Dear New World Investor:

It’s the dog days of summer. There are a couple of biotech conferences coming up next week, but not much else happening until Corning and PayPal report June quarter earnings on July 29. Then the floodgates open with earnings reports through August – not to mention the next Fed meeting and the first guesstimate on June quarter GDP on July 30.

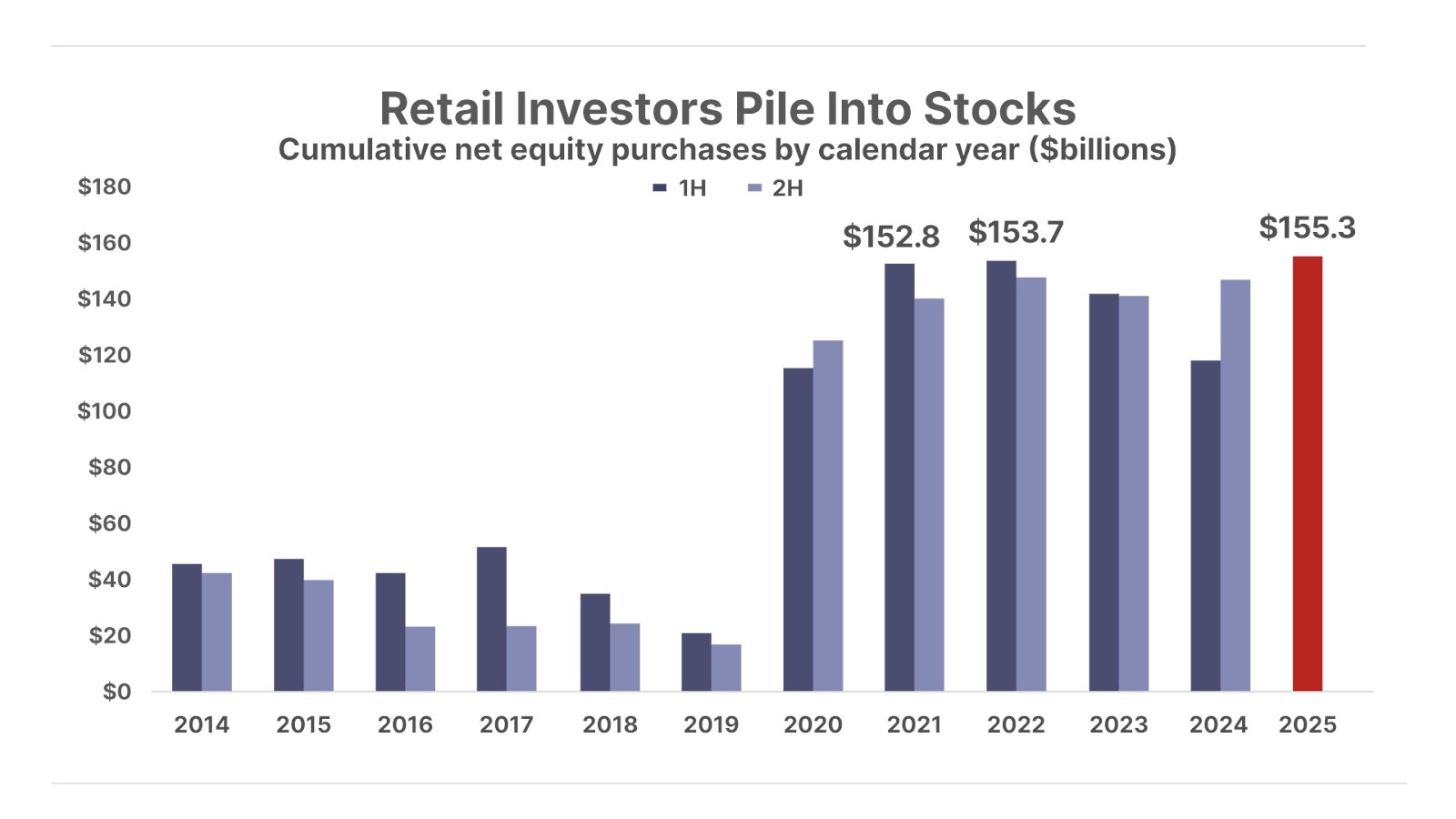

The market analytics firm Vanda Research says retail investors bought $155.3 billion worth of stocks in the first half of 2025. That was a record for the first half of any year.

Yet the major sentiment indicators are a long way from overwhelmingly bullish and there still seems to be a large amount of cash on the sidelines. It looks to me like the easy money has been made. Over the next few weeks I’m going to review all the buy limits and target prices for the market environment going forward.

Market Outlook

The S&P 500 added only 0.2% since last Thursday, but that was enough for a new record close today. The Index is now up 6.8% year-to-date. The Nasdaq Composite gained only 0.1%, again enough for a new record close today. It also is up 6.8% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 3.7% on continued M&A speculation. It is still down 1.9% year-to-date, though. The small-cap Russell 2000 rose 0.6% and is up 1.5% in 2025.

The fractal dimension continues to move down toward the 55 level that will signal a new trend has started.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX ScyNexis – Resolution of GSK situation

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model estimate of June quarter real GDP growth is still at +2.6%. The Blue Chip economists have steadily increased their forecast and probably will be up to the same area by the July 30 announcement.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Monday, July 14

Crypto Week – Congress passing crypto legislation all week.

AKBA – Akebia – 10:00am – H.C. Wainwright 4th Annual Kidney Virtual Conference

Tuesday, July 15

Consumer Price Index – 8:30am

Wednesday, July 16

INO – Inovio – 4:30pm – Orphan Drug Summit Presentation: DMAb Technology: The Transformational Potential of Next Gen DNA Medicine in Rare Diseases

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $212.41) is not on the leading edge of AI, to no one’s surprise. Their long game is to stay a bit behind but eventually implement whatever is proven to work to satisfy their ginormous user base. The news that Apple is testing Anthropic or OpenAI to power Siri, instead of its own in-house models, is in line with that strategy. Apple has had discussions with both companies about using their large language models for Siri, asking them to train versions of their LLMs that could run on Apple’s cloud infrastructure for testing.

The Silicon Valley rumor is that Apple will introduce the iPhone 17e early in 2026, instead of waiting for September. The “e” is the entry-level phone – I just bought a 16e for a birthday present for my wife. It’s a great phone with the Apple Intelligence bells and whistles. AAPL is a Buy under $205.

Corning (GLW – $52.26) coverage was initiated with an Outperform at Wolfe Research. GLW is a Buy under $33 for a $60 target in 2025.

Meta Platforms (META – $727.24) is on the leading edge of AI because it’s still run by its founder and he has a majority of the voting shares. According to Bloomberg, Apple’s top AI executive, Ruoming Pang, is leaving for Meta’s new Superintelligence Labs team for a compensation package worth millions of dollars per year.

Zuck is poaching top talent from Scale AI, OpenAI, Google, and other companies to become the leader in AI. Reuters had this list:

ALEXANDR WANG – Meta hired the former Scale AI CEO to head the new division as chief AI officer. Zuckerberg has also hired some Scale AI staff after Meta invested $14.3 billion in the data-labeling startup.

NAT FRIEDMAN – The former GitHub CEO will co-lead the unit with Wang and head the company’s work on AI products and applied research. Friedman co-founded the venture capital firm NFDG, which has backed high-profile startups including Safe Superintelligence, Perplexity, and Figma.

DANIEL GROSS – The former CEO of AI startup Safe Superintelligence has joined the team to lead the AI products division. Gross had co-founded NFDG.

RUOMING PANG – Pang was the head of Apple’s Foundation Models team and responsible for advanced AI features. He joined Meta with a multi-million-dollar compensation package, according to Bloomberg News.

TRAPIT BANSAL – The AI researcher joined OpenAI in 2022, where he played a key role in developing the “o-series” reasoning models. Bansal has directly worked with OpenAI and Safe Superintelligence co-founder Ilya Sutskever, according to his LinkedIn page.

