Dear New World Investor:

The second estimate of March quarter real GDP growth this morning was little changed on the surface, down 0.2% instead of the initial estimate of down 0.3%. But under the hood, the positive difference seemed to be inventory investments to beat President Trump’s tariffs. Personal consumption growth was revised down from +1.8% to +1.2%. That’s a relatively big revision in this series and probably means the economy is a little weaker than we thought.

Market Outlook

The S&P 500 added 1.2% since last Thursday in this holiday-shortened week. The Index is up 0.5% year-to-date. The Nasdaq Composite gained 1.3% as Nvidia came through – again. It is still down 0.7% for the year, though. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 1.8%. It is down 10.6% year-to-date. The small-cap Russell 2000 booked a 1.3% gain but is down 7.0% in 2025.

The fractal dimension added to its already fully-consolidated position. We might see more of this wishy-washy action, but the next leg up could start anytime.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX ScyNexis – Resolution of GSK situation

EQT EQT –natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model estimate for June quarter real GDP slipped two-tenths to +2.2% due to weaker private domestic investment growth.

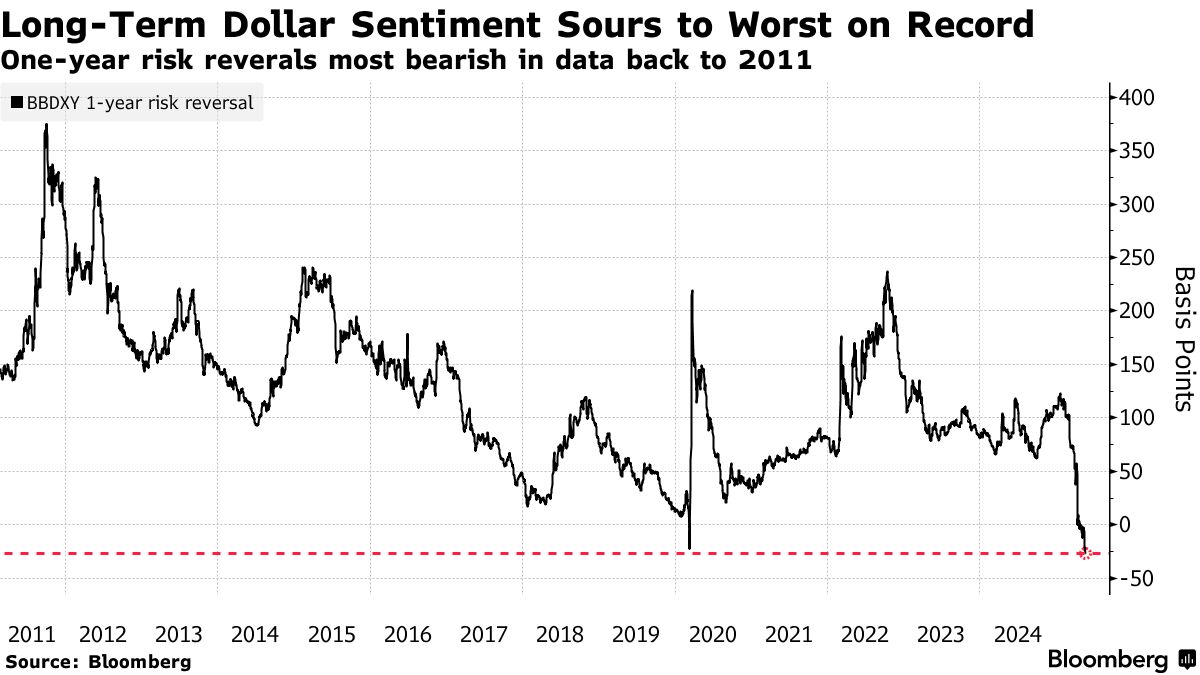

Dollar Death Watch

The dollar has been slipping, which lends strength to stocks.

