Dear New World Investor:

Last September 16, CareerBuilder and Monster merged. The CEO said: “The combination of CareerBuilder and Monster brings together two strong, trusted, complementary brands to create a job board with greater scale and reach.”

On Tuesday, a short nine months later, the merged company filed for Chapter 11 bankruptcy. What happened? This:

The latest Conference Board Consumer Confidence report said that households’ “appraisal of current job availability weakened for the sixth consecutive month” and consumers “were more pessimistic about business conditions and job availability over the next six months.”

Weak help wanted ads could be an early warning indicator, but as I’ve said, I am watching what the Fed watches – weekly new unemployment claims – to see if there is real employment weakness. If and when that number goes over 250,000 for a few weeks in a row, the pressure on the Fed to cut rates even though inflation is above their 2% goal will be intense. Today it was 236,000, a decrease of 10,000 from last week’s 246,000. So, we’re flirting with 250,000, but not there.

Continuing claims did go up from 1.937 million last week to 1.974 million, the highest level since November 2021. An increase in continuing claims is a sign that those out of work are taking longer to find new jobs, but that’s not the main focus of the Fed.

Even so, according to the CME FedWatch Tool, after the employment claims data markets are pricing in a 27% chance the Fed cuts interest rates at its July 30 meeting, up from a 12.5% chance last week, Odds of a cut by the end of September surged from 64% to 92%.

I still think Chairman Powell needs to see worse labor numbers or substantially lower inflation numbers before he cuts interest rates, preferably starting with the Fed’s favorite inflation indicator, the Personal Consumption Expenditures Index, at 8:30am tomorrow. And remember that there is a “surprisingly” strong June quarter GDP number coming on the morning of July 30 before the stock market opens.

Market Outlook

The S&P 500 added 2.7% since last Wednesday and came within a point of its all-time high today. The Index is up 4.4% year-to-date. The Nasdaq Composite gained 3.2% and also is up 4.4% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 1.2% since the last issue. But it is still down 7.1% year-to-date. The small-cap Russell 2000 gained 2.8% and is down 2.6% in 2025.

The fractal dimension again is hinting that the consolidation may be over and a new, roughly three-month long, uptrend could start with indexes near all-time highs. One big up week or two or three smaller up weeks would do it.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX ScyNexis – Resolution of GSK situation

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Friday, June 27

Personal Consumption Expenditures Index – 8:30am – The Fed’s favorite inflation indicator

Monday, June 30

Business Employment Dynamics – 10:00am – More hard truth about real payroll growth before the election

Friday, July 4

Markets Closed

Happy 249th, America!

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $201.00) added tennis to the free Apple Sports app. Tennis fans can access live scores for Grand Slam and 1000-level tournaments, and can track every point across all men’s and women’s singles matches, beginning with Wimbledon. AAPL is a Buy under $205.

Corning (GLW – $51.70) declared a 28¢ quarterly dividend payable September 29. The stock closed today with a 2.17% yield. GLW is a Buy under $33 for a $60 target in 2025.

Gilead Sciences (GILD – $107.62) and Kymera Therapeutics (KYMR) entered into an exclusive option and license agreement to accelerate the development and commercialization of a novel molecular glue degrader (MGD) program targeting cyclin-dependent kinase 2 (CDK2) with broad oncology treatment potential including in breast cancer and other solid tumors.

CDK2-directed MGDs are a new type of drug designed to remove CDK2 – a key contributor in tumor growth – rather than just inhibiting its function. Traditional inhibitors of CDK2 prevent it from working, but often interfere with similar proteins, which can cause undesired side effects. MGDs have the potential to provide more precise, safe and effective treatments for cancers that rely on CDK2 activity by selectively removing this protein from cells. GILD is a Long-Term Buy under $90 for a first target of $120.

Meta Platforms (META – $726.09) officially announced its next pair of smart glasses with Oakley.

The smart glasses have double the battery life of the Meta Ray-Bans (which have sold over two million pairs), and are able to capture 3K video. They feature a front-facing camera, open-ear speakers, and microphones. You can use the glasses to listen to music, take photos, and make and receive calls. They include Meta AI to answer questions or execute commands like “How strong is the wind today?”or “Take a video.” Wearers can ask Meta AI about what they’re seeing, and get it to translate languages.

Last December, the company announced it will spend $10 billion to build the biggest data center in the Western world on 2,250 acres in Louisiana (that’s about 1,700 football fields for you city folk). Last June, only six months after taking office, Governor Jeff Landry signed into law a 20-year sales tax exemption for data centers built before 2029. As CNBC delicately put it: “The fact that the state was courting Meta at the time was not disclosed.”

UBS raised their target price from $683 to a whopping $812, pointed to rising consumer and advertiser interest in AI tools, especially in areas like Business Messaging and Meta AI, as key revenue drivers going forward. META is a Buy under $655 for a long-term hold.

Micron (MU – $126.00) crushed the May third quarter and raised guidance for the August period. May quarter revenues were up 36.6% from last year to a record $9.3 billion, thanks in large part to sales of high-bandwidth memory (HBM) for AI datacenters. HBM grew 50% from the preceding February quarter, driving total revenues up 15.5% from the February second quarter. GAAP net income hit $1.89 billion or $1.68 a share, while pro forma income was $2.18 billion or $1.91 a share. The consensus was at $8.85 billion and $1.61 pro forma.

Click for larger graphics h/t Seeking Alpha

On the conference call (AUDIO HERE and SLIDES HEREand PREPARED REMARKS HERE and TRANSCRIPT HERE) and follow-up analyst call (AUDIO HERE and TRANSCRIPT HERE), CEO Sanjay Mehrotra said they expect high teens DRAM bit growth this year, so: “We are on track to deliver record revenue with solid profitability and free cash flow in fiscal 2025, while we make disciplined investments to build on our technology leadership and manufacturing excellence to satisfy growing AI-driven memory demand.”

