Dear New World Investor:

Well, you all just set a personal best – consecutive Fed days without panicking – as Chairman Powell et. al. held interest rates steady Wednesday at 4.25%-4.50% for the fourth meeting in a row since last cutting in December. They kept their projection for two rate cuts this year, which is two more than we’re likely to get unless the labor market falls apart.

They changed language that previously said “the risks of higher unemployment and higher inflation have risen” to “Uncertainty about the economic outlook has diminished, but remains elevated.” That sounds a little more positive, but at the same time they increased their estimate of the core Personal Consumption Expenditures (PCE) Index from 2.8% to 3.1%, and cut their real GDP projection for the year from 1.7% to 1.4%. so, will the Fed cut interest rates in 2025?

Cautious Fed = cautious investors.

Data from market research firms SentimenTrader, Ned Davis Research, and Vanda shows that equity exposure remains below historical averages, with mutual funds, hedge funds, and retail traders slowly rebuilding their risk positions. BofA’s latest Global Fund Manager Survey showed a sharp drop in risk appetite, with a net 28% of investors taking a more-cautious-than-normal level of risk in their portfolios.

And that, folks, is where the future buying will come from. This widespread negativity, which flipped last week’s up candle to a down candle, has fully consolidated the fractal dimension – laissez les bons temps rouler.

Market Outlook

The S&P 500 lost 1.1% since last Thursday on war scares. The Index is up just 1.7% year-to-date. The Nasdaq Composite lost 0.6% and is up 1.2% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 2.0%. It is down 8.2% year-to-date. The small-cap Russell 2000 dropped 1.3% and is down 5.3% in 2025.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX ScyNexis – Resolution of GSK situation

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model forecast for June quarter real GDP growth dropped a tenth from 3.5% to 3.4% on softer housing starts. That’s still significantly higher than the consensus. The message to the Fed: In spite of higher interest rates and tariff tantrums, the economy is coping.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Friday, June 20

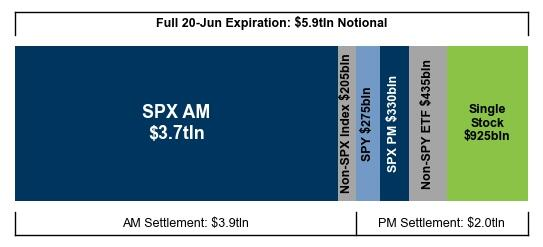

Biggest June Options Expiration In History – $5.9 Trillion

Summer Solstice – 10:42pm

Monday, June 23

QUIK – QuickLogic – Through 6/25 – DAC

Wednesday, June 25

SCYX – ScyNexis – 9:30am – Annual meeting

NVDA – Nvidia – 12:00pm – Annual meeting

Short Interest – After the close

MU – Micron – 4:30pm – Earnings conference call

MU – Micron – 6:00pm – Post-earnings analyst call

Thursday, June 26

March quarter GDP – 8:30am – Third estimate

SFTBY – Softbank – 9:00pm – Annual meeting

Friday, June 27

Personal Consumption Expenditures Index – 8:30am – The Fed’s favorite inflation indicator

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $196.58) won an appeal after the Court of Appeals threw out a $300 million verdict in a patent case filed by intellectual property management company Optis Wireless Technology. The appeals court said a new case should occur for both infringement and damages.

The new operating system upgrades this fall will add more Apple Intelligence like an enhanced listening experience in Apple Music; easier navigation with preferred routes and Visited Places in Apple Maps; new ways to make and track purchases with Apple Intelligence in Apple Wallet; customized playback experiences with Apple Podcasts; a refreshed boarding pass in Wallet; and the introduction of Digital ID.

UBS says Apple is seeing near-term iPhone strength. I suspect that 16e sales are especially strong, where Apple is counting on Services sales for most of the profits. AAPL is a Buy under $205.

Gilead Sciences (GILD – $108.00), as I expected, got FDA approval yesterday for lenacapavir, now named Yeztugo, as a pre-exposure prophylaxis (PrEP) to reduce the risk of sexually acquired HIV. It is the first and only twice-yearly option available in the US for people who need or want PrEP.

The FDA is launching national priority review vouchers to cut drug review time for “selected manufacturers.” No regulatory capture here! Perhaps with some experience this will spread to all drug review times. GILD is a Long-Term Buy under $90 for a first target of $120.

Meta Platforms (META – $695.77) finally is monetizing WhatsApp! They introduced channel subscriptions, promoted channels, and ads in Status in the WhatsApp Updates tab to help users find channels and products they’re interested in. META is a Buy under $655 for a long-term hold.

