Dear New World Investor:

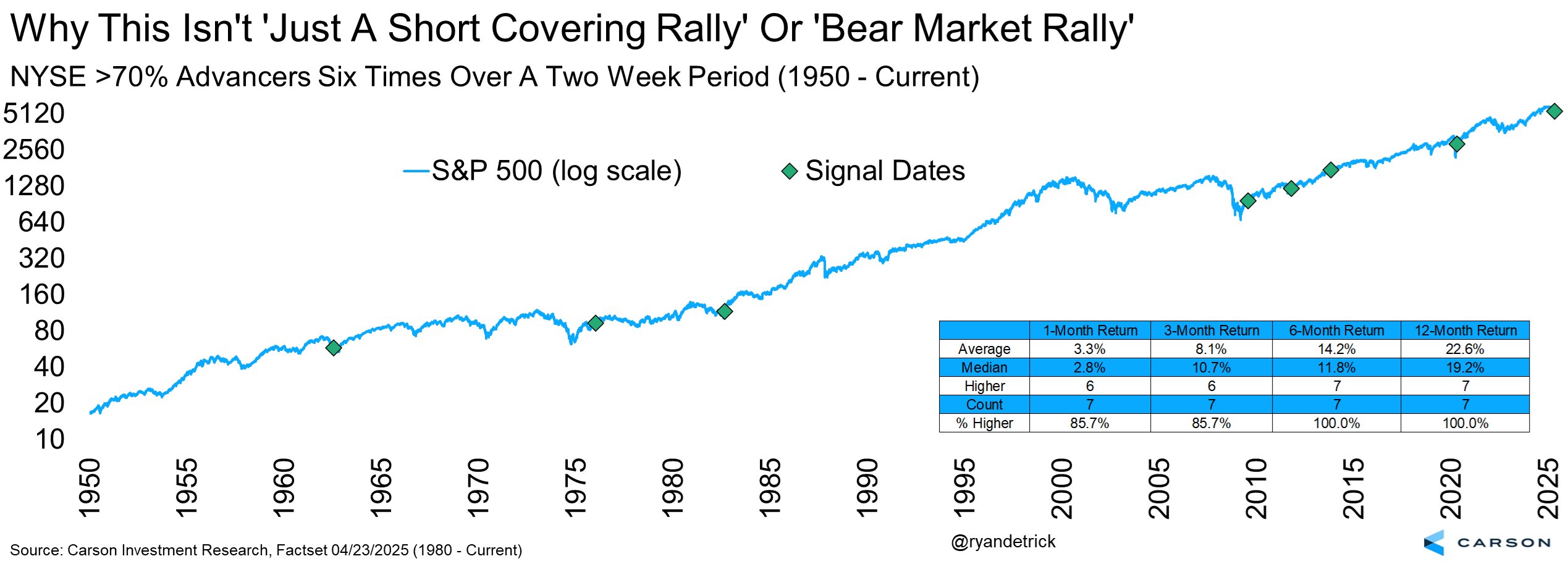

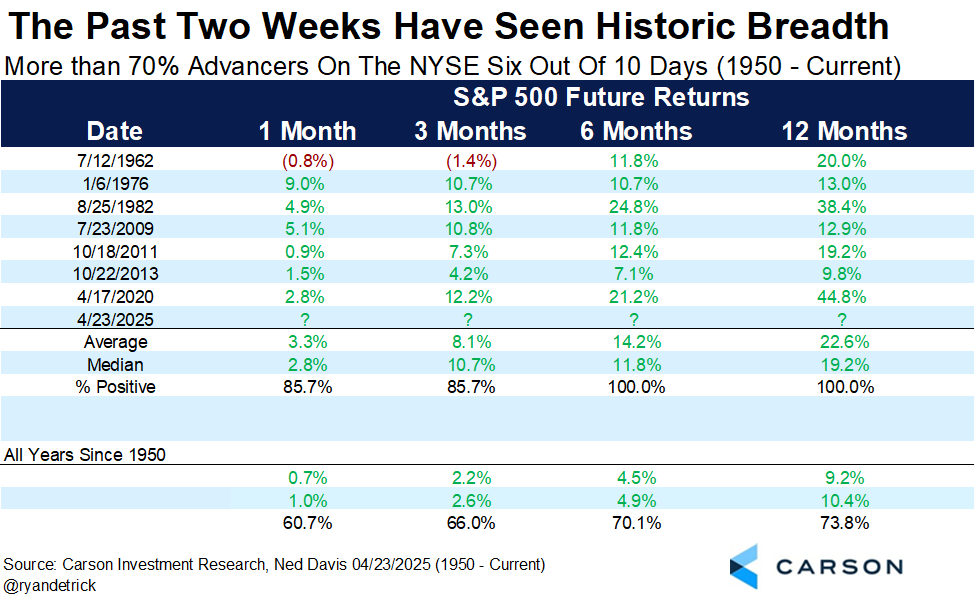

The downturn is over. During the past two weeks we’ve seen historic breadth, including six days with more than 70% of stocks advancing on the New York Stock Exchange. This is NOT what you see in a bear market rally or a short covering rally. This is how new bullish phases start.

