Dear New World Investor:

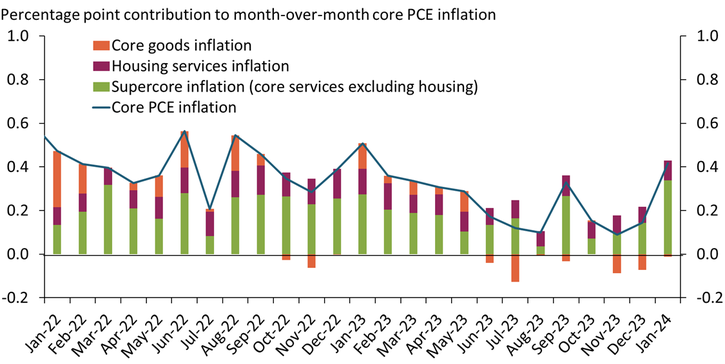

Last Friday’s May Personal Consumption Expenditures (PCE) index increased 2.3% year-over-year, a slight uptick from April’s 2.2%. The month-over-month increase from April was 0.1%. The Fed’s favorite inflation indicator, the core PCE that excludes changes in food and energy prices, was up 2.7% year-over-year. Both the April increase and the consensus expectation for May were 2.6%. Month-over-month, the core PCE rose 0.2%, also a tenth above both the April increase and the consensus expectation for May.

“Supercore” PCE is a measure of inflation that focuses on the prices of core services excluding housing and energy services. It is sometimes referred to as “sticky” inflation because these prices tend to be less volatile and more persistent than other categories of inflation.

The Fed has said they look at the Supercore PCE as an important inflation indicator. That’s important right now because the Supercore has fallen to just over 1% looking at the last three months annualized rate.

Fed Chairman Powell just testified that the central bank is “well-positioned to wait” before moving interest rates, and I don’t think there’s anything in this report to change that. Wall Street focused on other data showing signs of slowing economic growth. Real personal spending decreased 0.3% in May after increasing 0.1% in April. Personal income fell 0.4% in May, well below the 0.7% increase seen in April and the 0.3% increase economists had expected.

But Powell needs to see a direct impact on the labor markets before he makes a move – and that just isn’t there. The Job Openings and Labor Turnover Survey (JOLTS) report for May showed job openings unexpectedly rose in May to the highest level since November 2024. The consensus expected job openings to decline to 7.3 million openings. Instead, they increased from 7.39 million in April to 7.76 million in May.

The JOLTS report also showed that 5.5 million hires were made during the month, down from the 5.61 million made during April. The hiring rate ticked lower to 3.4% from the 3.5%. The quits rate, a sign of confidence among workers, moved up to 2.1% from 2% in April. Both the hiring and quits rates are hovering near decade lows, but I’m not worried about that because layoffs also are low. This morning’s new claims for unemployment fell to a six-week low of 233,000.

I’ve left this morning’s June payrolls data for last, in part because it is often later revised so much in the Business Employment Dynamics reports that it’s become a joke for economists and investors. (But not for traders, who pretend it means something and play their daily gotcha game.)

Click for larger graphic h/t Yahoo Finance

FWIW, June payrolls additions were 147,000, well above expectations for +110,000 and directly opposite Wednesday’s report from payroll processor ADP that US private businesses reduced the number of jobs in June for the first time in over two years. ADP said companies eliminated 33,000 jobs in June, the first monthly decline since March 2023.

TL:DR – According to the CME FedWatch Tool, after Wednesday’s ADP report Wall Street thought there was a 23% chance the Fed cuts rates at the July 30 meeting and a 96% chance that at least one cut happens by the end of the September meeting. After Thursday’s payrolls report, the odds of a July cut fell to 4.7% but the odds of a September cut held at 95.3%. I think they’re wrong on September.

Stocks went up after Wednesday’s weak ADP report because it meant the Fed was more likely to cut interest rates. Stocks went up again Thursday after the strong payrolls report because it meant the economy isn’t falling apart. When Wall Street realizes their September rate cut is a pipe dream, some traders will sell stocks because interest rates aren’t cut. Other traders will buy stocks because it means the economy is solid. If you’re a trader, you do you. For investors, just buy the leaders of the biggest technology change in history.

Market Outlook

In this holiday-shortened week, the S&P 500 added 2.3% since last Thursday to an all-time closing high today at 6,279.35 and a record intraday high at 6,284.65. The Index is up 6.8% year-to-date. The Nasdaq Composite also booked record highs today, gaining 2.2% from last Thursday. It is up 6.7% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 1.9% as biotech M&A activity picked up. It’s still down 5.4% year-to-date, though. The small-cap Russell 2000 won the week, up 3.5%, and now is up 0.8% in 2025.

The fractal dimension is heading down to signal a new uptrend when it drops through 70. New uptrends that start from all-time highs are the most fun of all.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX ScyNexis – Resolution of GSK situation

EQT EQT – natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model estimate of June quarter real GDP growth fell to +2.6%, while the Blue Chip economists are at +2.0%.