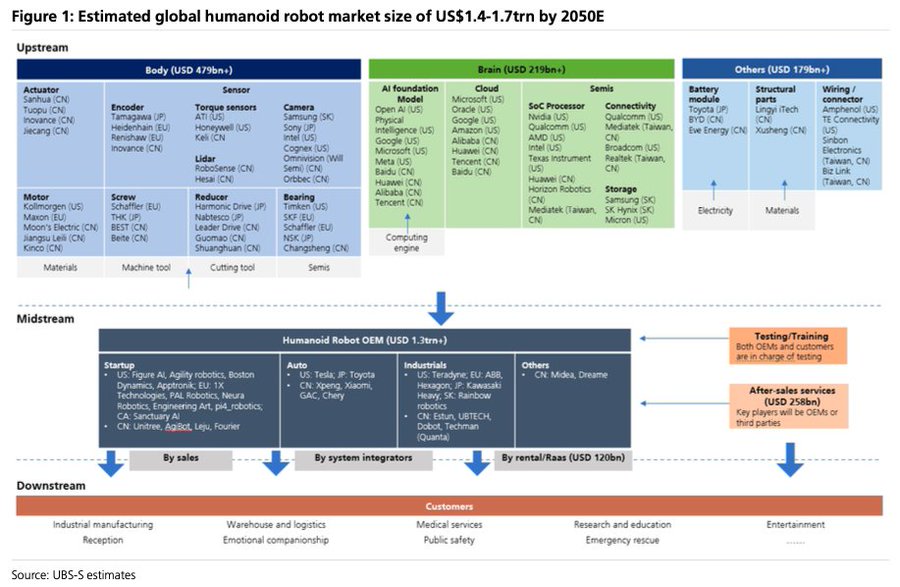

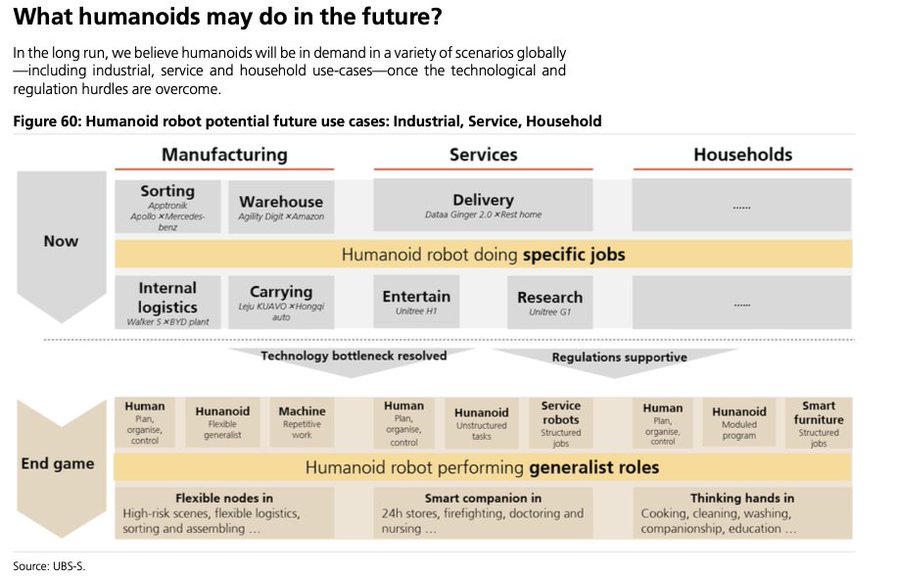

Nvidia (NVDA – $145.48) will be a major supplier of semiconductors and software to the humanoid robot market. According to UBS, it could be worth between $1.4 and $1.7 trillion by 2050.

Will you use one? Yes, you will – because they’ll be everywhere. Your great-grand-kids will not understand how you functioned without one.

CEO Jensen Huang did a keynote at VivaTech 2025:

NVDA is a Buy under $125 for a $180 first target.

Palantir (PLTR – $139.96) CTO Shyam Sankar and top executives from Meta and OpenAI were sworn into the U.S. Army Reserve as lieutenant colonels in the newly formed “Detachment 201: Executive Innovation Corps.” They will help the Army transform for future missions and adopt bleeding-edge technology.

AIPCon 7 is another success:

PLTR is a Buy under $100 for a $150 target.

SoftBank (SFTBY – $29.81) raised $4.8 billion from selling 21.5 million of its 85.4 million T-Mobile shares at $224 each, a slight discount to Monday’s closing TMUS price of $231. I expect Masa to use the cash for AI investments and more stock buybacks. SFTBY is a Buy under $25 for a first target of $50 in the next two years.

Small Tech

Fastly (FSLY – $6.80) named a new CEO to replace Todd Nightingale. Although Nightingale may have screwed up at the end of last year, I thought he righted the ship in the March quarter. Oh, well…the new CEO, Kip Compton, was the Chief Product Officer of Fastly and previously the SVP: Strategy & Business Development at Cisco. He seems OK. FSLY is a Buy under $10 for a 3- to 5-year hold to $50+.

Primary Risk:Content and applications delivery networks are a competitive area.

QuickLogic (QUIK – $6.00) will exhibit at the Chips to Systems Conference next week. This was formerly known as DAC – the Digital Automation Conference – and was a big deal. QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

ARK Venture Fund (ARKVX – $30.71) can be bought through a Charles Schwab account. 26.58% of the assets are in Elon Musk-companies (bolded). The 15 largest holdings, all private, are:

1 SPACEX 13.25%

2 NEURALINK CORP. 7.59%

3 OPENAI 6.86%

4 X.AI HOLDINGS CORP. 5.74%

5 HAMMERSPACE, INC. 3.28%

6 ANTHROPIC, INC. 3.16%

7 LAMBDA LABS 3.16%

8 BLOCKDAEMON, INC. 3.02%

9 EPIC GAMES, INC 2.34%

10 SHIELD AI 2.25%

11 DISCORD INC. 2.25%

12 RADIANT INDUSTRIES, INC 2.21%

13 TENSTORRENT HOLDINGS INC. 2.03%

14 GROQ, INC. 1.90%

15 APPTRONIK, INC. 1.90%

ARKVX is a Buy for the SpaceX IPO.

Primary Risk: Cathie sells the stock before the IPO..

Inflation MegaShift

Gold ($3,387.40) reserves at central banks will rise over the next 12 months, according to 95% of the 73 respondents to the latest Central Bank Gold Reserves Survey by the World Gold Council. A record 43% of respondents believed that their own gold reserves will increase over the next 12 months. None of the respondents expect a decline in their gold reserves. The majority of respondents (73%) see moderate or significantly lower US dollar holdings within global reserves over the next five years.

The fractal dimension booked this slightly down week after last week’s big upmove as just more consolidation. The best outcome would be full consolidation over the 55 level with gold near its all-time highs, ready to break new ground.