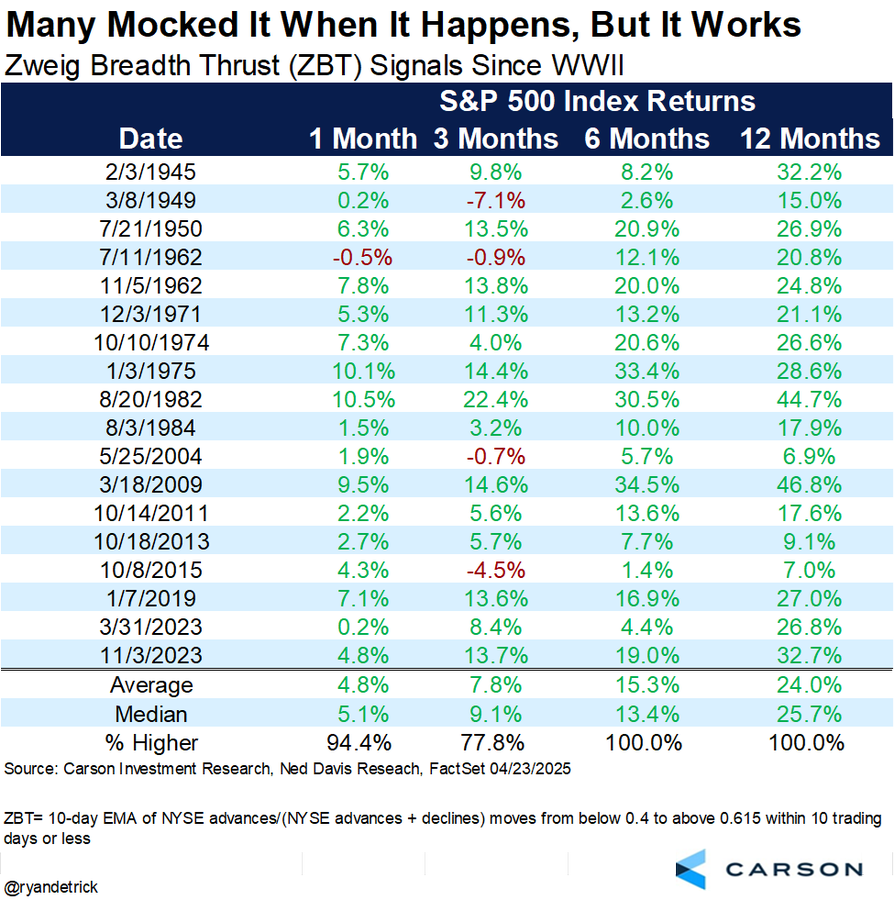

Also, the Zweig Breadth Thrust, developed by Marty Zweig, is used to quantify market momentum. It is computed by dividing the number of advancing stocks on an exchange each day by the total number of stocks (advancing + declining) listed on it. You then take that daily percentage of advancing stocks and track the 10-day moving average.

A Zweig Breadth Thrust signaling the start of a new bull market happens when the 10-day moving average moves from below 40%, indicating an oversold market, to a level above 61.5% within any 10-day period. This is a rarely occurring event. Since World War II, it has happened only 18 times After a Zweig Breadth Thrust, the S&P 500 has NEVER been lower 6 or 12 months later.

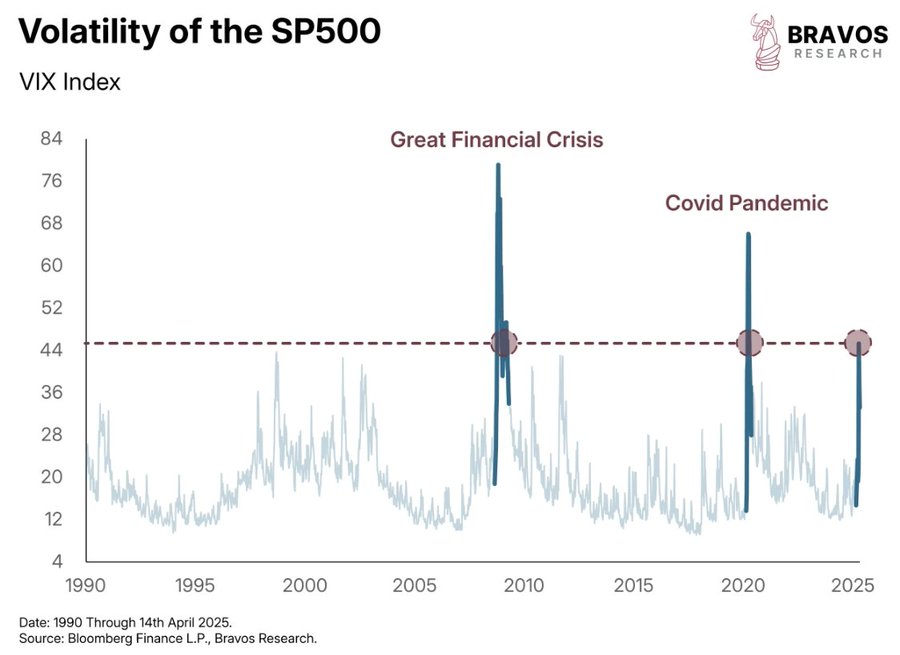

The fear that gripped investors showed up in the VIX Fear & Greed Index, which hit levels seen only two times since 1990: the 2008 Great Financial Crisis and the 2020 Covid-19 pandemic.

Market Outlook

The S&P 500 added 3.8% since last Thursday as we ran out of sellers. The Index is still down 6.7% year-to-date, though. The level of bearish sentiment among individual investors has exceeded 50% for nine straight weeks, which is the longest such streak for records dating back to 1987, according to the American Association of Individual Investors. Now they have to chase.

Click for larger graphic h/t AAII

The Nasdaq Composite gained 5.4% as tech stocks recovered in advance of March quarter earnings reports that started after the close today with strong Alphabet (Google) results. It is still down 11.1% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) soared 6.5% and it looks like the biotech bear market is finally over. It is down 10.2% year-to-date. The small-cap Russell 2000 added 4.1% but is the lagger in 2025, down 12.2%.

The fractal dimension is reflecting the up-one-week-down-the-next-week action by continuing to show consolidation of the Trump rally. If we really are about to break out to the upside, there is plenty of energy to power a multi-month rally of several hundred points.

