Dear New World Investor:

The headline April Consumer Price Index was +2.3%, the slowest increase since February 2021 and a tenth below both market expectations and the March number even though many of President Trump’s tariffs were in effect. Month-over-month, prices increased 0.2%. That was better than the 0.3% estimate but worse than the 0.1% monthly decline in March. As usual, the lagging Shelter category accounted for about half of the increase.

The Fed’s favorite inflation indicator, core inflation excluding food and energy, rose 2.8% year-over-year, the same as in March. It was up 0.2% month-over-month, better than the 0.3% estimate but worse than the 0.1% monthly increase in March. I don’t think this report will change the Fed’s attitude of watchful waiting to see what the impacts of tariffs are on inflation and the economy.

Those expecting a recession have varying ideas of where it would start and how it would unfold. Harris Kupperman suggested this:

I am mostly watching the weekly new claims for unemployment for a sustained rise over 250,000. That would indicate real employment weakness and a recession. Unless and until that happens, I don’t think the Fed will cut – nor should they. The monthly payroll numbers continue to be untrustworthy. The latest Business Employment Dynamics report showed a net job loss of 3,000 private jobs in the September 2024 quarter.

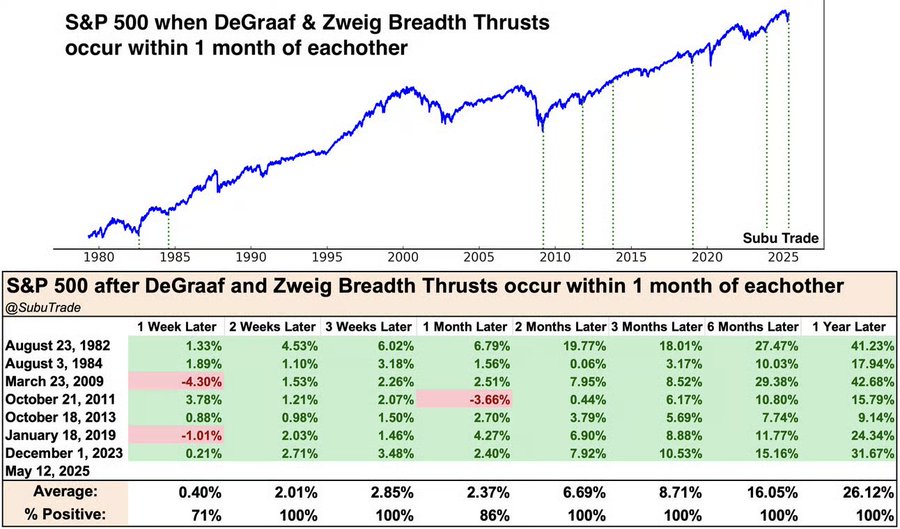

Monday saw a DeGraaf Breadth Thrust, when at least 55% of S&P 500 stocks hit a 20-day high. Three weeks ago we got a Zweig Breadth Thrust I wrote about. Here’s what happens when we get both Thrusts within a month of each other. Higher 100% of the time after two months, and an average 26.12% higher a year later.

Market Outlook

The S&P 500 added 4.5% since last Thursday after President Trump’s stunning successes in the Middle East and the expected cooling of tariff fears. The Index is now up for the year, although only by 0.6%. The Nasdaq Composite gained 6.6% but is still down 1.0% year-to-date. The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 0.6% as investors looked for more cyclical companies that would benefit from a better environment. It is down 13.9% year-to-date in one of the most dramatic underpricings of future potential I’ve ever seen. The small-cap Russell 2000 climbed 3.5% and is down 6.1% in 2025.

The fractal dimension is nearly fully consolidated. The rally that is consolidating the Tariff Tantrum decline can fully consolidate and power a new uptrend just as it approaches the last highs. Fun.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX – ScyNexis – Announce restart of the MARIO trial, maybe GSK reintroduces Brexafemme

EQT EQT –natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model increased to +2.5% this morning due to strength in both personal consumption expenditures and private domestic investment growth. The stock market is going to be surprised.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Sunday, May 18

NVDA – Nvidia – 11:00pm – CEO Jensen Huang keynote at Computex 2025, Taiwan

Monday, May 19

INO – Inovio – Through 5/22 – TIDES USA 2025: Oligonucleotide & Peptide Therapeutics

Tuesday, May 20

CMPS – Compass Pathways – 10:30am – RBC Capital Markets Global Healthcare Conference

AKBA – Akebia Therapeutics – 2:30pm – H.C. Wainwright BioConnect Investor Conference

Wednesday, May 21

QUIK – QuickLogic – Unspec. – Ladenburg Thalmann Innovation EXPO25

RDW – Redwire – 10:00am – Annual meeting

GILD – Gilead – 11:30am – RBC Capital Markets Global Healthcare Conference

Thursday, May 22

MDNAF – Medicenna – 9:00am – Annual meeting

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $211.45) is thinking of increasing iPhone prices without blaming price increase on tariffs, according to the Wall Street Journal. I doubt it. Apple introduced the 16e to give people a lower-cost way to enter the ecosystem. They are more interested in driving down costs than raising prices. AAPL is a Buy under $205.

Corning (GLW – $47.60) CEO Wendell Weeks presented at the JPMorgan Global Technology, Media, and Communications Conference (AUDIO HERE and TRANSCRIPT HERE). Wendell repeated their guidance to add more than $4 billion in annualized sales (their internal goal is $6 billion), achieve a 20% operating margin, and double earnings per share by the end of 2026.