Silver just hit a 13-year high, but it’s still very undervalued relative to gold. That is partly because it has industrial demand, so it underperforms when investors worry about global economic weakness. It does have safe haven demand when things heat up. I’ve made a number of silver recommendations:

A Bag of Junk Silver ($36.38) is a Buy for a hold until 2025-2026.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Exchange-Traded & Closed-End Funds

Global X Silver Miners Exchange-Traded Fund (SIL – $48.51) is a Buy up to $30 for a first target of $50 when silver gets back over $40. The silver miners should outperform both the large and junior gold miners in the next upleg for precious metals that will run until 2024-2025.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Sprott Physical Gold and Silver Trust (CEF – $30.63) is a Buy under $18 for a target price of $30.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Miners & Related

Coeur Mining (CDE – $9.02) has transitioned from a gold miner to a gold and silver miner. CDE is a Buy under $5 for a $20 target as gold and silver go higher.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Dakota Gold (DC – $3.88) is a pure gold miner. They said initial results from 19 drill holes in their 2025 drill campaign at the Richmond Hill Oxide Heap Leach Gold Project were consistent with previous drilling and in line with expectations. One drill hole intersected 1.94 grams per tonne of gold over 60.0 meters, of which 51.9 meters is potentially heap leachable material. They currently have two drills operating at Richmond Hill. DC is a Buy under $2.50 for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

First Majestic (AG – $8.35) is a pure silver investment with their own mint. AG is a Buy under $11 for a $23 next target price as production increases and the price of silver rises.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Sandstorm Gold (SAND – $9.19) CEO Nolan Watson did his seventh shareholder FAQ.

SAND is a Buy under $10 for a $25 target.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Sprott Inc. (SII – $65.43) did another financing for its Physical Uranium Trust, this time a $100 million deal – 5.8 million units at $17.25 each. That should support uranium prices for a while. Buy SII under $40 for a $70 target price.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $104,469.02) continues to fluctuate in a narrow range over $100,000, building up energy for the push to $150,000 – probably by year-end.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $58.97) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $18.88) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Geopolitics have traders streaming back into energy stocks. After fewer than 5% of them were trading above their 50-day averages in April, more than 95% have climbed above.

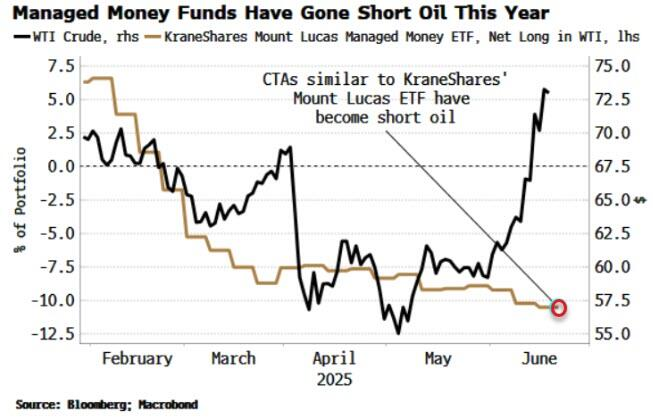

Oil – $75.80

Oil staged a face-ripper 11%+ rally because of rising geopolitical tensions. Believe it or not, managed money in aggregate remains short oil.

JPMorgan wrote: “Since 1979, eight notable regime changes have occurred in oil-producing nations, with prices spiking by 76% from onset to peak and averaging a 30% increase, leaving lasting effects. If history serves as a guide, further destabilization of Iran could lead to significantly higher oil prices sustained over extended periods.”

Iran has threatened to close the Strait of Hormuz in response to continued Israeli attacks. Currently, about 20% of global oil and 30% of global LNG passes through the Strait of Hormuz. Tanker rates already have doubled as shipowners steer clear of the Strait.

The July 2026 Crude Oil Futures (CLN26.NYM – $65.80) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $38.81) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $8.18) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $5.77) posted a new Corporate Presentation. They are producing uranium ore at three mines today and the mill is in full operation. They can switch it back and forth between uranium and rare earths:

They have four long-term uranium supply contracts for deliveries in 2025 through 2030. They will deliver 220,000 pounds of U308 in 2025 and “significantly” more in 2026. They finished the March quarter with $73.9 million in cash, $89.6 million in marketable securities, $20.4 million of receivables, $34.5 million of finished inventory at cost ($46.4 million at market), and no debt. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

* * * * *

Which means there’s lots of real estate that’s worth significantly less if only cash buyers are able to buy. – @cherrygarciafan

Not to mention you won’t be able to get fire insurance.

* * * * *

The GREATEST ORGAN PIECE EVER WRITTEN…is far WEIRDER than you think

* * * * *

Your hearing about the Geophysical Event Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 6/18/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $196.58) – Buy under $205

Corning (GLW – $50.49) – Buy under $33, target price $60

Gilead Sciences (GILD – $108.00) – Buy under $90, first target price $120

Meta (META – $695.77) – Buy under $655 for a long-term hold

Micron Technology (MU – $121.82) – Buy under $102, first target price $140

Nvidia (NVDA – $145.48) – Buy under $125, first target price $180

Onsemi (ON – $52.26) – Buy under $60, first target price $100

Palantir (PLTR – $139.96) – Buy under $100, target price $150

PayPal (PYPL – $68.57) – Buy under $68, target price $136

Snap (SNAP – $8.23) – Buy under $11, target price $17+

SoftBank (SFTBY – $29.81) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $8.50) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $72.93) – Buy under $70; 3- to 5-year hold

Fastly (FSLY – $6.80) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $14.27) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $6.00) – Buy under $10, target price $40

Rocket Lab (RKLB – $27.85) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $30.71) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $3.47) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $3.56) – Buy under $2, target $20

Compass Pathways (CMPS – $4.80) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $2.35) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.95) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.65) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.74) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($36.38) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $45.85) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $50.34) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $30.63) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $48.51) – Buy under $30, target price $50

Coeur Mining (CDE – $9.02) – Buy under $5, target price $20

Dakota Gold (DC – $3.88) – Buy under $2.50, target price $6

First Majestic Mining (AG – $8.35) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.60) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $9.19) – Buy under $10, target price $25

Sprott Inc. (SII – $65.43) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $104,469.02) – Buy

iShares Bitcoin Trust (IBIT – $58.97) – Buy

Ethereum (ETH-USD – $2,523.70)– Buy

iShares Ethereum Trust (ETHA- $18.88) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $65.80) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $38.81) – Buy under $40; $100+ target

Vermilion Energy (VET – $8.18) – Buy under $11; $24 target

Energy Fuels (UUUU – $5.77) – Buy under $8; $30 target

EQT (EQT – $59.37) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $41.18) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

TG Therapeutics (TGTX – $35.17) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

First! Never had one post while reading comments.