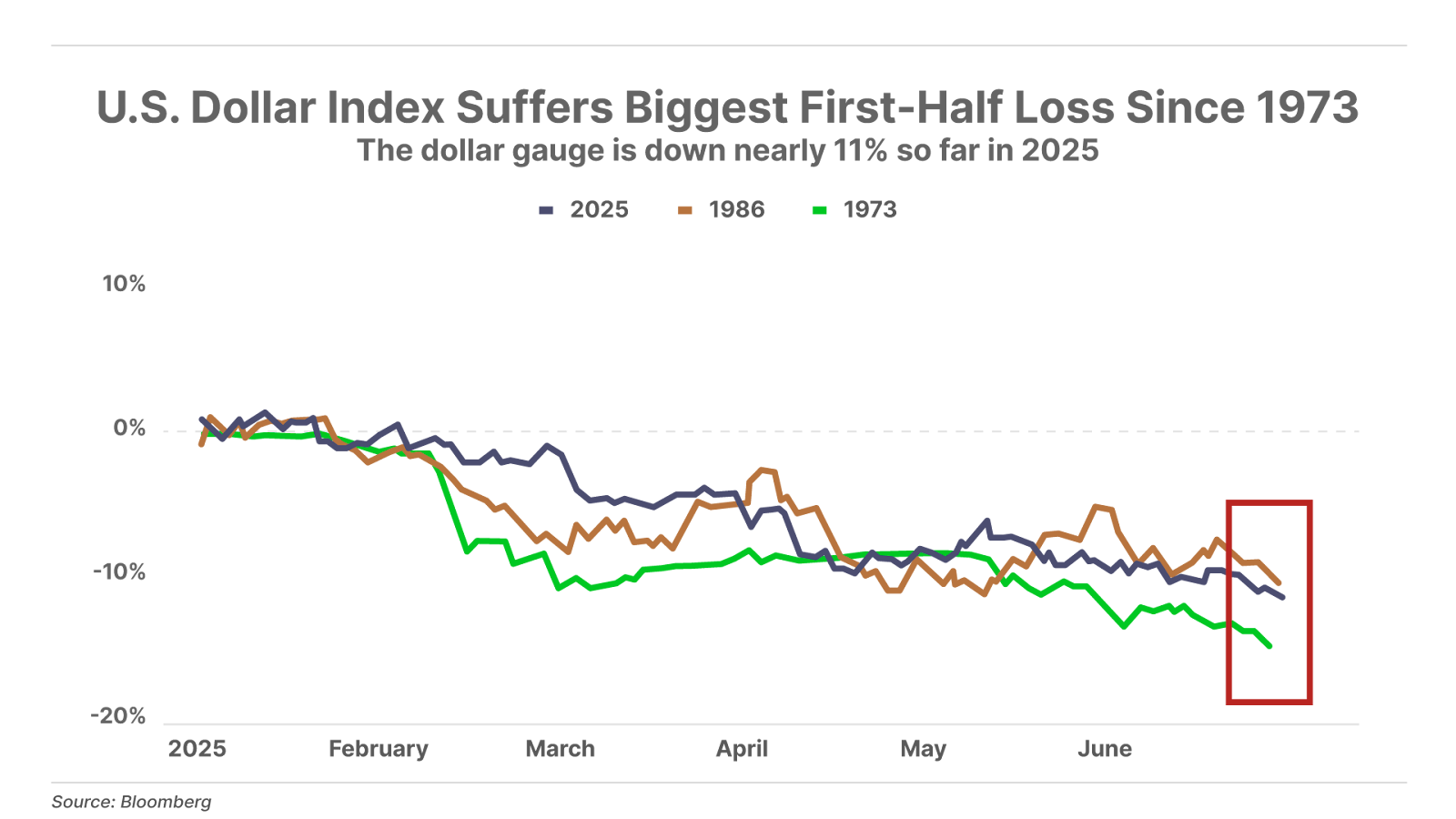

Dollar Death Watch

The dollar index (DXY) is down 10.8% so far this year. That is its worst first-half performance since 1973, when the gold-backed Bretton Woods system ended. June was the 6th consecutive declining month, matching the longest downtrend in 80 years, and the steepest six-month drop since 2009.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Friday, July 4

Markets Closed

Have a great long weekend!

Monday, July 7

AG – First Majestic – Through 7/11 – Rule Symposium on Natural Resource Investing

DG – Dakota Gold – Through 7/11 – Rule Symposium on Natural Resource Investing

Thursday, July 10

Short Interest – After the close

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $213.55) was upgraded from Underperform to Hold at Jefferies. Better late than never, I guess. AAPL is a Buy under $205.

Gilead Sciences (GILD – $111.75) was named to Time magazine’s 100 Most Influential Companies 2025 list. And here I thought no one else was paying attention! GILD is a Long-Term Buy under $90 for a first target of $120.

Meta Platforms (META – $719.01) also made Time’s 100 Most Influential Companies list. Zuck just launched Meta Superintelligence Labs to house the company’s various teams working on foundation models such as the open-source Llama software, products, and fundamental AI research projects. It will be led by recently-hired Scale AI ex-CEO Alexandr Wang and former GitHub CEO Nat Friedman.

The stock hit a new all-time high Monday, but then backed off because Wall Street hates it when Zuck spends big dollars on AI. As you probably can guess, I love it. Meta is in talks for $29 billion from private credit giants to fund its AI data centers. META is a Buy under $655 for a long-term hold.

Nvidia (NVDA – $159.34) closed at a record high today with a market capitalization of $3.89 trillion, just under the most valuable company in market history record of $3.915 trillion that Apple clinched in late 2024. NVDA is a Buy under $125 for a $180 first target.

Palantir (PLTR – $134.36) named Accenture Federal Services, the leading US federal technology company, as a strategic partner and preferred implementation partner for US federal government customers. This is a big deal because Accenture has a long history and deep involvement in numerous government agencies. As part of the collaboration, Accenture Federal Services and Palantir will partner to train and certify Accenture Federal’s Data & AI team of 1,000 professionals on Palantir Foundry and Artificial Intelligence Platform (AIP).

Palantir also announced the launch of Warp Speed for Warships, a bold new program envisioned to accelerate warship production, fleet readiness, and digital transformation. Warp Speed for Warships is funded by the U.S. Navy’s Maritime Industrial Base Program and is an extension of a strategic collaboration between Palantir and BlueForge Alliance focused on reestablishing American maritime dominance. BlueForge Alliance is the nonprofit integrator supporting the Navy’s efforts to strengthen the maritime industrial base.

Warp Speed for Warships is powered by Palantir’s proven Warp Speed manufacturing operating system. It is designed to accelerate shipbuilding modernization and readiness by digitally connecting the network of shipbuilders, suppliers, and critical partners responsible for building and sustaining the Navy’s fleet.

Palantir defense specialist Madeline Hart talked to Stephen McBride about why Silicon Valley [actually, El Segundo] is taking over the military, and why it’s a good thing.

PLTR is a Buy under $100 for a $150 target.

SoftBank (SFTBY – $36.94) sold $2.2 billion of short-term notes with interest rates from 6.5% to 7.5%, maturing from 2029 to 2035. More money for Masa’s AI investments and stock buybacks. SFTBY is a Buy under $25 for a first target of $50 in the next two years.

Small Tech

Enovix (ENVX – $11.39) announced a $60 million stock buyback program through year-end 2026. ENVX is a Buy up to $20 for a 4-year hold to $100+ as their BrakeFlow lithium-ion battery takes market share.

Primary Risk: A new competitor invents a better battery.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

Inovio (INO – $1.33) sold 14,285,715 shares of stock with an equal number of warrants at $1.75 per unit to raise about $23 million. I didn’t expect them to raise money until after FDA approval in 2026. The stock was clobbered for 37.85% today – a severe over-reaction. It’s all about approval for INO-3107 next year, and that’s as close to a lock as you’ll ever see in biotech. INO is a Buy under $14 for a very long-term hold.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: Early 2026

Probable time of next financing:After FDA approval in 2026

Inflation MegaShift

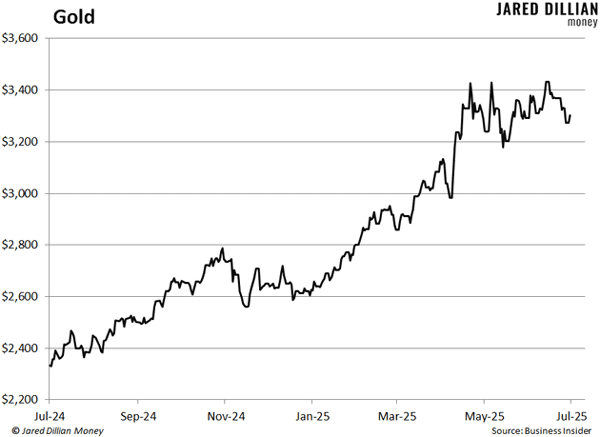

Gold ($3,342.90)looks like it is falling apart, delayed-reaction style, from peace breaking out in the Middle East, but don’t be fooled. It may take a little time for gold to find its footing again, but the long-term chart still looks great – the trend is intact.