He said that when they thought they’d have at least 100% tariffs on China, it only reduced their earnings expectations by 1¢-2¢ a share. Now it looks like the final rate will be much lower than 100%.

Wendell said: “Our upside variance to that growth rate inside the data center is driven by what the industry calls the scale-up of the network as hyperscalers create more capable nodes that move from less than 100 GPUs per node today to hundreds of GPUs per node in the future. Historically, an AI node has been within a single server rack.

“As hyperscalers scale up, AI nodes are shifting to stretch across multiple server racks. This

causes the distance to link these GPUs within the node to get longer. This will cause the links to

reach about 100 gigabits per second, what we call the electrical to optical frontier line, which

roughly marks the point where fiber connections become more techno economical than copper.

“Now to help understand the size of this upside opportunity created by crossing that frontier, a

single Blackwell-like node has more than 70 GPUs with more than 1,200 links using more than

two miles of copper. As that node scales up, those two miles will be replaced by fiber connections, and those miles will grow over time as more and more GPUs are included in the AI node.

“Additionally, as data rates rise with more capable GPUs, our upside increases further. This

opportunity alone is two to three times the size of our existing $2 billion enterprise business if we

are successful technically. We’re working with key customers and partners as we speak today on

making that future a reality.”

He mentioned that the two largest and lowest-cost fiber facilities in the entire world are both in North Carolina and they’re both owned by Corning. GLW is a Buy under $33 for a $60 target in 2025.

Gilead Sciences (GILD – $100.34) Chief Commercial Officer Johanna Mercier presented at the BofA Healthcare Conference (AUDIO HERE and TRANSCRIPT HERE). She said the sturm und drang around President Trump’s tariffs and policies towards drug companies hasn’t affected them much, in part because no one knows what the real situation will be. They have a small group that works on potential situations and how Gilead should respond. Everyone else is focused on moving drugs through trials to approval or launching and marketing approved drugs.

Trump’s “most favored nation” pricing of prescription drugs depends on knowing the real, not list, prices in other developed countries. That’s very murky. Medicaid already gets a discounted price for Gilead’s HIV drugs, and she hasn’t seen any pressure for lower prices. GILD is a Long-Term Buy under $90 for a first target of $120.

Meta Platforms (META – $643.88) said a study showed that in the US, Meta’s personalized advertising technologies were linked to nearly $550 billion in economic activity and 3.4 million jobs in 2024. It will not surprise you to learn that the study was performed by…Meta Platforms.

In 2019, Meta announced a project to create a new cryptocurrency that could be used across Facebook, WhatsApp, and many other digital platforms. They pulled the plug on their plans in the face of strong opposition from Congress and other lawmakers. Now, Meta is testing the crypto waters again. They are in discussions with crypto firms to introduce stablecoins as a means to manage payouts, and have hired a Vice President of Product with crypto experience to lead the discussions. META is a Buy under $655 for a long-term hold.

Micron (MU – $95.45) presented at the JPMorgan Global Technology, Media, and Communications Conference (AUDIO HERE and TRANSCRIPT HERE), Manish Batia, EVP: Global Operations, said they are seeing healthy demand for both DRAM and NAND and have been able to raise prices. High-bandwith DRAM (HBM) for AI applications remains under strong demand with very good pricing. Micron’s HBM3 uses 30% less power than competitors.

Their HBM3 12-High memory has been designed into Nvidia’s next generation GB300 that will be ramping in the second half of 2025. That memory will be the majority of their HBM demand in the second half, with the crossover from 8-High to 12-High happening in their August fiscal fourth quarter. Yields are improving rapidly and will reach production targets by the end of the May third quarter. They’ll sell more than $4 billion of HBM3 this year. By 2030, he thinks HBM will be a $100 billion opportunity.

Their next product, HBM4, comes out in 2026. They are negotiating supply contracts right now and will announce when they are sold out. Customers (read Nvidia) are accelerating the cadence of their new platforms from 12-18 months to 12 months. The qualification cycle is much longer for HBM than regular DRAM, which benefits the leaders. When Samsung finally gets their act together and ships a competitive product, he doesn’t think it will affect Micron’s pricing.

Micron is well into the $16 billion expansion of their Boise manufacturing operation, which obviously dovetails with President Trump’s goal of manufacturing in the USA. That is attracting some new customers looking for a US-based alternative for their supply chain. MU is a Buy under $102 for a $140 first target.

Nvidia (NVDA – $134.83) coat-tailed on President Trump’s Saudi Arabia trip to form a partnership with HUMAIN, the new full AI value chain subsidiary of the Kingdom’s Public Investment Fund, to transform the country into a global powerhouse in AI, cloud and enterprise computing, digital twins, and robotics. This will bring billions of dollars of revenue over the next few years.

Trump plans to rescind the Biden AI chip curbs as part of a broader effort to revise semiconductor trade restrictions. The repeal seeks to refashion a policy launched under President Biden that created three broad tiers of countries for regulating the export of chips from Nvidia and others. The Trump Administration will not enforce the AI diffusion rule when it takes effect on May 15, and is actively working toward a new rule that would strengthen the control of chips abroad.

