, with inflows of 27.8 tons.

The fractal dimension shows all the energy has been completely used up. Today’s spike high might be as good as it gets for a few months – the energy needs to rebuild.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $84,991.36) had another successful test of the 50-week moving average last week. I think it’s headed to a new all-time high around $150,000.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $48.26) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $11.98) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $64.32

Oil weakened after OPEC lowered its demand growth forecast this year to 1.30 million barrels per day from its previous forecast of 1.45 million barrels per day. They said the impact of US tariffs are part of the reason for the downward revision, even though no one knows what either the tariffs or their real impact will be.

In addition, traders are worried about increased supply from Iran. The US and Iran met last Saturday for nuclear talks – the first since 2022 – that both sides described as “constructive.” Goldman Sachs is now estimating a glut of 800,000 barrels a day this year. I still expect a shortage of oil.

But the scary headlines had an effect and the net managed money position (i.e., hedge funds, speculators) in Brent crude CRATERED last week following Trump’s tariff announcement and OPEC+’s surprise output hike acceleration. It was the largest weekly decline in net position on record.

The July 2026 Crude Oil Futures (CLN26.NYM – $59.49) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $34.53) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $6.52) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $4.95) will benefit as China has suspended the export of specific rare earth minerals and magnets to the United States. These materials are vital for industries such as automobiles, semiconductors, defense, and aerospace. This move comes amidst ongoing trade tensions, with China also drafting new regulations aimed at restricting these exports to American companies, potentially affecting global supply chains. Energy Fuels is well-positioned to provide rare earths and – more important – processing in the US.

This morning, the company said that it has successfully developed the technology to produce six of the seven rare earth oxides, at scale, that are now subject to the newly enacted Chinese export controls. Their White Mesa Mill in Utah currently has the commercial capacity to process monazite ore concentrates into separated neodymium-praseodymium oxide. Management said they now can design, construct, and commission the expansion of their existing infrastructure to produce samarium, gadolinium, dysprosium, terbium, lutetium, yttrium, and other oxides, at scale from monazite relatively quickly with “appropriate U.S. government support.”

The Center for Strategic and International Studies said the United States is particularly vulnerable to disruptions of these supply chains, emphasizing that rare earths are crucial for a range of advanced defense technologies and are used in some types of fighter jets, submarines, missiles, radar systems, and drones. The Department of Defense set a goal to develop a complete rare earth element supply chain that can meet all US defense needs by 2027. I expect Energy Fuels to raise their hand and say: “Here.” UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

EQT (EQT – $50.98) reports earnings next Tuesday. Wall Street is looking for a robust 53.44% jump in revenues due to acquisitions to $2.17 billion with earnings per share up sharply from 82¢ last year to $1.03. June quarter guidance is expected to be for an 88.51% revenue increase to $1.8 billion and 48¢ a share versus a small loss last year. EQT is a buy under $35 for a first target of $70 and a long-term hold for much higher prices.

Primary Risk:Natural gas prices fall.

Freeport McMoRan (FCX – $32.90) will benefit from China-led buying that has helped to shore up sentiment on copper even as worries about a deepening trade war continue to swirl. China’s March trade data, released Monday, showed that metals exporters front-loaded shipments in anticipation of worsening trade frictions in the last full month before the US tariffs make an impact.

Freeport reports earnings next Thursday. The consensus is for revenues is down 13.44% to $5.47 billion due to the Indonesian export restrictions. The average earnings estimate of 25¢ is in a wide range from 19¢ to 34¢. Revenue guidance for the March quarter should be for $6.99 billion, up 5.54% from 2024, with earning of 50¢ a share, again in a wide range from 35¢ to 69¢. FCX is a buy under $44 for a $65 target within two years.

Primary Risk: Copper prices fall.