Top 5

Changes this week: None

Near-Term – chronological order

AKBA Akebia Therapeutics – Vafseo launch

SCYX – ScyNexis – Announce resolution of the manufacturing problem, lifting of clinical hold, restart of MARIO trial, maybe GSK files for hospital use approval

EQT EQT –natural gas price rebound

USL United States 12 Month Oil Fund, LP – crude should rise quickly

FCX Freeport McMoRan – copper shortage

Long-Term – alphabetical order

ABCL AbCelllera – Will become a huge pharma royalty company

UUUU Energy Focus – Domestic uranium supplier

EQT EQT – largest US natural gas company

IBIT iShares Bitcoin Trust – Bitcoin is headed for $150,000

META Meta – a (the?) leader in the metaverse

PLTR Palantir – a (the?) leader in AI applications software

RKLB Rocket Lab – #2 to SpaceX in space

SCYX ScyNexis –First new antifungal in 20 years

Economy

The Atlanta Fed’s GDPNow model estimate for March quarter real GDP growth slipped a bit from -2.2% to -2.5% due to weaker housing numbers. The alternative model that excludes gold imports is at -0.4%.

Coming Events

All times below are ET, and most presentations and slides are archived on the companies’ websites so you can listen to them.

Friday, April 25

Short Interest – After the close

Monday, April 28

MDNAF – Medicenna – 10:00am – Poster at the American Association for Cancer Research (AACR) annual meeting

Tuesday, April 29

META – Meta Platforms – All day – LlamaCon

PYPL – PayPal – 8:00am – Earnings conference call

GLW – Corning – 8:30am – Earnings conference call

ABCL – AbCellera – 3:00pm – Poster presentation of preclinical in vivo data on T-cell engagers at the AACR meeting

QUIK – QuickLogic – 3:10pm – Andes RISC-V Conference

SNAP – Snap – 5:00pm – Earnings conference call

Wednesday, April 30

March quarter GDP – 8:30am – First estimate

Personal Consumption Expenditures Index – 8:30am – The Fed’s favorite inflation indicator

MDNAF – Medicenna – 10:00am – Second poster at AACR

META – Meta Platforms – 5:00pm – Earnings conference call

ENVX – Enovix – 5:00pm – Earnings conference call

Thursday, May 1

GLW – Corning – 12:00pm – Annual meeting

AAPL – Apple – 5:00pm – Earnings conference call

Friday, May 2

April payrolls – 8:30am – March was +228,000

Big Tech: The Biotech & Digital Dominators MegaShift

There are at least four ways to make money in the stocks of these large, growing, dominant companies. You can:

* * Buy a stock and hold it

* * Buy a stock and write a call option against it

* * With a Level IV options account, write an out-of-the-money put option

* * With a Level IV options account, write an out-of-the-money put option and use part of the premium to buy an out-of-the-money call option

Apple (AAPL – $208.37) reports March second quarter earnings after the close next Thursday. Wall Street expects revenues up 3.64% from last year to $94.06 billion with earnings of $1.61 per share. June quarter guidance should be for $89.0 billion and $1.47.

Despite the tech bros sneering at Apple Intelligence, Morgan Stanley said that according to their latest AlphaWise survey, Apple Intelligence is “resonating with consumers” and adoption came in better than expected. AAPL is a Buy under $205.

Corning (GLW – $43.88) reports their March quarter earnings before the open on Monday. The consensus expectation is for revenues up 11.43% to $3.63 billion and earnings of 51¢ per share. Their June quarter guidance is expected to be for revenues of $3.82 billion and 56¢ earrings per share.

BofA reiterated their Buy rating because Corning has minimal direct impact from tariffs. Corning locates its overseas plants near its customers, so “direct” – yeah. But it is the indirect impacts that really count, If China can’t export large screen TVs to the US due to sky-high tariffs, they won’t be buying Corning screens. I expect a reasonable outcome to the tariffs kerfluffle, so GLW remains a Buy under $33 for a $60 target in 2025.

Gilead Sciences (GILD – $106.15) reported March quarter revenues after the close today. Sales fell 0.3% from last year to $6.67 billion, slightly below consensus expectations for $6.81 billion. They earned $1.81 per share, slightly above the $1.77 consensus.

March quarter HIV revenues always are lower than December, but grew 5.6% year-over-year. They are only weeks away from the June 19 PDUFA date for twice-yearly injections of lenacapavir for HIV prevention. They will launch in the US immediately following the decision.

I was surprised by the dip in oncology sales.

Veklury (remdesivir) was down sharply due to high inventories at customers, even though they saw an increase in patient demand.

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Dan O’Day said they have a lot of key milestones coming:

CFO Andrew Dickinson said they are not making any changes to their 2025 revenue expectations for total product sales of $28.2 billion to $28.6 billion or their non-GAAP guidance for $7.70 to $8.10. They think the tariffs that have been enacted to date could increase some of their indirect costs, but are expected to be manageable in 2025, in part due to potentially lighter foreign exchange headwinds than previously expected.

Gilead returned $1.73 billion to shareholders in the March quarter through $1.0 billion of dividends and $730 million of stock buybacks. S&P recently upgraded Gilead’s long-term debt rating from “BBB+ with a positive outlook” to “A- with a stable outlook.”

Their first pivotal Phase 3 trial of Trodelvy plus Merck’s Keytruda showed a statistically significant and clinically meaningful improvement in progression-free survival in patients with previously untreated PD-L1+ metastatic triple-negative breast cancer compared to Keytruda plus chemotherapy. Cantor Fitzgerald raised the stock from Neutral to Overweight with a $125 target. GILD is a Long-Term Buy under $90 for a first target of $120.