Nvidia just notified Chinese clients it’s preparing a downgraded H20 chip for release in July, designed to navigate Washington’s AI export restrictions. It will have reduced memory and power but still keeps Nvidia in the fight—right where and when it matters most. NVDA is a Buy under $125 for a $180 first target.

Palantir‘s (PLTR – $128.12) new mobile battlefield intelligence-gathering vehicle and trailer for the US Army was ranked as among their top-performing programs, according to a new assessment by the service. An April report to Congress of the Army’s “Highest and Lowest Performing” programs lists Palantir’s Tactical Intelligence Targeting Access Node — or Titan — and four other weapons systems among the star performers.

Palantir’s current $178 million Army contract underscores the Defense Department’s focus on using the latest software from Silicon Valley. Palantir beat out RTX, a mainline defense contractor, for the intelligence vehicle contract. Three Titan prototypes have been delivered, with four more expected by year-end and three more expected by the end of March. An Army spokesman said they are “assessing the number” they will buy as they “exercise prototypes and evaluate where they will be needed.”

Dan Ives of Wedbush raised his target price from $120 to $140. PLTR is a Buy under $100 for a $150 target.

PayPal Holdings (PYPL – $71.57) CFO and now also COO Jamie Miller was our third presenter at the JPMorgan Global Technology, Media, and Communications Conference (AUDIO HERE). She talked broadly about how the new management team designed and is executing the turnaround.

Their business is 50% retail and 50% services. Geographically, it’s 40% US and 60% international. Generally, the macro shifts that might slow one area accelerate another area, so they are not affected. China, both directly and as the supply source for their merchants, is less than 2% of their transaction volume.

She said they expect a very strong June quarter, but they are being prudent about the second half until the macro forces settle down. Buy Now Pay Later (BNPL) is a very short duration extension of credit with a 40-day average. It gives their merchant customers a clear sales uplift and they sell a lot of BNPL loans to get them off their balance sheet. PYPL is a Buy under $68 for a double in three years.

SoftBank (SFTBY – $26.92) reported their March 2025 fiscal year revenues up 7.2% from FY204 to $49.06 billion with earnings of $5.28 a share. That was their first annual profit in four years. At today’s close, the stock is selling for a Price/Earnings ratio of only 5.1x with a market capitalization less than half of the $172 billion value of their publicly traded subsidiaries plus Vision Fund investment. Plus, you get the future appreciation of their Vision Fund investments, their OpenAI investment, and CEO Masayoshi Son’s future AI investments for free.

On the conference call (CFO’S YOUTUBE HERE and FULL WEBCAST HERE and SHORT WEBCAST HERE and SLIDES HERE and TRANSCRIPT HERE), CFO Yoshimitsu Goto said they had net investment gains of $11.4 billion compared to a loss of $3.8 billion last year. They are making a big bet on OpenAI, with the Stargate Project to develop new AI infrastructure for OpenAI. Softbank committed to making follow-on investments of up to $40.0 billion in OpenAI, but they will syndicate $10.0 billion of that to co-investors. April 15 was the first closing, with OpenAI Global receiving funding for $10.0 billion. Of this amount, $1.5 billion was syndicated to co-investors and the remaining $8.5 billion was funded by Softbank’s Vision Fund 2.

They guided for June quarter revenues of $1.0-$1.1 billion, up 6.5% to 17.1%, with pro forma earnings per share of 30¢-38¢.

SoftBank has a strong pipeline of future IPOs to drive their stock price up:

Under the $3.4 billion stock buyback program authorized in August, SoftBank purchased a cumulative total of $1.6 billion by the fiscal year-end and $1.94 billion (57% of the authorization) by the end of April. SFTBY is a Buy under $25 for a first target of $50 in the next two years.

Small Tech

QuickLogic (QUIK – $6.00) reported March quarter revenues down 23.6% from last year to $4.33 million, but that was right on the $4.30 million analysts’ estimate. Their pro forma loss of 7¢ a share was a penny better than the 8¢ loss expectation.

On the conference call (AUDIO HERE and PREPARED REMARKS HERE – highly recommended – and TRANSCRIPT HERE), CEO Brian Faith said they see solid 2025 revenue growth and positive cash flow as Intel 18A momentum builds. He added: “Last quarter, I said that we expected to be awarded the first of two eFPGA Hard IP contracts for Intel 18A designs within weeks, and the second one very shortly after that. I forecasted the combined value would be mid-seven-figures and if awarded in the expected time-frame, that the revenue would be recognized in Q2.

“The first of these contracts was awarded a few weeks after our last conference call and on April 28th we announced that we delivered design-specific eFPGA Hard IP for the customer’s Intel 18A Test Chip.”

For QuickLogic to do a Test Chip on its own would have cost millions of dollars. They contributed the eFPGA Hard IP license in return for access to the customer’s Test Chips. The Test Chips enable them to fully characterize power consumption and performance, which means prospective customers have less risk in committing to QUIK’s eFPGA Hard IP on Intel 18A silicon. These IP sales have a very high profit margin and Brian said that just having an eFPGA Hard IP Test Chip heading into fabrication this summer has given some prospective customers confidence to accelerate their engagements.

Brian continued: “The second contract is with the same customer, but for a different program. The customer has advised us that it has been awarded funding for the program, but funding for the production ASIC, which is a sub-component of the program, will not be awarded until Q4. Due to this delay, our revenue guidance for Q2 is $4 million. While disappointing, it does not change our full-year outlook for solid revenue growth, non-GAAP profitability, and positive cash flow.”