On their technology, he said: “We remain the sole supplier in volume production of LP (low-power) DRAM in the data center…We are making excellent progress on our 1γ (1-gamma) DRAM technology node, with yield ramping ahead of the record pace we achieved on our 1ß (1-beta) node. We completed several key product milestones during the quarter, including the first qualification sample shipments of 1γ-based LP5 DRAM. Micron 1γ DRAM leverages EUV (extreme ultraviolet lithography), and the node provides a 30% improvement in bit density, more than 20% lower power, and up to 15% higher performance compared to 1ß DRAM. We will leverage 1γ across our entire DRAM product portfolio to benefit from this leadership technology.”

For the August fourth quarter, he guided for 38.1% revenue growth to $10.7 billion ±$300 million with GAAP earnings of $2.29 ±15¢ a share and pro forma earnings of $2.50 ±15¢ a share, more than double last year’s $1.18 and well above the consensus for $9.88 billion and $2.03 pro forma.

The company ended the quarter with $12.22 billion in cash, marketable investments, and restricted cash. MU is a Buy under $102 for a $140 first target.

Nvidia (NVDA – $155.02) became the world’s most valuable company again after the stock set a new all-time closing record today at $155.02, about 6 ½ months after their January 6 high at $149.43. DeepSeek? China tariffs? H20 GPU sales to China banned? Fuggedaboudit. Loop Capital raised their target price to a Wall Street-high $250. NVDA is a Buy under $125 for a $180 first target.

Palantir (PLTR – $144.25) entered a $100 million, 5-year strategic product partnership with The Nuclear Company, which is leading gigawatt-scale deployment of nuclear power across America and pioneering the modernization of nuclear construction. Together, the companies will co-develop and deploy NOS (Nuclear Operating System), the first AI-driven, real-time software system built exclusively for nuclear construction. NOS will transform the construction of nuclear reactors into a data-driven, predictable process, enabling The Nuclear Company to build plants faster and safer for less.

Nuclear plant construction probably is the most regulated (many would say over-regulated) in the world. NOS will find broad use in the West. I expect Palantir to develop operating systems for many more regulated industries.

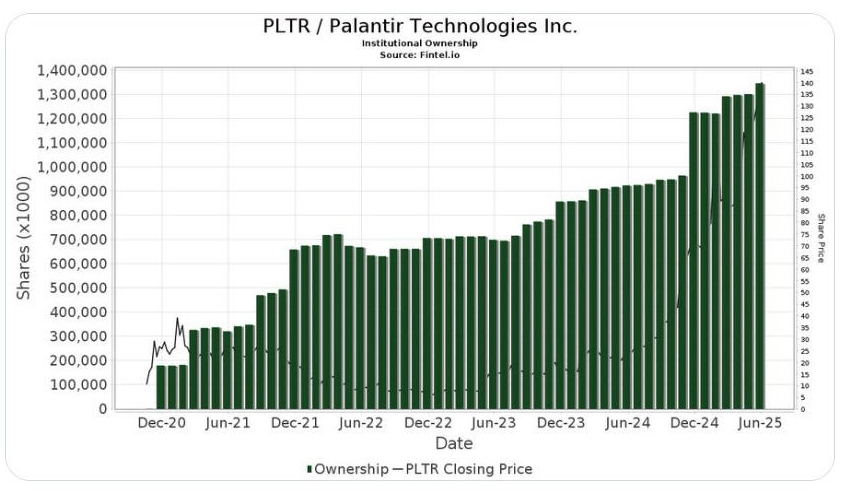

Loop Capital increased its target price from $130 to $155 after meeting CFO Dave Glazer. Loop sees “explosive AI potential.” Institutional ownership is up to around 60%.

PLTR is a Buy under $100 for a $150 target.

PayPal Holdings (PYPL – $73.17) announced that Taco Bell will use both PayPal and Venmo to deliver a fast, secure, way to pay in the Taco Bell app and website. Through July 31, customers checking out with PayPal in the Taco Bell app can also receive 20% cash back on any purchase over $5. PayPal Debit MasterCard customers can earn an additional 5% cash back.

PayPal also announced multi-year agreements with the Big Ten and Big 12 conferences that will modernize the distribution of institutional payments from university athletic departments to student-athletes in a new revenue-sharing model. The new institutional payments initiative ensures a secure, efficient, and transparent way to distribute funds to payees. PYPL is a Buy under $68 for a double in three years.

SoftBank (SFTBY – $34.37) CEO Masayoshi Son reportedly has proposed a $1 trillion US AI hub to Taiwan Semiconductor (TSMC) and the Trump team. Masa thinks big! SFTBY is a Buy under $25 for a first target of $50 in the next two years.

Small Tech

Rocket Lab USA (RKLB – $35.14) said Electron’s next launch will be this Saturday from Launch Complex 1 in New Zealand. This is the first of two dedicated missions on Electron to deploy a single spacecraft for a confidential commercial customer. It will launch less than 48 hours after Electron’s 67th launch – the company’s fastest launch turnaround from Launch Complex 1 ever.

The stock hit a record high today after they announced they have been selected to deploy satellites for the European Space Agency. RKLB is a Buy up to $13 for my $30+ target as low earth orbit satellites and space exploration grow.

Primary Risk: A new competitor emerges.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

Compass Pathways (CMPS – $2.66) made their first Phase 3 top-line data announcement and ***we***have***a***winner***! A single administration of COMP360 demonstrated a highly statistically significant and clinically meaningful reduction in symptom severity as measured by Montgomery-Åsberg Depression Rating Scale (MADRS1). The independent Data Safety Monitoring Board (DSMB) found no unexpected safety findings and no clinically meaningful imbalance in suicidal ideation between treatment and placebo arms.