But traders are too bearish to think the downtrend can continue in the near-term.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Tuesday, June 3

ON – Onsemi – 1:40pm – BofA Global Technology Conference

Wednesday, June 4

ENVX – Enovix – Unspec. – William Blair Growth Stock Conference

GILD – Gilead Sciences – 11:05am – Jefferies Global Healthcare Conference

FSLY – Fastly – 12:20pm – William Blair Growth Stock Conference

Thursday, June 5

AKBA – Akebia – 8:45am – Jefferies Global Healthcare Conference

Friday, June 6

81st Anniversary of D-Day

May payrolls – 8:30eam

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $199.96) said the App Store in the US facilitated over $400 billion in developer billings and sales in 2024. For more than 90% of billings and sales facilitated by the App Store, developers did not pay any commission to Apple. Earnings of U.S. developers have more than doubled in the last five years, while the size of the App Store ecosystem has nearly tripled from $142 billion in 2019 to $406 billion last year. AAPL is a Buy under $205.

Corning (GLW – $49.96) is collaborating with Broadcom (AVGO) on a co-packaged optics (CPO) infrastructure that will significantly increase processing capacity within AI data centers. Corning will supply cutting-edge optical components for Broadcom’s Bailly CPO system, the industry’s first CPO-based 51.2 terabit per second (TBps) Ethernet switch. This combination will deliver significant improvements in optical interconnection density and power savings, making it ideal for large-scale AI clusters. GLW is a Buy under $33 for a $60 target in 2025.

Gilead Sciences (GILD – $111.11) announced positive topline results from its second Phase 3 clinical trial of Trodelvy. The trial met its primary endpoint, demonstrating a highly statistically significant and clinically meaningful improvement in progression-free survival compared to chemotherapy in patients with first-line metastatic triple-negative breast cancer (mTNBC) who are not candidates for PD-1/PD-L1 inhibitors, meaning they are PD-L1 negative or are ineligible to receive immunotherapy.

This is the first clinically meaningful advance for this patient population in over 20 years versus chemotherapy. Trodelvy now has the potential to be the backbone treatment for all patients across first-line mTNBC. Gilead will present detailed data from the trial at the big American Society of Clinical Oncology (ASCO) meeting starting this weekend.

CEO Dan O’Day presented at the Bernstein Annual Strategic Decisions Conference (AUDIO HERE and TRANSCRIPT HERE). It was the standard presentation in their recent blitz of one brokerage firm conference a week. The stock has held up well as more investors realize how strong their oncology business really is. GILD is a Long-Term Buy under $90 for a first target of $120.

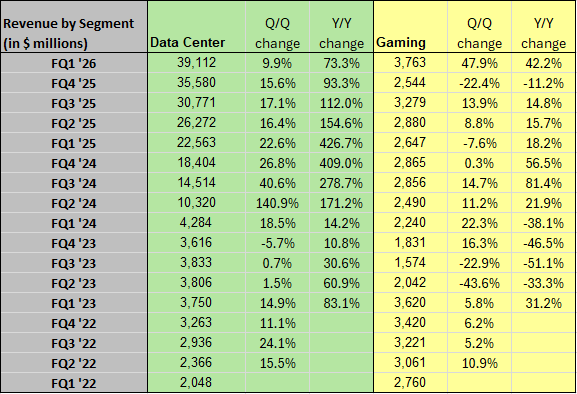

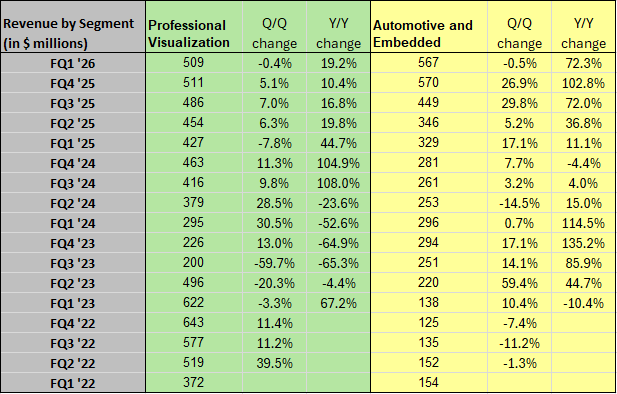

Nvidia (NVDA – $139.19) reported April first quarter revenues up a very strong 69.2% from last year to $44.06 billion, beating the $43.25 billion consensus estimate. Net income of $18.8 billion was up 26% from last year. Earnings per share hit 81¢, also beating the 75¢ consensus estimate.