The fractal dimension confirms it as we head steadily towards full consolidation. These time-based consolidations can be boring, but they’re less stressful than consolidations caused by sharp price drops. Plus, we wind up fully consolidated near the all-time highs, making the subsequent upleg much more fun.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $109,895.95) has been consolidating in this $105,000 to $110,000 range for quite a while. It could continue, but we all know what happens next – the uptrend resumes.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $62.19) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $19.49) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $67.00

According to the Energy Information Administration, US total oil liquids production set a new record high in April at 20.826 million barrels a day (m b/d) in April using monthly data. US total oil demand for April was 20.213m b/d, well above the initial 19.725m b/d figure estimated for April using weekly data). Although Wall Street doesn’t realize it yet, April or May will be the peak in US production this year while demand keeps growing.

Energy services researcher Baker Hughes said that this week US energy firms cut the number of operating oil and natural gas rigs for the 10th week in a row – the longest such streak since July 2020.

The July 2026 Crude Oil Futures (CLN26.NYM – $62.07) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $35.80) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $7.51) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $6.17) said their Pinyon Plain uranium mine in Arizona continues to significantly exceed previous production estimates. During June, they mined 230,661 pounds of U3O8 from the Pinyon Plain mine, resulting in 638,700 total pounds of U3O8 mined in the June quarter.

These elevated mining rates are mainly driven by the high uranium grades at Pinyon Plain, which averaged 3.51% U3O8 during the month of June and 2.23% during the second quarter. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

Freeport McMoRan (FCX – $45.80) moved up as copper broke through $5.00 a pound ($10,000 a ton) due to plunging inventories and unexpected supply disruptions exposing the market’s tightness. Easing tariff tensions and rising electrification demand also are driving bullish sentiment. It’s been a lot longer coming than I expected, but I believe copper may be heading toward a structural repricing.

The Trump Administration has scheduled a Section 232 national security review for copper. This national security review is the same one used to impose the current 50% duties on steel and aluminum. At the same time, global exchange copper inventories have plunged 44% since late February, signaling a sharp tightening in supply.

The steepest drawdowns have come from the Shanghai Futures Exchange (SHFE) and London Metal Exchange (LME), where copper has exited warehouses at a rapid pace. This marks a stark reversal from early to mid-2024, when rising inventories weighed on prices and stalled the rally. Exchange stocks of copper are the official, transparent inventories stored in major exchange warehouses, and are a closely watched indicator in the industry because they can act as the market’s buffer to any sudden demand requirements. Total visible copper inventories have precipitously declined to cover only six days of global copper demand. FCX is a buy under $44 for a $65 target within two years.

Primary Risk: Copper prices fall.

* * * * *

Your gardening throughout the season Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 7/03/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $213.55) – Buy under $205

Corning (GLW – $53.04) – Buy under $33, target price $60

Gilead Sciences (GILD – $111.75) – Buy under $90, first target price $120

Meta (META – $719.01) – Buy under $655 for a long-term hold

Micron Technology (MU – $122.29) – Buy under $102, first target price $140

Nvidia (NVDA – $159.34) – Buy under $125, first target price $180

Onsemi (ON – $56.60) – Buy under $60, first target price $100

Palantir (PLTR – $134.36) – Buy under $100, target price $150

PayPal (PYPL – $76.59) – Buy under $68, target price $136

Snap (SNAP – $9.27) – Buy under $11, target price $17+

SoftBank (SFTBY – $36.94) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $11.39) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $75.93) – Buy under $70; 3- to 5-year hold

Fastly (FSLY – $7.03) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $15.99) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $6.20) – Buy under $10, target price $40

Rocket Lab (RKLB – $35.66) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $31.68) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $3.80) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $3.62) – Buy under $2, target $20

Compass Pathways (CMPS – $3.26) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $2.57) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.33) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.64) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.73) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($37.08) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $45.85) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $50.58) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $30.45) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $49.09) – Buy under $30, target price $50

Coeur Mining (CDE – $9.12) – Buy under $5, target price $20

Dakota Gold (DC – $3.78) – Buy under $2.50, target price $6

First Majestic Mining (AG – $8.46) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.72) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $9.63) – Buy under $10, target price $25

Sprott Inc. (SII – $69.92) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $109,895.95) – Buy

iShares Bitcoin Trust (IBIT – $62.19) – Buy

Ethereum (ETH-USD – $2,585.33)– Buy

iShares Ethereum Trust (ETHA- $19.49) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – $62.07) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $35.80) – Buy under $40; $100+ target

Vermilion Energy (VET – $7.51) – Buy under $11; $24 target

Energy Fuels (UUUU – $6.17) – Buy under $8; $30 target

EQT (EQT – $55.31) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $45.80) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

TG Therapeutics (TGTX – $36.72) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

First. Happy 4th!

Happy 4th all

Opie – making sure yiu saw my reply to your comment on last weeks board “Ive never initiated a political commentary only responded – political comments only as they may relate to or impact the stock market ate relative – hateful or opinionated commentary unrelated to the market has no value here”. What noone here needs is any more “hate Trump” vitrial – Ive never seen so many people wishing bad for the pilot flying their plane

The problem is that I caught a plane that was supposed to be going to Philadelphia and the damn pilot is flying it to Moscow instead.

Wouldnt it be wonderful if we could just ignore the rest of the world as if it would never be a threat to the US

Oh and BTW ending wars was the platform he ran on that a record number of voters voted for, no surprises,

Steve,

Rule #4 DOESN’T say “Don’t discuss politics, unless you are responding to others.” Its says “Don’t discuss politics.” Period. You have made more political comments than anyone else! Do you really think you are helpful somehow??

what record number of voters?

2024 Trump received 77,303,568 votes

2020 Joe Biden 81,268,773 votes

WRONG. Trump was leading until a halt in counting in the early AM. This coincided with sudden influx of massive bags of votes which were 99% for Biden. This was obvious fraud, denied by the corrupt media that you read, and enabled a corrupt Deep State justice dept engaged in law fare persecution of truth tellers.