QuickLogic has invested heavily to become the first available source for eFPGA Hard IP for the Intel 18A process, and I expect this to lead to many contracts over the next few years. QUIK was one of only four companies to present at the Intel Foundry Ecosystem Spotlight – the other three were Cadence, eMemory and Synopsys.

In addition to the June quarter revenue guidance for $4 million (±10%, as usual), CFO Elias Nader guided for a pro forma loss of 7¢ to 8¢ a share. QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

Redwire (RDW – $12.93) reported March quarter revenues down 30.1% from last year to $61.4 million and had a GAAP loss of 9¢ a share. Although revenues were way short of the $74.5 million estimate, the loss was much smaller than the 38¢ loss estimate. How did that happen?

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Peter Cannito said that although bookings increased significantly compared to the December quarter, with key wins coming from the European market, there were notable delays in awards in the US government market. He attributed the delays to the transition of key decision makers in NASA, the Space Development Agency, and other agencies, as well as budget uncertainty associated with Trump Administration priorities.

In addition, they had net unfavorable economic adjustment charges (EAC) of $3.1 million, primarily due to additional unplanned labor and increased production costs related to the development of new technologies required to meet customer specifications.

Peter said they will see minimal impact from tariffs. They have a US-based supply chain for their US customer base and a Europe-based supply chain for international customers. Their current contracts have an established supply chain with materials on order. They are not seeing widespread price increases.

During the quarter they won $56.2 million in contracts and finished March with a $6.0 billion pipeline of potential contracts. They reaffirmed their 2025 revenue guidance for $535-$605 million in revenue if the acquisition of Edge Autonomy had been completed on January 1. It will close in June.

Redwire ended the quarter with $54.2 million in cash. RDW is a Buy under $18 for a $36 first target as space exploration grows.

Primary Risk: A new competitor emerges.

Rocket Lab USA (RKLB – $25.22) will launch NASA’s astrophysics science mission – the Aspera spacecraft – on Electron no earlier than the March quarter. Through the use of a telescope to study ultraviolet light, Aspera will examine hot gas in the space between galaxies, called the intergalactic medium, that is thought to contribute to the birth of stars and planets. Aspera will be the first NASA astrophysics mission to gather and map these ultraviolet light signatures, potentially unlocking a deeper understanding of the origins of stars, planets, and life in the universe.

Rocket Lab is spending heavily on Neutron R&D this year to get to first launch. I don’t think Wall Street realizes that as soon as we get first launch, Rocket Lab “flips the switch” to account for any future Neutron spending as a capitalized cost against launch revenues rather than an immediately deductible expense. There will be a sharp improvement in reported earnings, followed by breakeven free cash flow in 2026 as they begin commercial launches. RKLB is a Buy up to $13 for my $30+ target as low earth orbit satellites and space exploration grow.

Primary Risk: A new competitor emerges.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

The FDA announced the completion of their first AI-assisted scientific review pilot and an aggressive agency-wide AI rollout timeline to scale the use of AI internally across all FDA centers by June 30. FDA Commissioner Makary said: “I was blown away by the success of our first AI-assisted scientific review pilot. We need to value our scientists’ time and reduce the amount of non-productive busywork that has historically consumed much of the review process. The agency-wide deployment of these capabilities holds tremendous promise in accelerating the review time for new therapies.”

They were able to perform scientific review tasks in minutes that used to take three days. Welcome to the 21st century, FDA! Anything that speeds up the review process is good news for every biotech company.

Akebia Therapeutics (AKBA- $2.54) continues to inch up. I still think Amgen will buy them, but it’s hard for an acquiring company to pay more than a 100% premium to the current stock price. If I’m right that $10 is the minimum CEO John Butler would even look at, that means AKBA has to get to $5 a share on its own. I think that will happen this year, probably after sales to the big two dialysis providers really kick in in the September quarter. But those sales could show up in the June quarter, or another event, like an easy path forward for the non-dialysis trial, could drive the stock sooner. Buy AKBA up to $2 for the Vafseo launches in the EU, UK, and US.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Editas Medicine (EDIT – $1.40) reported March quarter results on Monday but didn’t hold a conference call, probably because they presented at the BofA Healthcare Conference on Tuesday. Revenues were up 308.8% from last year to $4.66 million compared to the consensus guess for $0.71 million. They recognized the remaining deferred revenue upon closing out a collaboration agreement with a strategic partner.

Due to $40.9 million in restructuring and impairment charges related to the discontinuation of the reni-cell program, the company lost 92¢ a share compared to the 57¢ loss estimate.

At the American Society of Gene & Cell Therapy (ASGCT) annual meeting this week, they showed in vivo preclinical data demonstrating the successful use of targeted lipid nanoparticles to deliver cargo to hematopoietic stem progenitor cells (HSPCs). They also showed in vivo preclinical proof of concept to upregulate expression of a target liver protein to meaningfully reduce a common disease-associated biomarker.

I don’t expect preclinical data to move a biotech stock, but these are both a big deal. Editas is on track to announce two in vivo gene editing development candidates via gene upregulation, one in HSCs and one in liver, in mid-2025. They will disclose one additional target cell type/tissue beyond HSCs and liver by year-end.