The big revenue chunk is, of course, data centers, which was up 73.3% from last year’s blowout quarter. Gaming had a record quarter, but it’s now less than 10% of data center.

Visualization and automotive both were down from the January quarter, but they are so small that it doesn’t matter.

CEO Jensen Huang said: “Our breakthrough Blackwell NVL72 AI supercomputer — a ‘thinking machine’ designed for reasoning— is now in full-scale production across system makers and cloud service providers. Global demand for Nvidia’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognizing AI as essential infrastructure — just like electricity and the internet — and Nvidia stands at the center of this profound transformation.”

Here’s the deal on Nvidia. Given that the stock’s valuation is, to put it mildly, stretched, investment returns have to come from earnings growth. At some point in the next few years, data center revenues will flatten out. Both humanoid robotics and self-driving will grow for years, but they are not large enough to keep earnings growing at the current clip. Even though I’ve thought Jensen is a genius since I met him 25 years ago, we’ll have to sell NVDA when data center revenues flatten. That’s not right now, for sure. But on the conference call (AUDIO HERE and CFO SLIDES HERE and TRANSCRIPT HERE), they guided July second quarter revenues to $44.1-$45.9 billion. That’s quarter-over-quarter growth of only 2.0%-6.1%, compared to 16.4% sequential growth in last year’s second quarter. It’s year-over-year growth of 46.8%-52.8%, compared to 154.6% last year. So the rate of growth is slowing but is still extremely high for a company of this size.

Nvidia had $27.4 billion in cash flow from operations in the quarter, nearly double last year’s $15.3 billion. They bought back $14.1 billion in stock and finished the quarter with $53.7 billion in cash.

Buried inside President Trump’s One Big Beautiful Bill is the most important AI law the US has ever passed. It bans state-level AI laws for 10 years, puts $500 million into AI-powered government systems, mandates AI in Medicare by 2027, and forces agency-wide coordination. NVDA is a Buy under $125 for a $180 first – and maybe final – target.

Palantir (PLTR – $122.32) is now used by Fannie Mae to investigate loans and applications, What once took them 60 days can be done with Palantir software in seconds.

CEO Alex Karp did a great interview at the Economic Club of Chicago.

PLTR is a Buy under $100 for a $150 target.

PayPal Holdings (PYPL – $70.93) CEO Alex Chriss also presented at the Bernstein Strategic Decisions Conference (AUDIO HERE and TRANSCRIPT HERE). He hammered again on the “PayPal Everywhere” theme, including branded checkout and Venmo. One of the big initiatives he has started is both bringing ways to increase sales for companies that use PayPal for checkout and finding ways to make using PayPal more valuable for consumers – one-click checkout, the Buy Now Pay Later option, personalized discounts, and even showing them ads for things they want to buy. PYPL is a Buy under $68 for a double in three years.

Snap (SNAP – $8.28) CEO Evan Spiegel knows AI and machine learning are the future of Snap:

SNAP is a Buy under $11 for a $17+ target.

Small Tech

PagerDuty (PD – $16.11) reported April first quarter revenues up 7.8% from last year to $119.81 million, matching the Street estimate for $118.98 million. They earned 24¢ a share pro forma, well ahead of the 19¢ estimate.

On the conference call (AUDIO HERE and SLIDES HERE), CEO Jennifer Tejada said they generated $8.2 million in free cash flow in the quarter. She said their “non-GAAP operating margin reaching 20%, exceeding our target by 500 basis points. Given the substantial progress we have made on optimizing our bottom-line performance, we have a clear path to GAAP profitability.”