Meta Platforms (META – $533.15) introduced Edits, a new video creation app for making great videos directly on a phone. The app supports video creation, powerful editing tools, and data-driven insights.

The company reports March quarter results on Wednesday after the close. Consensus expectations are revenues up 13.46% to $41.36 billion with earnings of $5.22 per share. Zuck’s June quarter guidance should be for $43.96 billion in revenues and $5.59 earnings per share. META is a Buy under $655 for a long-term hold.

Micron (MU – $77.42) announced a market segment-based reorganization of its business units to capitalize on the transformative growth driven by AI, from data centers to edge devices. They’ll have four business units:

* * Cloud Memory: Memory solutions for large hyperscale cloud customers, and high-bandwidth memory (HBM) for all data center customers.

* * Core Data Center: Memory solutions for OEM data center customers and storage solutions for all data center customers.

* * Mobile and Client: Memory and storage solutions for mobile and client segments.

* * Automotive and Embedded: Focused on memory and storage solutions for the automotive, industrial, and consumer segments.

The big grower right now is Cloud Memory, but in a couple of years the other three units will be providing most of the growth. It’s smart of Micron to get positioned ahead of this transition. MU is a Buy under $102 for a $140 first target.

Nvidia (NVDA – $106.43) investors “balk at beaten down valuation as risks mount,” according to Bloomberg. Really? A portfolio manager said: “The outlook isn’t as compelling as it was, and you really have to make a lot of assumptions here, about tariffs, China, hyperscalers, the macro. Because all those things are compounding, the level of uncertainty is much higher than it has been.”

This shows a misunderstanding of how the semiconductor business works. Yes, Nvidia has to write off their inventory of GPUs made for the Chinese market. But nobody is canceling orders, and if they did, Nvidia would simply speed up the delivery date for someone else’s order. When a chip is sold out for months into the future, as Nvidia’s are, customers are delighted to get an earlier ship date.

CEO Jensen Huang has visited China twice in three months to see if he can thread this needle.

NVDA is a Buy under $125 for a $180 first target.

Palantir‘s (PLTR – $107.78) EVP: UK & Europe Louis Mosley was interviewed by Amit on the AI revolution and Palantir’s massive opportunity:

Palantir has a huge market in government and large enterprises. But they also have Palantir for Builders to enable startups and medium-sized companies to leverage Palantir’s AI software with their own builders to deliver value. It is the same enterprise-grade software but they lean on the talent of their customers to do the building.

PLTR is a Buy under $100 for a $150 target.

PayPal Holdings (PYPL – $64.77) said US users can earn 3.7% annually in rewards on holdings of the PayPal USD stablecoin (PYUSD) in their PayPal or Venmo wallets. They can use their PYUSD balances to pay at millions of merchants, send directly to other PayPal and Venmo users, fund remittances on Xoom without transaction fees, convert 1:1 to their fiat balance, convert to other cryptocurrencies, and send on-chain to supported wallets on the Ethereum and Solana blockchains.

The company reports their March quarter before the open on Tuesday. Analysts are forecasting revenues to be up 1.85% to $7.84 billion and earnings to be up 7.4% to $1.16 per share. PayPal’s June quarter guidance is expected to be for revenues of $8.09 billion and $1.21 earrings per share. PYPL is a Buy under $68 for a double in three years.

Snap (SNAP – $8.33) also reports their March quarter earnings on Tuesday, but after the close. CEO Evan Spiegel is expected to produce revenues up 12.59% to $1.35 billion with earnings of 4¢ per share. His June quarter guidance should be for revenues of $1.38 billion and 5¢ earrings per share. SNAP is a Buy under $11 for a $17+ target.

Small Tech

Enovix (ENVX – $6.79) reports their March quarter on Wednesday. Wall Street thinks revenues will be down 10.49% to $4.72 million with a loss of 17¢ per share. June quarter guidance should be for revenues of $5.1 million and a 16¢ loss. ENVX is a Buy up to $20 for a 4-year hold to $100+ as their BrakeFlow lithium-ion battery takes market share.

Primary Risk: A new competitor invents a better battery.

QuickLogic (QUIK – $4.93) will present and exhibit at the Andes RISC-V CON Technology Summit in San Jose next Tuesday. The presentation, delivered by QuickLogic’s Vice President of IP Sales, will focus on using embedded FPGA (eFPGA) technology to customize embedded RISC-V processing solutions from Andes Technology. QUIK is a Buy up to $10 for my $40 target as their earnings repeatedly surprise Wall Street.

Primary Risk: Customers’ product introductions and associated royalties are unpredictable.

Redwire (RDW – $10.97) launched a new drug development technology and a cancer-detection experiment to the International Space Station. This is a high-volume Industrial Crystallizer capable of processing samples up to 200x the volume of what could previously be processed in the original PIL-BOX technology, opening the door to large-scale production for real world commercial applications on the ground.

This first-of-its-kind experiment called Golden Balls will attempt to produce gold nanospheres in space for the first time ever. Gold nanoparticles are currently being explored by researchers as a cancer therapeutic due to their unique properties and they have been used as a biomedical testing tool for early detection of cancer and other diseases. Gold nanospheres could lead to early testing and diagnosis of cancer and other diseases, targeted drug delivery, and enhanced radiation and photothermal therapy. The experiment launched on board SpaceX’s 32nd commercial resupply mission to the International Space Station on April 21.

The company filed their annual report. They wrote: “Redwire’s primary business model is to provide mission critical solutions based on core space infrastructure offerings for government and commercial customers through long-duration projects.”

They had Redwire hardware on over 200 spaceflight missions for more than 100 customers in 2024. They finished the year with $296.7 million in contracted backlog. CEO Peter Cannito wrote: “2024 was a transformational year for Redwire as we moved up the value chain from subsystems and components to full space missions with five new spacecraft platforms. As a result of this strategy, we enter 2025 with a solid foundation and numerous opportunities for rapid growth.”