SHUCHAO BI – Bi joined OpenAI in 2024 after working for over 10 years at YouTube and Google. He co-founded YouTube Shorts and built multi-stage deep learning models to optimize Google Ads performance, according to his LinkedIn page.

HUIWEN CHANG – Chang joined OpenAI in 2023 after working as a Research Scientist at Google for more than four years, according to her LinkedIn page. She is a co-creator of GPT-4o, OpenAI’s multimodal model, and invented MaskGIT and Muse text-to-image architectures at Google Research.

JI LIN – Lin joined OpenAI in 2023, where he contributed to building advanced multimodal reasoning systems and the Operator reasoning stack, OpenAI’s computer-using agent architecture.

JOEL POBAR – Pobar joined Anthropic in 2023, where he oversaw infrastructure and inference pipelines for large language models. He also worked at Meta for about 11 years.

JACK RAE – Rae was a pre-training technical lead for Google DeepMind’s Gemini and spearheaded the reasoning development for Gemini 2.5.

HONGYU REN – Ren joined OpenAI in 2023, co-creating multiple o-series and GPT-4o models. He helped lead post-training efforts for the ChatGPT maker’s most advanced reasoning models.

JOHAN SCHALKWYK – Schalkwyk was a former Google Fellow and oversaw major research and product integrations in speech AI. He has joined Meta Superintelligence Labs as a Voice Lead, according to his LinkedIn page.

PEI SUN – Sun worked on post-training, coding, and reasoning for Gemini at Google DeepMind. He previously created the last two generations of self-driving unit Waymo’s perception models.

JIAHUI YU – Yu joined OpenAI in 2023. Previously, he led the perception team at the AI startup. He co-created o3, o4-mini, GPT-4.1 and GPT-4o models.

SHENGJIA ZHAO – Zhao worked as a research scientist at OpenAI. He co-created ChatGPT, GPT-4, all mini models, 4.1 and o3.

This is a dream team! META is a Buy under $655 for a long-term hold.

Nvidia (NVDA – $164.10) rose as OpenAI said it has no plans to use Google’s in-house chip to power its products. The AI lab is in early testing with some of Google’s tensor processing units (TPUs), but it has no plans to deploy them at scale right now. Currently, OpenAI is actively using Nvidia’s GPUs and AMD’s AI chips to power its growing demand, while developing its own chip (which I predict will never go into production).

Meanwhile, Microsoft’s GPU design effort, the next-generation Maia AI chip, is facing a delay of at least six months, The Information reported. When the chip, code-named Braga, goes into production, it is expected to fall well short of the performance of Nvidia’s Blackwell chip that was released late last year. Microsoft had hoped to use the Braga chip in its data centers this year, but unanticipated changes to its design, staffing constraints, and high turnover contributed to the delay.

Like its Big Tech peers, Microsoft has focused heavily on developing custom processors for artificial intelligence operations and general-purpose applications, a move that would help reduce the tech giant’s reliance on pricey Nvidia chips. I’ve seen this play before, and it ends in tears as the AI software folks say they can’t make do with semiconductors that are one or two years behind the Nvidia processors the competition is using.

CEO Jensen Huang spoke at the Milken Institute:

Today, Nvidia became the first company ever to hit a $4 trillion valuation. NVDA is a Buy under $125 for a $180 first target.

Palantir (PLTR – $142.50) CEO Alex Karp gave advice for people in their 20s, like my 2nd-oldest daughter:

PLTR is a Buy under $100 for a $150 target.

PayPal Holdings (PYPL – $75.70) partnered with the Big 12 Conference and student athletes to launch a school-branded Venmo Big 12 debit card for students, alumni, and fans. Cardholders get 15% cash-back offers, ticket giveaways, events, and game-day upgrades. PYPL is a Buy under $68 for a double in three years.

Snap (SNAP – $9.34) will introduce new lightweight, immersive Specs in 2026. They’ve spent 11 years and more than $3 billion to invent this new type of computer for augmented reality. Specs have a powerful wearable computer integrated into a lightweight pair of glasses with see-thru lenses. SNAP is a Buy under $11 for a $17+ target.

SoftBank (SFTBY – $36.61) bought back 2,803,500 more shares in June. Keep buying, Masa! SFTBY is a Buy under $25 for a first target of $50 in the next two years.

Small Tech

Enovix (ENVX – $14.12) announced preliminary June quarter results and a warrant dividend to raise money from existing shareholders.

The June results were excellent. Revenues of $7.5 million were well above their guidance range of $4.5 million to $6.5 million. The GAAP gross profit of $0.8 million and pro forma gross profit of $1.2 million marked the third consecutive quarter of positive gross profit on both a GAAP and non-GAAP basis. This compares favorably to a gross loss of $0.7 million on a GAAP basis and gross loss of $0.6 million on a non-GAAP basis in the second quarter of 2024. They lost 15¢ a share pro forma, at the low end of their guidance for a 15¢ to 21¢ loss.

CEO Raj Talluri said: “This marks our fifth straight quarter exceeding the midpoint of guidance for both revenue and adjusted EBITDA. We’re executing to plan, building momentum, and positioned to scale significantly as our new products and customers come online.”

Raj said that last week they shipped the first battery samples for qualification to their smartphone customer, which probably is Samsung. Now named the AI-1, for Artificial Intelligence Class, it is protected by 190 Enovix architecture-specific patents that enable the use of 100% active silicon anodes. It offers 7,350 milliampere-hours (mAh) with an energy density exceeding 900 watt-hours per liter (Wh/L), a high discharge rate across wide temperature ranges, and long (900+) cycle life. AI-1 is the highest energy density battery commercially available in the market today.

The warrant dividend comes on July 21. You’ll get one warrant for every share of stock you own on July 17. The warrants are exercisable at $8.75, so they already are in the money, and will be listed on Nasdaq with the symbol ENVXW. They expire on October 1, 2026. If they all are exercised, Enovix will raise $253.8 million. The company held a conference call on the warrants (AUDIO HERE and FAQ HERE).

Northland reiterated its Outperform rating and $25 target price, citing last week’s announcement of a $60 million stock buyback program as “a very bullish sign” of the company’s path to volume production.

After completing the SolarEdge asset acquisition in South Korea and making other capital expenditure payments, principally related to Fab2 in Malaysia, Enovix finished the quarter with $203 million in cash. ENVX is a Buy up to $20 for a 4-year hold to $100+ as their BrakeFlow lithium-ion battery takes market share.

Primary Risk: A new competitor invents a better battery.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