So why did the stock drop 50%? The MADRS1 reduction, while “highly statistically significant and clinically meaningful,” was -3.6. In the Phase 2 trial it was -6. I am not surprised because this was a much larger 238-patient trial, and most drugs show a decline in efficacy from Phase 2 to Phase 3. The important points are (A) the FDA will approve it, and (B) doctors will use it. I don’t expect this decline to last for long, so take advantage of it.

This first Phase 3 COMP005 trial is the first study of an investigational, synthetic psilocybin, and the first classic psychedelic, to report Phase 3 efficacy data. The second ongoing pivotal Phase 3 trial, COMP006, continues to enroll well, with 26-week data expected in the second half of 2026. CMPS is a Buy under $20 for a very long-term hold to a 10x.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2028

Probable time of next financing: Late 2025

Medicenna (MDNAF – $0.66) reported their March fiscal year results. They had total operating costs of $20.4 million compared to total operating costs of $18.7 million for the 2024 year. The increase was due to an increase in R&D expenses of $3.6 million, which was partially offset by a reduction in G&A expenses of $1.9 million.

The net loss for the year was $11.8 million or 15¢ per share, compared to a net loss of $25.5 million or 37¢ per share for the 2024 fiscal year. But most of the decrease in net loss for the 2025 year was a paper decrease in the fair value of the derivative warrant liability of $6.3 million compared to an increase of $7.9 million in 2024. The significant decrease in fair value of the warrant derivative is due to the decline in their stock price year-over-year, which is the key variable in the valuation of a derivative liability.

They said the MDNA11 Phase 1/2 clinical trial remains on track for data readouts in the second half of 2025 as both a single agent and in combination with Merck’s Keytruda. It continues to exhibit deep and durable anti-tumor activity in difficult-to-treat solid tumors with best-in-class potential relative to competing IL-2 programs. Response rates are in the 30%-50% range in various tumor cohorts amongst high dose patients. Three cancer patients treated with MDNA11 remain tumor-free for as long as 18 months since achieving complete resolution of all target and non-target lesions.

The Phase 2b development plan for MDNA11 will be solidified by the end of this calendar year, including evaluation of strategies for accelerated approval. They ended March with $24.8 million in cash, enough to carry them to mid-2026.Buy MDNAF under $3 for a first target of $20.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Entering Phase 3

Probable time of first FDA approval: 2026

Probable time of next financing: 2025

ScyNexis (SCYX – $0.74) got a delisting notice from Nasdaq on June 20, and has until December 17 to get their stock back over $1. They can do that by resolving the GSK situation. I will contact them to urge them to follow Medicenna’s model and not do a reverse split. Buy SCYX under $2.50 for a first target price of $20 after ibrexafungerp is approved for hospital use and a buyout at $50.

Primary Risk: Ibrexafungerp fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: 2026

Probable time of next financing: Never

Inflation MegaShift

Gold ($3,341.60) was down a bit for the week as Iran did not go full suicide mode after President Trump bombed their nuclear facilities. But it’s still near its all-time highs because it’s obvious that is a very unstable situation.

The fractal dimension shows a steady march towards full consolidation, but we’re probably still several weeks away.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $107,068.59) rallied to the top of its recent range on the Iran chaos, but also on the obvious support the Trump Administration has for cryptocurrencies.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $61.14) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $18.46) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $65.22

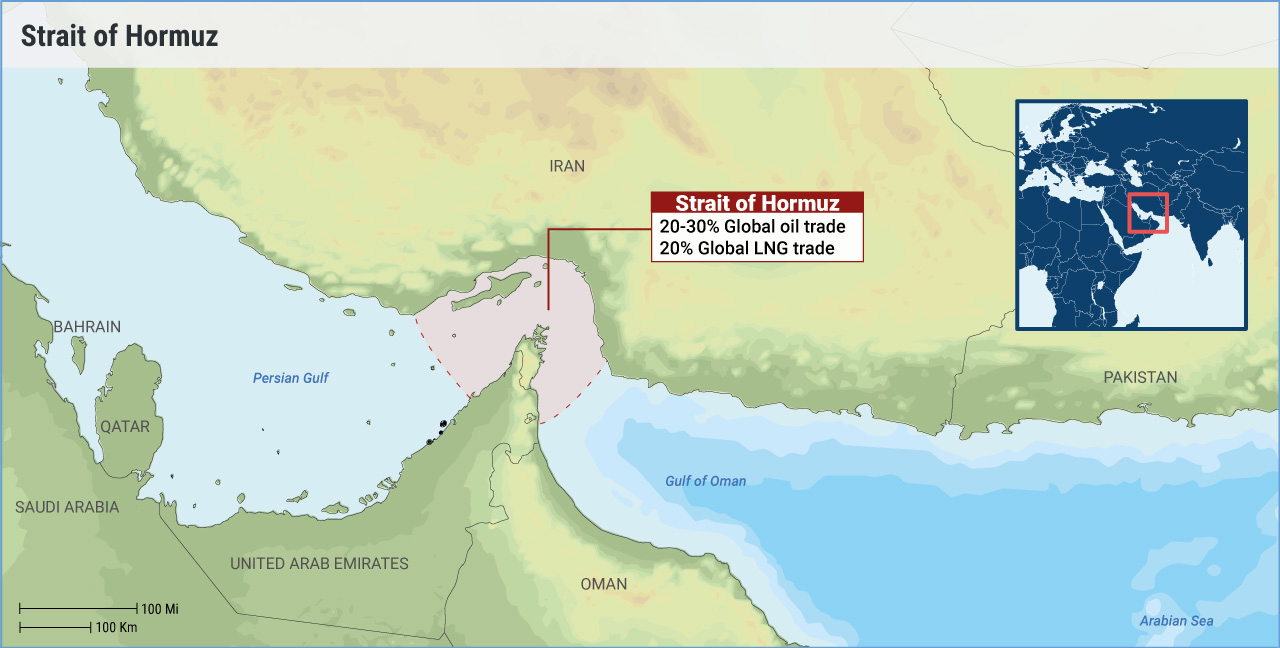

Oil prices faded after the Iran situation simmered down for now, but 20 million barrels of oil per day, as well as all of Qatar’s liquefied natural gas (LNG) exports, pass through the narrow Strait of Hormuz that connects the Persian Gulf to the Gulf of Oman.