They have a meaningful competitive advantage:

Annual recurring revenue increased 7% to $496 million, and the dollar-based net retention ratio was 104%. They saw expansion activity across approximately a quarter of their enterprise accounts in the quarter.

For the July second quarter they guided for revenue growth of 6%-7% to $122.5-$124.5 million with pro forma earnings per share of 19¢ to 20¢. For the full year, they guided for revenue growth of 6%-7% to $493.0-$499.0 million, $7 million less than previous guidance. They expect pro forma earnings per share of 95¢ to $1.00, an increase of 5¢ a share.

The company finished the quarter with $597.1 million in cash. PD is a Buy up to $30 for a 2- to 5-year hold as their digital operations management Software-As-A-Service gains market share.

Primary Risk: Digital operations management is a competitive area.

Redwire (RDW – $14.43) delivered the onboard computer for the European Space Agency’s (ESA) Comet Interceptor mission – the first spacecraft to visit a comet coming directly from the outer reaches of the Sun, carrying material untouched since the dawn of the Solar System. RDW is a Buy under $18 for a $36 first target as space exploration grows.

Primary Risk: A new competitor emerges.

Rocket Lab USA (RKLB – $27.35) is acquiring Geost, an electro-optical and infrared (EO/IR) payload development and manufacturing company and provider to high-priority national security satellites. They are paying $125 million of cash and $150 million in privately placed shares of stock, plus up to $50 million in potential additional cash earn-out payments tied to revenue targets.

Their formal entry into the satellite payload segment strengthens their position as a provider of end-to-end national security space solutions. The acquisition will close in the second half of the year. RKLB is a Buy up to $13 for my $30+ target as low earth orbit satellites and space exploration grow.

Primary Risk: A new competitor emerges.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

Akebia Therapeutics (AKBA- $3.01) will have three poster presentations at the European Renal Association Congress next week. One is on the safety data for Vafseo. The other two seem designed to support their impending non-dialysis trial:

Vadadustat Combination with Ferric Citrate, Compared to Either Agent Alone, Protects Against Inflammation-Induced Anaemia and Anaemia-Induced by Chronic Kidney Disease

and

Real-World Use of HIF-PH Inhibitors and ESAs in Non-Dialysis-Dependent CKD with Anemia: Insights from a Japanese Database study.

Buy AKBA up to $2 for the Vafseo launches in the EU, UK, and US.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

ScyNexis (SCYX – $0.89) dosed the first new patient in the renewed Phase 3 MARIO trial. (They enrolled 25% of the projected patients before the clinical hold.) This triggers a $10 million milestone payment from GSK, to be followed by another $20 million in six months. As management said: “There is a disagreement between SCYNEXIS and GSK regarding the resumption of the MARIO Study and GSK’s responsibility for paying these milestones. SCYNEXIS is working to resolve the disagreement.”

I don’t know why GSK may have lost interest in the hospital applications of ibrexafungerp. They may have changed their minds or they may just be angling to add ScyNexis’ second-generation fungerp, SCY-247, to the deal. The most likely outcome is that they return all rights to ibrexafungerp to ScyNexis in return for not having to pay the remaining milestones. ScyNexis would then license it to another partner. Buy SCYX under $2.50 for a first target price of $20 after ibrexafungerp is approved for hospital use and a buyout at $50.

Primary Risk: Ibrexafungerp fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: 2026

Probable time of next financing: Never

TG Therapeutics (TGTX – $35.71) is presenting three posters on Briumvi this week at the Consortium of Multiple Sclerosis Centers annual meeting:

1. No Association between Decreases in Serum Immunoglobulin Levels and Serious Infections with Long-Term Ublituximab Treatment in Patients with Relapsing Multiple Sclerosis

2. Retrospective Evaluation of Infusion Tolerability: Ublituximab Real-World Observational Survey

3. Safety and Tolerability of 30-Minute Ublituximab Infusions: Updates from the ENHANCE Study

Hold TGTX for a target price in a buyout of $40 or more.