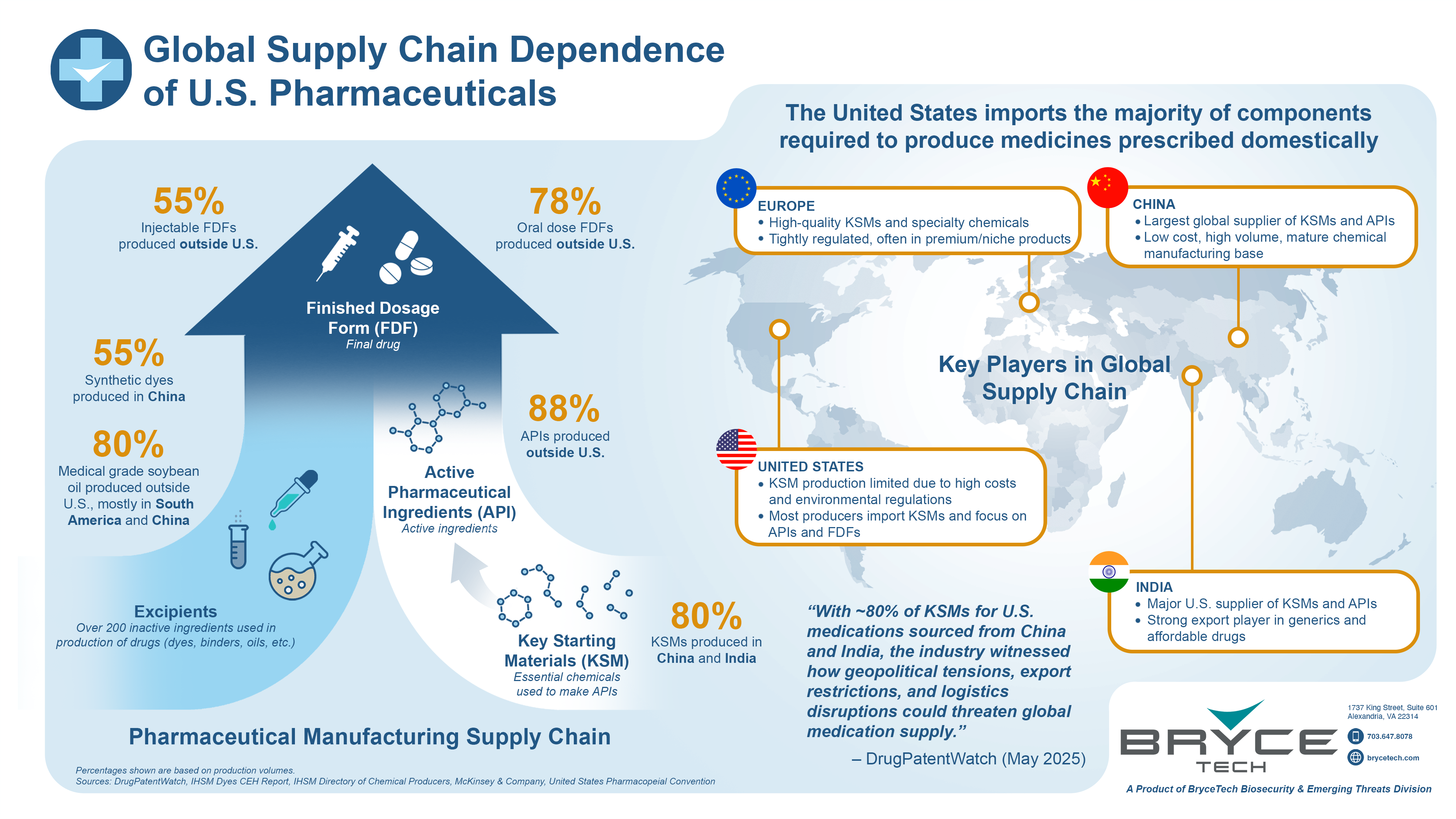

Click for larger graphic h/t @_BryceTech

Akebia Therapeutics (AKBA- $3.98) presents Monday at 10:00am at the H.C. Wainwright 4th Annual Kidney Virtual Conference. CEO John Butler might say something positive about June quarter Vafseo sales. Buy AKBA up to $2 for the Vafseo launches in the EU, UK, and US.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Inovio (INO – $1.39) will do an Orphan Drug Summit Presentation on DMAb Technology: The Transformational Potential of Next Gen DNA Medicine in Rare Diseases next Wednesday. Inovio is the absolute leader in DNA medicines, a position I believe is worth multiples of today’s $70 million market capitalization. INO is a Buy under $14 for a very long-term hold.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: Early 2026

Probable time of next financing:After FDA approval in 2026

Inflation MegaShift

Gold ($3,333.50) didn’t close at $3,333.33, but it was close. The market makers sometimes hit those kinds of closing numbers just for fun. I think gold is headed for $4,000 or $5,000 over the next few years, a 20% to 50% gain, with silver likely to have a higher percentage gain with more volatility. But the real reason to have 3% to 10% of your assets in gold and silver is that they aren’t correlated with the stock market and provide welcome diversification in difficult times.

The fractal dimension is accelerating towards full consolidation without a dramatic collapse in price. That’s a good thing.

Miners & Related

Dakota Gold (DC – $4.14) moved up after the company said the S-K 1300 Initial Assessment Technical Report with cash flow demonstrated robust economics for Richmond Hill. On the conference call (AUDIO HERE), CEO Robert Quartermain said: “Delivering this robust IACF on the back of our heap leach resource announced four months ago in February, speaks to the quality of our project and our teams’ capabilities. This is a very positive outcome for Dakota Gold and its shareholders, and it forms the platform from which we can grow and expand our mining and exploration activities in the Homestake District. We now expect to advance through feasibility and into production as soon as 2029, based on our current work and project understanding – firmly placing Dakota Gold as having one of the largest development gold assets in the U.S.”

The Measured & Indicated resource identified 168.3 million tonnes at a grade of 0.566 grams per tonne gold (g/t Au), for a total of 2.6 million ounces produced over a 17-year life of mine. At a base case gold price of $2,350 per ounce, the project has an after-tax net present value at a 5% discount rate of $1.6 billion and internal rate of return of 55%. At recent metal prices of $3,350 the net present value increases to $2.9 billion and the internal rate of return to 99%.

Just so you know I didn’t recently fall off a turnip truck, I am well aware that a Measured & Indicated resource is not a Proven & Probable resource, a gold grade of 0.566 g/t is kinda low, a 5% discount rate is very low, and all internal rates of return are BS. However, Dr. Quartermain is talking gold promoter language and it is raw meat for the gold bugs who promptly ran the stock over $4.

Their required initial capital is only $384 million, including a $53 million contingency, with life of mine All-in Sustaining Costs (AISC) averaging only $1,047 an ounce. Work has commenced on the Feasibility Study planned for completion in early 2027, with construction in 2028, and production targeted for 2029. In addition, an ~80,000 feet drill campaign is underway to target higher-grade areas for initial mining and the conversion of resources from Inferred to the Measured & Indicated category. DC is a Buy under $2.50 for a $6 target as gold goes higher.

Primary Risk: Robert Quartermain doesn’t find enough gold. Secondary risk: Prices of precious metals fall due to US dollar strength.

First Majestic (AG – $8.64) said total June quarter production rose 48% from last year to 7.9 million silver equivalent (AgEq) attributable ounces, consisting of 3.7 million silver ounces, 33,865 gold ounces, 16.1 million pounds of zinc and 9.0 million pounds of lead.

CEO Keith Neumeyer said: “During the first half of the year, our operations achieved strong and consistent production, supported by disciplined cost management. We closed Q2 ahead of budget with strong momentum, despite weather-related disruptions and power outages in the final days of June that impacted production at Los Gatos, San Dimas, and La Encantada. Looking ahead, we are revising our 2025 guidance positively to reflect improved production and cost targets. The integration of Los Gatos is progressing well, with numerous synergies and opportunities already being identified and leveraged.”

Their 2025 attributable consolidated production guidance increased from 27.8 – 31.2 (mid-point: 29.5) million AgEq ounces to 30.6 – 32.6 (mid-point: 31.6) million AgEq ounces, a 7% increase compared to the original guidance. AG is a Buy under $11 for a $23 next target price as production increases and the price of silver rises.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Sandstorm Gold (SAND – $9.84) will be acquired by Royal Gold (RGLD). Although the deal was at a good 21% premium, it’s an all-stock deal, so the arbitrageurs shorted RGLD and bought SAND. That knocked RGLD stock down enough to leave SAND almost unchanged.

But here’s where investors beat speculators. Royal Gold is a great company and we SAND shareholders will own 23% of it when the deal closes in the December quarter. You will get 0.0625 of a share of RGLD for every SAND share you own. Knowing how much future growth is built in to SAND’s portfolio, I think we’ll make a lot of money from here. We will hold RGLD for a long time.

CEO Nolan Watson explained the transaction here:

with (SLIDES HERE). SAND is a Buy under $10 for a $25 target.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $113,600.14) hit a new record high, its first since May. The technicians tell me the next target is $146,400, with major support at $107,000 and $100,000.