RDW is a Buy under $18 for a $36 first target as space exploration grows.

Primary Risk: A new competitor emerges.

Rocket Lab USA (RKLB – $21.88) won a contract from Kratos to launch a full-scale hypersonic test flight for the Department of Defense. The mission will launch on Rocket Lab’s HASTE rocket from Rocket Lab Launch Complex 2 on Wallops Island, Virginia, no earlier than the March 2026 quarter. This launch agreement is the first full-scale flight test to be awarded by Kratos under the MACH-TB 2.0 contract, a $1.45 billion program designed to rapidly expand the number and frequency of opportunities to test hypersonic technologies for the nation. RKLB is a Buy up to $13 for my $30+ target as low earth orbit satellites and space exploration grow.

Primary Risk: A new competitor emerges.

Biotech MegaShift

If you can afford it – and it would not be too big a position in your portfolio – putting $2,000 into each of these speculative biotechs might be a good way to start. Buying these out-of-favor, fallen, or forgotten companies that can get important products through the FDA at very low market capitalizations seems like a good strategy to me.

Risks

Development-stage biotechs are subject to investor sentiment swings from wildly optimistic to excessively pessimistic – mostly the latter recently. After the Primary Risk for each company, I’ve added the clinical stage of their lead product, the probable time of their first FDA approval, and the probable time of their next financing.

As always, you need to think about an appropriate position size. You could buy a full position upfront and then just hold on, or buy some upfront and leave room to add more on the inevitable financings, transient clinical trial setbacks, and the like.

Akebia Therapeutics (AKBA- $2.28) adds a few cents almost every day, whether the broad market is up or down. That is a typical pattern for a stock under institutional accumulation.

There hasn’t been an announcement that they exceeded the $10 million to $11 million of March quarter Vafseo revenues that they said they expected in the March 13 conference call, but I wouldn’t be surprised to hear that they did half a million more.

I still think Amgen has to acquire Akebia this year. Buy AKBA up to $2 for the Vafseo launches in the EU, UK, and US.

Primary Risk: Vafseo doesn’t sell in the US.

Clinical stage of lead product: Approved

Probable time of next approval: 2026

Probable time of next financing: Never

Compass Pathways (CMPS – $3.99) completed dosing for all participants in Part A of the COMP005 Phase 3 trial for treatment resistant depression (TRD). They are on track to disclose top-line six-week primary endpoint results in late June. CMPS is a Buy under $20 for a very long-term hold to a 10x.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: 2027

Probable time of next financing: Late 2025

Inovio (INO – $1.92) was nominated in the Best Biotech category for the World Vaccine Congress’ 18th Annual ViE Awards, which recognize excellence and innovation in the vaccine industry. INO is a Buy under $14 for a very long-term hold.

Primary Risk: Their drugs fail in the clinic.