The US Court of Appeals affirmed-in-part and vacated-in-part the Patent Trial and Appeal Board’s (PTABs) previous decision and remanded it back to the PTAB for further review in the US patent interference involving specific patents for CRISPR/Cas9 editing in human cells between the University of California, the University of Vienna, and Emmanuelle Charpentier and the Broad Institute. Editas’ in-licensed patents covering CRISPR/Cas12a are not at issue in the interference and are unaffected by the decision.

At the BofA Conference (AUDIO HERE and TRANSCRIPT HERE), CFO Amy Parison said they are “open to all avenues” to bring in necessary capital. The company finished the quarter with $221.0 million in cash, enough to carry the into the June 2027 quarter. EDIT is a Buy under $6 for a double in 12 months and a long-term hold to much higher prices.

Primary Risk: Other companies’ gene-sequencing drugs fail in the clinic.

Clinical stage of lead product: Partnered: Approved. Owned: Going into the clinic mid-2025.

Probable time of next FDA approval: 2028

Probable time of next financing: Late 2026 or never

Inovio (INO – $1.95) reported a March quarter GAAP loss of $19.7 million or 51¢ per share, much better than the 74¢ loss estimate. It also was much better than last year’s $30.5 million or $1.31 a share. R&D expenses fell to $16.1 million from $20.9 million last year due to limiting most of their focus to getting INO-3107 over the finish line. Even better, General & Administrative expenses decreased to $9.0 million from $10.6 million last year thanks to their cost-saving cutbacks.

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Jacqueline Shea said they have started device design verification testing, which is required for the BioLogics Licensing Application (BLA) for INO-3107. That keeps them on track to submit the BLA as a rolling submission in mid-2025, complete the submission by the end of the year, and request priority review. INO-307 already has Breakthrough Therapy designation.

I expect INO307 to be approved in mid-2026 and have immediate success because doctors are waiting for it.

They finished the quarter with $68.4 million in cash, which Jackie says will carry them past the BLA filing into the March 2026 quarter. INO is a Buy under $14 for a very long-term hold.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: Early 2026

Probable time of next financing:After FDA approval in 2026

ScyNexis (SCYX – $0.98) reported a March quarter loss of $5.4 million or 11¢ a share. That benefited from a $2.9 million paper gain on the fair value adjustment for warrant liabilities, so the real loss was $8.3 million or 15.5¢ a share.

The Good News: The FDA lifted the clinical hold on ibrexafungerp in late April, so the Phase 3 MARIO trial can resume.

The Bad News: GSK notified ScyNexis of their intention to immediately terminate the trial.

This is weird. MARIO is a step-down trial for invasive candidiasis to show that hospitalized patients treated with IV echinocandin can then be treated with oral ibrexafungerp or, for comparison, oral fluconazole. I expect ibrexafungerp to be statistically superior to fluconazole, and I thought this was one of the main reasons GSK wanted ibrexafungerp.

ScyNexis wrote: “ScyNexis does not believe that GSK currently has the right to unilaterally terminate the MARIO study under the license agreement with GSK (GSK License Agreement) and is seeking to resolve this disagreement.”

That is my read, too. It’s a ScyNexis trial and they simply turn the results over to GSK. Surely GSK isn’t doing this just to save a few million in milestone payments, so they must have decided not to pursue the hospital indication even if the trial succeeds. I have no idea why they would do that.

ScyNexis added: “Meanwhile, ScyNexis is resuming the MARIO study with the goal of having subjects enrolled in the coming weeks. While at this time it is too early to say how this disagreement regarding the MARIO study may be resolved, GSK has reiterated its commitment to continued collaboration regarding other aspects of the GSK License Agreement, including with respect to the commercialization of Brexafemme for the VVC and rVVC indications.”

I still think a marketing powerhouse like GSK can make Brexafemme a big success because there are so many women who either don’t respond to fluconazole at all or are sick and tired of having to treat yeast infections over and over. Brexafemme kills them, fluconazole doesn’t. But I’d like to see GSK actually reintroduce Brexa instead of having ScyNexis tell me that they plan to do it.

ScyNexis ended the quarter with $53.8 million in cash, enough to carry them into the September 2026 quarter. Buy SCYX under $2.50 for a first target price of $20 after ibrexafungerp is approved for hospital use and a buyout at $50.

Primary Risk: Ibrexafungerp fails to sell.

Clinical stage of lead product: Approved

Probable time of next FDA approval: 2025

Probable time of next financing: Never

Inflation MegaShift

Gold ($3,243.90) bounced off the $3,200 level as the dollar strengthened a bit and sellers decided they didn’t need a safe haven anymore.

The fractal dimension shows this drop as the necessary consolidation of the last $1,000 upturn. Let it play out.

Miners & Related

Sprott Inc. (SII – $55.54) said the Sprott Physical Uranium Trust completed a $25.55 million non-brokered private placement of trust units. The Trust is the world’s largest physical uranium fund with 66.2 million pounds of physical uranium in U3O8 form and now $31.4 million of net cash to buy more. Buy SII under $40 for a $70 target price.

Primary Risk: Prices of precious metals fall due to US dollar strength.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $102,852.98) is solidly bid over $100,000. My target is still $150,000 by yearend.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $58.67) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $19.16) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $61.77

In the afterglow of President Trumps triumphant trip to the Middle East, traders are worried that a deal with Iran could flood the market with oil. They have to be kidding. Iran is already producing 3.3-3.4 million barrels a day and selling all they want to.