If you don’t like political arguments on this board, why are you starting one on a new board right now? And naively lecturing me, no less? If you bothered to check the previous board, you would have seen I replied to your comment there. That’s where this conversation should have ended, after Murphy started it on that board. He violated his own rule #4, making political statements unrelated to investments. Not only that, his post was patently false information.

Murphy initiated this issue by posting a political attack against someone he obviously dislikes. It was completely unrelated to any investment information. Worse, it was completely false. There is an obvious problem when a financial guru starts posting false information on their investment recommendations report.

I’ve been a subscriber here for over a quarter century, and political arguments got out of control on this board when Murphy started talking about Trump when Trump first ran for President, provoking political arguments that hadn’t occurred previously. Unfortunately, we lost a subscriber who provided some GREAT investment recommendations, and probably others.

Murphy is the one who initiated the controversy (as he’s done before), and we are the ones who are responding. So what’s your point? You seem confused. Its pretty simple. Murphy needs to follow his own rule. His own hateful false claim that some politician made some false comment was not related to any investment point he was making, just interjected in the middle of his Radar Report that we paid for.

Secondly, this wasn’t started by “hate Trump” vitrol, it was AOC vitrol. Trump himself spreads the hate and gets it back, no surprise there.

Someone asked MM last week about RKLB. It was $35, higher than his target of $30. MM didn’t address the question about whether it is a sell or hold. Either he is asleep or actually thinks it is a hold. He should explain why he thinks it is a hold. It clearly is no longer a buy below $13. I don’t follow it, but I think there are better places for money, such as AKBA. Even after a doubling from $2, the gain from AKBA is likely to dwarf RKLB.

Agree AKBA is a buy but there are 3 industries with potential explosive growth in next few years: AI & super computing, Crypto, and Space travel – be wise to have at least one stick in all 3, and RKLB is one of those

All 3 industries have already had YUGE stock increases. The problem is valuation in relation to business prospects. In our lifetime, we saw the dot.com bust. Investor with big winners in these industries are the loudest pumpers that they are going to the moon or the sun or another galaxy.

I agree. I am now up 71 percent and I got in late on AKBA. (Thanks to you, by the way) and thanks

Keep holding, of course.

INO–maybe it gets approved, but what is the long term outlook? There are many vaccines on the market, lots of competition. Big Pharma Pfizer/Moderna could stomp on INO, analogous to how JNJ wiped out ARTH. But CAPR has exosome technology, which will probably be the safest tech for vaccine delivery. CAPR will likely get approval for its DMD drug, for a double from $10 now to at least $20 by Aug 31 or even earlier. DMD alone could fetch $100 or more, but the long term potential is its exosome platform with blue sky potential of $500 or more. Some say that Big Pharma is interested in exosomes for drug delivery. Pfizer or Moderna is more likely to be interested in CAPR than INO.

Do you think that expected approval may already be built into the current CAPR price? Why do you think it will double?

When the Adcom was announced a month ago, CAPR plunged from $12 to $6. That was a reasonable fear, because people thought there was something wrong. Next, Adam Fraudshit lied about a few things and caused another plunge from $12 to $7. When 2 cases of FUD cannot get the stock below $6, that means today’s $10 is reasonable value. Upon approval, the stock could be $15-30. But the medium term target is much higher, as the entire DMD community has suffered a major blow as Sarepta’s gene therapy recently reported a tragic death from liver failure. The only option left is CAPR’s deramiocel. The DMD community is clamoring for it. RFK is supportive for approval of drugs for rare, tragic diseases like DMD. He himself went to a foreign clinic for experimental therapy of his voice condition. He is devoted to children’s health as a founder of Children’s Health Defense. Bears are vocal about the lack of the gold standard of double blind placebo controlled (DBPC) trials. But CAPR is doing everything the FDA wants. The inspection of the manufacturing labs went well. The FDA accepted left ventricular ejection fraction as a surrogate endpoint, and the use of historical controls showing the tragic natural history of DMD. The new FDA officials are flexible in encouraging speedy approvals with good data despite the lack of the customary DBPC trial for tragic diseases like DMD with unmet needs.

Sarepta (SRPT) is charging $3.2 million for a one time treatment. Another company has a simple product, duvyzat for treatment of skeletal muscle weakness in DMD. That product costs $700K annually. But only CAPR has treatment for cardiac muscle weakness in DMD. It is up for approval for cardiac disease in DMD, and will soon get dual approval for skeletal and cardiac muscle damage in DMD, based on good data for both and compelling demand. Estimates of $1 million annual cost seem reasonable for THE leader in DMD treatment.

There are 15-20K DMD cases in the US, with additions for Becker MD which is less severe. I don’t know how long it will take to get all or most of the patients on deramiocel, but look at numbers.

Nippon S is a Japanese company already involved with genetic disease and is a likely partner for marketing. An agreement may be already done. CAPR will get 35-50% royalties. Someone on ST did financial estimates a few days ago. $1 million X 15K patients X 0.3 royalty X 0.5 overhead for NS divided by 50 million shares is $45/sh earnings. P/E of 15 is stock price of $675. Discount that all you want for delays in getting all patients on board. Safety is excellent.

The exosome platform is the real kicker, beyond DMD. CAPR processes cardiac cells from donors. There is brilliant bioengineering to get the exosomes from the cardiac cells to possess anti-inflammatory and anti-fibrotic effects. For kidney repair in CKD, kidney exosomes will heal. The work was done by Eduardo Marban, MD, PhD. His wife, Linda Marban, PhD is the CEO of CAPR. For many diseases, the exosome platform will be critical. Big Pharma is interested in exosomes for vaccines. The stock price could be multiples of $675.

I’ll leave it to Chris to critique my analysis and see which is the better long term prospect, CAPR or NGENF. I think CAPR is a much quicker big payoff, although long term, both are the best opportunities today. Both CAPR and NGENF are treating tragic conditions. In addition, they are both sympathy plays that have been scientifically proven to work.

I think NGENF has greater potential than CAPR. Near term I think CAPR will at least double come September (and go much higher if the shorts haven’t closed their positions by then — last reported as 25% of the float and expensive to borrow). JGMD has painted a lovely picture for CAPR and I would love to see it all come true, but I am not sure Esuardo Marban’s ex-wife is the person get it there (although I wish the best for her).