Second

MM: I went to Schwab and entered a purchase order to start a position: Buy $3,500.00 ARKVX @ Market

I got back: Order Messages

I had the same response when trying to purchase through my existing Schwab account. Spoke with a rep and he said not possibble to go through them.It is for professional managers only. Hmmmm. Any other options?

I bought through SOFI. It was a bit of a pain, but worked well.

Repost of my reply to MM about QUIK’s supposed turnaround.

“You said this several times over many years. QUIK’s supposed turnaround keeps stumbling. Why should it be any different now?”

MM please answer.

Revenues

2022 $16.2 million

2023 $21.2 million

2024 $20.1 million

2025E $22.0 million

2026E $30.85 million

To all posters – I am suggesting as MM has stated previously to avoid giving political opinions on this board, it only interferes with the reason we are all here and that is to find and share good investment ideas. There are plenty social media sites for all to politically comment, we certainly don’t need another one.

Here is your opportunity to start a position in CAPR.

I would like to see the larger version of the robot graphics. I clicked on: “Click for larger graphic h/t @Mayhem4Markets” but it did not take me to them. It did take me to Mayhem4markets in X, but then what?

Not looking good for CAPR

Great buying opportunity

Positive news for CAPR?

https://www.statnews.com/2025/06/20/fda-ouster-top-gene-therapy-official-nicole-verdun-placed-on-leave-after-review-committee-canceled/

FUD FUD from Adam Feuerstein (AF). Lies, lies. Vinay Prasad skeptical of CAPR’s treatment then cancelled the Adcom? NO NO–at the end of a roundtable video, he and a PhD lady were SUPPORTIVE of innovative ways to streamline approvals for treatments for tragic conditions. The lady eloquently said that this treatment would transform the lives of young men with DMD from tragedy to longer survival. Also, bad journalism–“according to sources familiar with the matter” which is said twice. I am not a journalist, so if I think something is true, I say it as a personal belief based on my experience. But if a journalist doesn’t cite sources, he is not to be trusted.

MM’s career highlight was in 2012 when he called out the FUD from AF about DNDN. DNDN was one of MM’s best calls. AF is graying now, and a new generation of young investors doesn’t know his bad past. Same goes for co-author Matthew Herper.

Chris?

Adam Feuerstein is such a snake. I was in a couple stocks like DNDN that he had shorts paying him for hit pieces. He is not to be trusted!!

If you can forgive my pumping after I bought more each day for the past 3 days, I suggest you buy ASAP below $8. Linda said today at the fireside chat that the Adcom has been cancelled because approval is very clear. CAPR gave the FDA what they wanted. A possible cherry on top is that if there is any fear before PDUFA, she will unblind the phase 3 HOPE 3 data to show benefits in cardiomyopathy and also for skeletal muscle. The FDA will be pleased and she might even get double approval for skeletal and cardiac muscle benefit. Very important, the large number of patients in HOPE 3 will put to rest the bear arguments that the small numbers in HOPE 2 will cause rejection. Personally, I feel that it is better to show 4 year data in small numbers of patients than to show only 1 year data for larger numbers of patients.

My buys weren’t all perfectly timed, I’ll confess. My first buy was a few weeks ago at $7.60 upon the announcement of an Adcom, which created fear that there was a problem. Upon release of the excellent 4 yr OLE a few days ago, I bought more at $11.90. Then the FUD from Adam Fudstein came out, and I still wanted more shares, so I bought more at $11.44. Then the criminal shorts who hired Adam F for the hit job got the price down to $6.07. This short group under the ID of Big Bear on ST said they would cover their shorts upon cancellation of the Adcom. Well, today Linda obliged, and I felt this marked another good buying opportunity. So I bought more today at $7.60 mid afternoon. My average cost is just below $9. I feel that the high chance of approval will make all my buys pay off well. This will still be true even for a more lukewarm approval with required post-marketing phase 4 monitoring.

But watch for a possible another short attack down to $5. They are like the incorrigible Iran dictators who will never surrender and will keep attacking and promoting terrorism until the end is near and they manage to get exile in a 3rd world country. If another short attack comes without a rejection at PDUFA, just remember to do the opposite of what Adam F says, and consider buying some more.

Bought more today at 7.20 and 7.50 but my average isn’t as low as yours. vERY Scary.. I know Steve wants a double in 1 year and I think the best odds of that is CAPR or AKBA, Comes with a lot of risk though.I have a lot of money in money market waiting for blue chips to fall 20%. I’m probably wrong but I Think s and p goes to 4500 to 4800.

Trump played the Iran nuke destruction well. He didn’t bomb the whole country as the primitive Iran surrogates did to Israel, but after the nuke infrastructure was mostly destroyed, he pushed for peace. I thought with the unrepentant Iran attacks on Israel and US bases afterwards, he was going in today with wave 2 of nuke destruction. But Iran offered a cease fire, so maybe they got the message after all. If there will truly be Middle East de-escalation, there won’t be a market crash to 4800. Maybe a recession, but then interest rates will be cut to rally the market.