Clinical stage of lead product: Phase 3

Probable time of first FDA approval: Early 2026

Probable time of next financing:After FDA approval in 2026

Inflation MegaShift

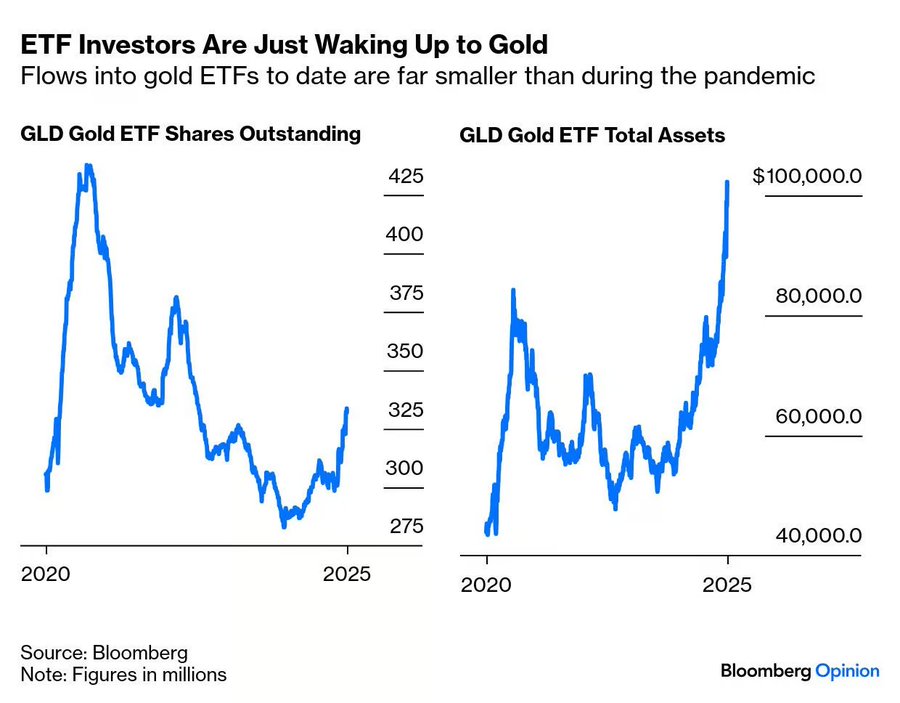

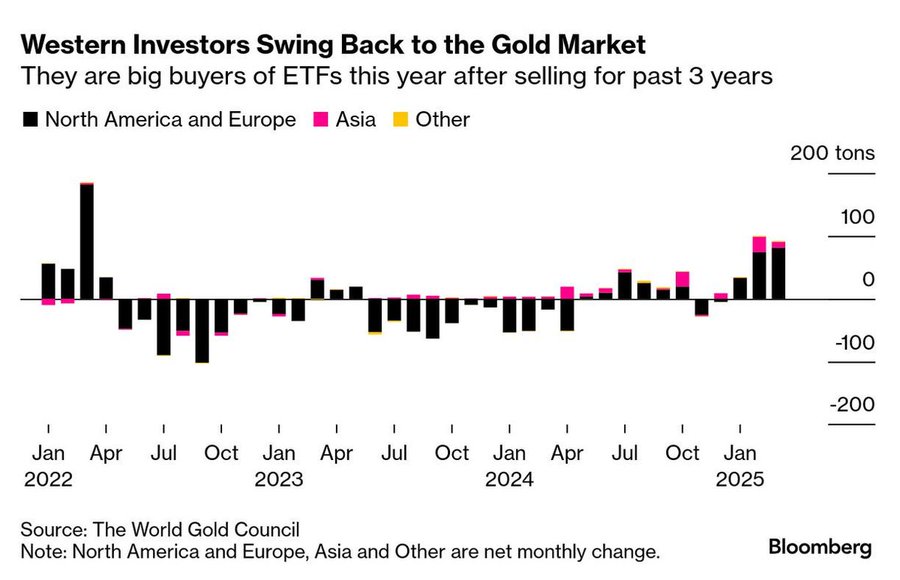

Gold ($3,356.80) hit a new record high Tuesday at $3,485.60 as the dollar fell to its lowest level since late 2023, and then backed off as stocks rallied and the dollar strengthened. Western investors were sellers of gold in 2022, 2023, and 2024. Now they are buyers.

Click for larger graphic h/t @WinfieldSmart

For an exchange-traded fund, the total number of shares outstanding is a good gauge of retail interest. Outstanding shares of the SPDR Gold Shares ETF (GLD) are still far below recent levels

Alright, I know you must be sick of hearing this, but the fractal dimension is TOTALLY OUT OF GAS and overdue for consolidation, either by parking gold near here for a few months or a scary decline back to ~$3,000.

Cryptocurrencies

Cryptocurrencies are a diversifying asset that offer a unique opportunity to make (or lose!) a lot of money quickly.

Bitcoin (BTC-USD on Yahoo – $93,530.81) has rallied almost 25% from its April 7 low, trading more like a safe haven asset (think gold) than a risk-on asset (think Mag 7 stocks). It’s still down from its $109,000 record high the day of President Trump’s inauguration. Plus, the 60-day deadline of Trump’s executive order for the Secretary of the Treasury to deliver an evaluation of the legal and investment considerations for a Strategic Bitcoin Reserve is less than two weeks away.

In another sign of a shift in sentiment, US-listed bitcoin ETFs took in a combined $381 million on Monday, the biggest influx since January 30.

BTC-USD, ETH-USD, IBIT, and ETHA are Strong Buys.

Primary Risk: Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Bitcoin Trust (IBIT- $53.26) remains the cheapest and easiest way to buy bitcoin. IBIT is a Buy for the 2028, 2032, and 2036 halvings.

Primary Risk:Bitcoin falls due to over-regulation or is surpassed by another cryptocurrency.

iShares Ethereum Trust (ETHA- $13.37) remains the cheapest and easiest way to buy ethereum. ETHA is a Buy for the coming explosion in token-funded start-ups.

Primary Risk: Ethereum falls due to over-regulation or is surpassed by another cryptocurrency.

Commodities

Oil – $62.77

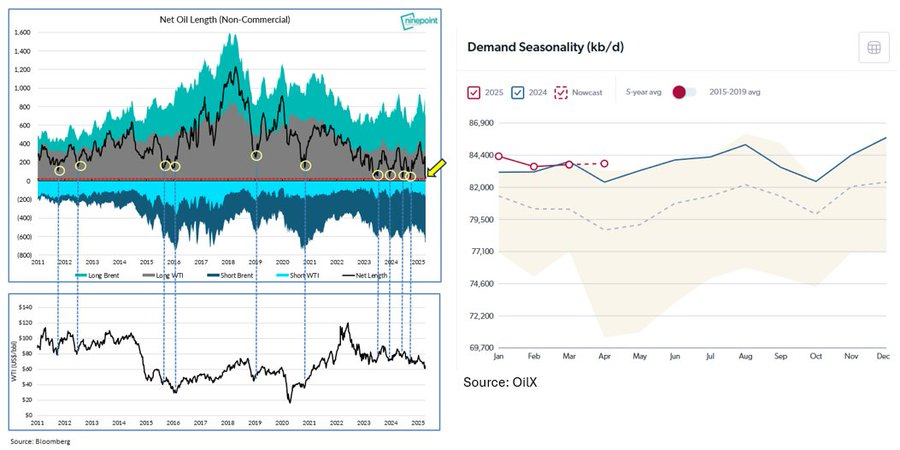

Crude prices are buffeted by worries about increased supply, depending on how much Saudi Arabia wants to punish the now-obvious OPEC+ cheaters, and worries about weak global demand if there is a recession.

The oil market is just starting to wake up to what I’ve been writing for months – US production has peaked. US oil production for April is coming in at 12.85 million barrels a day, 800,000 barrels a day less than the consensus estimate.

On the demand side, here’s an interesting contrast. Energy Aspects’ OilX real-time market platform estimates April physical oil demand is up 1.4 million barrels a day from April 2024 (left graphic), far stronger than the consensus estimate, while the financial demand for oil (net speculative length) last week hit its second lowest level in recorded history (right graphic).

I believe we are headed back to $70 – $80 oil in a hurry.

The July 2026 Crude Oil Futures (CLN26.NYM – no trades – June closed at $60.54) are a Buy under $70 for a $200+ target. Only buy futures for all cash; do not use margin.