It’s awfully easy for Iran to cause a lot of chaos with a little effort. Just sayin’.

The July 2026 Crude Oil Futures (CLN26.NYM – no trades – June settled at $61.56) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $35.29) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $7.49) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $5.90) said that the Government of Victoria, Australia, has approved the Work Plan for the construction and operation of the Donald Rare Earth and Mineral Sand Project. The Donald Project is a joint venture between Energy Fuels and Australia-based Astron Corporation Limited.

This is the final major regulatory approval required to construct and operate the Donald Project. It enables the finalization of critical activities, including arrangements for debt and equity financing, before a final investment decision can be made. Energy Fuels has the right to invest a total of $119 million, plus issuance of $17.5 million of stock, to earn up to a 49% interest in the project.

The Donald Project is expected to provide Energy Fuels with a low-cost long-term supply of monazite- and xenotime-bearing Rare Earth Element mineral concentrate which they will process into high-purity separated REEs at their White Mesa Mill. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

Freeport McMoRan (FCX – $44.46) will be a big winner when copper prices take off, as the great resource investor Rick Rule thinks they will:

The company declared their usual 15¢ dividend, half base and half variable depending on how much money they’re making. FCX is a buy under $44 for a $65 target within two years.

Primary Risk: Copper prices fall.

* * * * *

Warren Buffett’s First Interview

* * * * *

“On June 11, 1776, the Continental Congress nominated a drafting committee of five men to compose a declaration of independence. The committee consisted of one southerner – Thomas Jefferson of Virginia – two New Englanders – John Adams of Massachusetts and Roger Sherman of Connecticut – and two from the Middle Colonies – Robert R. Livingston of New York and Benjamin Franklin of Pennsylvania. On July 1, 1776, Congress reconvened. The following day, the Lee Resolution for independence was adopted by 12 of 13 colonies, with New York not voting. Immediately afterward, the Congress began deliberating the Declaration. With minor changes by Adams and Franklin, Congressional discussions produced some alterations and deletions. But the basic document remained Jefferson’s. The process of revision continued through all of July 3rd and into the late morning of July 4th, when the Declaration was officially adopted.”

h/t @DiMartinoBooth

* * * * *

Your Why Everything Feels Like It’s Breaking—and Why That’s the Point Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 6/26/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $201.00) – Buy under $205

Corning (GLW – $51.70) – Buy under $33, target price $60

Gilead Sciences (GILD – $107.62) – Buy under $90, first target price $120

Meta (META – $726.09) – Buy under $655 for a long-term hold

Micron Technology (MU – $126.00) – Buy under $102, first target price $140

Nvidia (NVDA – $155.02) – Buy under $125, first target price $180

Onsemi (ON – $53.65) – Buy under $60, first target price $100

Palantir (PLTR – $144.25) – Buy under $100, target price $150

PayPal (PYPL – $73.17) – Buy under $68, target price $136

Snap (SNAP – $8.14) – Buy under $11, target price $17+

SoftBank (SFTBY – $34.37) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $10.53) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $74.97) – Buy under $70; 3- to 5-year hold

Fastly (FSLY – $6.89) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $14.90) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $5.97) – Buy under $10, target price $40

Rocket Lab (RKLB – $35.14) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $30.88) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $3.74) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $3.74) – Buy under $2, target $20

Compass Pathways (CMPS – $2.66) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $2.12) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $2.25) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.66) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.74) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($36.55) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $45.60) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $50.12) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $30.40) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $48.51) – Buy under $30, target price $50

Coeur Mining (CDE – $9.05) – Buy under $5, target price $20

Dakota Gold (DC – $3.84) – Buy under $2.50, target price $6

First Majestic Mining (AG – $8.38) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.62) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $9.31) – Buy under $10, target price $25

Sprott Inc. (SII – $67.70) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $107,068.59) – Buy

iShares Bitcoin Trust (IBIT – $61.14) – Buy

Ethereum (ETH-USD – $2,416.12)– Buy

iShares Ethereum Trust (ETHA- $18.46) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – no trades – June settled at $61.56) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $35.29) – Buy under $40; $100+ target

Vermilion Energy (VET – $7.49) – Buy under $11; $24 target

Energy Fuels (UUUU – $5.90) – Buy under $8; $30 target

EQT (EQT – $58.15) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $44.46) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

TG Therapeutics (TGTX – $37.95) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

Does anyone have Circle Internet Group CRCL? Up 589% this month. Issuer of stablecoins.

MM – do you still brlieve BTC will hit $150k this year and ETH will out perform BTC? If so why is neither in your near term top picks? Have you changed your mind? Please reply as I am heavily invested in both

MM & all – does anyone belueve theirs still money to be made in quantum computing stocks? The popular ones IONQ, DWAVE.and BTQ have all run up, are they still buys or is there another one to get into early?

MM – RKLB surpassed your target price, still good buy now? Next target price?

RKLB may continue upward, who knows? Nobody has unlimited amounts of money, so new money should go into undervalued situations. I haven’t followed RKLB and missed it, but it is probably a hold at best, or a sell if someone needs money to invest in things like NGENF, CAPR, AKBA which have MUCH more upside than RKLB. Even TGTX which has done well is a hold, not a buy.

Chris, on ACHV, the price tanked today in proportion to the expected dilution from the $45 million capital raise. My average cost is $4. Is it worthwhile to average down at $2.35? When do you expect approval? How long will it take to reach the target prices of $16 given? Of course, $16 would now be $10-11.

I sold almost all my ACHV earlier this year as I knew they would have to raise cash and that would probably crash the stock. Now that they have announced the raise, I bought back today, I expect approval in March. I don’t see how RFK’s MAHA FDA can reject it.