Jeffrey Sachs from Columbia U is one of those intellectual leftist assholes I hate. He condemned Trump’s attack on Iran. What an ass. He would advise ass-kissing diplomacy which never works with religious fanatic regimes. Under Sachs’ policy, religious maniac regimes would annihilate the entire world. Columbia U allows pro Palestinian hatred toward Israel, the only real US ally in the ME.

It is highly unusual to see doubles in blue chips, except after many years. If you skillfully buy special situations like AKBA and CAPR, your odds of doubles are high, and there are possibilities for life changing 1-100X baggers. Even though my original purchase of KERX/AKBA was at a big loss, I recognized the value of TDAPA for AKBA and averaged down to $1.75. I have a double, although after many years. I think the likely approval of deramiocel will produce at least a triple to $20-30 by approval Aug 31 in CAPR. Maybe 10-20X in a few years. You also don’t want quick doubles or more, since high short term capital gains are a killer. I prefer taking over a year for gains to realize low capital gains taxes.

We need to get all of those people out of power

at Columbia, Harvard and the rest of those universities. All of those

students are coming out of college after years of these professors in their ear about communism and liberalism. Now they are out in the world spreading the gospel of how capitalism is bad and socialism is the new American way! Take governor Gavin Newscum for instance. If you think California was bad after Arnold S, look at it NOW. California debt is trying to keep up with the US debt! If he keeps it up, he will end up like the I-ah-told-ya in a concrete bunker trying to stay alive from angry taxpayers.

JGMD – Im having trouble understanding you on CAPR. You say lookout for a fall to $5, then you say expect a possible triple to $30. If your best opinion says it will be approved and going to $20-$30 then why wait to buy hoping for another drop, why not back up the truck now?

Steve–I’m with you. I have trouble understanding how organized shorts can crater the price of ANY stock. Especially with CAPR, the cost of borrowing shares to sell short is astronomical, about 50%. I lose track, but it is like buying junk junk bonds that pay 50%. Maybe this is a partial answer–10% declines trigger stop loss selling. This is the avalanche of 50% declines from scared retails who are just momentum players. They don’t care about trying to understand the science and other fundamentals. They are trend follower short term traders only.

I did back up the truck somewhat. I now have 6000 shares, but this pales against many ST posters who casually say they have 5-10X what I have. Whatever you have, HOLD and do not sell when the next short attack occurs. Despite the 90+ % odds of approval before 8/31, there will probably be another short attack with another crap FUD piece. Buy MORE if this happens at $5 or whatever.

Do you remember MM in his glory in 2012 when he called out the FUD from Adam Feuerstein on DNDN? The FUD kept coming like nukes, right up to about 1 week before approval.

Be grateful for the scientific info presented on ST by Asher77, quito_yume. They will give you courage to hold what you own and buy when there is more nuke blood in the streets from FUDSTERS. Due to the high demand for deramiocel, quite_yume is estimating a share price $100-250 in 2026. Read his posts of today and last PM and the replies.

How can a treatment fetch $1 million annually per patient? Pharma has lobbying power to get $1 billion total sales, because of the LONG time for all the FDA regulatory steps to get approval, not to mention the high cost of R & D. $1 B can come from a million patients on common diabetes or heart drugs, or 1000 patients on deramiocel at $1 MM each. If the cost of maintaining disabled people on life support and custodial care exceeds the cost of the drug, insurance companies will go for it.

You convinced me. I bought some yesterday at $7.29.

Why the huge drop in CAPR??

Chris where are you on CAPR?

I’ve been buying Calls on CAPR with Sept and Dec expirations on every short attack. As with the DNDN approval, I expect CAPR’s price to overshoot all Price targets by about 50% on approval due to a short squeeze about 10 weeks from now.

Clever strategy. At the bottom of the short attack, when the stock was down 50% from before the attack, probably the options were down 80-90%. That compensates for the time risk of options.

Welcome to investing in emerging biotech stocks! These are not stable blue chip stocks. Emerging biotechs are capable of huge jumps and drops in price, probably even more than most small caps. News or rumors or someone big getting in or out has a big impact on price, at least temporarily.

Note also that something like 9 of 10 emerging biotechs will go bust, but those that get FDA approvals will grow by an order of magnitude. Don’t risk more than you are willing to lose. Don’t sell at each drop and buy at each jump in price, a losing strategy. Be prepared to wait years to see how it plays out. Consider just investing just a small amount if you will be bothered at every setback.

This is legalized gambling IMHO. Sometimes you win, sometimes you lose.

Excellent advice. CAPR is most likely a big winner from here, but not in the early days of research. Asher77 and quito_yume on ST give a historical perspective. Their research floundered for years, and there were 2 big reverse splits. Early investors were destroyed. Chris mentioned it many months ago at about $15, but I was LUCKY to take advantage of the recent Adcom scare. Those who bought at $20+ should still do well, but they have been suffering with paper losses. I got burned on early stage APTO, and am skeptical of MDNA’s science. For 1-2 year time horizon, I think CAPR is unbeatable, AKBA a decent second.

Everyone talks about the bubble in the stock market but there is no mention about the one in real estate. Housing prices are over the top inflated everywhere. Thanks to house flippers and crazy everyday home buyers prices have continued to go straight up for many months/years. Until recently. Inventory and prices in Florida are indicative of a crash coming. Is there any way to play that side of the real estate market?

Short REIT stocks?

What happened to NGENF Has MM dropped it from his stocks No mention anywhere of this stock?

MM never recommended NGENF, and never commented on it as far as I’ve noticed. NGENF was mentioned by subscriber Chris. Similar to subscriber Douglas mentioning SGMT a few comments below here. On this discussion board, some of us exchange info on various other investments we like.

Dr. JG What kn your opinion is the next catalyst for AKBA if there is any ?