Click for larger graphic h/t @HFI_Research

The July 2026 Crude Oil Futures (CLN26.NYM – no trades – June closed at $60.31) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $33.88) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $6.78) is going to take advantage of high European natural gas prices.

VET is a buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

Energy Fuels (UUUU – $4.46) will benefit from a soon-to-be-announced executive action from the Trump Administration to try to speed nuclear reactors’ deployment. The orders could seek to leverage the Departments of Defense and Energy to avoid any licensing delays from the Nuclear Regulatory Commission. Both Departments have the authority to regulate reactor development and might partner to break the Nuclear Regulatory Commission’s stranglehold on progress. UUUU is a buy under $8 for a $30 target.

Primary Risk: Uranium prices fall.

* * * * *

Russian Philharmonic tango?

* * * * *

Your looking at next level pond design Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 5/15/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $211.45) – Buy under $205

Corning (GLW – $47.60) – Buy under $33, target price $60

Gilead Sciences (GILD – $100.34) – Buy under $90, first target price $120

Meta (META – $643.88) – Buy under $655 for a long-term hold

Micron Technology (MU – $95.45) – Buy under $102, first target price $140

Nvidia (NVDA – $134.83) – Buy under $125, first target price $180

Onsemi (ON – $44.52) – Buy under $60, first target price $100

Palantir (PLTR – $128.12) – Buy under $100, target price $150

PayPal (PYPL – $71.57) – Buy under $68, target price $136

Snap (SNAP – $8.58) – Buy under $11, target price $17+

SoftBank (SFTBY – $26.92) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $7.79) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $71.02) – Buy under $70; 3- to 5-year hold

Fastly (FSLY – $8.04) – Buy under $10 for a 3- to 5-year hold to $50+

PagerDuty (PD – $16.78) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $6.00) – Buy under $10, target price $40

Redwire (RDW – $12.93) – Buy under $18, first target price $36

Rocket Lab (RKLB – $25.22) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $30.47) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $2.02) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $2.54) – Buy under $2, target $20

Compass Pathways (CMPS – $3.95) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $1.40) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.95) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.75) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $0.98) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($32.74) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $39.20) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $44.30) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $28.54) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $39.58) – Buy under $30, target price $50

Coeur Mining (CDE – $7.41) – Buy under $5, target price $20

Dakota Gold (DC – $2.79) – Buy under $2.50, target price $6

First Majestic Mining (AG – $5.66) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.45) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $8.15) – Buy under $10, target price $25

Sprott Inc. (SII – $55.54) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $102,852.98) – Buy

iShares Bitcoin Trust (IBIT – $58.67) – Buy

Ethereum (ETH-USD – $2,540.28)– Buy

iShares Ethereum Trust (ETHA- $19.16) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – no trades – June closed at $60.31) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $33.88) – Buy under $40; $100+ target

Vermilion Energy (VET – $6.78) – Buy under $11; $24 target

Energy Fuels (UUUU – $4.46) – Buy under $8; $30 target

EQT (EQT – $56.00) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $38.47) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

TG Therapeutics (TGTX – $33.59) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

MM can you check out Quantum computing. I own D wave (QBTS). It is up 100% in six months.

D wave up over 50% in 5 days.

My repost from the last board.

“Who will fund MARIO–GSK or SCYX? GSK withdrew Daprodustat (another HIF drug like Vafseo) from the US, due to legal risks over cardiac complications. For Brexa, GSK assessed that it will be mediocre for invasive fungal infections just as it is for VVC. I was not impressed by early studies of Brexa for invasive fungal infections. SCYX is a DOG company with a mediocre product whose royalties are breadcrumbs. SCY 247 may be better, but it is in early phase 1-2 studies. SCYX is like a premature fetus that won’t survive without heroic life support. SCYX is entitled to sue GSK for getting out of the license agreement, but they have no money for legal bills. The latest earnings suck. So much for all the cheerleaders that claimed it was undervalued from just the royalties. Let’s see if MM removes SCYX from his top 5 list.” (correction, 20X biotech list)

Oh, I see that MM is still a believer in SCYX. Most NWI subscribers are sick of their near 100% losses in SCYX. Now below $1, it will plunge further from a reverse split and GSK abandonment. There are much better places for your money than SCYX. Now 72 years old, I have no tolerance for big losers. They will shorten your lifespan. AKBA, CAPR, NGENF are in a different universe and will rescue you from past NWI disasters.

Fyi,arth did file for bankruptcy guessing scyx will have to follow that path unless their is a savior

JGMD, I always appreciate your perspective on the different stocks that are recommended. What’s your thoughts on Medicina (MDNAF)? Have you looked at their recent data release for MDNA11 in combination with Keytruda?

CYDY just released results this week for their drug Leronlimab. It was shown to be effective in 88 pct. of Metastic Breast Cancer patients when used with a PD -1 blocker such as Keytruda. The women were still alive after 4 years Huge announcement from European Oncology Conference this week.

SCYX- Agreed, most definitely a sell. A form of arrogance for MM to keep it on the buy list. GSK cuts the cord and he does not understand why? The only thing that matters is that they did and it is the only thing we need to know to bail out of this wreck.