* * * * *

RIP Joel Krosnick cellist extraordinaire

* * * * *

Your expecting them to run it hot Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 4/17/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $196.98) – Buy under $205

Corning (GLW – $41.52) – Buy under $33, target price $60

Gilead Sciences (GILD – $104.54) – Buy under $90, first target price $120

Meta (META – $501.48) – Buy under $655 for a long-term hold

Micron Technology (MU – $68.80) – Buy under $102, first target price $140

Nvidia (NVDA – $101.43) – Buy under $125, first target price $180

Onsemi (ON – $34.64) – Buy under $60, first target price $100

Palantir (PLTR – $93.78) – Buy under $100, target price $150

PayPal (PYPL – $61.00) – Buy under $68, target price $136

Snap (SNAP – $7.86) – Buy under $11, target price $17+

SoftBank (SFTBY – $23.75) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $6.16) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $61.77) – Buy under $60; 3- to 5-year hold

PagerDuty (PD – $14.74) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $4.60) – Buy under $10, target price $40

Redwire (RDW – $10.11) – Buy under $18, first target price $36

Rocket Lab (RKLB – $19.74) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $29.65) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $2.42) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $2.06) – Buy under $2, target $20

Compass Pathways (CMPS – $3.13) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $1.28) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.74) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.82) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.90) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($32.45) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $42.81) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $46.78) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $29.36) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $41.54) – Buy under $30, target price $50

Coeur Mining (CDE – $6.03) – Buy under $5, target price $20

Dakota Gold (DC – $2.82) – Buy under $2.50, target price $6

First Majestic Mining (AG – $6.52) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.39) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $8.49) – Buy under $10, target price $25

Sprott Inc. (SII – $52.70) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $84,991.36) – Buy

iShares Bitcoin Trust (IBIT – $48.26) – Buy

Ethereum (ETH-USD – $1,586.26)– Buy

iShares Ethereum Trust (ETHA- $11.98) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $59.49) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $34.53) – Buy under $40; $100+ target

Vermilion Energy (VET – $6.52) – Buy under $11; $24 target

Energy Fuels (UUUU – $4.95) – Buy under $8; $30 target

EQT (EQT – $50.98) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $32.90) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Fastly (FSLY – $5.39) – Hold for March quarter results

TG Therapeutics (TGTX – $38.32) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

1

second

what will happen next

China caves in and we get the greatest trade deal in history. Powell gets the boot , the new guy lowers interest rates into the 4’s and the US stock market blows up and goes to 50 K!!

Someone caved, but it wasn’t China.

https://www.washingtonpost.com/world/2025/04/24/trump-trade-war-china-preparation/?itid=hp_more-top-stories_p002_f003

All hat and no cattle.

Chris, as smart as investor you seem to be you can’t be gullible enough to believe anything the Washington Post produces. They are a left wing propaganda machine.

I don’t believe EVERYTHING that WAPO prints, so I use several news sources. Just as much of the liberal mainstream media ignored the Hunter’s Laptop story, conservative media has chosen not to cover Trump negotiating against himself with China. The WAPO story was also reported by Reuters and AP. I can’t explain why it may not have been reported in your news feed except for the fact that to an objective observer it makes Trump look bad.

https://www.reuters.com/markets/global-markets-wrapup-1-2025-04-23/

https://apnews.com/article/china-us-tariff-negotiations-trump-481ff4402f5c34776ffcb8ced4c8ae42

See Trump say China tariffs will come down “substantially”, won’t be anywhere near 145%.

https://youtu.be/iEGgHbmk6pU?t=3

Both Reuters and AP are leftwing rags. Look at this excerpt from AP–

“China’s position is consistent, and we are open to consultations and dialogues, but any form of consultations and negotiations must be conducted on the basis of mutual respect and in an equal manner,” Commerce Ministry spokesman He Yadong said.”

Get this straight–the CCP is a thug mass murderer whose talk about mutual respect is utter hogwash. The CCP respects nobody. So the AP is the mouthpiece of He Yadong and other rogue commie administrators.

No world leader has the business acumen of Trump. He uses tariffs as negotiating tactics only, and is well aware of the historical economic failures of tariffs.

Today’s Epoch Times’ statement about CCP minister He Yadong on this issue–

“On April 24, Chinese Ministry of Commerce spokesman He Yadong said that any suggestion of progress in bringing tariff rates down was groundless.”