Primary Risk: Briumvi, the MS drug, fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: NM

Probable time of next financing: Never

Inflation MegaShift

Gold ($3,340.00) edged up a bit thanks in large part to continued weakness in the US dollar. As I suggested above, that’s probably coming to an end.

The fractal dimension continues to steadily consolidate – six weeks done, probably 12 more weeks to go. Better a consolidation due to time than one due to a sharp drop in price, because then the next leg up can start from a higher level.

Miners & Related

Coeur Mining (CDE – $8.14) presented at the Raymond James London Silver Conference (SLIDES HERE). It was the typical background presentation yet again, with this 2025 Key Deliverables slide:

CDE is a Buy under $5 for a $20 target as gold goes higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

First Majestic (AG – $6.13) announced a second significant discovery within a year of vein-hosted gold and silver mineralization at the Santa Elena property in Sonora, Mexico. The property now hosts four significant gold-silver deposits. CEO Keith Neumeyer said: “The past twelve months of our exploration activities at Santa Elena have been outstanding. The Santo Niño discovery marks yet another exciting milestone for the district, and the drilling shows the vein remains open for expansion in most directions. At the same time, step-out drilling at the Navidad Discovery continues to intercept exceptionally high-grade mineralization and expand the resource envelope. Together with the producing Santa Elena and Ermitaño mines, these new deposits confirm Santa Elena as a truly prolific district with tremendous untapped potential. We believe Santo Niño and Navidad will meaningfully extend the mine life and will unlock additional value to the portfolio.”

AG is a Buy under $11 for a $23 next target price as production increases and the price of silver rises.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Sandstorm Gold (SAND – $8.89) posted Episode 7 of CEO Nolan Watson’s FAQ series:

SAND is a Buy under $10 for a $25 target.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $106,151.67) seems firmly bid above $100,000. I still expect $150,000 within 12 months, most likely by year-end.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $59.99) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $20.09) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $60.92

Oil stayed flat at this low level as everyone pretended this weekend’s additional unwinding of the voluntary cutbacks really means anything, since the only country that actually cut exports was Saudi Arabia and they aren’t increasing exports now. Speaking at the World Utilities Congress in Abu Dhabi, UAE energy minister Suhail-al Mazrouei said he felt oil demand “is picking up” and could “surprise us” if investment in hydrocarbons do not pick up. But, hey, he’s just the UAE energy minister and the paper oil hedge fund bears know better, right? Right?

The July 2026 Crude Oil Futures (CLN26.NYM – $59.27) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.35) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $6.65) is selling its Saskatchewan and Manitoba assets for $415 million cash. They’ll use the cash for debt repayment to accelerate deleveraging efforts and strengthen their balance sheet. Management said: “The Transaction marks another significant step in our strategic plan to high-grade the asset portfolio that began three years ago, shifting our focus toward long-duration, scalable assets with deep inventory of high return on capital opportunities. Our liquids-rich gas position in Western Canada, combined with strategic acquisitions in Europe and significant exploration success in Germany have reframed Vermilion’s global gas franchise that will serve shareholders for years to come. Cash proceeds from the Transaction will strengthen Vermilion’s balance sheet and provide further capital allocation flexibility for core Canadian and European assets.”

VET is a buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $5.03) rose after President Trump issued executive orders to clear regulatory and permitting roadblocks and accelerate nuclear technologies such as small modular reactors. The goal is to quadruple US nuclear power production over the next 25 years from approximately 100 gigawatts in 2024 to 400 gigawatts by 2050. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

EQT (EQT – $55.37) will benefit from higher natural gas prices as the “shoulder season” ends early due to higher temperatures driving demand for air conditioning. EQT is a buy under $35 for a first target of $70 and a long-term hold for much higher prices.