MM – its time for some honest assesment. Youre main reason for SCYX seems to be failing. if GSK is no longer supporting the MARIO trial, whats the compelling case to hold SCYX? Is it not prudent to move my SCYX loss into AKBA or another more promissing investment? I dont wish to hold another year in some remote chance SCYX somehow completes MARIO and is approved for hospital use if I can cut bait now?

Steve, you manage your own portfolio. You can move some money from SCYX elsewhere, and keep a smaller amount. MM will not make any suggestions about managing your portfolio, nor will he give up on any of his many many recs.

You wrote…“ Thursday after President Trump’s stunning successes in the Middle East” Are You Kidding Me? ???

So whats not stunning?? Trillions of dollars of new investment coming to the US, what dont you understand? This constant Trump hate for no reason is getting old. I suppose closing the border to near zero illegal crossings in his first month from Biden allowing over 10 milion cross illegally and saying he needed more money and congressional vote to stop is not stunning either?? Cmon man stop with the uninformed bias opinions against Trump. Its like wishing bad to the pilot flying your plane

Maybe its like complaining about the drunken bus driver going 65 in a 25 zone! 😉

Most of what Tramp’s doing at the moment in the Middle East is a real plus, but you don’t mention the dangers of trusting a terrorist who now controls Syria. Its like gambling in one of Trump’s bankrupt casinos. Giving weapons to certain Middle East nations might work well to get them to be aligned with us for the near term. But those weapons can be used against us and our allies in the future. We hesitated previously since they had been enemies of Israel. Egypt, Syria, Jordan, Iraq and Lebanon attacked Israel. Most Arab countries around Israel are hostile, and there’s ongoing hostilities that won’t get better with ongoing bombing and relocation of Palestinians. Giving weapons to both sides might be lucrative to US companies but we might regret their use in the future.

We know Trump doesn’t read, but I have to wonder if Trump has ever bothered to have anyone summarize for him the 28 redacted pages of the 9/11 report that showed high-level Saudi involvement in the attack. “Trump’s stunning successes in the Middle East” reminded me of the first words out of Laura Ingram’s mouth last night: “Disgraced FBI Director James Comey …”. Almost all news sources have biases which ignore news unfavorable to those biases and slant favorably stories which favor their biases, but for anyone who wants an extremely unbiased news source, I recommend

http://ground.news

Chris, have you ever heard the saying “hold your friends close but your enemies closer”? Look it up if you dont get the meaning. Whats the option, position the US as enemy number one versus China, Russia, and the entire Middle East – how long donyiu think we can be safe and independent with that strategy? We dropped two A bombs on Japan – alls fair in war and noones safe, so the alternative is to find some level of live and let live in the world or we all parish with the threat of nuclear. Trumps speech in Sudan was right on, the past strategy of the US forcing our beliefs on rest of tge world has only caused hate, death and war – time to try another way

21 hours ago — NervGen has received Fast Track designation from the FDA for the advancement of NVG-291 in individuals with spinal cord injury.

NGENF up 47 cents to $3.33 right now.

Many thanks to Chris for this rec!

For clarity, NervGen received Fast Track designation in October of 2023. I think the big moves over the last two days are attributable to the proximity of data from the Phase 2a trial (less than 3 weeks), yesterday morning’s operational update and the reiteration of the Expanded Access program that was announced March 31. That March 31 announcement should have made clear to anyone interested that NVG-291 works in humans. Although NervGen has plans for a multi-center Phase 3 trial in the US and abroad, I wouldn’t be surprised to see Trump’s FDA approve commercialization after a much smaller trial. I’m disappointed that the next indication will not be an ALS trial, but I guess the economics for that disease aren’t as compelling as for stroke. ALS drugs have been approved after even modest results from Phase 2 trials, but none of those drugs have proved effective as data from post-approval trials demonstrated.

I cant stop laughing at the thought and thanking God at the same time that Biden or Kamala had zero chance of winning the presidency for no other reason (though mamy others) that wed still be spending billions of tax payers dollars on waste and fraud, dedtroying female sports byvallowing biological males to compete against them, and sttill being invaded by illegal immigrants pouring over our borders, to include murders, rapists, child and drug traffickers. I never felt safe in the world or even walking out my front door with Biden as president (though finding out he wasnt mentally president for at lesst 2 years, who knows who was running the country).

You forgot Ukraine conflict escalatory policies, no communication of any kind with the hated Russian Federation leading straight to WW3, nuke conflict and the end of the planet. Trump may be an ignorant RE impresario but at least he talks about peace.

The ASIA (American Spinal Injury Association) schedule was posted yesterday. NervGen will present the NVG-291 trial results there June 3rd around 10:40 am (MST).

ASIA schedule updated this morning NervGen is no longer on the schedule for June 3rd.

So they arent presenting? If not whats the next catalyst date?

The American Spinal Injury Association has again revised its 21-page schedule.

On June 3 in the 10:40 to 11:40 slot (Phoenix time) Dan Mikol is again scheduled to present “A 16-week Placebo-controlled Phase 1b/2a Study of NVG-291: Results for the Chronic Cohort”

Yes, that’s super exciting! Monica is also speaking at a separate session:

Monica Perez from Shirley Ryan who ran the trial is speaking:

Latest Updates on Topics in Spinal Cord Injury and Rehabilitation (TSCIR) Monica Perez, PT, PhD Kathy Zebracki, PhD, FASIA

Anyone – what are the CAPR catalyst dates for ADCOM and/or P3 results?