The United States 12 Month Oil Fund, LP (USL – $34.11) is a Buy under $40 for a $100+ target.

Vermilion Energy (VET – $6.34) is a Buy under $11 for a target price of $24 or more.

Primary Risk: Oil prices fall.

EQT (EQT – $48.82) reported March quarter sales up 25.0% from last year to $2.15 billion, a bit above the $2.09 billion consensus estimate. Pro forma earnings of $1.18 per share also beat the $1.01 estimate.

On the conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Toby Rice said: “EQT is off to an exceptional start in 2025, with the first quarter generating the strongest financial results in recent company history. Seamless coordination across our integrated midstream and upstream assets resulted in volumes at the high end of guidance, and our tactical production response opening chokes into peak winter prices drove higher realizations. Along with lower-than-expected capital spending, EQT generated more than $1 billion of free cash flow in the first quarter alone.”

EQT is curtailing production when gas prices fall and then selling gas when prices rise.

Toby announced the acquisition of Olympus Energy for $500 million in cash and 26 million shares of stock. Olympus has a contiguous 90,000 net acre position in Southwest Pennsylvania with net production of approximately 500 million cubic feet a day. EQT is buying them for only 3.4x adjusted EBITDA (earnings before interest, taxes, depreciation & amortization) and a 15% free cash flow yield.

The deal will close early in the September quarter.

For the full year 2025, they raised their sales volume guidance 25 billion cubic feet equivalent (Bcfe) to

2,200 Bcfe – 2,300 Bcfe. They reduced their capital spending plan by $25 million to $1,950 million – $2,070 million. During the year, they plan to turn-in-line (TIL) 95 to 120 net wells, including 32 to 50 net wells in the March quarter. That would give them total sales volume in the second quarter of 520 Bcfe – 570 Bcfe. EQT is a buy under $35 for a first target of $70 and a long-term hold for much higher prices.

Primary Risk:Natural gas prices fall.

Freeport McMoRan (FCX – $37.63) reported March quarter revenues down 9.3% from 2024 to $5.73 billion. Wall Street was at $5.47 billion. Freeport earned 24¢ per share pro forma, just above the 23¢ estimate.

As they guided in January, consolidated production of copper fell to 888 million pounds due to a major maintenance project in Indonesia. They produced 287,000 ounces of gold and 23 million pounds of molybdenum.

As the company warned, gold sales were down sharply due to the timing of shipments, which raised the net cost of producing copper because they subtract gold sales from copper production costs. Annual guidance for copper and gold sales is unchanged.

Average realized prices were up across the board.

Click for larger graphic h/t Seeking Alpha

On this morning’s conference call (AUDIO HERE and SLIDES HERE and TRANSCRIPT HERE), CEO Kathleen Quirk said the copper leach project is going well and will be up to a run rate of 300 million pounds a year by the end of 2025. Leaching their waste piles is like discovering a new mine, without the hassle of building one.

She said that tariffs could raise the cost of goods for US mines by 5% or so, depending on what the final tariffs are. Freeport is an important “Made in America” company.

FCX is a buy under $44 for a $65 target within two years.

Primary Risk: Copper prices fall.

Gustavo Dudamel – Márquez: Danzón No. 2

* * * * *

Your tracking humanoid robots Editor,

Michael Murphy CFA

Founding Editor

New World Investor

All Recommendations

Priced 4/24/25. Check out the complete Portfolio page HERE.

Buys

These are the stocks everyone needs to own because transformative events are happening over the next year or two, and I expect to hold them long-term.

Tech Dominators

Apple Computer (AAPL – $208.37) – Buy under $205

Corning (GLW – $43.88) – Buy under $33, target price $60

Gilead Sciences (GILD – $106.15) – Buy under $90, first target price $120

Meta (META – $533.15) – Buy under $655 for a long-term hold

Micron Technology (MU – $77.42) – Buy under $102, first target price $140

Nvidia (NVDA – $106.43) – Buy under $125, first target price $180

Onsemi (ON – $39.96) – Buy under $60, first target price $100

Palantir (PLTR – $107.78) – Buy under $100, target price $150

PayPal (PYPL – $64.77) – Buy under $68, target price $136

Snap (SNAP – $8.33) – Buy under $11, target price $17+

SoftBank (SFTBY – $25.57) – Buy under $25, target price $50

Small Tech

Enovix (ENVX – $6.79) – Buy under $20; 4-year hold to $100+

First Trust NASDAQ Cybersecurity ETF (CIBR – $64.70) – Buy under $60; 3- to 5-year hold

PagerDuty (PD – $15.68) – Buy under $30; 2- to 5-year hold

QuickLogic (QUIK – $4.93) – Buy under $10, target price $40

Redwire (RDW – $10.97) – Buy under $18, first target price $36

Rocket Lab (RKLB – $21.88) – Buy under $13, target price $30+

ARK Venture Fund (ARKVX – $30.10) – Buy for SpaceX

$20-for-$1 Biotech

AbCellera Biologics (ABCL – $2.60) – Buy under $6, target $30+

Akebia Biotherapeutics (AKBA – $2.28) – Buy under $2, target $20

Compass Pathways (CMPS – $3.99) – Buy under $20, hold a long time for a 10x return

Editas Medicines (EDIT – $1.61) – Buy under $6 for a double in 12 months and a long-term hold to much higher prices

Inovio (INO – $1.92) – Buy under $14, hold a long time

Medicenna (MDNAF – $0.74) – Buy under $3, first target $20, then maybe $40

ScyNexis (SCYX – $1.07) – Buy under $3, target price $20, then $50

Inflation

A Short-Sale or REO House – ($415,400) – Hold

Bag of Junk Silver – ($33.63) – hold through silver bull market

Sprott Gold Miners ETF (SGDM – $41.86) – Buy under $28, target price $50

Sprott Junior Gold Miners ETF (SGDJ – $46.52) – Buy under $39, target price $100

Sprott Physical Gold and Silver Trust (CEF – $29.59) – Buy under $18, target price $30