Primary Risk:Natural gas prices fall.

* * * * *

* * * * *

Your looking for a mini-excavator Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 5/29/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $199.96) – Buy under $205

Corning (GLW – $49.96) – Buy under $33, target price $60

Gilead Sciences (GILD – $111.11) – Buy under $90, first target price $120

Meta (META – $645.05) – Buy under $655 for a long-term hold

Micron Technology (MU – $96.80) – Buy under $102, first target price $140

Nvidia (NVDA – $139.19) – Buy under $125, first target price $180

Onsemi (ON – $42.94) – Buy under $60, first target price $100

Palantir (PLTR – $122.32) – Buy under $100, target price $150

PayPal (PYPL – $70.93) – Buy under $68, target price $136

Snap (SNAP – $8.28) – Buy under $11, target price $17+

SoftBank (SFTBY – $26.39) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $8.07) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $71.03) – Buy under $70; 3- to 5-year hold

Fastly (FSLY – $7.34) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $16.11) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $5.16) – Buy under $10, target price $40

Redwire (RDW – $14.43) – Buy under $18, first target price $36

Rocket Lab (RKLB – $27.35) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $30.35) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $2.04) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $3.01) – Buy under $2, target $20

Compass Pathways (CMPS – $4.14) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $1.83) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $2.13) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.73) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.89) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($33.47) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $42.70) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $48.49) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $29.26) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $42.94) – Buy under $30, target price $50

Coeur Mining (CDE – $8.14) – Buy under $5, target price $20

Dakota Gold (DC – $3.07) – Buy under $2.50, target price $6

First Majestic Mining (AG – $6.13) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.56) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $8.89) – Buy under $10, target price $25

Sprott Inc. (SII – $58.04) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $106,151.67) – Buy

iShares Bitcoin Trust (IBIT – $59.99) – Buy

Ethereum (ETH-USD – $2,643.51)– Buy

iShares Ethereum Trust (ETHA- $20.09) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $59.27) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $33.35) – Buy under $40; $100+ target

Vermilion Energy (VET – $6.65) – Buy under $11; $24 target

Energy Fuels (UUUU – $5.03) – Buy under $8; $30 target

EQT (EQT – $55.37) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $39.03) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

TG Therapeutics (TGTX – $35.71) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

1

MM – what is your comment about Blackrocks ststement that AI could potentially break the BTC limited supply code, should we be concerned?

MM–On AKBA, please acknowledge my last post on why AKBA will NOT be able to rip off insurance companies for NDD V at 4-5X the $2500 price for DD V post TDAPA. Everyone should listen and read the transcript of the last fireside chat at the 20 min mark. Butler mumbles and fudges on this point. It is a scam, despite his other accomplishments. The financial analysts have not challenged him on this point, although they have not updated their price targets.

SCYX–I’ll tell you why GSK abandoned Brexa. The drug is MEDIOCRE, never showed profits for VVC. GSK has better prospects. They even abandoned US daprodustat, a decent drug if you ignore the slightly elevated risks of heart failure. MM, you are not a doctor, and merely spout company promotions.

MM —

On the 1944 New Yorker cover may I conclude that King George is “absit invidia” because Jensen Huang hadn’t been born yet?

MM – is RKLB your best reco for the space and rocket category? Your target is $30 but its just about there now – whats the 52 wk potential of this stock? Thanks

AKBA–the 2nd paper cited by MM to be presented next week is interesting for the better efficacy of V vs ESA. However, the good increase in Japanese patients starting V from 15% in 2021 to 55% in early 2024 shows how long it took. Ultrabulls like Hsainu on Stocktwits think the majority of patients will be on V after only 3 months. TDAPA in the US is a big incentive not present in Japan. Even so, I doubt the growth rate will be as rapid as Hsainu says. Hence, my 2025 target is much lower than his $30 target. We’ll find out about Q2 in mid Aug.