CAPR or NGENF which one buy first?

NGENF in my opinion. I was an original investor in NervGen dating back to March 2019 prior to them going public. I have added to my position consistently since and even bought a few more shares this morning. We are only a few weeks away from the data readout of the first human trials. Strong likely hood the data read out will be positive (use caution as anything can happen). I also love CAPR but the timeline near term is better for NervGen because we KNOW data will be released early June.

NGENF and CAPR are both exciting at the moment. NGENF is approaching $4 but it has doubled recently. There will be pressure to take profits on a move to $10. There will be lots of money needed to fund future trials for many neurological conditions.

I took the opportunity to buy some CAPR last week at $7.60 when I realized that fear of the Adcom was wrong. After likely FDA approval 8/31/25, it could run to $25 or much more. In addition to the great prospects for muscular dystrophy, the future of its exosome technology for drug delivery is staggering. I am hoping for a pullback to $8-9 to buy more. If the Adcom is questionable, due to capricious experts called in by the FDA, CEO Linda Marban will release phase 3 safety studies. There may be a brief buying opportunity from $5 before the rocket takes off. I don’t know how long that could take.

Buy both.

NervGen is back on for Tuesday June 3rd at ASIA:

GENERAL SESSION 6: Clinical Trial Updates: Clinical Trials: What’s the Latest and When Will it Get Here? 10:40 AM – 11:40 AM (MST) / Moderator: Isa McClure, PT, MAPT Co-Moderator: James Hamer

A 16-week Placebo-controlled Phase 1b/2a Study of NVG-291: Results for the Chronic Cohort – Daniel D. Mikol, MD, PhD

Also Monica Perez from Shirley Ryan who ran the trial is also speaking at a different session:

Latest Updates on Topics in Spinal Cord Injury and Rehabilitation (TSCIR) Monica Perez, PT, PhD Kathy Zebracki, PhD, FASIA

https://asia-spinalinjury.org/wp-content/uploads/2025/01/2025-Scientific-Meeting-Program-05.07.25.pdf

Does somebody know something? The stock is soaring

BSMD, I assume you are invested in NGENF. It looks like a positive outcome for June 3. Suppose the stock vaults to $10+. Will you take profits and re-enter when the reality of funding future trials hits?

Chris, same question. You will probably have a giant absolute gain from your large position, so you might be tempted to take some profits.

I just sold my small position in URGN after a narrow negative Adcom vote on their drug candidate. The best outcome would be on FDA PDUFA June 13 when conditional approval may come, but with the requirement for a phase 4 trial. This would cause financial stress in a company still losing money on its approved drug. URGN is analogous to SCYX.

Adcoms and FDA approvals are mostly founded on pseudoscience that the only road to truth is the double blind placebo controlled trial. Some drugs have been approved from only single arm trials where there is a compelling need. This is the main risk for CAPR, but it is unethical to do a placebo arm in a trial for Duchenne muscular dystrophy. The natural history of untreated DMD is so bad–these young men die of heart failure in their 20’s. A modest number of treated patients with their drug candidate have excellent results shown by heart MRI measurements, superior to untreated DMD patients from historical data. This is why CAPR’s data will be accepted by the Adcom and FDA, because there are no existing treatments.

Here’s my criticism of the doctrine of the double blind placebo controlled trial. Suppose you do a study of car tires to see whether a new material is better for road handling, etc. You assume that the rest of the car is the same for all cars in the study arms. But you don’t know the health of the cars’ engine, transmission, etc. You can try to match the arms by these criteria, but you cannot know all the hidden variables. A single controlled trial may or may not work. Many trials could nearly eliminate the possibility of variability, but you never know for sure.

I plan to sell some shares in an IRA and add to my CAPR holdings. I will also sell about 1/2 my shares in another Schwab account (all long-term) and none in my Interactive account. I will eventually move the shares I bought directly from NervGen into trading accounts. No rush.

Good, thanks. What do you think of the negative SA article on CAPR posted by Dash_Man on Stocktwits this AM?

JGMD, Yes I am heavily invested in NGENF. I was an original investor dating back to 2019 prior to them going public, I have participated in other funding rounds after them going public and have continued to purchase shares on the open market even as recent as this week. To answer your question which I know is probably foolish I personally won’t sell any shares @ $10, $20 I would take a few shares off the table but I am in it for the long haul. Depending on the June 3rd readout that may change my perspective.

With CAPR, I have used mostly options for my positions. I have been consistently adding to both CAPR and MDNAF and would continue to do so with any NervGen proceeds in the near term.

That’s the spirit–long haul for NGENF. On Stocktwits, this AM Dash_Man posted a FUD SA article on CAPR. Look at my (viber7) rebuttal there, and buy strategy if Adcom is negative.

What are SCYX holders doing, is it still worth holding or time to sell? MM your comments also?

Today I sold my fairly large position in SCYX at 85% loss. That’s after averaging down. Based on my original purchase, I would have been down 97%. It has no hope of avoiding a reverse split in time for an SCYX lawsuit against GSK. I called this a DOG DOG DOG for several years based on its mediocrity as a drug for VVC. They can’t get anything done in a timely manner. I can put this money towards better prospects.

MM will hang on to ZERO. Old men refuse to get rid of their egos until they are in the crosshairs of a firing squad. In general, my worst patients are men. Women are more humble and flexible.

New World Investor for 5.22.25 is posted.