Global X Silver Miners ETF (SIL – $40.86) – Buy under $30, target price $50

Coeur Mining (CDE – $5.84) – Buy under $5, target price $20

Dakota Gold (DC – $2.75) – Buy under $2.50, target price $6

First Majestic Mining (AG – $6.24) – Buy under $11, next target price $23

Paramount Gold Nevada (PZG – $0.39) – Buy under $1, first target price $10

Sandstorm Gold (SAND – $8.51) – Buy under $10, target price $25

Sprott Inc. (SII – $52.47) – Buy under $40, target price $70

Cryptocurrencies

Bitcoin (BTC-USD – $93,530.81) – Buy

iShares Bitcoin Trust (IBIT – $53.26) – Buy

Ethereum (ETH-USD – $1,772.02)– Buy

iShares Ethereum Trust (ETHA- $13.37) – Buy

Commodities

Crude Oil Futures – July 2026 (CLN26.NYM – no trades – June closed at $60.54) – Buy under $70; $200+ target

United States 12 Month Oil Fund, LP (USL – $34.11) – Buy under $40; $100+ target

Vermilion Energy (VET – $6.34) – Buy under $11; $24 target

Energy Fuels (UUUU – $4.81) – Buy under $8; $30 target

EQT (EQT – $48.82) – Buy under $35; $70 first target

Freeport McMoRan (FCX – $37.63) – Buy under $44; $65 target within two years

Holds

These are holds but not sells – yet. They could get moved back to one of the buy categories if their prices drop or outlook improves, or they could become sell recommendations in the future.

Fastly (FSLY – $5.85) – Hold for March quarter results

TG Therapeutics (TGTX – $40.30) – Hold for buyout at $40+

Publisher: GwynRose LLC, 5348 Vegas Drive, Suite 868, Las Vegas, NV 89108

New World Investor does not act as a personal investment adviser or advocate the purchase or sale of any security or investment for any specific individual. The recommendations and analysis presented to members are for the exclusive use of members. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time. Nothing in this presentation should be considered personalized investment advice. No communication to you by Michael Murphy or any of our employees or contractors should be deemed as personalized investment advice.

Copyright ©GwynRoseLLC 2025

New World Investor Mastermind Group

1. Post unto others as you would have them post unto you.

2. Keep it clean, like a 1950s family television show. Your alter ego can run free on Twitter.

3. NO PERSONAL ATTACKS! If you don’t like the stock, don’t trash the person. Everyone is responsible for their own due diligence and investments.

4. Don’t post here about politics or religion – you aren’t going to change anyone’s mind. Again, NO PERSONAL ATTACKS!

5. The investment implications of something going on in politics or religion is OK.

6. Of course, there’s never a reason to slur someone based on race, religion, gender, sexual orientation, or country of national origin.

7. Please, no snark!

Print This Post

Print This Post

1

I think you are right about ETH taking off with the tokenization.

Michael, What are the costs of PZG’s financing. What is PZG NPV at current prices of gold and silver and does that include the cost of their financing. I am tryin gto determine if it is an exceptional buy now at these prices. Thanks

Chris,

ACHV is an interesting opportunity. On 4/22, phase 3 Orca was reported successful for cytisinicline in smoking cessation. Currently, the stock is consolidating its modest gain from a low of $2.00.

Chantix was approved in 2006. Most of its growth was after Obamacare made it more financially accessible in 2010. Cytisinicline will probably get FDA approval in June, but in June the Supreme Court may rule against coverage for smoking cessation drugs. How do you think this will play out? Although RFK is anti-Big Pharma, even he would endorse this new and safer version of Chantix. Both sugar and smoking are major killers.

If the Supreme Court keeps coverage for smoking cessation, the stock will fly. But if the Court abolishes Obamacare coverage for that, the stock will decline which would be a good buying opportunity. I am looking to increase my stock position. The question is now, or wait for Court rejection to back up the truck. Company cash will last until only Q3, so expect dilution until sales ramp up in 2026 or later.

Lately, CMC manufacturing issues have caused CRL’s after successful phase 3’s, such as with MIST. Has ACHV resolved any potential CMC problems?

How did we get here?

Donald Trump tanked the economy based on a book on Amazon.

He told Jared Kushner to find him an economic advisor–someone who could make him “look tough” and talk tough on China. Jared searched Amazon, saw a book called Death by China, and thought the title was “cool.” So he cold-called the author, Peter Navarro, and gave him a job.

Navarro had no economic credibility—just an obsession with tariffs.

and a made-up expert named “Ron Vara” whom he cited repeatedly in his books.

Who’s Ron Vara? A fictional economist Navarro invented. It’s an anagram of his own name.

This is not a joke. This is literally how the Trump administration created its trade policy– one that wiped out $11 trillion in wealth, crashed market,and is nearly sending the into another Great Depression.

A fake expert. A book cover, An Amazon search.

That’s it. Thats how we got here.

Someone sent this to me.Some of it may be true.

I do think Trump has one goal, cut taxes for the very rich adding trillions of dollars to debt. It’s the reason for doge and the tariffs. He has said tariffs could replace in come tax. That’s ridiculous.

Yeah don’t think we have seen the lows, as May is going to show up with lots of store shelves empty, recession to follow in the fall.

economic uncertainty is on the table until the golden boy gets flushed. plenty of opportunities in the ensuing uncertainty, very few long.

Steve,

BITX paid a .54 dividend this month. I am collecting a dividend as Bitcoin hopefully goes up.

New World Investor for 5.1.25 is posted.