Have a look at INMB. Closed yesterday at $6.28. This morning they announced an 8 am conference call for Monday. The stock ran up to $11.84. Around 1 pm they announced a dilutive offering at $6.30 per. You can buy now for $5.16.

Chris, I dont follow, if they jjst diluted the stock then what will drive the price up?

Capital raises let a company survive, a good thing, but only If the money is used for a good purpose like enabling drug approval. Then that is a good investment that will greatly outweigh the dilution negatives. But if money is just for survival without a realistic hope of a turnaround, then dilution is totally negative. I kept buying VLD all the way down, but that was stupid because I didn’t admit that they had little hope of regaining business. MM was also too late in recognizing this. Now they are on the move, but with all the reverse splits and dilutions, I have no idea whether the adjusted price is higher than when I sold at a 95% loss, or whether they are just a PR machine like they were last year.

ACHV has an excellent smoking cessation drug which is a better version of Chantix, a blockbuster of the past. Here’s your opportunity. I still say CAPR, AKBA are better, even though they have moved up.

Chris, is this dead money until March 2026?

Yu can always sell near term OTM Calls against your shares and get a better return than you would from a bank. Selling $2.50 puts is not a bad idea either.

A few months ago, there was fear that the ACA mandate for insurance to cover smoking cessation drugs would be cancelled. What’s the status on that? Supposedly RFK, Jr himself uses nicotine patches, but some of his administration colleagues want to cancel the ACA mandate. This inconsistency is typical of govt policies regardless of political party. The left hand doesn’t know what the right hand is doing.

Im reading ACHV will be submitting NDA soon, is that accurate and will it be a stock price catalysts?

You did the same thing as I think most did. You only read about the dilution that was announced at 4:03 on June 26 and the pricing that was announced a few hours later. But at 4:01 there was the announcement that they submitted their NDA. The FDA will either accept or reject that application within 30 days. Acceptance may be a catalyst. Approval in March or April should move the shares to $10 or more.

Chris are you still a bulll on MDNAF? I know at one time you were.

I own MDNAF because I believe one day I will wake up and find the company has made a deal that will make my shares at least 10 times higher than today. I don’t know if that will be next week, next month or next year. So it’s dead money until that occurs. They’ll release more data this year including in the combo trial with Keytruda. I don’t know if they will sell out to Merck or another BP, but I am willing to park money in MDNA for now, knowing it may be dead money until a deal is made. One day I might re-analyze the opportunity cost and decide to put my money elsewhere for a smaller return on a shorter timeline.

Thanks!!!

Since FDA approval is likely, I don’t see any risk that the NDA application will be rejected. Do you?

NDA acceptance/rejection has nothing to do with how good a drug may be. An NDA can contain thousands of pages of documents and there are many ways that an NDA can be rejected as unsatisfactory. Imagine you were filing a passport application and you neglected to check a box indicating whether you are male or female. Your application will be rejected. Now imagine you are filing an application to commercialize a new drug which is a far more comprehensive document and you failed to include something the FDA considers material. Your application can be rejected. Fortunately, the FDA will tell you where your application is inadequate and it may be an easily addressable problem, but approval will be delayed. A couple years ago everyone assumed ACHV’s approval would have already occurred, but the FDA threw a curveball and asked for data on extended exposure in case people made multiple quit attempts using cystinicene. No one saw this coming and it likely cost John Bencich his job at ACHV. ACHV’s CMO took over as president and she seems quite competent. I was concerned about FDA acceptance of Capricor’s NDA and considered its investability questionable until the time expired for the FDA to reject the application. If a month passes and there is no rejection of ACHV’s application, I will probably add to my investment.

Trials include baseline characteristics of the treatment and placebo groups. It is well known that people often or even usually have multiple quit attempts. The protocol is described in detail, so presumably the new CEO has no obvious omissions. Still, this kind of oversight should not have affected an application acceptance, but a CRL or rejection could occur later near the PDUFA date. If anything, delay of NDA acceptance could be fixed quickly, not take 2 years, so a delay might be a back up the truck buying opportunity. Since ACHV has worked closely with the FDA this time, I highly doubt the NDA will be rejected.

Also, we have the new FDA that wants to get more efficient approvals, esp in a severe health problem like smoking. This isn’t the tragic need for dying rare DMD patients with CAPR, but for smoking it is a health problem that affects 10’s of millions of people.

PLTR – Any clues as to what hammered Palantir today?

i do like akba here i also like skye iwould appreciate all responses

i have been lightening up on tgtx to buy akba and skye what do my friends on this board think?

m

AKBA is a timely buy now for those not invested, awaiting Q2 ER in mid August. I have plenty of AKBA at average cost of $1.75. I hate chasing stocks. There was a rumor that TGTX might have something in azercel, but otherwise we are just waiting for buyout. Perhaps TGTX has stagnated because of R&D expenses, but if azercel becomes a good asset, TGTX could resume its climb. Certainly AKBA has more potential than TGTX at this time.

AKBA rated Strong Buy, Skye rated Buy, TGTX rated Strong Sell. Probably a good move, but you never know! 😉

I came across another one for everyone to check out. It’s currently trading at $1.60. Tiziana Life Sciences is a NASDAQ listed (NASDAQ:TLSA) clinical stage biotechnology company that specializes in the developing transformative therapies for neurodegenerative and neuroinflammatory. Our clinical pipeline includes drug assets for Secondary Progressive Multiple Sclerosis, Alzheimer’s, and ALS. Tiziana is led by a team of highly qualified executives with extensive drug development and commercialization experience.