NGENF has the potential to be a multi-billion dollar company. SCI is a relatively small market, affecting fewer than 300,000 people in the US at a system cost of about $50 B. I think it will become part of the standard of care for all SCI patients, but that is still small potatos. We knew 291 worked in animal models of SCI, MS, stroke and Alzheimer’s (ALZ) but we didn’t know if it would work in humans. Now we know it works in humans for SCI and I see no reason why it shouldn’t work in humans for any of those other diseases (and more). I always thought a cure for ALZ would be the Holy Grail. I recall that Biogen’s mkt cap leapt by many billions when its questionable aduhelm was approved. But actually, the number of people diagnosed with ischemic stoke annually is about 60% higher than those with ALZ although the lifetime cost of treatment and system cost is several times higher for ALZ. I always thought ALS would be a layup for 291, but when I realized the market value of 291 for ischemic stroke I had to agree that is a good next indication for the company. Also, there is the wild card of Accelerated Approval which could happen this Fall. That would catapult NGENF far aheaf of CAPR.

Finally, we have the move this week by Dan Mikol, MD PhD. Dan is a great guy. He was the Director of the U Michigan MS Center for 12 years before he moved into the pharma business. He held lofty positions at Novartis, Biogen and Amgen before he was intrigued enough to become the Chief Medical Officer at NervGen. He designed the brilliant trial that proved 291 works for people with SCI. This week he became the chief of Neuroscience for AbbVie (mkt cap $335B). is one of the world’s experts in NVG-291. I imagine he will be very interested in reporting all the good things he knows about little old NervGen (mkt cap $250M) ABBV has been on a buying spree since Humira’s patent expiration, AbbVie has spent over $20 billion on acquisitions, including $8.7 billion for neuroscience firm Cerevel, $10.1 billion for cancer drugmaker ImmunoGen and $1.4 billion for Alzheimer’s-focused biotech Aliada. Do you think there is any chance that NervGen gets an offer from ABBV for a few billion? Even $2B would be 8x NervGen’s current price of $2.43 or about $19.50. I’d call that a win. Dr. Mikol would call it a windfall with all the options he has accumulated in his 4 years at NervGen.

Chris, I own small amounts of NGENF and CAPR. In your opinion, if you had $10,000 would you put it in one over the other, equal split between the two? I’ve read and reread your and JGMD’s thoughts along with anything else I could view and read. I’m torn. Ideas?

Keep in mind these early stage biotech investments are risky investments. Others may be working on alternatives to both of them. Consider splitting your money between them, not 0% & 100%, purely as a risk reduction strategy? Maybe 25-75 or 50-50? I am hoping that at least one pays off big time, but there is a possibility that only one or neither one do.

Depends on when your timeline for selling is. If you plan to sell in the next 3 months, I’d split it 65/35 CAPR/NGENF. If you plan to hold for 5 years I would do the opposite. If you gave me $10,000, I would probably split it 40/40 between drugs and whores and then waste the rest. Seriously, I’d do 50/50. If CAPR gets hit with another short attack, sell some NGENF to buy more CAPR and after approval even out your allotment.

Thanks

On ST, gusm17 modeled uptake of deramiocel. I (viber7 on ST) went with it, and projected PPS of $160 from 2000 patients by end of 2027. It is clear that most of the 15K DMD patients will want deramiocel, so the question is how long it will take and how much will it cost for production to scale up for 15K patients. I then projected at peak sales for 15K patients, target of $600. Also, why do you think Linda is not up to the task of executing all this?

Not saying she’s not up to it. But if she is about to become a very wealthy lady, I think she would rather do things with the rest of her life that are more exciting than run a biotech company. And once they get approval, it should be easy to find someone to run the company.

Linda has already hired medical directors/advisors to help with execution of the enormous potential CAPR has. Yes, she could always sell out and live the good life like the thousands of rich, attractive women. But she has spent decades doing science and knows that there is nothing more exciting than continuing to advance her company for the benefit of not only DMD patients, but other areas of health. In a way she is like Trump who could have continued his business pursuits and not risk his life becoming president again. Trump had “everything” –money, women, fame. What was he going to do with the rest of his life to top that? Hopefully to save the world from demonic tyrants like Iran, China. Russia plus George Soros who funds the destructive democrat machine in major US cities.

So you believe she is different from “the thousands of rich, attractive women” who want to live the good life? I have been following her for many years and I think I know her pretty well. She makes about $1.5M per year and has well over 200,000 shares of CAPR. She is one of 8 Board members as well as President and CEO. I can readily see her handing one of those titles to someone else or at least hiring a lot more help to run the bigger ship. Even Larry Ellison decided that his 450 foot yacht, Musashi, was too big for him so he got one a third smaller. And he still has a crew of 23 to operate the smaller ship.

Some would argue that Trump ran for president to avoid prison, that he has earned far more money in the past 6 months than he ever could have made elsewhere and that he has been a wuss regarding Putin and backed off of excessive tariffs with China.

Having followed Marban for many years, I think I know her a bit better than most shareholders. Trust me, she is ready to work less hard than she has been this year.

No question that Linda will hire enough expert managers to handle rollout of deramiocel and mundane aspects. But she wants to be captain of the ship, expanding the exosome platform. You may not appreciate the joy of scientific discovery which she has experienced and hopes to carry to fruition. I doubt she is like other superficial rich bimbos.

On 9/11/08, I met Suzanne Somers and her husband at a book event. She had money from her bimbo days on Three’s Company. But she went through a wicked menopause and got involved in anti-aging medicine with bioidentical hormones. She was a regular at scientific anti-aging meetings, meeting real doctors (unlike most docs who are frustrated navigating the fraudulent insurance socialized medicine game) and taking cutting edge treatments to improve her life quality. She was 62 when I met her, and saw her up close. Fabulous face and body. She had a meaningful life, especially the 2nd half, full of substance vs the bimbo 1st half.

Having 200,000 shares, that is a tiny 0.4 % of the 50 million shares in the whole company. So she is highly motivated to grow the shares from $11 a hundred fold to $1100. There are probably some ST posters with that many shares.

Thanks Chris for this great discussion. Larry, this is for you, too.

I believe CAPR is the more advanced company for sooner payoffs than NGENF. But let’s assume NGENF gets lucky with accelerated approval. That would be great for investors and maybe for patients. Too bad that 291 is still work in progress. The chronic SCI trial was a good milestone success in proving that 291 works in humans. But for the sake of best results for patients, more trials for SCI are needed. Leslie Fuller in the latest Blink of an Eye interview posted by Chris on the previous board, said that she expects 291 to continue to produce more benefits for her. (Aside, I started playing violin at age 10. People said I was good for an amateur, but they were pessimistic that I would improve to a pro level. I kept practicing and thinking about how I could continue to improve. Now at age 72, I have more beautiful sound with better technique in some ways than several pros I know. Never give up if you love what you do.) Doses and duration of therapy will be tweaked. I would be unhappy if the rigid FDA insisted on phase 3 double blind placebo controlled studies for all indications. At that rate, NGENF will never get approvals for anything, and investors and patients will lose. I favor small quick studies with lots of tweaks to get more info. Now they are doing the subacute SCI trial. Let them tweak the protocol, because more data on the subacute could be used for the chronic to get more info for both. They should enroll faster to avoid the delays last time because many people couldn’t tolerate the painful electrical tests and there were too many exclusionary criteria. Who cares about the academic approach of correlating electrical measurements with clinical findings? It is all interesting, but time and money are limited. Let them do the clinical work rapidly to get more results quickly. Maybe this first human trial is good enough to get accelerated approval. Then the company can get much more money from sales, enabling more extensive trials with more patients. Make the patients sign waivers to get rid of rapacious lawyers who sue because outcomes are not as good as hoped for. Thankfully and hopefully, the new FDA wants to quickly approve drugs for companies like CAPR and NGENF whose patients have no hope otherwise, so phase 2 studies lacking placebo controls can be accepted.