Mid Aug Q2 earnings report. Q2 is the defining moment to see if ultra bulls are correct. If the thesis is correct, Q3,Q4 will blossom as large dialysis organizations get on board. Q2 is like delivering a healthy newborn to celebrate that miracle, and early 2026 is like the child growing up and winning the Nobel Prize for cancer research.

You wax poetic Dr JG Thank you

Ok, thanks. Not a big fan of shorts, though.

Question for you,MM since you are probably still awake,what’s your thought on CMPS do you feel that the results they posted yesterday justified a 50 precent haircut in the stock price,and is this a back of the truck moment..

Could you please not wait until Thursday to respond tx,RonS

Here is another one for subscribers to take a look at. I was lucky enough to get in at $2.40 back in April and then again at $4 in June.(it’s currently trading around $9.50) They had good results from their China partner on the Acne Phase 3 trial and it has taken off since, but it’s their MASH that could be huge for them.(This is not investment advise, so due your own DD before you invest)

SGMT

Sagimet is a clinical-stage biopharmaceutical company developing novel fatty acid synthase (FASN) inhibitors that are designed to target dysfunctional metabolic and fibrotic pathways in diseases resulting from the overproduction of the fatty acid, palmitate. FASN is a regulator of lipid synthesis and a key pathway implicated in multiple diseases, such as metabolic dysfunction-associated steatohepatitis (MASH), formerly known as nonalcoholic steatohepatitis (NASH), acne and select forms of cancer.

Our lead drug candidate, denifanstat, is an oral, once-daily pill and selective FASN inhibitor in development for the treatment of MASH, for which there is only one recently approved treatment in the United States and no currently approved treatments in Europe. We announced positive topline results for FASCINATE-2, a Phase 2b clinical trial of denifanstat in MASH with liver biopsy-based primary endpoints, in January 2024. In October 2024, the FDA granted Breakthrough Therapy designation to denifanstat for the treatment of noncirrhotic MASH with moderate to advanced liver fibrosis (consistent with stages F2 to F3 fibrosis).

In addition to MASH, we are exploring the use of our FASN inhibitors, which include denifanstat and our pipeline product candidate, TVB-3567, in acne and in select forms of cancer, disease areas in which dysregulation of fatty acid metabolism also plays a key role.

Acne

In June 2025, we reported that denifanstat met all primary and secondary endpoints in a Phase 3 clinical trial for the treatment of moderate to severe acne vulgaris conducted by Sagimet’s license partner Ascletis Bioscience Co. Ltd. (Ascletis) in China. Ascletis reported that denifanstat was generally well-tolerated. The Phase 3 clinical trial (NCT06192264) was a randomized, double-blind, placebo-controlled, multicenter clinical trial in China to evaluate the safety and efficacy of denifanstat for the treatment of patients with moderate to severe acne. The 480 enrolled patients were randomized 1:1 into two treatment arms to receive denifanstat 50mg or placebo, once daily for 12 weeks.

In March 2025, we announced the clearance of our Investigational New Drug (IND) application for a first-in-human Phase 1 clinical trial of our second FASN inhibitor, TVB-3567. TVB-3567 is a potent and selective small molecule FASN inhibitor, planned to enter clinical development for the treatment of acne. Following the IND clearance, we initiated a first-in-human Phase 1 clinical trial of TVB-3567 for development of an acne indication in June 2025.

Cancer

Denifanstat is currently being tested in China by Ascletis in a Phase 3 clinical trial in recurrent glioblastoma multiforme (GBM) in combination with bevacizumab.

Thanks for the tip DD so did we already miss the move on SGMT? Is there a near trrm catalyst that will drive price higher? Give us some opinion on timing.

The next catalyst is GBM trial from Chinese partner Ascletis, which I think is supposed to be late 2nd quarter/early 3rd quarter. Less certain is announcement of a partner to support the 2 US phase 3 w Denifanstat monotherapy, but if announced, would be a nice catalyst. So there may be a chance that it dips short term until there is any news announced.

GBM is another condition associated with the high ratio of triglycerides/HDL. A low carb diet has improved the survival time in GBM. For acne, it is well known that better diet improves acne. This is standard dermatology care, although nowadays few dermatologists sit down and discuss diet with their patients. They have no time, being hassled by stupid bureaucratic regulations.

Thanks for the tip. As a minimum, this is a chance for me to learn more about these liver fibrosis treatments. But I don’t like buying after any huge runup. That resembles the chart of CAPR. MASH is readily reversible just by losing weight. A high % of middle aged and elderly people have MASH, esp when the serum triglyceride/HDL cholesterol ratio is high. Mine is just below 1, many are 2-4 which is already unhealthy, and I have seen those who are 30. There are standard treatments to lower the ratio, like fibrate drugs and fish oil, but most effective to lower the ratio and reduce MASH is just losing weight via a low carb diet plus exercise. Much less common is fibrosis, which happens when the inflammation in the liver from excess liver fat progresses to fibrosis.

The target market for denifanstat in MASH should ideally be only the fibrosis cases, and maybe for the severely fatty liver in those patients who will never lose 100 lbs. Most people with MASH don’t have defective FASN enzymes–they just aren’t dedicated to diet and exercise. I resent insurance money going to lazy people who refuse to lose weight and think that society should pay for their bad behavior. But I have sympathy for patients with genetic disorders like DMD where the patients are innocent victims and die young. That’s what insurance is for, to pay for compassionate use in innocent victims. It shouldn’t be for schemes by lazy, immoral people who use insurance to force others to pay for their sins. CAPR’s deramiocel will be approved from only phase 2 limited studies without the usual more demanding phase 3 double blind placebo controlled studies required for standard drugs. SGMT faces tougher odds.

If I had been lucky to buy SGMT at $2.40, I would hold shares and not take profits because of the potential. But new buyers should wait for a correction, and for the FUD to come out from shorts who actually want to buy at cheaper prices. Just like what happened with CAPR.