Foralumab (TZLS-401) – Lead immunotherapeutic candidate

Foralumab is a fully human anti-CD3 monoclonal antibody, designed to modulate the immune system by targeting the CD3 epsilon subunit of the T cell receptor complex. This mechanism aims to induce regulatory T cells (Tregs), offering potential therapeutic benefits in autoimmune, inflammatory, and neurodegenerative diseases.

https://x.com/TizianaLS/status/1937871793374503294

Thx for the tip DD but whats the near term catalyst? No more patience for multiyear holds on very early biotechs

You won’t achieve success by asking what the next catalyst is for any stock. You have to understand the business fundamentals. Watch the old iconic interview of Buffett that MM posted. Buffett never understood any tech company and didn’t invest there. Those experts who understand the business all know what significance the next catalyst is, better than anyone who doesn’t have that perspective. Often the catalyst is widely known and discounted, so when it comes the stock sells off. “Buy the rumor, sell the news.” Better yet, buy when the stock is off the radar, sell the news. The charm of even the young Buffett is that he wanted to avoid the “noise” of Wall Street financial mavens who know all the catalysts, seasonality and other bullshit unconnected to a company’s business.

For me, my likely success will come to fruition NOT by buying early stage companies which get diluted to death, but by buying late stage ones that already have crashed from multiple dilutions, and in the 11th hour for stupid reasons like fear of adcom or other FUD from Adam fuckheads working for shorts. For CAPR, despite the ebullient cheer, there will probably be another short attack before PDUFA day 8/31. I will be there waiting to buy more cheap shares if it happens.

CAPR–today we either have a correction, or shorts creating cheaper prices. This could go on for another 6 weeks. Buy more at $5-10.

ACHV–recent highs were a little under $4. There is possibility of 35 million shares being added to the already 34 million outstanding, for a dilution of about 50%. This would reduce the target by half. But why should tutes buy at $3 when they can buy at $2.00, a fair price considering the possible 50% dilution? The company has very low cash now, and needs $45 million to survive until approval, and for launch expenses until they are cashflow positive. That means they need to dilute more at $2 than at $3 to raise that amount of $. The stock could decay to way below $2 just before the time of approval. We need patience. Backing up the truck at $1.50 or even less would greatly lower my average cost, now $4. The vaping trials will take longer, so there is great opportunity for long term capital gains if we are patient. Target $8-10 in 1 year, an excellent return. Higher upon successful sales in 2-3 years.

Chris?

With all due respect JGMD, catalysts are what drives stock prices near term, revenues drive it long term, if I just wanted revenue driven gauns Id buy tech etf, so yiu should rethink your comment – appreciate your feedback but you are off on this point

I’m afraid you miss my main point. The market for most all stocks has plenty of full time professional experts following the news. They know all the catalysts long before you do, and have mostly bid up the price by the time you ask the question of what the catalysts are. They manipulate the market and get cheaper prices than you or I. The only way we win is by detecting crowd thinking from these pros, and plan buys when the crowd AND WE are scared and fearful. That occurs from FUD from Adam Fudshits who are hired by shorts to invent lies to scare everyone who got in at high prices. Buy when you are scared, NOT when you want to jump on the bandwagon of the optimism from pumpers.

I first learned all this from Peter Lynch, manager of the Fidelity Magellan fund in the 1980’s. Peter said 50 analysts are following each blue chip, so his only edge was going to a store, observing the business, talking to employees to learn the truth, rather than the stupid armchair number crunching of 50 analysts. Buffett and John Templeton bought when others were fearful, and sold when others were pumping.

Another way to beat the pros is to hold situations for years to capture the marathon gains. Pros often just care about 1 year targets. Their salaries depend on finding new things and then selling the 1 year gainers to have money to invest. These great situations are RARE. I think my 4 big investments currently will amply pay for my many past mistakes.

In the game of engineered anti-CD20 antibodies, TGTX is peerless. No single drug will ever beat Alzheimer’s because it is has a myriad number of causes (recall my discussion of the disgust of the magic bullet approach by Dr. Dale Bredesen). See what Stocktwits experts think.

TLSA Tiziana Life Sciences rated Buy. Overbought now but strong relative strength. Low debt vs equity, good return on equity, neutral price vs sales, neutral free cash flow, high price to book value, earnings rated neutral (growth, surprises, trend, projected P/E, consistency), high relative strength vs market, good money flow into the stock, low short interest, poor volume trend. Experts somewhat bullish.

Not to be confused with TSLA, rated very bearish right now.

I don’t follow TSLA. However, based on sentiment, it was most negative when Musk was on board with Trump’s program. Now he is distancing himself from Trump, and today is very critical of policies against alternative energy and the support of fossil fuels. Clearly, Musk says all this to support TSLA.

Charles Payne has guests on his show that talk about quantum computing. I learned about D wave and BTQ technologies six months ago. They are both up over 100%. They are a little risky so I didn’t buy that many shares.

Ray Wang is on Varney. He is very good at explaining big tech. When Nvidia hit bottom a few weeks ago Wang said Nvidia was a good buy. I bought and Nvidia is up over 50%. He explains what big tech is doing and how much money they are making.

One part of Trump’s Big Beautiful Bill that I don’t understand is “no income tax on overtime earnings”. This seems like bad policy to me. Obamacare had the negative result of reducing the number of full-time workers at Target and other big employers and increased the number of part-time workers because the big employers didn’t want to have to pay health insurance for all of their full-timers. That was bad policy because most workers prefer to have a full-time job rather than 2 (or 3) part-time jobs due to scheduling conflicts, time and money spent commuting, etc. Having no income tax on overtime means workers will have even greater incentive to try to put in overtime. The result of that will mean there will be fewer people employed because employers will have more employees willing to work overtime to get the work done instead of hiring more people.

I would love for anyone to show me where I’m wrong.

Trump wants to trumpet “tax cuts” and has no concern for your issue of fewer jobs to go around? The less obvious impacts that you mention deserve some attention but I’ve never heard them discussed or evaluated before.

“Amazon will soon use more robots in its warehouses than human employees — with more than 1 million machines already deployed across facilities, according to a report.”

https://nypost.com/2025/07/02/business/amazon-will-soon-employ-more-robots-than-humans-report/

The job market is always changing.