CAPR has deramiocel which is ready to go and bring in big money. Chris, why do you think Linda is not the most qualified to pull this off? She has a PhD in cardiac physiology and is no scientific slouch, unlike Dr. Ruth Westheimer who had a PhD in English, escaped the Nazis and became the most popular pop psychologist and sex therapist of the 80’s. Linda looks like she gets things done. All 15K DMD patients will want deramiocel. Will the San Diego plant be able to handle all that, and how long will it take to expand production? But some ST poster today said that there are lawsuits against the company. What the fuck with this FUD?

Larry, I have much more invested in CAPR than NGENF. I may buy more CAPR in the next few weeks if shorts give opportunities from FUD. I can’t see how NGENF gets approval before CAPR. After CAPR approval, I will hold and hold. After that, I will buy more NGENF during quiet periods. Both are great long term buys and holds.

JGMD thanks. That was helpful

CAPR–on ST, poster jerzypawlik said that the Law firm, Bronstein, Gewirtz, Grossman is investigating CAPR on behalf of disgruntled shareholders who got burned after the article in STAT from Adam Feuerstein. The claim by Adam F is that the Adcom was cancelled because approval is uncertain. Talk about basing a lawsuit on fraudulent claims from A Fudshit, the mark of disreputable law firms. The evidence is more suggestive that the Adcom was cancelled because approval is MORE likely considering the tight relationship between the company and FDA on strategy for getting approval. MM has said for a long time these lawsuits are immaterial because the insurance company settles these usually frivolous suits. A good lawyer gathers evidence from reliable sources, not from A Fudshitters.

This is just desperate FUD from bears at the last moment who are about to be burned on approval of the drug. I have learned to take advantage of FUD from shorts to allow me to buy more shares at lower prices.

Chris, another NGENF problem is that for things like ischemic stroke, many patients have minor, ministrokes and make decent recoveries, so this isn’t a desperate situation like SCI for NGENF and DMD for CAPR where those patients are hopeless. Still, there are lots of stroke patients who are severely disabled and they face decades of useless chronic care. I also am not sure if the 291 or the upcoming 300 peptides will help these other neurological conditions. Jerry Silver thought that the mechanical SCI injuries would be helped by 291, and he was right. The other conditions have different mechanisms–ischemic, metabolic, genetic, degenerative–so it is speculative whether 291 0r 300 will help. It IS encouraging that animal models of these conditions were helped by 291.

I watched a presentation yesterday by NGENF that was from a couple months ago. The presenter (CEO I believe) was saying there was significant display of hand movement in several within the trial and inconclusive results in foot movement. He went on to suggest that it could be possible to get approval for the use for hands only while continuing research for feet. I found that to be pretty interesting and that the company was looking at ways to move forward in the approval process.

ps this was my interpretation based on a YouTube video I watched yesterday. There are several and I watched a few that had the most recent dates (2-4 months ago) but I think I have the jest of it.

As Ron White once said, “I had the right to remain silent, but not the ability”.

Interesting. Sure, approval for hands only would be fabulous. The company needs money for more trials, so approval for anything would greatly help. That’s why I wrote that trials need to be done more quickly so approvals can come sooner. Scientific rigor may be slightly sacrificed, but real life science comes from more experience with the drug so more data can be generated. As patients gain access, the hand improvements will be seen, and with time and more protocol improvements, leg benefits may occur. Then the company will have more data and get approvals for the whole body. For the two big beneficiaries so far, Larry Williams and Leslie Fuller in the latest Blink of an Eye podcasts, they both had major improvements in walking speed and hand function.

I own small amounts of NGENF and CAPR. In your opinion, if you had $10,000 would you put it in one over the other, equal split between the two? I’ve read and reread your and JGMD’s thoughts along with anything else I could view and read. I’m torn. Ideas?

Madeline Hart appears to have defense ideas that conflict with Pete Hegseth’s.

Question for all: Why do we say this is the 249th birthday for the US when we still had to win the Revolutionary War in 1783 and didn’t establish the Constitution until 1787, ratified it in 1788, and the first Congress and president didn’t take office until 1789?

Continental Congress sighned declaration of independence in 1776.

After Thomas Jefferson spent 17 days in June 1776 drafting the Declaration of Independence with advice from others, it was accepted on July 2 and not signed until August 2nd.

https://www.archives.gov/founding-docs/timeline

SILVER PETITION!?

Having requested a couple of times the addition of charts, fractals, and commentary to no avail I now ask subscribers to join this petition in support by replying AGREE.

At $37 following years of consolidation silver appears poised for explosive price appreciation.

Finally CEF with 1.2 million oz of gold an 52.8 million oz of silver exceeds the stated $30 price target and needs target revision and commentary. (68% gold and 32% market cap gold and silver, respectively currently: this mix likely to dramatically shift as silver outperforms IMO).

Tariton – how do you revommend investing in silver, etf, miners, other?

CEF, PHYS, PSLV, AEM, AGI, ODV, MAG, RUPRF, NGD, WDOFF

Totally agree. Silver is way out of sync with the gold silver ratio.

AGREE needs commentary by MM.

MM, please see comment from subscriber Brent on last report regarding INO. You were not expecting a raise until February of 2026 and he’s saying there are more coming. What are your thoughts?

It was a necessary evil. INO’s cash position reached a low enough point in 2024 that they are now in a position of having to raise capital roughly equivalent to their cash burn rate going forward until INO-3107 sales are sufficient for INO to be cash flow breakeven. In 2024 they did a capital raise in Q2 and again in Q4 and it was obvious they were going to need to raise capital again in 2025. After they announced their Q4 raise in early December I wrote in part in the 12/12/24 report comments:

“Everyone can make their own assumptions as to how much of a cash cushion INO would want in 2026-Q1 when they get FDA approval and the timing and number of capital raises(s) to get there.My guess is there will be two. I’m guessing they’ll do another one in Q2 about the time their cash/investment balance drops to $50M. I think they will do a second in Q4 to create a cash cushion going into FDA approval. They did two raises in 2024, two quarters apart, so that also continues that pattern. I think they’ll want a minimum of a $50M cash balance in 2026-Q1. Given that, they will need to raise an additional $60M in 2025. That’s a whole lot of additional near-term dilution!”