I just did a search on pubmed.org. In the search box, type “denifanstat FASCINATE-2” to get 12 articles. In one of the articles, there is a long list of drugs that reduced MASH more than placebo. Denifanstat is one, but the common generic oral drug pioglitazone used for diabetes is another. The most effective drug is tirzepatide (brand is Mounjaro), a combined GLP-1/GIF drug used for weight loss. For weight loss, it beats the single GLP-1 Ozempic, Wegovy. That shows the supreme importance of weight loss in reducing MASH, any way you can achieve it.

What I don’t like is the roundabout way the benefits are described in the trials. MASH is graded from 0-8, and the criterion of benefit is reduction in the score of greater than or equal 2. What I wanna know is what % reduction in liver fat was seen, and more important, what benefit there is in total body weight loss, lipids like cholesterol, triglycerides, HDL. That’s what is clinically relevant. Otherwise, these studies are basically interesting science experiments with questionable clinical relevance.

SGMT is looking to have a combination product of denifanstat and an already approved drug, res (spelling?) which produced synergy of 80% in the number of patients achieving that reduction in MASH score. But this is for 2026 with readouts later.

A similar situation exists with Alzheimers disease and amyloid plaques. Lots of drugs have demonstrated reduction in plaque, but trials didn’t show any benefit for the real endpoint, clinical symptoms of dementia. Companies producing those drugs had mediocre sales, and they flopped.

Compare all this with widely accepted drugs for diabetes or HBP. There is hard clinical outcome data showing the higher risk of diabetes complications for HbA1c over 7.0 and higher cardiac risks for BP over 120/80. For all patients, I try to get HbA1c below 6.0. The lower, the better. Clinical trials cannot measure subtle benefits with my more strict criteria, but every time I see a patient who has cardiac symptoms I urge them to get with my program.

Bottom line, if you have a lot of $ invested in SGMT, I would sell 30% to recover your investment, and let the rest ride as an intelligent speculation. But you’ll pay high taxes on your short term capital gain. For new investors, I would wait for a big pullback to maybe $4 before buying. FUD may offer even cheaper prices. It might seem that what I wrote is FUD, and it would be if it were coming from Adam Fudshit with a degree in political “science” and a hired hound for hedge fund shorts.

Thanks for the information. I don’t have a lot of $ invested in it, but I closed out most of my position and am waiting for a pullback in the 4’s like you said.(That’s what I did with CAPR recently)

Does anyone think I should hold on to my NGENF shares, Im down considerably?

Steve Check out last months discussion re NGENF with Chris and JGMD very interesting

Ok what week was it?

Yes hold. Looks promising but you have to be patient (no pun intended!)

Yes, I would hold. Hopefully, you didn’t buy too much NGENF. I only bought 4000 shares for total cost $7000. I was not as daring as Chris who probably holds many times that amount. My plan is to buy lots more during quiet periods while we await news on further trials and funding. Maybe we will get FUD articles to lower the price. The most important milestone we hit is this confirmation that animal trial success also translates into people. Long term (I hope your health is good so you can live another 30 years) it will be a super winner for all kinds of neurological conditions. Dilution is a big risk with any long term company that needs funding for lots of trials. However, Chris thinks that approval can come soon for the spinal cord injury patients, so that is in favor of holding your position and possibly adding. Even if I had bought 2000 shares at $3.50, I would still hold. Either way, selling now at $2.70 to harvest $5400 ($1600 loss) or $10,800 ($3800 gain), I would rather see NGENF to fruition for much bigger payoffs.

A similar thing happened to me with KERX. My initial buy somewhat below MM’s buy price was still way too high. I kept averaging down, so when AKBA merged with KERX, my cost basis was $4.09 for AKBA, but I only had 2300 shares worth $9400. I had forgotten about it because I was disillusioned with Auryxia. But I reinvented myself when Vafseo was about to be approved. When MM explained TDAPA, I realized this was a great opportunity for V to become a big blockbuster. I proceeded to accumulate another 39,000 shares before and after approval to get my average cost down to $1.75. (I wasn’t so clever with SCYX. I kept averaging down but I had too much in it at high prices, so I realized that I would need to spend $100K to significantly average down to $2. Now SCYX is floundering at $0.70, and is in danger of reverse splitting which will step on this 2 inch waterbug 100 times to kill it. Lesson–be careful not to overpay for anything, otherwise you may be homeless.)

Here is a one hour interview with a guy who received NervGen’s drug

https://open.spotify.com/episode/3CA1RpOLHkNldN6xgY7jLB

Thanks for this wonderful podcast. Larry Williams is a fitness enthusiast who was highly motivated to recover from his C4-6 incomplete spinal cord injury from a mountain bike accident in Nov 2022. During the 4 months at Shirley Ryan rehab, his progress was slow but definite, so he used his powers of positive motivation to improve even more. Many healers know that there is a positive placebo effect. A strictly placebo person would do nothing, and say, “just give me the drug, I don’t want to bother doing anything for myself.” They would not get as good results as someone who tried to help themselves in even a small way, such as prayer, research, better diet, whatever other exercise they are able to do, etc. Larry got NVG-291 but enhanced his recovery with other things he did.

RFK, Jr should publicize podcasts like this and say that better health comes from efforts by patients. Copayments at least 10% should be applied to most drugs. This would give patients the proper incentive to do diet, exercise and other things to improve their health. I have reversed diabetes and many other conditions in patients who have listened. They no longer need some of the drugs they were taking, or doses can be reduced for less risk of side effects. The health care system will save lots of money in this way. Patients who take action will also save money by eliminating some drugs. Motivated people save money, while lazy people pay some costs. Many lazy people will change their attitudes and develop personal responsibility. They will profit financially by doing this.