Congress kicks off its highly anticipated “Crypto Week” on Monday, July 14. Lawmakers will debate a series of bills that could define the industry’s regulatory framework. The GENIUS Act is among the regulations the House will consider. The bill, which recently passed through the Senate, proposes a federal framework for stablecoins.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $64.50) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $21.35) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $66.89

Oil rose after Yemen’s Houthi militants sank a commercial ship in the Red Sea and kidnapped the crew members they didn’t kill. Then Bloomberg reported that OPEC+ is discussing a pause in further production increases, and oil shot up, right? No, oil fell on the news there might not be further supply increases because – get this – traders are interpreting the OPEC+ talks as a sign that “the market may not be able to cope with more oil,” according to Ole Hansen, head of commodity strategy at Saxo Bank A/S.

So if OPEC+ increases supply, oil goes down because there’s more supply. And if OPEC+ doesn’t increase supply, oil goes down because it’s a sign of weak demand. That’s all you need to know to understand (1) why the paper oil traders are so heavily short oil; and, (2) what is going to happen when the rubber band snaps back.

The July 2026 Crude Oil Futures (CLN26.NYM – $62.38) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $36.07) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $7.85) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Freeport McMoRan (FCX – $47.21) rose as copper prices surged after President Trump announced a 50% tariff on copper that will likely start August 1. FCX is a buy under $44 for a $65 target within two years.

Primary Risk: Copper prices fall.

* * * * *

Your watching The Illusion of Thinking Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 7/10/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $212.41) – Buy under $205

Corning (GLW – $52.26) – Buy under $33, target price $60

Gilead Sciences (GILD – $114.54) – Buy under $90, first target price $120

Meta (META – $727.24) – Buy under $655 for a long-term hold

Micron Technology (MU – $123.11) – Buy under $102, first target price $140

Nvidia (NVDA – $164.10) – Buy under $125, first target price $180

Onsemi (ON – $59.52) – Buy under $60, first target price $100

Palantir (PLTR – $142.50) – Buy under $100, target price $150

PayPal (PYPL – $75.70) – Buy under $68, target price $136

Snap (SNAP – $9.34) – Buy under $11, target price $17+

SoftBank (SFTBY – $36.61) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $14.12) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $73.71) – Buy under $70; 3- to 5-year hold

Fastly (FSLY – $6.93) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $15.82) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $6.71) – Buy under $10, target price $40

Rocket Lab (RKLB – $39.10) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $31.80) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $4.25) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $3.98) – Buy under $2, target $20

Compass Pathways (CMPS – $3.72) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $3.06) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.39) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.62) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.70) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($37.65) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $44.84) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $50.41) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $30.48) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $49.11) – Buy under $30, target price $50

Coeur Mining (CDE – $9.11) – Buy under $5, target price $20

Dakota Gold (DC – $4.14) – Buy under $2.50, target price $6

First Majestic Mining (AG – $8.64) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.72) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $9.84) – Buy under $10, target price $25

Sprott Inc. (SII – $70.23) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $113,600.14) – Buy

iShares Bitcoin Trust (IBIT – $64.50) – Buy

Ethereum (ETH-USD – $2,870.88)– Buy

iShares Ethereum Trust (ETHA- $21.35) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $62.38) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $36.07) – Buy under $40; $100+ target

Vermilion Energy (VET – $7.85) – Buy under $11; $24 target

Energy Fuels (UUUU – $6.51) – Buy under $8; $30 target

EQT (EQT – $54.52) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $47.21) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

TG Therapeutics (TGTX – $37.67) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

First! Last 2 weeks on this board were the best. Learned a lot. Thanks for sharing

1

MM a correction with regards to ENVX, you don’t receive one (1) warrant for every share of Enovix common stock you own on July 17, what you will receive is one warrant for every seven (7) shares of common stock you own.

I’m a bit confused about the ENVX warrants, can someone explain.

I have 1100 shares so does this effectively mean I can buy 158 warrants at $8.75 – or are these extra shares I can buy?

If they’re warrants (& I’m not exactly sure what a warrant is) can I then sell them or convert them to shares ?

Just not come across them before in my share dealings.

Appreciate any info on this.

Cheers

Steve

Look at the FAQ using the link in MM write up for the answers to your questions. It is very detailed.. Also, the expiration date is (ctober1, 2026 not 2025

There is also a Poison Pill which will allow the company to cancel the warrants if Share price averages $10.50+

“What is the Early Expiration Price Condition?

If, during any 30 consecutive trading days, the volume-weighted average price (VWAP) of Enovix common stock is at or above $10.50 for at least 20 of those days (not necessarily consecutive), then the warrants will expire early”

Thanks Eric, to be honest I missed the link so thanks for pointing it out… have a great day

Silver on afterburner in the pre-mkt. Will add to AG though one thing both Gold and Silver stocks have NOT done is to reliably track the metals for reasons that I do not understand. As an example, GDX should probably be trading above $100 with Gold at $3350+/oz. instead of languishing at $52. So for silver, stocks are fine but SLV and AGQ are probably better now that the metal appears to be headed towards $50/oz.

CAPR CRL – another empty promise biotech, I believed you JGMD and Chris, now what???

Another glaring example of destructive behavior by mindless bureaucrats, possibly corrupted too. I am losing money young people in need of this therapeutic may lose their lives, what a shame.

Will add to the position.

Correct–mindless bureaucrats, maybe reliance on AI at the Fed. “Statutory guidelines” are suggestive that AI could have been involved in the CRL. I hate hate AI for its destructive consequences. From the beginning, Linda said that they were following FDA guidelines and the mid cycle review showed no issues. Was the mid cycle review done by AI?

BTW, is it possible to fill orders in the premarket? How is this done? Call the broker personally? A few people bought this AM below $5 and have big gains at this moment.

More later as I study the CC by Linda and the HOPE 3 trial.

Chris?

Schwab offers several extended hour trading options. I’d assume other brokers do as well.

Yes E*TRADE and Fidelity offer extended trading as well.

Thanks. I should have been prepared with my Fidelity account. By the time I woke up, it was 8 AM. I could have gotten $5.50. There will probably be more opportunities within the next many months.

Thanks.

Steve,

Subscribers on this board offer ideas that look promising. As stated previously, emerging biotech is very risky. You have to expect some losses and setbacks. This is not easy money. If you want less volatility, stick to blue chip stocks or mutual funds. You have asked for a lot of advice, and you can’t blame anyone but yourself for your own investment decisions. Sometime you win, sometime you lose.

You can sell some and hold some, or buy more when there are setbacks. The trick is to understand what are legit problems that can’t be rectified, and which are setbacks that may even provide buying opportunities for future gains. It hurts but that’s life in the stock trading and investment universe.

I appreciate the insights that Chris and JGMD provide. Yeah we lost some today, but gain more other times. Otherwise we wouldn’t be here listening to others ideas.

2:14PM: HC Wainwright & Co. analyst Joseph Pantginis maintains Capricor Therapeutics (CAPR) with a Buy and lowers the price target from $77 to $24.

maybe i should buy CAPR vs selling AKba as i think by todays price action – they will disapoint again in Mondays meeting

any thoughts appreciated especially you MM – ive been with you a looooooooong time!

Chaz, what meeting is on Monday?

AKBA chat.

AKBA won’t say that much. The bell rings early August with Q2 ER. You have a year to buy CAPR hopefully at lower prices, maybe $5. Now I say that the money will be made first in AKBA. CAPR if it gets approval will advance much more over several years, because it has a monopoly on THE best DMD treatment, unlike AKBA which is fighting to get ESA patients to switch to V.

JGMD when you say you have a year to buy CAPR, is that because you expect this delay to set the approval back that long? Obviously, until the next meeting with the FDA to give additional guidance regarding their willingness to accept the additional data and how much of it, we can only speculate. Do you think the next meeting could happen within the next 30 days or is that too aggressive?

Given my lack of liquid funds, I’m wondering if shifting my CAPR money to AKBA or NGENF for a period of time, then back to CAPR as the time gets closer has any merit. Of course, as of today that’s just an idea, not the plan which is premature until after the next FDA meeting which will provide guidance and hopefully a better timeline will become clearer.