If the goal is to “guarantee” more jobs, then sure, hire more people at cheaper salary + benefits. But a great way to get economic growth for companies is to give incentives for workers to make more money. Tips or overtime both encourage workers to make more. Time and a half for overtime and double time on holidays do this. Even better is not taxing tips and overtime. Nothing talks better for incentives than keeping more of your money. Workers are more friendly and go out of their way to please customers when they are paid more and keep more of what they earn. Via word of mouth, happy customers from company A which has better incentives will get more customers to visit than from company B whose workers are making less and will be disgruntled and ignore customers. A’s business will grow which will enable more hiring for motivated workers. B’s business will stagnate or decline when customers observe they are treated nicer at A than at B. Another benefit of this policy is that the usual conflicts between workers and management/owners are lessened. Owners don’t have to give up their profits because workers demand more money from them. Workers make more due to proper incentives, more business comes in, and everyone is happy. The business pays its taxes anyway, but the workers’ effective tax rate is reduced, depending on the proportion of total earnings from non taxed overtime.

A related situation is restaurant waiters who aren’t taxed on tips. More tip take home earnings encourage better service at tables. Customers come back and want to be served by the waiter who is enthusiastic and takes care of them. Restaurants operate on low margins and need growth to survive. The overhead of building operating expenses is relatively constant, so growth in number of customers is the only way the profit margin can be increased. Then more workers are needed to service more customers.

Understanding this basic psychology of what motivates people to work harder is the key to understanding why socialism which “guarantees” full employment causes reduced productivity and more business failures compared to free market capitalism with lower taxes.

Murphy states “4. Don’t post here about politics or religion…”However, Murphy started pro-Trump political rants on this board years ago before Trump was elected President, which resulted in occasional big political arguments among subscribers, which Murphy then tried to stop.

Murphy made recent comments about people not “understanding Trump’s Art of the Deal”, not really related to investments in his recs.

This week Murphy included the photo of AOC, claiming she made statement she never made. Google it…Based on search results, there is no evidence or quote where AOC states that a particular holiday “glorifies rich white guys who refused to pay taxes” or anything similar. So Murphy maybe you can explain yourself. Maybe you just invent or copy and paste political or investment advice without bothering to verify sufficiently.

AOC is infamous for her disparaging comments about the rich, rdmember her attending the Met Gala with “tax the rich” written on her dress (not thinking attending this formal event for the rich might be hipocracy) and her buddy Jasmine Crocket definately has used the term “rich old white guys” so yea theyre both punks who dont qualify to be in politics

Steve, you were the one criticizing somebody else on this board who made mildly political comments…citing Murphy’s rule#4 “Don’t post here about politics…” And now you post about politics and excuse Murphy for breaking his own rule #4.

Funny how only your side gets to bash whoever they want, and everyone else is supposed to just shut up.

Murphy probably doesn’t follow comments very often, but he ought to remove his political post, and maybe even say “Oops! Sorry for breaking my own rule!”

Ive never initiated a political commentary only responded – political comments only as they may relate to or impact the stock market is relative – hateful or opinionated commentary unrelated to the msrket has no place here

So in other words, you agree with me that Murphy had no business putting in the AOC OMG picture and fake quote.

It was unrelated to anything he was saying, and of course opinionated. And since it falsely represented that AOC said, you could call it hateful as well.

And despite objections, he failed to remove the post (although he probably doesn’t look at comments often).

Re: AOC’s “TAX THE RICH” dress. I’m reminded of John Dillinger’s response when someone asked him why he robs banks: “Because that’s where the money is.” Who would propose taxing the poor more? The same guy who tries to get blood from a stone? The US was doing a good job paying off the debt incurred during WW2 with top marginal tax rates that were never below 70% until Reagan came in and blew up the national debt with top rates as low as 28%. Even his VP George H Bush knew that was unsustainable so he raised taxes and paid for it at the ballot box. I think the US needs to return to the 39.6 rate from the Clinton and Obama era. As Buffett said:

This is a skewed line of reasoning from Buffett. Buffett is pitching investments to clients. Even if capital gains and ordinary dividend rates are high, quality undervalued stocks will outperform CD’s, T bills/bonds, corporate bonds over most periods of holding. But overall economic growth is higher with lower tax rates, for both investors of modest means and the wealthy. Milton Friedman turned several high tax countries around with free markets. In addition to taxes, over-regulation is a growth killer. It is hard enough to compete, but then the regs cause more people to be hired to do stupid, unproductive compliance things. This causes more business failures. Today the regs are more oppressive than ever, so if the economy did OK during the pre-Reagan area, now under overreg, it is struggling more. When businesses are about to fail, there is more cheating and fraud required to survive.

Interview with Leslie Fuller, who suffered a severe SCI 8 years ago and then got NervGen’s NVG-291. She went from 233 seconds on the 10 meter walk test to 19 seconds after 3 months on the drug, went from 240 seconds on the 9 hole peg test to 32 seconds after 2 months and even regained her sense of smell and ability to withstand cold temperatures as well as a lot less neuropathic pain and continues to improve.

https://blinkofaneye.org/blinkofaneyepodcast/

Seems some lost patience in NGENF today.

PLEASE, don’t give up. Don’t think like a short term trader. These idiots have casino mentality and don’t care about the profound efforts of researchers to improve the lives of patients. I want to make money, but also want to obtain some meaning about the noble successes of some of these companies. I don’t want to spend hours trying to become more adept at technical analysis, kind of pseudoscience anyway. I put the time in learning about how great research is improving humanity.

Exactly! I invest in biotech partially because its helping people overcome serious medical problems. And if we can make money funding worthwhile projects, so much the better!

Right on!!

Fabulous for her. Maybe most people on NVG 291 have only modest improvements, but we celebrate people who have big recovery like Leslie. More research will investigate why some people do better than others. More knowledge will lead to even more improvements at different levels of recovery, to benefit all.