This week’s capital raise is roughly equal to one quarter’s cash burn extending their cash to roughly early 2026-Q2 but at that point their cash position would be $0, which of course they won’t allow to happen. I don’t think they want their cash position much lower than $50 million. The lower the cash levels the worse the terms they’ll get when they need to do a raise.

The INO-3107 BLA submission continues to push out and is now a rolling submission that is likely to be final in Q4, maybe close to year-end, putting approval around mid-2026. So even with this week’s capital raise INO won’t have the cash to reach the BLA approval date. Given that, INO is going to need one or two additional capital raises after this one. I continue to think they’ll be another one in late Q4 or early Q1 of 2026 and then they may need to do a final one prior to BLA approval to get their cash position high enough to sufficiently fund a product launch.

Raising capital when your stock price is a buck and change is brutal financially.

without a doubt,one of the worst subscriptions I have ever been a part of–reminds me of the Federal Reserve report after its monthly meeting—make a few crossouts and changes and done–No changes to the top five and long term holdings repeatably is ludicrous-seems like doing less and less each week is the path MM follows

I’m here mostly to note MM’s market commentary and subscriber comments. Having been a long term subscriber, MM appears to never or rarely issue a SELL except when there’s a big win. Some recs just seem to disappear, never get discussed anymore, but I don’t trace his recs over time.

I also subscribe to other investment services, and try to limit my gambling!! 😉

Eric Jackson explains quantum computing. I bought D Wave (qbts) 6 months ago. Up 200%. BTQ Tech (btqqf) up more than 100%.

He has more stocks that have big potential. Hoping for a pull back to buy.

https://www.youtube.com/watch?v=bY-sdiRaHRs

Eric and Charles Paine are great, I doubled on BTQ and olan to buy IREN and CIFR

Gary, are you buying IREN, CIFR or more BTQ? These are low MC explosive growth stocks so “waiting for a pull back” could result in misding out,

I am buying more. Just looking for a good entry point.

Gary which one are you buying?

BTQ, IREN and CIFR

I bought IREN today. BTW I follow Eric Jackson on X

Take a look at UPXI – they are buying Solana like Microstrategy bought BTC, $4 per share and Cantor gives it $16 PT

Keep in mind that price targets are often inflated by brokerages that want investment banking business from companies that need money. That’s pumping at its worst. Also, any of our bio stocks could have one target on approval and another target after several years of launch. You have to understand the business to know the possible later targets. Don’t have blind trust in pumpers here or on the radio. That includes me. For example, AKBA spiked to $2.50 upon approval in March 2024, but eroded to $1 almost a year later. This was because nearly everyone was disappointed that they delayed launch for 9 months. But those who understood the incentives of TDAPA knew that those 9 months created great buying opportunities. My conservative target for 2025 is $10, and possibly much higher later as we see if Vafseo captures most of the DD market and whether V is approved for NDD anemia. A better example is CAPR where the target on approval very soon is about 1.5 to 3X $10 now, or $15-30, but perhaps $1000 in 5 or more years hoping that nearly all 15K DMD patients get deramiocel, and the exosome platform takes off for many other diseases.

MM Can you comment on the Royal Gold buy out of Sandstorm.

Thanks

Royal Gold (RGLD) is acquiring Sandstorm (SAND) in an all-stock deal. The deal was at a 20% premium, but as usual, the Street knocked down the acquirer, so SAND is only up 6.5%. After the deal closes, SAND shareholders will own 23% of RGLD, which is a good place to be. I’ll move SAND to a hold for the merger.

Thanks MM Hope all is well!

I own some in the money SAND Jan 2026 calls, what happens to those?

I think you had best exercise them as I am doing with my itm ENVX calls.

MM – is there a readon why you only responded to the SAND question and not the many others? I asked about new target (since its over current target) and near term projection for RKLB last week. Is it a new lolicy of yours to not actively reply to questions?

Chris & JGMD & anyone else – is ACHV worth hokding onto, Ive lost since I bought, what near term catalyst coukd drive the price or is this another long term incubator stock? Appreciate all feedback

Im reading ACHV will launch on their own rather than partner or sellout, so no payoff early and seems to me it will significantly delay financial results thus any stock price movement, not to mention likely need for a cap raise – so is this worth holding near term?

Follow me on Stocktwits, viber7. Someone thought that ACHV is making a blunder in using a digital marketing firm, Omnicom instead of a full sales team from a Big Pharma partner. This is what caused the fall in the stock from $2.20’s to $2.00. I said, no, this is the right, cost-effective strategy. This isn’t rocket science like the sophisticated HIF concept of Vafseo, or the bioengineered cardiospheres from CAPR, or the innovative peptide NGENF 291. ACHV/Omnicom just have to do the social media work to reach smokers directly. ACHV raised $41 million with this offering. They determined that this was enough to get them through approval and launch. HOLD for several years for a target of $20, or much higher, $92 or $175 with different assumptions as suggested by ItalianGrasshopper14 on ST. Don’t try to be a clever trader and sell now and think you can get back later cheaper. $2 is cheap enough. If it goes down to $1.50 buy more and accumulate for the long term.

Chris? Anyone here who does marketing in today’s world?

JGMD – thx for the usual detailed reply, much apprecisted. So when do they launch it? Im in the vonsumer packaged goods business so I know it takes 6 mos to a year to fill the retail pipeline (assuming this will be a retail non prescription product?).

ACHV’s drug will be approved in Q2 of 2026. You know better than I about when launch can start. Correct me if I’m wrong, but I think launch can start immediately in a few select centers. More centers can be on board as the pill factory produces more. I like how CAPR got its manufacturing plant inspected over 2 months before the expected PDUFA approval date and is very close to resolving the minor deficiencies noted. (That should tell you that deramiocel WILL be approved. No doubt. I hope you already started a CAPR position and can scoop up more if short FUD gives us a gift.) It would be dumb for ACHV to get approval and then say, gee whiz, I think I’ll order toilet paper for the bathrooms in the plant, and duh, I’ll think about where I want the plant and wait until the Trump tariffs resolve. Also, CAPR has its plant in the US. Foreign plants may save costs, but now we see the risks in foreign plants. Would you like a plant in the Middle East where Iran can bomb it or block shipping thru Hormuz? Fuck the CCP. Apple should locate elsewhere. The higher cost of production can be subsidized by the US govt which would save big money on defense if everyone except traitors stands on principle and starves the CCP, Russia, etc. I fully agree with Trump’s latest order to slap a 10% further increase in tariffs for any country that does business with BRICS nations.