I don’t understand the arbitrary timelines of FDA meetings with companies seeking approval, CRL’s, resubmissions, new BLA applications, and plenty of other bureaucratic nonsense. If the FDA wanted to work together with CAPR to get this therapy approved ASAP while adequately assessing efficacy and safety, they would be more efficient. Their objections based on small numbers of patients and use of historical controls could have been addressed long ago, so it is obvious political corruption that in the 11th hour they issue a CRL. The FDA misled the company by saying that they accepted the small numbers and historical controls because of the rare DMD and compelling need to approve therapy desperately sought by DMD patients and families. How come the mid cycle review was fine and they now issue the CRL? This fiasco should be a lesson to any stupid voter who wants incessant oppressive regulations that do little to protect the public, but 1000X more harm In screwing them The FDA and regulatory agencies in many other fields all have blood on their hands.

Stocktwits has many posters who understand the intricacies of FDA timing much better than I. It’s hard enough to select small bios that have mega payoffs from the 99% of trash. Then to figure out the optimal timing of how to move your money around is another problem. Too many unknowns as we have just seen. My best, least risky idea would be for new money, buy AKBA rather than CAPR. But AKBA has already more than doubled over my $1.75 average cost. CAPR may retreat to $5 from $7.64 now, but the realistic potential of CAPR is so great that even if your average cost is $20, I think you’ll get there in 2026 when it is approved, and much higher several years later when it is rolled out to the DMD patients who ALL want it. To keep it simple, hold your CAPR, AKBA, my best bets. Scale into NGENF and ACHV over the next year. ACHV is nearest its bottom, so even though the big money won’t be made for another year, it is a safe buy at this price.

I missed ENVX not because I was asleep. I didn’t think it was investable because of the silence in how many big contracts would be signed, and the already high market cap. I can’t dance at every party, but I can spend my time on things I understand better. We can retire on any one of these bios that make it big. Just have a choice of a few of them.

Back to CAPR. Many CAPR investors are blaming Linda when the blame rests with the FDA who misled the company and all of us. I feel the HOPE 3 is nearly guaranteed to be successful as an academically accepted double blind placebo controlled much larger study building on the good data from the small HOPE 2 and its OLE over 4 years. Short term, AKBA is probably the best gainer from here, but long term, CAPR seems to be the best. I remember a recent video of Linda saying that if the Adcom was shaky, she would trot out her big guns, the HOPE 3 existing data to clinch approval, maybe even getting dual approval for skeletal muscle and cardiomyopathy. We might actually be in better shape now than a few days ago for long term gains.

Thanks for all your insight and details on these stocks.

So why would Wainwright drop the target price so far??

Too bad it is hard to get the full report on any brokerage recommendation. My assessment is that the timeline for CAPR has been delayed for up to 1 year. Suppose that a month ago, HCW projected $77 after 2 years of sales. So now I say, use that target 3 years from now, possibly less depending on whether dilution is needed to raise money for 1 more year of survival without revenue. CAPR said they have cash until 2027, so maybe they can squeak by with launching just before cash runs out, so no dilution. If they prudently decide to dilute and raise more cash, then $77 in 2 years becomes $50 in 3 years. I’ll still be happy.

But maybe HCW figured $24 after 1 year of launch which is 2 years away, instead of $77 after 2 years of launch and the same 2 years away. That’s fair.

Easy Opie, dont need a lecture on the risks of investing in early stage biotechs, dont be so thin skinned. I ask for advise but also give advise, check it out. If youre gonna pump a stock as confidently as CAPR was pumped on this board be ready to explain when it fails – I was asking whats next, why the CRL, still looking for answer

JGMD touched base earlier and I’m sure will come back after digesting what info is available. Chris has a network of professions who, I feel confident, are weighing in and discussing what the future options could be. After all, as we all have seen over the years, no one can predict what the FDA will do or what they are thinking. Most of their guidance is ambiguous at best. I listened to the webcast (about 31 minutes) and understood very little. I look forward to, and will appreciate hearing experienced voices like Chris and JGMD weigh in.

Here I am, actually happy. I couldn’t find the transcript or recording of the CC by Linda at 8:30 AM. The webpage was dysfunctional on my work PC. But I dug further. HOPE 3 is a bona fide double blind placebo controlled study of 104 patients that began June 2022. No use of natural historical controls which the FDA didn’t like. Some HOPE 3 patients could have 3 years of data, others, 2, etc. The last patient started treatment June 2025. I don’t know how long it takes to see the effects of treatment whether a few months or a year. In any case, Linda will submit the HOPE 3 data that exists very soon and have a type A meeting with the FUD (deliberate OOPS, FDA!). This HOPE 3 should amply confirm the good HOPE 2 and HOPE 2 OLE for 4 years. In 2026 we will have 4 year OLE for 100 patients. DELICIOUS! The major stock risk is the possible need for dilution. Cash reserves until 2027, so with 2026 approval, they might need a capital raise. Better yet, a bridge loan for a few months. Each patient brings in a million bucks. He can walk or wheel himself into the bank, lift the secretary off her chair and say, “sweetie, I couldn’t satisfy you before, but now I can. Give CAPR several million bucks, and all my fellow young men will give you great ‘gasms.’ ”

For AKBA, a young poster on YMB named Paul R added lots of shares right after the 2022 CRL at 25 cents. He got his average cost down to $1 from much higher before the CRL. It takes guts to do that, but this is the way to make real money if you know what you own. I am very impressed how CAPR quickly rebounded from $4.33 in premarket to high $8’s and closed nicely at $7.64. Usually CRL doldrums last a while, and then rebound occurs much later. I have lots of shares at average $9. We have about 1 year to look for cheap shares. If it never gets down to $5-6 again, I’ll still be very content with my current position. Just don’t try to be clever and take a loss, hoping to get back in cheaper later. Holding quality situations usually pays off. I revise my 2 year target after approval from $160 to $100, and $1213 whenever target with most of the 15K patients to $850 due to possible needed dilution. Linda will be a coiled spring ready to explode production of deramiocel after this stupid FDA political delay. BE PATIENT.

This should get you to the webcast replay

. To participate via webcast, click here to access the live stream.

Thanks. I feel even more confident after listening to Linda. I’m not an expert in statistics, but here are my impressions. She said that HOPE 3 is overpowered for LVEF (cardio) and well powered for PUL (skeletal muscle), more powered than in HOPE 2. To understand power, you look at the chance of advantage and ask how many sample sizes it would take to be confident. To prove which of two top race horses is more valuable, you might need 10 races to do this. Horse A wins 7/10, B wins 3/10. 7 vs 3 is good enough to draw a reliable conclusion. 10 races are powered enough to show this. Now suppose that A and B are identical twins with the same height, weight and trainer. It might take 1000 races with 550 A wins and 450 B wins to conclude A is better than B. 10 would be underpowered, 1000 is enough power, and 100,000 is overpowered. P value of 0.05 means that there is 5% chance that the results are wrong. The lower the P value, the better.

Linda said that even HOPE 2 had P values less than 0.05 (great) and good power, although the FDA thought that only 7 patients wasn’t enough power. She now says that 104 patients is overpowered, with estimated P values even lower. Even if the FDA thinks less optimistically than Linda, they probably will agree at the type A meeting coming up that HOPE 3 will be well powered. I’m still wondering how Linda could know that the HOPE 3 P values are very low and it is overpowered WITHOUT KNOWING THE HOPE 3 RESULTS?

Opie, I recall you used to be an experimental psychologist and probably have good knowledge of statistics. What do you think?

I’m not a statistician, so this is just my two cents. (My background is undergrad applied math, philosophy of science/logic, and MA/PhD in psychology. Taught psych stat courses (among many other courses for five years). Few scientific publications. About 20 years as an engineer designing new products and services. Also design, build and renovate homes, sort of a hobby.)