Only caveat is that with small samples, one has to worry about enthusiasm in a couple subjects contributing to results that don’t replicate with larger sample sizes later. Not much info about the control group. But so far, so good, if not spectacular results for those who previously showed no improvement without this new treatment. FDA approving compassionate use also a good sign. This could be a spectacular investment. Too bad we have to wait so long for further work to be completed, reviewed and approved.

Right. On a more mundane level, I did more reps with the same weight in the gym when I was in a good mood. But no amount of enthusiasm was going to enable me to lift 2X the weight. The spirit was willing, but the flesh wasn’t.

Too much skepticism comes from those wanting large phase 3 trials. Suppose you were investigating whether shooting bullets point blank kills. A control arm is unethical and not needed. All you need is n=1. For NVG 291, n=10 for each arm nearly proves the benefits. Half did better on the GRASSP test. That’s great. It would be efficient to informally tweak the dosing and duration a few times, then do another small trial and presumably get more dramatic benefits. I would NOT want a single tweak, then waste time and money on larger trials.

Like CAPR which is going to get approval based on only 8 patients getting deramiocel but for a long 4 years, NGENF can follow that strategy and get approval based on small phase 2 studies. Both DMD and spinal cord injuries are tragedies with no other effective treatments.

Also, Leslie said that some patients who got 291 had enhanced libido and sexual dreams. That is the ultimate test for well being–pleasure in life.

A pat on the back and tip of the hat to M. Murphy for his recommendation to buy the dip in CMPS at $2.66 in this Radar Report. Four days later it’s at $3.50. This could have been his best call since he sent out an Flash Alert to buy the dip in PLTR last year.

Yesterday, I bought more ACHV at $2.19. I was surprised at how the offering was well accepted. Tutes were willing to pay $3.00. Small investors like me could buy at the market price, but big demand from tutes would increase the price, so they thought $3.00 was a fair deal. Almost 17 million shares were bought. Added to 34 million OS, that yielded 51 million shares, a 50% increase. Prior to the offering, the PPS fluctuated from $3-4, so two thirds of that is $2.00-2.67. I got a decent price. The slight uncertainty of whether the FDA will reject the NDA is reflected in the current PPS. It is highly unlikely that the NDA will be rejected, since the company has worked long and carefully with the FDA. If the NDA is rejected, the stock will plunge, but the likely scenario is upon NDA acceptance in 60 days, we see the high 2’s. Someone on Stocktwits did a valuation, assuming 5% market penetration of present smokers, $1500 revenue per patient, partnerships, and calculated a target of $92 or so.

Chris, ACHV faded late today. A stocktwits poster thinks that an ad agency (Omnicom) doing the marketing is an inferior strategy to standard Pharma marketing. Although I like personal contact rather than AI and other digital marketing, I don’t know. Maybe digital marketing is cheaper and more cost effective for a cash strapped ACHV. This marketing company has had Big Pharma clients. This strikes me as FUD that creates cheaper prices to accumulate more shares. We still have to be patient for about a year before approval.

I think some posters are making a mistake in their valuation. There were only 15 million shares actually paid for in the offering. There were 15 million warrants exercisable at $3.00 plus another 1.766 million warrants. Some posters are claiming that this represents total dilution by 32 million shares added to 34 million OS. But I disagree with that view. I say that only 15 million shares were actually issued. When the warrants are exercised, the buyers have to buy the shares in the open market, but those are not extra shares. The warrant holders are guaranteed a buy price no higher than $3.00. I conclude that the dilution is only 1 minus 34/49 or 30%, so a fair share price now is 70% (not 50%) of the $3-4 price before the offering. That’s $2.10-2.80.

What do you think?

That ST poster has ID–Italian green, something like that. If 7% go for the drug and the price is $2000, then target is $175.

I see INO screwed us again. I can’t wait to see MM’s spin on why this was good.

https://ir.inovio.com/news-releases/news-releases-details/2025/INOVIO-Announces-Pricing-of-25-Million-Public-Offering/default.aspx

It was a necessary evil. INO’s cash position reached a low enough point in 2024 that they are now in a position of having to raise capital roughly equivalent to their cash burn rate going forward until INO-3107 sales are sufficient for INO to be cash flow breakeven. In 2024 they did a capital raise in Q2 and again in Q4 and it was obvious they were going to need to raise capital again in 2025. After they announced their Q4 raise in early December I wrote in part in the 12/12/24 report comments:

“Everyone can make their own assumptions as to how much of a cash cushion INO would want in 2026-Q1 when they get FDA approval and the timing and number of capital raises(s) to get there.My guess is there will be two. I’m guessing they’ll do another one in Q2 about the time their cash/investment balance drops to $50M. I think they will do a second in Q4 to create a cash cushion going into FDA approval. They did two raises in 2024, two quarters apart, so that also continues that pattern. I think they’ll want a minimum of a $50M cash balance in 2026-Q1. Given that, they will need to raise an additional $60M in 2025. That’s a whole lot of additional near-term dilution!”

This week’s capital raise is roughly equal to one quarter’s cash burn extending their cash to roughly early 2026-Q2 but at that point their cash position would be $0, which of course they won’t allow to happen. I don’t think they want their cash position much lower than $50 million. The lower the cash levels the worse the terms they’ll get when they need to do a raise.

The INO-3107 BLA submission continues to push out and is now a rolling submission that is likely to be final in Q4, maybe close to year-end, putting approval around mid-2026. So even with this week’s capital raise INO won’t have the cash to reach the BLA approval date. Given that, INO is going to need one or two additional capital raises after this one. I continue to think they’ll be another one in late Q4 or early Q1 of 2026 and then they may need to do a final one prior to BLA approval to get their cash position high enough to sufficiently fund a product launch.

Raising capital when your stock price is a buck and change is brutal financially.

New World Investor for 7.3.25 is posted.