Does anyone know why AKBA shot up so much today?

maybe because of the up coming conferences this week and because they have something that other companies dont have as of yet,enjoy the ride

What the hell just happpened to NGENF – positive results and stock price plummeted!!

Results were mixed, more positive than not, but price dropped back to the range before the recent run-up. Conference tomorrow.

Demonstrated “increased electrical connectivity between the brain and hand muscle in individuals with a cervical level spinal cord injury (SCI).”

Also “positive trend in the secondary endpoint evaluating change in “GRASSP” score, a measure designed specifically to assess hand function in people with cervical injuries.” However that is a trend not statistically significant, which is more difficult to accomplish with a small sample size.

Stock opened at $4.36 and dropped as low as $1.50, now around $2.60.

I mostly agree. With N = 10 for both drug and placebo groups, it would be rare to see any kind of statistical significance, unless there were obvious clinical benefits that could not occur by chance. But even with positive electrical data, that wouldn’t occur by chance, since chronic patients without therapy got nowhere. No doubt, new dosage and time treatment protocols will show some clinical benefit, but even this is speculative and may take time to prove itself. The company has the 300 substance, as if to say they had reservations about this trial with 291. As investors, do we want to wait around for mega payoffs while dilution and funding problems afflict us? Those with small positions might wait it out, but big investors may cash out.

Chris?

Monday’s trading action on NGENF, with a nice jump at the open followed by a trip down to $1.50 and then back up to $2.50 is indicative of a lack of consensus on the meaning of the results. Make no mistake, the trial showed that NervGen has the first drug to show a beneficial effect in SCI. As in animal trials, the drug did not show functional improvement in all subjects who received the drug, but fully half of those recipients achieved a GRASSP prehension score at least 4 points higher than baseline. Such an increase is subjectively experienced as “better” if not “much better”. Prehension increases are one of (if not THE) most sought improvements for SCI patients. That this was achieved in patients injured more than a year prior is a major breakthrough. Patients and therapists will still be very eager to use this drug in combination with other therapies such as PT, electrical stimulation, stem cells and brain-machine interfaces. I look forward to seeing such trials as well as results of trials with different dosages and for more than 12 weeks on the drug.

One more thing. As I’ve previously stated, I don’t think NervGen has THE solution to SCI, but I do believe their drug will be part of the solution for EVERY person with SCI when it is approved for commercial use.

Face it Chris, NGENF is as much a dud as most of MMs biotechs, Im sorry I listened to all the hype about it on this board and lost money. This is dead money.

I’m sorry you lost money by buying after it ran up. Now thta we know the drug works in humans, I wouldn’t be surprised to see more grant money for future trials rolling in from organizations like Wings for Life which paid for most of the expenses associated with this trial

The GRASSP results showed some improvements that would enhance the quality of life for some of these SCI patients. Such great potential, but today’s 4:15 PM CC displayed a lack of decisive direction on the part of management. Apparently Dr. Jerry Silver has died. We could have used his commanding enthusiasm I enjoyed in his past videos. What’s the outlook for the stock with such exciting potential, but in the hands of management that lacks clear direction? Jerry would have said they will go out on a gangbuster dog and pony show, the way he got funding for his research at Case Western Reserve University. A similar situation has existed with ACXP who developed the best antibiotic for C difficile which impresses me with preservation of the microbiome. Great scientific work, but lousy promotion by David Luci. ACXP stock is almost dead.

Chris, thanks for your level headed view. I now say that the trial was a success in that it accomplished its goal of showing some clinical benefit in terms of GRASSP. Turning a key to open a door is a great indicator of functional hand ability. Even I have occasional difficulty with this if the key is stuck! I could sell my small position at a little profit, or risk waiting for announcement of BP partnering for future trials, FDA accelerated approval or not. My analogy with ACXP is not fair, since there are plenty of established treatments for C diff even if ACXP is better. BP is not really interested in another antibiotic, just as with ARTH, nobody was interested in a superior bandaid. But NGENF has a ground breaking achievement in SCI, so there should be good BP interest in partnership or buyout. That said, I imagine Chris may want to sell some of his large position and re-enter while news of funding is quiet, or even after dilution. Even for me, it might be better to hold rather than take the risk that the stock zooms higher on positive news of financial support in some form in the not too distant future. Yeah, I realize that my FOMO (fear of missing out) isn’t a prudent strategy. Anyone here who wants the occasional home run is not prudent the way a conservative blue chip investor is. FOMO IS prudent for small amounts of money, like a prudent lottery ticket if there is such a thing.