I think you know most or all of this….but to add some explanation: P-value refers to the probability that the results may have occurred by chance. Generally, a P-value less than .05 (less than 5% of the time would occur just by chance) is considered “statistically significant”, and the results are considered to confirm that there’s a reliable difference between the intervention (med) and the control condition or control group (no med). (I’d say p<0.05 is good rather than great, but that’s in psych studies, maybe not in medical research.) Sometimes especially with large sample sizes, investigators like to see P-values less than .01 (1% or less probability these results occurred just due to chance variation). And its always good if someone else replicates these results, with a different sample of people, done by a different investigator, under somewhat different conditions. (We have tried to replicate some studies and failed to confirm results that others found.)

I would also guess that the FDA would like to see excellent safety results, or take this into account when considering approval. My understanding is that Phase 1 studies are supposed to be a safety study with a small sample of “gineau pig” subjects, to verify that the med doesn’t cause harm, before doing larger or repeated trials, although investigators are going to look for evidence of the effectiveness of their med candidate too. For example, with Arena’s weight loss drug, there was a concern about cancer in studies done with rats, although the mechanism was different for humans, so it was not supposed to be relevant, but was used as one excuse to reject Arena’s drug during the first Adcom meeting. Effectiveness of an drug candidate isn’t good enough if there are safety concerns or negative side effects; or else label warnings are required on the med container. Not sure if this may be an issue with CAPR.

There’s also a concept of the power of a study to be able to detect an effect. Did you design a study that would likely find an effect if there is one? I don’t see why this use of the word power should have anything to do with FDA review, since they did find a statistically significant effect (I presume, I haven’t read anything about it.)

Then there is the medical power of the proposed intervention. If a med or procedure doesn’t do much, not a strong effect, even tho it is shown to have a statistically proven “statistically significant” effect, the intervention isn’t very useful. When most people say “significant” in common parlance, it means powerful, whereas statistical significance just means it likely has an effect due to the trial drug, not necessarily an obvious powerful effect. I’m sure the FDA would care about the magnitude of the effect of a proposed new med. Later dosing studies might be required. And larger doses might create worse side effects or begin to create safety issues. (For example, a little salt in the diet doesn’t matter or could be good in hot environments. A LOT of salt in one’s diet creates medical problems.) So the FDA might get biased against approval if the proposed med is shown to work, but not work as substantially as they might desire to see to risk putting that med into use in the general population. I don’t really know, but these judgments might create bias that is technically not warranted in some of the FDA meetings or reviews of trial results.

Not sure if this is answering your question.

Good tutorial, thanks. In the case of “power” Linda and the FDA are primarily concerned with statistical power–how many patients it takes to demonstrate whatever effect or efficacy or goal. For deramiocel, in early research, they gave only a single injection which had negligible effect over a certain time period. They decided to treat every 3 months, and efficacy was shown. (I worry that NGENF will face a similar problem. The early trial was a decent success as a proof of concept in humans, but it is not ready for prime time.)

Cancer chemotherapy drugs get approved if efficacy is only a 4 month prolongation of survival. With months of side effects, it is questionable whether it is worth it, although I am not a dying patient who deserves a chance to accept risks and benefits of a drug like that. CAPR and NGENF patients don’t die as quickly as cancer patients do, so the standards for approval can be more rigorous for CAPR and NGENF.

BTW, higher rates of cancer were eventually seen in ARNA’s drug, Belviq. It nice to know that rats can teach us humans something. For NGENF, it’s nice to know that rats predicted responses in humans. I think NGENF has enormous potential, and I don’t know exactly how to play accumulating more shares.

I agree. She sounded pissed off on the call. Once approved, she will be swinging for the fences.

This issue between CAPR and the FuDA appears similar to ARNA’s first Advisory Committee meeting rejection, which seemed blatantly corrupt. ARNA CEO walked out of the meeting, some in Congress started questioning FDA about this meeting. I doubled down, and almost tripled down until discussing with someone who worked in biotech. Michael Murphy was at his best with guidance approaching the second AdCom meeting, which is why I’m still here after all these years. ARNA eventually became my second largest lifetime investment profit, 13x gain for bulk of shares sold about $10 on day of approval, bought below $1.

CAPR could become a similar investment win. Agree with El Capitan Nemo about adding CAPR shares (now on sale for a discount 😉 If not already heavily invested. Look at it as a potential opportunity, but remember biotech is a risky minefield, and remember to consider appropriate position sizing risks. (A rule I break sometimes….)

MM was in his heyday in 2012 for ARNA. On approval day, the stock hit $13, then 12 the next day, and over a few months was down to 8. I was following MM who said to hold after approval, hoping for EU approval and $20 target. I sold 3/4 of my shares at $4, only $1 gain from my cost. But I held 1/4 of my shares. ARNA re-invented itself with its autoimmune drug, Estrasimod. A 10 reverse split occurred, and on approval ARNA got a buyout at $90 (original price $9), so I did well on those 1/4 shares. Lessons from this are contradictory. Most pro investors take profits on spikes on approvals, unlike MM and myself. But holding ARNA for its different drug was better. I believe that CAPR will get a mildly delayed approval, with a mild risk coming from political sabotage from FDA payoffs from competing BP interests or even SRPT which does gene therapy. But I think the long term potential is so great that I won’t sell upon approval.

SRPT is under a big cloud from the 2 deaths from liver failure.

I have to learn more about Elevidys, SRPT’s one time genetic therapy for DMD. Prevention is always the best strategy, but I don’t know if E can be used to slow disease once symptomatic. There’s where deramiocel has the most promise. Ideally, E will be used for primary prevention, and Deramiocel for secondary prevention of severe disease. I still think that D will be promoted for all patients. If all 23K worldwide MD patients get D, whenever that is, we have $1200 target stock price. For 2K patients, $160 target 2 years after launch. If Chris and Asher77 of ST are right that approval will be only mildly delayed to Oct/Nov 2025, we won’t have dilution so these targets are still in place.

Reading on X “Upcoming CAPR catalysts that will move the share price are Hope-3 results, and a PR with a new approval strategy and timeline following the FDA meeting. I expect good news on both catalysts, but don’t believe we’ll see either one until August/September”. Do all agree that we may see positive stock price movement by September?

Another boost in the stock may come soon if the type A meeting goes well. There are stupid discussions by bears on ST about the FDA agreeing on changing the secondary endpoint of LVEF to primary endpoint for this BLA for cardiomyopathy. Idiot bureaucratic FDA. Of course for a cardio approval, use the cardiac endpoint of LVEF and other MRI data. Whether the wordsmiths consider it primary or secondary misses the point. Bureaucratic stupidity is the only risk for this stock, since I think a good HOPE 3 is highly likely (overpowered with very low p value, according to Linda’s 7/11 CC).

In other words, a bear who thinks CAPR gets a final rejection despite good HOPE 3 is betting that Prasad and company are the devil bogeymen devoid of reason.

Yes I do

Bitcoin blows up. Now holding $28k on my $5,089 original stake. XLM hit a triple plus. Markets on a summer run up. FED to cut rates soon. . Powell backed into a corner. Don’t sweat the market mood swings. Sometimes it’s bipolar. Just IMO.

CAPR — My 2 cents. First, how long will the delay be for a new approval date? JGMD seems to think approval will be delayed for a year into 2026 at the earliest and wrote “The last patient started treatment June 2025.” Linda Marban said, “The last patient last visit was in June 2025” and “At this point the review clock has been stopped until we submit our complete response and we do not believe that a new BLA will be required.” If she is correct, then since CAPR was just 8 weeks away from the PDUFA date, then the new approval date might be delayed until only 8 weeks after additional data is submitted. As CAPR expects to have that data ready for submission this Q, say the end of September, the approval could come within 8 weeks of the end of September (or in late November). IMO, it is unclear at this point when CAPR can expect a decision.