Note that the trial included physical therapy and testing for all participants. It included their med for half the trial participants and no med treatment for the other participants, which is a placebo control. Staff did not know who got the drug and who did not. On this board, we previously discussed data showing better outcomes among participants receiving their med. Participant Larry was told after the trial that he did in fact get their med. Larry said it gave him the foundation having the ability to keep improving, move a little better with finger and legs. Went from walker a couple hundred feet to walking a mile. Larry can get on rowing machine, and forty five minutes on a treadmill without using a harness. One to one and one half miles per hour versus his previous six tenths of a mile per hour when starting the trial, doubling his speed.

This appears impressive to me. A friend of mine had a similar but worse injury when age 65, with similar symptoms to Larry. Several vertebrae in his neck replaced. Was in horrible pain initially, suicidal thoughts. Now walks almost 100 feet. Had repeated falls following this accident, once knocked unconscious after hitting his head. MDs had been deadening nerves to reduce intense pain, which also affects muscle control somewhat. Has lost control and strength in his hands especially. Can no longer play guitar despite being motivated. Difficulty on stairs but can navigate them slowly.

I feel for your friend. Mainstream medicine(MM) has little to offer without causing side effects. But some modalities spurned by MM include hyperbaric oxygen (HBOT), ozone. HBOT increases oxygenation in the blood even if hemoglobin saturates at pO2 of 100.

Ozone stimulates the redox system which helps healing. I have a small O2 tank which I got locally and a small ozone generator I got from simplyO3.com. You can do rectal insufflation at home which delivers O2 through the rectum. All this is cheap. Somewhat more effective is major autohemotherapy done professionally by holistic practitioners. They draw blood, externally ozonate it, then reinfuse it IV. Watch some videos on the site of David Minkoff, MD in Clearwater, Fla and plenty on youtube. David Brownstein, MD wrote a short layman book on ozone with theory and clinical applications.

Yesterday I watched a webinar from Quicksilver Scientific on peptides which are used for healing and tissue regeneration. BPC157, TK500, others. The most effective method of administration is IV or IM, but this is super costly. Much more affordable and practical but still expensive is the liposomal delivery system which is the trademark of Quicksilver. Tiny liposomes about 70-100 nm deliver the agent. Many companies sell liposomal products, but Chris Shade of Quicksilver tested them, and their much larger liposomes have poor bioavailability. Shade’s liposomes are almost as good as IV’s for bioavailability. I use several of their products. I spray into my mouth and it takes 2-4 minutes to nearly fully absorb into the tongue and cheek onward to the blood. Get your friend’s MD to join Quicksilver so he can get professional prices.

I hope NGENF gets its product (which is a peptide) approved in time for your friend to benefit. Meanwhile, the more modalities that can contribute to healing, the better. The single magic bullet approach of MM is less effective.

Larry Williams is a very intelligent blue collar worker who used to deliver tires to dealers. He is brutally honest and realistic, saying that only a few (1-2?) had major improvements from NVG 291. Now able to walk 1-1.5 mph, this is a far cry from his former walking speed of probably at least 4 mph. He is highly motivated, and it will take all his efforts to have a normal life again, hopefully not too long from now. It is also interesting that he said the electrophysiological tests were quite painful to do, and this is why many screened participants dropped out. So we can’t blame the company for slow enrollment in trials.

Opie, I just got the replay of the Quicksilver webinar with slides, prices and dosages. Those are retail prices. Professional prices are half of retail. That would be monthly $70 for BPC157, $110 for combinations at maintenance. To get therapeutic bolus dosing, multiply these by 6-10, perhaps for 1-2 months. This program is new. Anyone who tries this treatment is admittedly a guinea pig. Otherwise, nearly all people will do nothing, and wait 10 years or more for MM to catch up. Even then, options will be limited. FDA trials will be for limited indications, rigidly defined. Then a drug or procedure will need to get prior authorization and usually be rejected because the indication doesn’t match the narrow criteria. This is why MM is nearly worthless for most serious illnesses. Big Pharma plans it that way, so they can maintain their monopoly in health care. The population’s money is siphoned off to BP so they have little left for innovations like Quicksilver and others.

If you want to get this info, I can send it. Just write your email if you’re interested.

Thanks, I’ll copy and forward all this information to my friend and discuss with him. I’ve tried Quicksilver products from your earlier recs. NervGen looks very promising.

Good. These products from Quicksilver are new, but holistic docs have been using peptides for years. These underground docs have accumulated experience. MM disparages their anecdotal reports and doesn’t allow them a hearing in journals. Journals are political clubs. Revenue comes from Big Pharma ads, so BP keeps holistic docs out. Holistic organizations can’t afford ad rates. Just another example of how innovative politicians can’t get elected because the establishment keeps them out.

NGENF and CAPR are both promising for the same reasons–this is regenerative medicine. We need adjunctive solutions like the Quicksilver peptides. BTW, NGENF’s 291 is a peptide. There are peptides designed for different healing applications.

cantwate2000@yahoo.com

thanks

BTQ Technologies BTQQF is up 46% this week.

https://finance.yahoo.com/news/btq-technologies-unveils-quantum-stablecoin-113000058.html

Demonstrates How Quantum-Secure Stablecoin Models for JPMorgan, Tether, Circle, and Others Enter The Quantum future

I learned about this stock from Charles Payne’s show. He has people that explain quantum computing.

Thanks for the tip Gary, did we miss the opportunity? Are there catalysts that will drive the price higher?

Be careful. With any company that has jumped after posting good news, there is usually a pullback soon. Also, Payne’s show is popular on the radio. Nice and folksy, designed to offer comfort. That means any stock recommended is in the later stages of promotion. The best way to make money is buying when few know about it, or when Adam Fudshit is getting attention for writing articles for the shorts. Buy when you and others have fear, but not when you have FOMO, fear of missing out. Can you imagine FDR saying the only thing to FOMO is FOMO itself? Haha. I’m full of F’s tonight.

New World Investor for 6.26.25 is posted.