Yo Chris your input?

This illustrates what I said about never buying after a runup. Buy cheap when there is no excitement from short term traders and hype. (Ignore the hype from people like Monica Perez–“we’re very excited.” Scientists and clinicians in depressing fields like oncology are like mothers who think their ugly child is beautiful.) TA is mostly bullshit. NGENF was a model TA case with big rise on high volume.

I refused to buy CAPR after first Chris mentioned it and it had already run from $5 to 15. I got in a few weeks ago at $7.60 after it plunged to $6 on fear of the adcom. Now up 50%, I may still lose if the adcom people have the usual criticism about small numbers. But the FDA has accepted this limitation and may approve anyway for a disease like DMD where there is otherwise little hope. I may buy more if adcom is lukewarm and the price plunges to $5 or so, on expectation of FDA approval by 8/31/25.

Whats the date of the CAPR adcom?

Maybe in July. My strategy is to wait for another buying opportunity after a lukewarm adcom. I am not selling now to lock in gains.

Chris?

CAPR is zooming today. On Stocktwits, follow HarmonyPioneer67. She is informed, with positive hopes for cell therapy and exosome technology. CAPR’s drug deramiocel is up for approval with PDUFA 8/31/25. Deramiocel is exosome derived heart muscle cells. There is an article on exosome-based early diagnosis of ovarian cancer which is fatal within 5 years after clinical signs are apparent only in late stages. Think of exosomes as DNA on the outside of the cell, like your unique fingerprints.

My strategy is still not to chase any stock, but hope to add more on a lukewarm adcom in July.

I have BITX. In May it went up 19% and paid a dividend of 52 cents. It pays a dividend 10 out of 12 months. It is my Bitcoin investment.

Gary, you think bitx will outperform bitcoin, not concerned with the high volatility of this leveraged fund?

It is about two times Bitcoin. It goes up about twice as much as bitcoin and down twice as much. I also buy bitx options.

MM, I thought Medicenna was supposed to present at ASCO. Instead Fahar did a YouTube video with updates. Did they get kicked out again this year? I got in at .86 and thought I was getting a good deal. Today it’s trading at .67. What a joke!!

You got a great deal, the market makers are currently holding Medicenna down for some reason. Just have a little patience as with NervGen which may have the greatest investment potential of our lifetime. Biotech isn’t for the faint of heart…good things to come!

You really think this is going to do something? What realistic PT do you see for this?(MM’s is 20, then 40)

Are you saying Medicenna or NervGen may have the greatest porential? Whats the timeline for both to move up significantly?

NervGen with what they have achieved for the first time in human history. They should get either AA or BD when they meet with the FDA. This has the potential to not only help the SCI community but MS, Stroke patients and others. This is just my personal opinion, I’m not a financial advisor, you have to do your own research and due diligence.

MM – could you do an update on PZG – it seems to be breaking out of a long-term trading range but has horrifically underperformed GOLD over the past few years. I know it’s supposedly extremely undervalued and there has been bulletin board chatter that perhaps there are rare earth minerals on their properties. Seems like it may be time to add to my small holding.

WTF happened to Elon, he has gone crazy, on drugs perhaps? Its the fastest flip flop Ive ever seen

Elon has more intellectual purity in favor of free markets and reduced govt spending than Trump. The “big beautiful bill” is just another big govt spending bill. I’m with Musk.

New World Investor for 6.5.25 is posted.