Clearly Nicole Verdun was on the side of CAPR, but Vinay Prasad is not, despite all his chatter about speeding up approvals and getting good drugs approved for desperately unmet medical needs. There are several things that bother me about Dr. Prasad. Not the least of which is his occupation of three titles at FDA which were formerly held by three different people (Director of CBER, Chief Medical Officer and Chief Science Officer). His book Ending Medical Reversal was, imo, junk science. His conclusion that medical treatments which are at one time widespread and subsequently shown to be ineffective are a big medical problem ignores the fact that progress is the result of many failures. All drug trials have a limited number of patients. Bad side effects that only appear when drugs are in much greater use do not mean the drugs should not have been approved. The use of deramiocel has been shown to be helpful in severl ways for DMD patients and has shown no harm. I think he is a conceited person who thinks he knows better than an adcom full of experts and just another example of the new administration putting questionably competent people in lofty positions for which they are unqualified.

I agree about Prasad’s conceit. But I am most angry about the deceit from him and the deep state bureaucrats at the FDA who misled CAPR that they would accept small numbers of patients in phase 2 trials. If they wanted phase 3 studies (that’s OK to get more data) they could have said so at the midcycle review instead of throwing a CRL much later in the 11th hour.

About timelines for final approval, I said here and on ST that HOPE 3 started June 2022. Some of the 104 patients in that trial now have 3 year data, some have 2 year, some have 1 year, and some have less than 1 year. The last patient was last seen June 2025. (Thanks for correcting me on that.) This final data point could be ready in a few weeks. Even now, data for maybe 70-90 patients can be presented literally tomorrow. YES, the FDA could approve it in a few weeks, maybe even the original PDUFA date 8/31/25. But no, govt regulatory bureaucracy will slow it down to maybe 2026 some time. They waste time on procedural matters like whether this counts as an amendment, resubmission, new BLA, etc. If this govt agency wanted to be efficient, the chief could call Linda and say, securely deliver HOPE 3 to me and we will get it through before Aug 31.

The type A meeting could be soon. The window for adding cheap shares may be relatively short, possibly only a few weeks, awaiting the type A meeting.

Ive made more money on crypto and AI stocks than all the false promise longshot biotechs combined. That said, heres 2 strongly recommended early stage stocks to consider. BQT a canadian AI software protection company about to be uplisted onto NASDAQ, and IREN a profitable bitcoin miner converting to selling much needed energy to AI companies, builfing new massive energy generating plants – already negotiating with Oracle and other large companies. One last – UPXI who is stockpiling SOL and whose market cap is only 50% of the value of current SOL holdings – its a Michael Saylor strategy for SOL

Totally agree Steve. Six times(almost) my money on bitcoin and AI is the new gold rush!

John, what do you hold or buying today?

Bitcoin , ETH, and Stellar lumens. My bitcoin is up over 1000 percent. I bought bitcoin when it was $9,000 and change and I have thought that was outrageous and wrong the time.

Trump’s crazy tariffs brought in $27 BILLION in the month of June to the US Treasury to help pay down our insane debt levels. First surplus EVER!! CPI tomorrow will light up the stock market.

This is truly a golden era for the US, we have allowed the tariff imbalance and other countries to sell theyre goods tariff free while they tariff and block us otherwsys in their countries – that is over. Tariifs will not only reduce tge debt but can make soc sec and medicare solvent – we finally have a pres who understands business. I also believe we are headed for the strongest economy and stock market ever – starting 4th quarter and a big boom next year. Dont be caught in cash, ride tge wave in securities

I am all in, Steve.

Totally agree Steve. US companies have been operating like a one armed paperhanger for decades. We take all the low cost competition products into the US but the countries that ship them here don’t take any of ours back into their markets. Such a deal for China and all the rest. Every large big box store like Walmart, Costco and Target is now so dependent on China for their supply chain , that their operations would be significantly curtailed if that situation was halted . That’s NOT a good thing!

June CPI came in 2.7% higher than a year ago, up from 2.4 in May. Core CPI, the Fed’s favored indicator of inflation at 2.9! We are paying for Trump’s tariffs. Thanks for the tax increase, King L’Orange.

Food and energy (gasoline) 2 of the largest consumer expenses ARE NOT included in the core CPI number, and both are down significantly since Biden, worthless number

Energy includes your electric bill (which for me is much more than I spend on gasoline) and electricity is more expensive now than ever.

https://fred.stlouisfed.org/series/APU000072610

Oh yeah, I forgot to include food. Same story. I don’t know where some of you get your facts, but if they are coming from Trump, best check for yourself.

https://fred.stlouisfed.org/series/CPIUFDNS

“First surplus EVER!!”

Haha! Were you making a joke?? Obviously false.

Normally one looks at the year, not one month.

The last time the US federal government had a budget surplus was in fiscal year 2001 during the final years of the Clinton administration. Before that, 1969.

I am curious where some of these subscibers get their news.

OAN? Bannon (if he’s out of prison now)? Breitbart? unTruth antiSocial 😉 Stormtrooper Magazine? I gotta start reading these to figure out what’s goin’ on! Will post headlines soon! 😉

Lers see I bet yiur a tic toker, instagram and msnbc? Get a real well rounded opinion there (haha)

I subscribe to WSJ, NYT, WAPO and watch FoxNews, CNN, MSNBC and Meet the Press, This Week and Face the Nation. And you?

You can watch all you want, if youre not intelligent enough to understand the complexities or know the difference between fact and biased opinion then it doesnt matter what you watch or read. When you said the government shouldnt be generating a profit (also known as a budget surplus) you revealed your lack of political and business sense

You’re the one who can’t spell or punctuate properly — hardly proof of intelligence.

This is THE most intelligent post of all.The fact that it got 3 thumbs down shows the ignorance of those people. They want more and more govt debt. They are ignorant or stubbornly refuse to understand that out of control spending leading to gargantuan debt is what destroyed civilizations. None of them run out of control debt in their own households. They are fiscally responsible in their own households or even small localities. Why don’t they understand that the same applies nationally?

All leftwing rags except Fox, maybe WSJ. The NYT denied the Nazi Holocaust because it was too embarrassing to admit the atrocities of a socialist dictatorship. NAZI = National Socialist, by definition. Suggest getting a common sense education from the publications of the Ludwig von Mises Institute from Auburn University in Alabama. Don’t disparage Auburn as not having the ranking of the Harvard ilk. These prestigious bastions of liberalism are anti-American and pro-Arab. You could cite statistics from leftwing rags that support their views. Aside from inherent bias inherent in what they report, it is more important to understand the principles of a free lifestyle and respect for others’ rights to the same, without using big govt to impose actions that interfere with same.

In case you didn’t know, many studies show that Fox News viewers are the least informed about current events.

https://www.forbes.com/sites/quora/2016/07/21/a-rigorous-scientific-look-into-the-fox-news-effect/

The US is bringing in billions in tarriffs, did you think we would only have one month of income? You embarass yourself with your lack of fact and knowledge

Strong rumors of Jerome Powell being fired or resigning soon… he has probably cost the US people $3-5T this year alone in interest over the next few years, and corrupt. He lowers rates twice last year before the election with higher inflation than we have the last three reports and continues to sit on his hands while we have a massive tranch of debt to refinance – cant leave soon enough. Lower rates are the rocket fuel combined with tariff income that will send market roaring

I obliterated the 1 thumbs down you got. The world and Powell need to recognize the wisdom of Milton Friedman, who said that inflation is mainly caused by growth in the money supply. Tariffs raise consumer prices for the tariffed goods, but if the money supply stays constant, there is less money to buy other non tariffed goods, causing deflation in the latter goods. Don’t exclude food and energy from inflation figures, but recognize that they are volatile. So what? If there is stagnation, interest rates can be cut.

What economics illiterates are thumbing down? Govt socialism propaganda at all levels of education is destroying the US. This blatant Commie Mandami could get elected NYC mayor. Dem mayors have already sabotaged large cities. The fault is not primarily with the candidates, but with ignorant voters who fall for their promises.

Your words:

“Government socialism propaganda at all levels of education”?

What does this have to do with our stock picks?

What does this have to do with Powell’s caution in lowering rates too slowly or too cautiously?

I don’t remember teaching or preaching socialism propaganda in my psych, stat, computer science or engineering classes. How exactly does this happen?? I’m seriously curious to get your perspective on this.