Note how Epoch Times is factual, but AP chooses its comments to glorify the character of He Yadong. If the AP glorifies thugs, it is not to be trusted. Epoch Times property has been repeatedly sabotaged by the CCP. Its founders are Hong Kong CCP dissidents.

I don’t think President Trump is getting nearly enough credit for fulfilling a promise he made during his campaign. Although the timing may have been off a little bit, recall that he said, “When I win, I will immediately bring prices down, starting on day one.”

It may not have happened on day one, but he has achieved fantastic reductions in prices since he took office three months ago on January 20. A single share of SPY (the ETF tracking the price of shares of the 500 biggest publicly traded companies) on the last trading day before Trump took office versus the most recent trading day (April 17) is shown below.

On Jan 17 SPY closed at 597.58. On April 17 it was 527.15.

Clearly, Trump has been successful in bringing prices down. Admittedly, not on day one, but for the most part, he has brought prices down substantially. Some notable failures are WMT, V, PG and JNJ, which have gone up since inauguration day. But I am sure Trump is working hard on the golf course thinking about how he can bring down the price of those as well.

Shocking, a politician overprommising to get elected, how unusual….NOT! Bidens schedule was 10:00 to 4:00, thenmon the beach rest of time, Trump works 24/7. Cmon man try to be just a little fair and honest

Did you notice the amount of illegal immigrants (aka democratic voters) entering the country dropped 95% when Biden pretended he couldnt close the border without a congress vote?

12/27/21 s&p was 4766. 10/10/22 was 3583. This was a big drop under Biden. Then the market came back. Over the last 20 years the market is up with many dips happening over the years. I was happy to get nvda at 93. Because of Biden’s inflation my retirement check is worth 15% less. This check will never recover the loss from inflation.

MM, do you know why Scynexis has not sent a PR about this yet?

Yes, it was approved after nearly a two-year review on April 10. Hansoh Pharma, ScyNexis; China partner, will introduce it soon. ScyNexis should get a milestone payment and low double-digit royaltues.

I see that SCYX is up over 10% today. Is GSK finally going to release some good news?

MM–ENVX. Despite your belief in the promises of CEO Raj, the market cap still anticipates huge business. No announced contracts with numbers. I am sick of the bullshit of nondisclosure agreements. The stock could still decline another 50-75%. Please do a fair evaluation on various hypothetical contracts to justify a fair stock price.

The only reason I would sell ENVX shares before their earnings report comes out next week would be to replace those shares with LEAPs expiring in Jan 2027. I am quite interested to see what their recent revenues will look like. At the last report, revenues were $23M and the company had $1.43 per share in cash. I think the inflection point comes this year, but if it doesn’t happen until next year, the Jan 2027 Calls can still pay off well.

Thanks. Without any confirmation of big contracts, the stock is worth cash of $1.43 minus continuing losses. If it stays below $1, reverse splits will totally kill the stock. Jan 2027 LEAPS are probably safer than the stock, although 2028 LEAPS would be safer. During the Tariff Tantrum (TT), seeing which stocks held up better is an indicator of stock potential vs risk. ENVX was a poor TT stock, AKBA better, NGENF best. I have no position in ENVX. ENVX is highly dependent on Asian manufacturing, batteries sell for a few bucks, so ENVX is highly vulnerable to tariffs. For AKBA, pills cost pennies, a negligible cost even if tariffs are 100% or more. With monthly TDAPA payments of $1278 for 30 daily pills, each pill generates $42 in revenue, so pennies in costs even with tariffs is trivial.

HC Wainwright & Co. analyst Ed Arce reiterates Akebia Therapeutics (NASDAQ:AKBA) with a Buy and maintains $7.5 price target.

Write to Benzinga at editorial@benzinga.com Thought you might like this Doctor JG Don

Ed Arce has asked good questions at AKBA conferences. He is credible. Even if major dialysis organization Fresenius stays away from Vafseo because of its contract with Mircera, an ESA, $7.50 is a conservative target in one year. Another analyst put out a target of $10 months ago when he thought Fresenius would support Vafseo.

Did anyone read Kuppys Corner, please be wise and reply.

New World Investor for 4.24.25 is posted.