Also, what do you think of AI and digital marketing vs old line Big Pharma marketing with their exorbitant sales rep and manager salaries?

Both strategies are important. Marketing has 2 strategies: the PUSH represented by direct selling (and incentives) to physicians so they prescribe it, and the PULL which is marketing directly to consumers (digital) so they are asking and looking for it.

You say the drug wont be approved until 2026, I thought the PDUFA was 8/30 this year? Thats when it will be approved so they can launch immediately on approval

For CAPR, PDUFA is 8/31/25, although the late cycle FDA meeting is July 17-21 and approval could happen by the end of July if there are no further questions raised by the FDA. Be on the lookout for shorts + FUD next week creating cheaper prices. For ACHV, estimated approval is Q2 of 2026, which could be as late as June 30, 2026.

I don’t know whether the digital marketing by Omnicom for ACHV will be in PUSH and PULL or just PULL alone. So my question is, these days is AI/digital marketing more effective than the old fashioned network of regional sales managers and their reps swamping physician offices? This was like stockbrokers doing cold calling. After a while those sales reps and managers knew I wasn’t a good customer to prescribe routine drugs, since I regard most drugs as a last resort after nutritional work is done and the patient ignores that. 99% of MD’s jump right into drugs for everything, so they are good customers for Pharma.

Aside from my non drug style, I hated bothering with authorization procedures for new, more expensive drugs than established formulary drugs. Arguing with stupid medical directors is a great way to shorten my lifespan. Long ago, selective COX 2 inhibitors like celebrex needed authorization. The MD I argued with said that motrin which has higher GI side effects must be tried first. I thought to myself that he is basically a murderer of patients.

It will be by prescription only. I know so many older tobacco addicts who would love to try something new to help them quit. I was surprised by ACHV’s choice to do social media marketing but the more I think about it the more I like it. Going with a Big Pharma partner would mean having to get to all the doctors who have smoking patients (a huge number) and trust that those doctors will remember to Rx the drug to every smoker. Internet marketing is extremely efficient and can get to every smoker easily. Those smokers will ask their doctors to give them a script.

Thanks for your confidence in ACHV’s approach using social media. I like how they said some traditional sales reps will be used to call on docs, but this would be targeted. The stock quickly rebounded a bit in support of this new approach. Actually, not so new because Omnicom has several Big Pharma companies on board.

Pharma has a resl simple anf effective way to communicate to docs, they get incentives to write scripts, that can ge communicated relstively simpky and quickly by Pharma reps or electronically. Thats the PUSH strategy, social media is the direct to consumer marketing that is the PULL strategy. Need both to maximize awareness

Thanks. Probably incentives to write scripts is the best part of PUSH, but this is a no brainer product that can PULL the smoking public into doc’s offices to demand a script. For the doc, the most difficult part of attracting more patient visits is getting them to come to the office. Most patients come only when they are sick or have specific needs such as getting work or school papers filled out. I use this visit as a way to get the patient to understand that preventive medicine is what really saves more lives, far better than reacting to scary problems as they arise. I’d guess than PULL is more important than PUSH.

I originally had a cost basis of $4 in ACHV. About 2 years ago, I began to fear dilution from a cash raise when they were earlier in trials. But it rose to $4.50-5.00, so I didn’t sell when the potential was so great. But Chris had the guts to do the right thing in retrospect by selling and re-entering now. I have lowered my average cost to $2.93. No problem. This is worth holding for its high potential.

Enovix Declares Shareholder Warrant Dividend:

https://www.globenewswire.com/news-release/2025/07/07/3111296/0/en/Enovix-Declares-Shareholder-Warrant-Dividend.html

Guess I’d better exercise some itm ENVX calls to get these ENVXW Oct 1 ’26 8.75 options

Chris & JGMD – you both tout CAPR & NGENF, what about AKBA, is that no longer one of your top holds now?

I love all 3, but CAPR and NGENF are both unique situations where there is no other treatment for those serious, tragic conditions. No competition. CAPR will get about 40% royalty on its deramiocel at $1 million per patient, or $400K per patient. NGENF will also get big money for its unique treatment without peer. AKBA is fighting to prove that the oral drug Vafseo is superior to the 30 year established gold standard treatment with injectable ESA drugs. The main risk for AKBA is if they merely get 10% of all the dialysis patients on V, the stock returns will be only be good, not great. If V becomes the standard of care for dialysis and nondialysis CKD and gets over 70% of the market, then AKBA will skyrocket.

Remember that TGTX has THE best CD20 drug for MS. After several years, it seems to be in a plateau mainly because of competition from well established Ocrevus from Roche which is still the leader. My average cost is $6. Now at $36, that’s 6X. When I bought at $5 and then $7, the mood was unknown and fear, respectively. That’s why you must buy when these stocks are out of favor, not when you are wondering what the next catalyst is.

I now have a double in AKBA and have a large position, so I am looking for other situations nearer the bottom. Many AKBA ultrabulls will buy more at $6 on a great Q2 ER soon, but I won’t. I believe ACHV will be a laggard for me vs CAPR. AKBA and NGENF, but I want some diversification since I could be wrong on everything.

Anybody have any idea why EDIT is popping today?

R I P

https://bondoro.com/arch-therapeutics/

This is a prime example of the risks in small companies with even superior products. The wound industry is quite comfortable with existing products even if they are inferior to those of ARTH. This is why CAPR and NGENF are far superior investments–their unique products have a captive audience where there is NO COMPETITION. AKBA has the unique TDAPA scheme to dramatically boost V sales, but it remains a challenge to see if V displaces ESA standard of care. V is a superior oral drug, but ESA’s are well established. I already have more than 2X in AKBA, and expect to see at least $10 or 5-6X. More than that, I’m not so sure. TGTX has been a 6X winner for me. Briumvi is the best CD20 drug for MS, but there is still lots of competition from the inferior Ocrevus which is still the market leader by far. I’m debating whether to sell or to be greedy for more gains if MW’s plans for carT pay off.

But short term 2-3X in CAPR is quite likely, and much higher is very possible, depending on how fast Linda can move deramiocel production. Look at ST poster quito_yume who is one of the long term followers of CAPR. His post from July 8 was reposted early today. For US + EU + Japan, there are 23K DMD patients. With approx $1 million annual revenue per patient at 36% share for CAPR (this includes expenses), total PPS from all these patients on deramiocel would be $1213. That doesn’t include Becker’s MD, other etiologies of cardiomyopathy, the exosome platform. The most common causes of cardiomyopathy are after heart attacks, and alcoholic. There are established drugs for these cases of cardiomyopathy, but they are minimally effective. Deramiocel to the rescue? WOW just for DMD, and WOW WOW WOW for other conditions.

New World Investor for 7.10.25 is posted.