I don’t remember socialist propaganda in “Intro to Political Science” class at Brown University, where I believe you went to college or med school also. I can’t imagine how this would happen in kindergarten or grade school. Other than the idea that “all men (people) are created equal”, so everyone gets comparable education except those with certain disabilities in special ed. And some school districts certainly provide better education than other school districts, partly due to the people in the districts, partly to funding differences, etc.

Not my words…Internet search:

“Communism typically involves no private property, with a strong central government controlling production and providing necessities. It aims to abolish class structures and is often seen as requiring a violent revolution to achieve its goals. Production is intended to meet basic needs and is distributed freely, and religious freedom is generally absent.

Socialism, on the other hand, allows for individuals to own personal property. While the government has control over some production, private ownership and individual enterprise can coexist. Socialism seeks to diminish class differences, though some earning disparity can exist. It is typically achieved through democratic processes. Distribution is based on individual contribution, and religious freedom is allowed. ”

I know very little about Mamdani (correct spelling) but he has zero chance of seizing private property, companies, or distributing goods freely. But as someone who lives in NY metro, I can understand you being opposed to him or his policies. Your mayoral election is certainly a news item but not related to our investment discussions as far as I can tell.

Commies and socialists don’t spell out what bad things they are planning. Campaigns promise giving as many groups as possible freebies so they can get votes from all these special interest groups. Social justice for all, and numerous other platitudes, all false. Universities consist of academics who are sheltered by these platitudes who have little work experience. Years ago, I asked a Chinese lady who witnessed the rise of Mao, how could people fall for his crap? She basically said they were gullible and were suffering so much that they wanted to believe what Mao promised. Early on, Hitler was also charming, charismatic and wooed the crowd.

You are one of the gullible people who deny that Mamdami will attempt to seize means of production. He is an avowed Commie, advocates violent worldwide intifada and is supported by Bernie Sanders and AOC. Another friend thought Biden was a moderate in the early days of his campaign. But Biden brought criminals across the border which has terrorized and killed many people. Why? Not as a humanitarian mission, but as a means to buy votes for Dems who gave them freebies and a means to survive, that even the poor citizens of the US have to wait behind them. NYC mayor Eric Adams initially embraced making NYC a sanctuary city, but after facing reality that there was no money to give all the illegals benefits without sacrificing the needs of his resident poor, realized that it was a mistake. I have respect for people like Adams who admit their mistakes, but I have disgust for incorrigible academic assholes who never give up their wrongheaded dogma. I wouldn’t mind these academics who have the right of free speech, sticking to themselves, but when their free speech progresses to give mandates and control other people, that is wrong. It is true that Trump is attempting to micromanage world economies and dictate tariffs and other things, but he has a tough job trying to correct damage done by socialist Dems like Biden who efficiently destroyed social conditions in the US like defunding the police. Worse, the rise of terrorism from China, Russia, Iran directly relates to Biden’s weak America Last behavior. Don’t retort with flawed claims from leftwing media which I don’t trust at all.

You think Mamdami is only MY problem? No, it is also your problem because other Mamdami type Dems have destroyed major cities. A typical liberal makes excuses that bad things will be “contained” and as long as it is not in their neighborhood, everything is OK. No, a Commie NY will see mass exodus of billionaires, resulting in declines in quality jobs available for all income groups. In the last several years, productive people who could move did so and moved to Repub states like Florida, Tenn. Real estate is booming there.

Stick to your excellent stock analysis. Your liberalism is nurtured by left wing media and left wing academics. My views have been shaped by my experience in the real world, starting from my mother who was a housewife but had more common sense than the majority of damn professors I knew or read about. There were a few brilliant professors like Milton Friedman who had common sense. I respected economist Walter Williams who was a poor black child from Phila who grew up to understand free market wisdom. He had productive influence on some black people and tried to convince them that Dem black leaders were holding them back.

Regarding more subtle socialist indoctrination beginning in early grade school, a child is taught that his own needs are subservient to that of the group. “Don’t be selfish.” 40 years ago, I visited a Kibbutz in Israel. The young lady was interested in buying a camera for her hobby, but lamented that the group didn’t permit it because the group’s need for essentials was more important. She should have relocated to a private living situation where she could have had incentives and opportunities for her own fulfillment. I admired Ayn Rand’s writings such as “The Virtue of Selfishness” whose title was deliberately provocative. Rand promoted rational self interest which respects nonviolent free competition but not the typical connotation of selfishness achieved by theft, cheating and sabotage. She promoted her concept of rational self interest as the moral basis of free market capitalism. The academics rejected this due to their upbringing indoctrination in socialism. They deliberately transmuted “self interest” to “selfishness.” Then they justified their control with big govt, as long as the intellectual elites had control because they supposedly knew better what all classes of people want and need, better than individuals themselves.

Rand was atheist, and disliked the attempts of religion to justify the moral freedom of capitalism. Most religions support self-sacrifice as a noble ideal. That actually is more consistent with socialism to promote higher taxes to take more money from “selfish” people who should practice self-sacrifice for the benefit of the general public and especially special interest groups. An example was Biden’s forgiveness of student loans to buy student votes. So the support for capitalism by religious Repubs is on shaky ground. Religious groups asked Rand to throw in a little religion in her works to make her teachings more saleable to the general public, but she refused to harbor such inconsistency. There is a nice collection of her essays in “Capitalism, the unknown ideal.”

You deny basic principles underlying free societies, and why people are fleeing countries that have excessive regulations and limit freedoms. Commies are just worse socialists. You believe what you want to believe. Read Rand, the most eloquent defender of the moral basis for free market capitalism. If you have any intelligent refutations of her, I’m listening.

We can learn basic life skills in schools run by commies, socialists, religious and private groups. Your parents taught you how to go to the bathroom, get dressed, how to read at a beginning level, how to do home chores, etc. But public education institutions have had a decidedly leftwing bias. When it comes to voting, people need an education about why more govt power leads to worse social and economic results in the aggregate and esp also for individuals to be free of coercion. You are willfully blind if you deny this. You are free to live your own life according to your standards, as long as you don’t interfere with others’ right to the same. But govt workers have no moral right to enforce regulations that hurt others’ rights to live according to their standards. That means as little interference with others as possible. It is axiomatic that socialism/communism = interference, and free market capitalism = liberty. Most voters are poorly educated to understand this, and just vote for whichever candidate will give them freebies at the expense of others.

What economics illiterates are thumbing down?

Lots of economic illiterates on this site – betcha they think Mondami has great ideas too

Spell his name correctly, or you appear illiterate yourself

Dont care enough about the phony to know the correct soelling of his name

Unfortunately, he is not a phony for his real agenda, deliberately planned just like Mao, HItler, Xi, Kim of NK, Putin, numerous ayatollahs of Iran, Bernie Sanders, AOC. He’s got the backing of academics, who I consider the real phonies. Academics lend an air of respectability, which is actually the opposite of reality because of their intellectual damage to generations of college kids grooming to be future leaders.

I’ve learned to forgive people who make spelling errors, but I engage them in substantive discussions. Spell checks are flawed–often my spelling is “corrected” incorrectly because the stupid AI thinks I mean something else. With Mamdami, his name hasn’t been written until recently. In school, I was a good speller from my experience in reading, but even I made an error in spelling his name. No reflection on my literacy.

ARRNF American Rare Earths LTD is on fire. Up 43 percent today. (On the heels of MP Materials) My stake is up 53 percent in 2 days. You can buy 1000 shares for just $320. Closed today at .32. Now that’s what I am talk’in about. Do your own due diligence. I used some of my crazy money!

John, this stock is way above its ATH so other than people blindly rushing into precious metal stocks, whats driving it and what will drive it further? Appreciate the feedback

Heres another tip – OPEN. Activist is driving it, way undervalued restructure play, all other e-realtors closed shop so no competition, do your own DD but huge upside on it

I’m in for 1000 shares at $1.94? What the hell!!

New World Investor for 7.17.25 is posted.